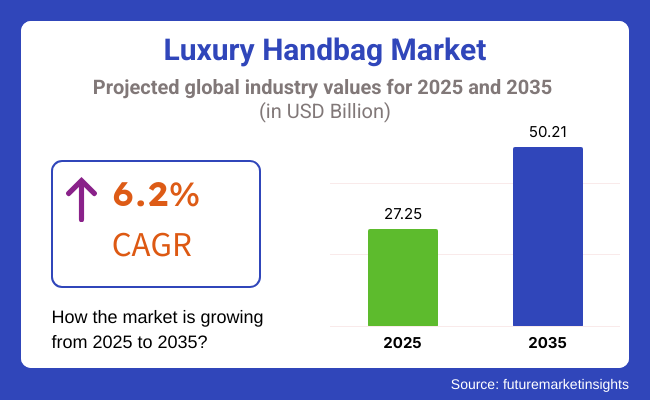

The luxury handbag market is expected to record a valuation of USD 27.25 billion in 2025 and reach a valuation of USD 50.21 billion in 2035, at a CAGR of 6.2%.

As per FMI analysis, the most significant contributor to the growth of this market is the fashion and retail industry, which is characterized by innovative solutions, particularly the luxury and ultra-premium handbag categories, which are expected to take the lead in the market with a 60% global share in 2035. Besides availing designer handbags that are made on request and leaving out the mass production stumbling block, the market is also moving toward fast fashion.

The rise of e-commerce and digital platforms has played a crucial role in this development by coming up with operational models that are more internationally used, especially in new economies. The urbanization and the increase in the number of rich clients in North America, Europe, and Asia Pacific are the main lucrative factors for the market as consumers are now exposed to exclusive and high fashion accessories more than before.

One of the trends that is really making a mark in the luxury handbag business is sustainability-related concerns, and that is where the brands are focusing on such ethical production practices, using eco-friendly materials, and transparent sourcing.

Some of these brands are focusing on vegan leather, upcycled fabrics, and closed-loop lifecycle concepts which are highly important for circular consumption and attract environments conscious shoppers. The enterprises are also adopting Blockchain technology which provides consumers with detailed information about the origins and the ethical standards that their luxury acquisitions have gone through.

Another factor, which is personalization and exclusivity, also proves crucial in the sale of products, for instance, AI-driven designs and little collection for which the customers get something different are very much in demand.

Explore FMI!

Book a free demo

Between 2020 and 2024, a robust demand for luxury handbags had arisen, mostly because of digital transformations, changing consumer preferences, and the upsurge in second-hand luxury products. E-commerce and social media influencers shaped the trends such that luxury brands would easily become accessible to the economically affluent consumers all over the world.

Increased focus on sustainability by resale buyers was fueling demand for limited-edition and vintage pieces. However, counterfeiting raised challenges for the brands, along with price hikes due to fluctuating economies and disruption in supply chains; therefore, brands turned their focus toward limiting availability, customization, and selling directly to consumers.

From 2025 to 2035, innovation and sustainability will redefine the luxury handbag market. AI-driven customization, blockchain-enabled authentication, and eco-friendly materials will dominate production. Luxury brands will integrate smart technology into handbags, offering personalized experiences.

Circular fashion will grow, with major players investing in their own resale platforms. Emerging markets, particularly in Asia and the Middle East, will drive premium demand, ensuring the market’s continued expansion.

| 2020 to 2024 Trends | 2025 to 2035 Projected Trends |

|---|---|

| Post-COVID gradual recovery, persistent growth through e-commerce and digital strategies. | Sustainability programs, AI-driven personalization, and the expansion of the middle-class are the main drivers of accelerated growth. |

| Turnaround in the second-hand and vintage luxury bags segment due to customers' rising demand. | Customization and the feeling of exclusivity have now become the primary buying reasons. |

| Implementation of the based on early awareness and the circular economy is one of the eco-friendly strategies. | Use of biodegradable, plant-based, and lab-grown leather has become a standard practice. |

| Digital marketing, AI chatbots, and AR try-ons are newly emerging technologies. | Web3, blockchain technologies, and AI-based design customization. |

