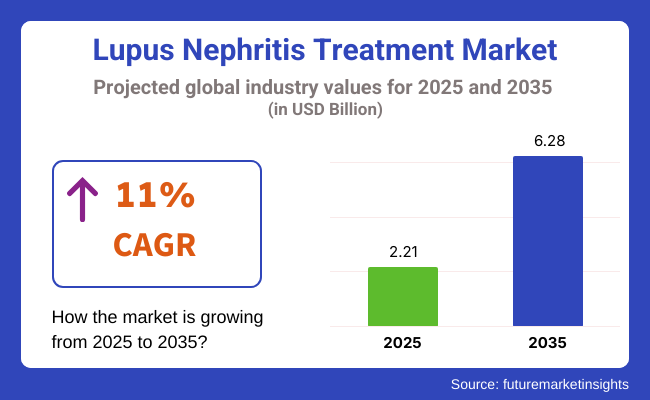

The Lupus Nephritis Treatment Market is valued at USD 2.21 billion in 2025. As per FMI's analysis, the industry will grow at a CAGR of 11% and reach USD 6.28 billion by 2035. In 2024, the lupus nephritis or alternatively known as systemic lupus erythematosus nephritis drug treatment industry saw an increase in drug approvals as regulatory bodies prioritized new biologics.

Clinical trials showcased dramatic improvements in efficacy, especially with combination therapy for severe patients. Pharmaceutical companies have made significant investments in monoclonal antibodies, corticosteroids, and other immunosuppressive therapies for lupus nephritis, leading to major launches that have improved patient outcomes. Competitive pricing and greater insurance coverage significantly improved access to advanced treatments.

From 2025 to 2035, the industry is set for significant growth. The use of AI-driven diagnostics may improve early detection of lupus nephritis, facilitating faster and more accurate treatment decisions, and biosimilars for biologics used in autoimmune diseases could impact pricing dynamics as they become available.

Moreover, the growing availability of biosimilarsfor biologics used in autoimmune diseases will make treatments more affordable, impacting pricing dynamics positively. Global expansion, particularly in Asia-Pacific, will drive growth as emerging economies invest in healthcare infrastructure and regulatory reforms, further improving access to advanced therapies.

The industry for systemic lupus erythematosus nephritis treatment is poised to experience long-term growth, as it is boosted by the evolution of biologics, targeted medicine, and AI-based diagnostics. FMI research identified that pharma firms investing in innovative therapies and developing industry access will gain the most, while traditional drug firms with older treatment modalities may witness competitive pressure. Rising healthcare investments in emerging landscapes will further drive industry growth.

Speedy biologic and precision therapy development

Pharmaceutical companies need to invest more in biologics and precision medicine to improve treatment effectiveness and stand out from conventional therapies. Widening clinical trials and obtaining quicker regulatory approvals will be essential to retain a competitive advantage.

Use AI and digital health to enable early diagnostics

Firms need to combine AI-driven diagnostic tools and digital health platforms to enhance early detection and personalized treatment. Aligning with payers and providers to integrate these technologies into routine care will propel adoption and patient outcomes.

Increase Industry Access Through Strategic Partnerships

Building relationships with Asian-Pacific healthcare systems, payers, and distribution channels will be critical to expanding industry coverage, especially in Asia-Pacific. Mergers, acquisitions, and licensing deals can further enhance international presence and competitive stature.

| Risk | Probability & Impact |

|---|---|

| Regulatory Delays in Drug Approvals | High Probability - High Impact |

| Pricing Pressures from Biosimilars | Medium Probability - High Impact |

| Supply Chain Disruptions for Key Ingredients | Medium Probability - Medium Impact |

| Priority | Immediate Action |

|---|---|

| Fast-Track Biologic Approvals | Strengthen regulatory engagement and accelerate clinical trial timelines |

| Expand AI-Driven Diagnostics | Partner with tech firms to integrate AI in early disease detection |

| Strengthen Supply Chain Resilience | Diversify supplier base and secure long-term contracts for critical ingredients |

To stay ahead, companies must double down on biologic innovation, accelerate the adoption of AI in diagnostics, and strengthen global industry access. Navigating pricing pressures while expanding treatment adoption requires a strategic focus on regulatory engagement and forming key partnerships, as outlined in FMI analysis.

Industry leaders will distinguish themselves by prioritizing measures to secure supply chain resilience and capitalize on digital health advancements. The roadmap, therefore, needs to focus on accelerating R&D cycles, selective M&A activity, and deeper penetration into high-growth areas for maximizing longer-term value.

Regional Variation:

High Variance in Adoption:

ROI Outlooks:

Shared Issues:

Regional Variations:

Pharmaceutical Manufacturers:

Providers & Distributors of Healthcare:

Alignment Across Regions:

Differences in Areas of Investment:

North America:

Europe:

Asia-Pacific:

High Consensus:

Key Variances:

Strategic Insight:

There won't be a single solution that suits everyone. Regional adaptation is required to realize growth potential, which involves fast-tracking costly North American innovations like CAR-T cells, increasing biosimilar production in Asia-Pacific, and balancing sustainability and price models in Europe.

| Country | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | The FDA's Accelerated Approval Program is speeding up approvals for systemic lupus erythematosus nephritis medications, but post-marketing surveillance obligations are being strengthened. The Biologics License Application (BLA) is required for biologic treatments, and cGMP (Current Good Manufacturing Practices) adherence is necessary. |

| United Kingdom | The Medicines and Healthcare Products Regulatory Agency (MHRA) has aligned with EU standards post-Brexit but is also working autonomously to accelerate orphan drugs. NICE (National Institute for Health and Care Excellence) guidelines determine the criteria for pricing and reimbursement decisions. |

| France | ANSM (National Agency for the Safety of Medicines and Health Products) oversees approvals, with rigorous HAS (Haute Autorité de Santé) assessments driving industry access. Government controls restrict drug price flexibility. |

| Germany | Compliance with AMNOG (Act on the Reform of the Industry for Medicinal Products) is demanded by BfArM (Federal Institute for Drugs and Medical Devices) for pricing negotiations. G-BA (Federal Joint Committee) evaluates new drug reimbursement. |

| Italy | AIFA (Italian Medicines Agency) requires rigorous pharmacovigilance and price controls. Early patient access schemes are in place, but reimbursement approvals are long. EU EMA (European Medicines Agency) compliance is required. |

| South Korea | The MFDS (Ministry of Food and Drug Safety) requires KGMP (Korea Good Manufacturing Practices) certification for manufacturers. Government price controls on drugs make it difficult for premium biologics. |

| Japan | PMDA (Pharmaceuticals and Medical Devices Agency) regulates approvals with a relatively slow review cycle. GMP (Good Manufacturing Practices) conformity is necessary, and biannual government price updates affect profitability. |

| China | NMPA (National Medical Products Administration) accelerates novel drugs under the MAH (Marketing Authorization Holder) system but has strict clinical trial requirements. GMP certification and compliance with centralized procurement guidelines are necessary. |

| Australia-New Zealand | Australia's TGA (Therapeutic Goods Administration) and New Zealand's Medsafe demand strict safety and efficacy evaluations. Orphan drugs have fast-track mechanisms available, but the negotiations with public healthcare are tough on prices. |

| India | Manufacturers are required by CDSCO (Central Drugs Standard Control Organization) to comply with Schedule M GMP. Governmental price regulation through the NPPA (National Pharmaceutical Pricing Authority) restricts premium pricing. |

During the forecast period 2025 to 2035, the global lupus nephritis treatment industry is expected to see the drug class grow at a CAGR of 11.0%. Corticosteroids are the most used drug class and are able to promptly suppress symptoms, even though their long-term administration is increasingly diminishing as physicians and patients search for steroid-sparing regimens. Mycophenolate and cyclophosphamide, two immunosuppressants, are projected to see high demand growth over the next several years, with mycophenolate likely leading due to its superior safety and efficacy profile.

Azathioprine use is decreasing as a result of the inroads made by newer types of immunosuppressants, while belimumab, the only FDA-approved biologic for systemic lupus erythematosus nephritis, is expected to be the primary growth driver. FMI forecasts double-digit growth in biologics and progress in precision medicine. Expected innovation because of more R&D into next-generation immunotherapies will keep being a disrupting factor against conventional treatment trends.

The route of administration segment of the global lupus nephritis therapy industry is expected to grow at a CAGR of 10.5% from 2025 to 2035. With Non-IV formulations dominate the pipeline, as they are better tolerated by patients and easily reversible: Mycophenolate and corticosteroids lead this section. In the Immunosuppressive industry, parenteral products like intravenous belimumab and cyclophosphamide are key drivers of growth in specialty pharmacies.

According to FMI's analysis, oral treatments have faced long-term compliance challenges, leading to increased interest in intermittent IV infusions. As pharmaceutical companies improve drug delivery systems to enhance patient adherence, the use of subcutaneous and sustained-release drugs is expected to rise. This trend for targeted biologics is projected to drive parenteral segment growth and be on the agenda of manufacturers in the same segment.