| Shopping online massively increases alongside DTC (direct-to-consumer) sales being on the rise. | Entwined operative models entail physical shopping stores but in a digital way, like metaverse shopping. |

| Growth is particularly high in North America, Europe, and China while the Middle East shows potential for emerging markets. | Asia-Pacific is leading with a significant extension of operations in India and Southeast Asia markets. |

| Brand engagement gets a huge impact from celebrities and social media influencers. | Brand communities, NFTs, and exclusive memberships are ways to retain customers. |

| Inflation and exclusivity strategies primarily responsible for price increments. | With the ultra-luxury brands, there is a fraction of the playing field that is timed drops and digital ownership. |

| Resale market experiences a fast-paced growth with Hermès, Chanel, and Louis Vuitton on top. | The market includes customized, unique, and AI-designed rare handbags. |

| High-end brands are often lacking in personalization features. | Hyper-personalization through AI and customers' virtual involvement in co-creation are the trends. |

Sustainability, digital transformation, and novel materials are shaping the trajectory of the luxury handbag industry. Brands are exploring sustainable leather alternatives, blockchain authentication, and personalized shopping experiences driven by AI. The second-hand market is booming, while the tastes of shoppers are turning toward simplicity, genderless styles and investment pieces. How Technology is Redefining Production Shopping and Authentication Experiences

Luxury labels are pushing the envelope, blending sustainable efforts with AI-driven customisation to speak to consumer demands. Material alternatives such as plant-based and bio-fabricated leather are softening its environmental footprint.

This guides customers through the customer journey analogously in a text scenario in areas as diverse as Virtual Shopping or NFC Microchips as a means of authentication. As tastes shift toward more subtle designs and micro bags, luxury handbags are also being increasingly framed as investment assets on the resale market.

| Trend | Analysis |

|---|---|

| Material Innovations | Luxury brands are increasingly using plant-based, lab-grown and recycled materials instead of traditional leather. These innovations preserve quality while minimizing environmental impact. Luxury brands are also looking to mycelium leather and bio-fabricated textiles for sustainable and premium handbag alternatives as consumer demands are changing. |

| Sustainability Initiatives | Luxury handbags are being reshaped by circular economy models, resale programs and green production processes. Driven by environmentally conscious consumers, the second-hand luxury market is growing. Luxury brands are also adopting buy-back and rental schemes, as well as considering ethical sourcing and recycled materials to reduce waste and extend product life cycles. |

| Digital Transformation | Tech tools like Blockchain authentication, NFC chips, and digital passports have been game changers for handbag traceability and authenticity. Tools like augmented reality (AR) and virtual shopping let customers browse and try bags prior to buying. Luxury brands are leveraging AI-led personalization in digital showrooms, helping drive engagement and enhance the online shopping experience. |

| AI & Personalization | AI-powered customization tools allow customers to design unique handbags that align with their individual style preferences. Predictive analytics also enable brands to predict trends and optimize inventory so more popular designs never run out. Luxury brands are incorporating AI into their customer interactions and online shopping experiences, enabling customized suggestions based on previous purchases and emerging tastes in clothing. |

| Emerging Consumer Trends | A new crop of minimalist handbags with muted branding and an ageless sensibility is on the rise. Gender-neutral designs are transforming the industry by erasing the old distinctions between women’s and men’s luxury accessories. Micro bags remain a hot fashion buy, while classic handbags are being seen more and more as long-term investments, valued for their resale potential and collectability. |

High-end backpacks are extensively bought because they combine fashion, function, and status symbol appeal. While conventional backpacks are made of regular materials, high-end versions are produced using top-quality materials like exclusive leather, suede, and designer textiles, providing durability as well as exclusivity.

Buyers, particularly in city and fashion industry, consider such backpacks a status symbol and sign of sophistication and hence are a favorite among business people, tourists, and fashion-conscious customers. Luxury brands also have innovative designs and craftsmanship that make their products unique as fashionable accessories and functional carry-ons.