Among distribution channel segments, the overall lupus nephritis treatment industry is projected to have a growth rate (CAGR) of 10.8% through the period between 2025 and 2035. Most sales are accounted for by hospital pharmacies since systemic lupus erythematosus nephritis management is so complicated with the use of biologics and immunosuppressants, which then make specialist monitoring more desirable while prescribing. Retail pharmacies are steadily growing due to the convenient prescription of corticosteroids and oral immunosuppressants for maintenance treatment.

Online pharmacies have become a high-growth channel for distributors, mainly because of accelerating e-commerce adoption and direct-to-patient biologic drug delivery programs. Online pharmacy sales are expected to expand as telemedicine also keeps growing, as do digital health solutions, in developed scenarios where prescription digitization and home delivery services are further picking up steam.

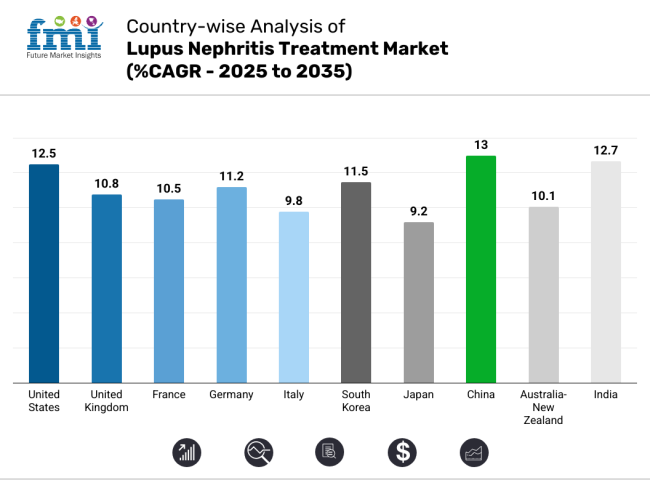

In the United States, the lupus nephritis treatment industry is predicted to grow at a CAGR of 12.5% during 2025 to 2035. The United States is anticipated to be the largest industry for systemic lupus erythematosus nephritis treatment products on account of high adoption of biologic drugs and robust healthcare infrastructure. Regulatory expediting via the FDA's Accelerated Approval Program has compressed drug development cycles, driving innovation.

Private healthcare insurer dominance and high per capita healthcare expenditures justify premium drug pricing. Nevertheless, increasing biosimilar competition and price scrutiny from Medicare reforms may squeeze margins. Higher investments in AI-based diagnostics and digital therapeutics will also help improve early detection, boost patient outcomes, and enhance industry reach.

The United Kingdom's industry for the treatment of lupus nephritis is likely to grow at a CAGR of 10.8% during the period from 2025 to 2035. The UK industry will grow consistently as the National Health Service (NHS) increases the availability of biologic drugs. MHRA's alignment with the EU regulatory framework post-Brexit has paved the way for approvals but added pricing negotiations via NICE.

Cost-effectiveness will continue to be a key driver, with reimbursement conditional on proven clinical benefit. The UK's growing emphasis on AI-based diagnostics and telemedicine integration in the management of systemic lupus erythematosus nephritis will drive industry growth further. Yet, the budgetary constraints of the NHS and regulatory issues may restrict quick growth, requiring strategic pricing and patient support programs to ensure long-term industry access.

The French industry for the treatment of systemic lupus erythematosus nephritis is forecasted to grow at a CAGR of 10.5% during the period 2025 to 2035. The French industry is supported by a well-organized universal healthcare system that provides wide access to sophisticated treatments. ANSM's rigorous approval process and HAS reviews have made France a primary regulatory model in Europe.

Although biologics remain prevalent, reimbursement choices are increasingly based on cost-effectiveness analyses. Biosimilars will surge in the industry as cost-containment policies tighten. Public-private collaboration for research continues to be robust, driving innovation in new therapeutics. But government negotiations on drug prices pose a challenge to premium-priced therapies.

The German industry for the treatment of lupus nephritis is projected to grow at a CAGR of 11.2% in 2025 to 2035. The growth of Germany's industry is backed by its strong healthcare infrastructure and high willingness to embrace innovative therapies. AMNOG's price negotiating system under G-BA supports early industry availability but demands strong evidence of clinical advantages.

Germany is a biologic and biosimilar innovation center and boasts robust indigenous manufacturing capacity. The need for AI-driven diagnostics is growing fast, further accelerating the nation's systemic lupus erythematosus nephritis treatment sector. Statutory health insurers' stringent cost-reduction measures could impact profitability. Notwithstanding this, Germany is a profitable industry because of its strong uptake of newer treatments.

Italy's lupus nephritis treatment industry is influenced by a combination of publicly accessible healthcare and tight cost containment. The industry for treating systemic lupus erythematosus nephritis in Italy is expected to achieve a CAGR of 9.8% during the period 2025 to 2035. AIFA's approval process keeps safety standards high but increases time-to-industry for new medicines.

According to the FMI research, biosimilars will gain traction as cost constraints limit the expansion of premium biologic therapies. Although Italy actively participates in EU-level research collaborations, slower reimbursement approvals present a bottleneck. Increasing clinical research initiatives and hospital-led trials will improve treatment options, but financial constraints within the national healthcare system remain a limiting factor for industry growth.

South Korea's industry for lupus nephritis treatment is growing as a result of government support for biotech research. South Korea's industry is projected to grow at a CAGR of 11.5% between 2025 and 2035. MFDS has rationalized drug approvals to promote investment in local manufacturing. Biologic medicines are taking industry share, backed by a growing incidence of autoimmune diseases and expanded insurance coverage for expensive therapies.

The integration of digital health, especially telemedicine and AI diagnosis, is speeding up the early detection of disease. Yet drug pricing regulations continue to be tight, and competition from local biosimilar drug manufacturers is heating up. Players venturing into this space have to strike a balance between innovation and affordability to ensure profitability.

Japan's industryfor lupus nephritis treatment is expanding at a moderate rate attributed to its aging population and stringent expectations for drug efficacy. The Japanese industry is likely to expand at a CAGR of 9.2% through 2025 to 2035. PMDA's regulatory system helps in ensuring strict safety evaluations, which in turn often results in longer approval timelines.

Moreover, biennial reduction in drug prices by the government is a challenge for pharmaceutical organizations. Notwithstanding this, there is growing demand for biologics, while domestic R&D in regenerative medicine is generating new treatment modalities. Japan's emphasis on digital healthcare solutions, such as AI-supported diagnosis, will drive future industry growth, but the high cost of drug development may slow commercialization.

China will be the fastest-growing industry for lupus nephritis treatment, driven by rising investments in healthcare and regulatory reforms. China's industry is anticipated to grow at a CAGR of 13.0% from 2025 through 2035. NMPA's quick approvals through the MAH system have enhanced industry access for innovative drugs, as per the FMI analysis. Furthermore, increasing universal healthcare coverage and government incentives for the production of biologics are the most important drivers.

But uncertainties around regulations, price controls, and having to comply with China's centralized procurement policies are hindrances for multinational companies. Domestic production of biosimilars is increasing and therefore making affordability a critical industry differentiator. The firms have to fight through a complex but extremely rewarding regulatory regime to thrive.

The Australian and New Zealand economies are being positively impacted by beneficial reimbursement policies and government-sponsored research programs. The Australian and New Zealand industryfor lupus nephritis treatment is predicted to grow at a CAGR of 10.1% during the forecast period of 2025 to 2035. TGA and Medsafe adhere to strict standards of safety and efficacy while making it easier for orphan drugs to get approved faster.

In addition, strong public healthcare infrastructures guarantee universal access to treatment, although negotiation of prices with government payers is essential. Expanded use of AI diagnostics and digital health tools is improving the early detection of diseases. Still, premium biologic industry penetration is limited as a result of rigorous reimbursement conditions, necessitating pharma companies to form long-term government collaborations to negotiate good prices.

India’s lupus nephritis treatment industry is experiencing rapid growth, driven by an increasing disease burden and improving healthcare access. The industry in India is forecasted to grow at a CAGR of 12.7% during the period 2025 to 2035. CDSCO’s regulatory framework is evolving to streamline drug approvals, but affordability remains a key concern.

Increased government-subsidized healthcare programs and local biosimilar manufacturing are making treatment more affordable. Price controls by NPPA, however, restrict the industry entry of expensive biologics. Increased investment in clinical trials and R&D for local drug development is likely to support the industry. Multinational players need to follow competitive pricing to gain momentum in this high-growth scenarios.

The lupus nephritis treatment industry is currently fragmented. Key players are pursuing competitive pricing, novel product development, and geographical expansion, particularly in high-growth regions like China and India, to strengthen their market position. According to FMI analysis, companies are investing in biologics and biosimilars, seeking differentiation amid pricing pressures from healthcare payers.