Another factor driving the demand for luxury backpacks is a change in consumers' lifestyles. With increasing individuals adopting on-the-go work, high-frequency traveling, and mixed-work environments, demand for adaptive but classy carry solutions has been booming.

Luxury backpacks offer ergonomic styles, multiple pockets, and tech-friendly designs, enabling users to transport essentials like laptops, tablets, and documents in a fashionable and organized way. This blend of functionality and style makes them extremely popular among young professionals, business executives, and digital nomads.

Also, the emergence of sustainable luxury has added to the rising sales of luxury backpacks. Most premium brands are adding sustainable materials, responsible sourcing, and handmade craftsmanship to appeal to green consumers.

Limited collections, celebrity sponsorships, and bespoke customization also add to exclusivity and demand. Therefore, luxury backpacks are not merely an accessory but a fashion statement that reflects personal taste, social standing, and contemporary lifestyle requirements.

Due to the increasing demand for sustainable and cruelty-free products, the synthetic materials segment is rapidly gaining momentum in the luxury handbag market. Luxury labels are offering innovative coursework to attract these eco-conscious consumers with outrageous design, intricate detailing and sustainable production practices.

This segment is directed toward consumers who care about animal welfare and sustainability while maintaining a high standard of aesthetics and materials. The growing preference for ethical luxury and green initiatives is expected to drive the synthetic materials segment in the forecast period.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.2% |

| Germany | 6.4% |

| India | 6.7% |

The industry depends on strong consumer spending and brand name. The top brands in this market are Louis Vuitton and Chanel, with online and store sales fueling growth. High net worth millennials and Gen Z are fueling demands, and resale sites are increasing the second-hand market. Exclusivity and sustainability are the strongest drivers of consumption patterns. FMI is of the opinion that the USA luxury handbag market is set t expand at 6.2% CAGR during the study period.

Growth Factors in the USA

| Growth Factors | Details |

|---|---|

| Economic Resilience | A strong economy supports consumer spending. |

| E-commerce Expansion | Online platforms enhance accessibility and convenience. |

| Brand Innovation | Continuous product development and marketing strategie |

The UK market features robust heritage brands like Burberry and Mulberry. London is a prime shopping destination for global travelers, and it is a sales driver. Department stores and online websites have consistent demand. Post-Brexit economic trends influence price and consumer sentiment, and luxury resale and sustainable materials trend upwards.

Growth Factors in the UK

| Growth Factors | Details |

|---|---|

| Cultural Affinity | Strong tradition of fashion and design |

| Tourism Influence | International visitors contribute significantly to luxury goods sales. |

| Digital Retail Growth | Increasing online sales channels expand market reach. |

The Japanese market relies on exclusivity, handcrafted, and status. Customers are drawn to enduring style, quality, and durability of the fashion being presented by Hermès and Gucci. Department stores and luxury boutiques demand sales with high resale activity that ensures steady demand for small quantities and vintage items. Investment suitability and enduring authority of luxury goods are of most concern to customers in Japan.

Growth Factors in Japan

| Growth Factors | Details |

|---|---|

| Cultural Appreciation | High regard for craftsmanship and premium materials increase the demand. |

| Urbanization | A concentrated affluent population in urban areas boosts market demand. |

| Retail Innovation | Integration of traditional retail with digital platforms enhances consumer engagement. |

The German luxury handbag market is driven by value-conscious consumers seeking functionality and dependability. Bottega Veneta and MCM are attracted to simple designs. Consumers are getting attracted by responsible and ethical sourcing, with eco-friendly raw materials finding it more attractive on a large scale.

Online retail channels and flagships are propelling retail sales, though city high-end consumers remain leading shoppers. FMI is of the opinion that the German market is set to witness 6.4% CAGR during the forecast period.

Growth Factors in Germany

| Growth Factors | Details |

|---|---|

| Economic Stability | A strong economy supports |

| Sustainability Trends | Growing preference for eco-friendly and ethically produced goods. |

| Heritage Brands | Presence of renowned luxury brand. |

India's premium handbag market is expanding rapidly with rising incomes and consciousness. Global competitors such as Louis Vuitton and Dior enhance reach, targeting aspirational shoppers. Social media and e-commerce enhance convenience, and high-end outlets in Indian metros such as Mumbai and Delhi attract premium buyers. FMI is of the opinion that the Indian industry will experience 6.7% CAGR during the study period.

Growth Factors in India

| Growth Factors | Details |

|---|---|

| Rising Affluence | Increasing disposable incomes among the middle and upper classes. |

| Western Influence | Growing exposure to global fashion trends. |

| Retail Expansion | Rapid growth of luxury outlets. |

Leading luxury handbag companies dominate through exclusivity, craftsmanship, and brand heritage. They control production, materials, and distribution, ensuring unmatched quality and prestige. Limited editions, VIP experiences, and iconic designs create desirability, reinforcing their influence. Strategic acquisitions, trendsetting collections, and celebrity endorsements further solidify their leadership, making their products symbols of status and investment.

Their dominance extends through global expansion, selective retail presence, and curated e-commerce strategies. By mastering storytelling, sustainability, and innovation, they maintain relevance while preserving their legacy. Sustainability initiatives, ethical sourcing, and circular economy practices enhance brand value. This balance of tradition and modernity ensures continued leadership, securing long-term consumer loyalty in an industry driven by heritage and exclusivity.

The luxury handbag market is highly competitive, characterized by legacy and new premium brands all utilizing heritage, craftsmanship, and innovative techniques to capture the consumer's interest. Some of the prominent names in the industry include Louis Vuitton, Chanel, Hermès, Gucci, and Prada, which command considerable market share courtesy of brand prestige, exclusivity, and strategic pricing.

Meanwhile, these brands direct most of their investments toward a direct-to-consumer channel while maintaining tight control over distribution and pricing and presence in new luxury markets like China and the United States. Meanwhile, brands like Bottega Veneta and Dior have gained momentum by refreshing designs and influencer collaborations for the next wealthy youngsters.

As the different brands have their individual growth strategies, the most common ones adopted in this particular luxury handbag segment are the emphasis on sustainability, digital engagement diversification, and personalization. Thus, Gucci wants to expand aggressively into digital marketing, e-commerce. Hermès, very exclusive, keeps its products on a demand basis with few production runs.

Chanel and Louis Vuitton continue investing in overall flagship renovations and immersive retail experiences to bring almost both modernity and history at once. In addition, brands are venturing into the secondhand or resale market either through partnerships or a brand's proprietary platform as demand for secondhand luxury grows. Such strategies serve to ensure that the brands remain desirable and attract different consumer demographics in a very fast-changing luxury landscape.

Key company insights

Hermès

By operating exclusively with limited production and craftsmanship, Hermès continues to enjoy strong sales growth.

Louis Vuitton (LVMH)

Louis Vuitton's emphasis on brand image and high pricing has recently induced an overpricing of its products that slowed sales many of its competitors have already overtaken.

Gucci (Kering)

A strategic restructuring is in the process to return brand visibility after declining sales.

Coach (Tapestry, Inc.)

Accessible luxury pricing and a high degree of product innovation led to increased revenues.

Ralph Lauren

Integrating a broad consumer base with pricing and brand elevation has led to a strong sales performer.

In 2025, the market is estimated to reach USD 27.25 billion.

By 2035, the market is projected to reach USD 50.21 billion.

Luxury backpacks are widely used.

Louis Vuitton (LVMH), Chanel, Hermès, Gucci, Prada, Dior, Saint Laurent (YSL), Bottega Veneta, Fendi, Balenciaga, Celine are some important key market players in the industry.

India, set to experience 6.7% CAGR during the study period, is expected to witness fastest growth.

By product type, the market is segmented into tote bags, backpacks, mini and micro bags, crossbody bags, and others.

By material type, the industry is segmented into leather, nylon, cotton, and synthetic.

By region, the market is divided into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Foot Care Product Market Analysis by Product Type, Distribution Channel and Region Through 2035

POU Water Purifier Industry Analysis In MENA: Trends, Growth & Forecast 2025 to 2035

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.