M&A activity and strategic alliances with biotech firms and research organizations are helping accelerate drug development, but the presence of numerous competitors indicates that no single company dominates the market. The integration of digital health solutions, including AI-powered diagnostics and telemedicine, is emerging as a key differentiator, improving early disease detection and patient engagement. These varied strategies signal a competitive, fragmented landscape rather than a consolidated one.

GlaxoSmithKline (GSK)

Share: ~30-35%

GSK's drug Benlysta (belimumab), the first FDA-approved biologic for systemic lupus erythematosusnephritis, dominates this industry. By forging strategic alliances and ramping up production capacity, the firm has broadened its reach.

Aurinia Pharmaceuticals

Share: ~20-25%

With the FDA-approved oral treatment Lupkynis (voclosporin) at its disposal, Aurinia holds a privileged position. The company has prioritized commercial efforts in the USA and Europe and adoption among nephrologists.

Roche/Genentech

Share: ~15 to 20%

Leveraging the success of Ocrevus (ocrelizumab), Roche is furthering it in clinical trials for lupus nephritis. So, it is investing in next-gen biologics to grow its portfolio.

Bristol-Myers Squibb (BMS)

Share: ~10-15%

BMS is currently studying Sotyktu (deucravacitinib)for systemic lupus erythematosus nephritis. Phase 2 trials are underway. Its goal is to become a big player in immunology-based therapies.

Novartis

Share: ~5-10%

Cosentyx (secukinumab)-The rheumatoid arthritis drug is in midstage studies for lupus nephritis. The company is also investigating combination therapies to increase treatment efficacy.

GSK went a step further in 2024, bolstering leadership by expanding insurance coverage for Benlysta in the USA and Europe, enabling improved access for patients. The company also started a real-world evidence study to strengthen the drug’s long-term benefits in systemic lupus erythematosus nephritis.

The adoption of Lupkynis was driven by Aurinia Pharmaceuticals' expanded sales force and focus on specialty clinics. It also signed a distribution deal in Asia, targeting emerging markets.

The Phase 2 data for Ocrevus in systemic lupus erythematosus nephritis was positive for Roche/Genentech, and the company plans to initiate three Phase 3 trials by the end of 2024. If successful, Roche could become a major disruptor in this space.

After promising early results, Bristol-Myers Squibb sped up enrollment for its Sotyktu trial. If the drug shows better efficacy, analysts say, BMS could free-pick GSK.

Novartis experienced a setback with its Cosentyx trial, leading to a mixture of data and modifications to the study's design. Nevertheless, the company proceeds to pursue its lupus nephritis indications.

The industry is segmented into corticosteroids, immunosuppressive, azathioprine (cyclophosphamide & mycophenolate) and belimumab.

It is bifurcated into oral and parenteral.

It is fragmented among hospital pharmacy, retail pharmacy and online pharmacy.

The industry is studied across North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East & Africa.

The sales of the lupus nephritis treatment market are driven by increasing disease prevalence, advancements in targeted therapies, and growing awareness of early diagnosis and treatment options.

Improvements in efficacy are expected to drive the highest growth rates for biologic therapies, including belimumab and next-generation monoclonal antibodies.

The major players in the industry are Mallinckrodt Pharmaceuticals, Salix Pharmaceuticals, GlaxoSmithKline plc., Pfizer Inc., ASKA Pharmaceutical Co., Ltd., Bausch Health, Johnson & Johnson Services, Inc., Janssen Global Services, Takeda Pharmaceutical Company Limited, Merck & Co., Inc., Cipla Ltd., Abbott Laboratories.

The expected CAGR of the industry during the forecast period is 11%.

The industry is expected to reach a value of USD 6.28 billion by 2035.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 17: Global Market Attractiveness by Drug Class, 2023 to 2033

Figure 18: Global Market Attractiveness by Route of Administration, 2023 to 2033

Figure 19: Global Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 37: North America Market Attractiveness by Drug Class, 2023 to 2033

Figure 38: North America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 39: North America Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Drug Class, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 77: Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 78: Europe Market Attractiveness by Route of Administration, 2023 to 2033

Figure 79: Europe Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 97: South Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 117: East Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 137: Oceania Market Attractiveness by Drug Class, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Route of Administration, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 157: MEA Market Attractiveness by Drug Class, 2023 to 2033

Figure 158: MEA Market Attractiveness by Route of Administration, 2023 to 2033

Figure 159: MEA Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lupus Anticoagulant Testing Market

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA