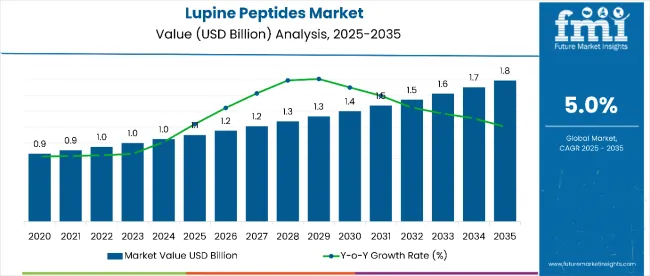

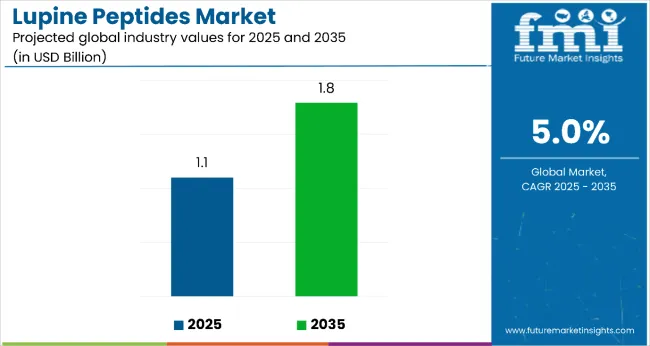

The market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 1.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 0.7 billion over the forecast period. This reflects 1.63 times growth at a compound annual growth rate of 5.0%. The market's evolution is expected to be shaped by rising demand for natural cosmetic ingredients, anti-aging formulations, and sustainable alternatives to synthetic peptides in personal care applications.

By 2030, the market is likely to reach approximately USD 1.4 billion, accounting for USD 0.3 billion in incremental value over the first half of the decade. The remaining USD 0.4 billion is expected during the second half, suggesting a moderately back-loaded growth pattern. Product innovation around collagen synthesis enhancement and matrix metalloproteinase inhibition is gaining traction due to lupine peptides' favorable bioactivity profile and clean-label appeal.

Companies such as Celsie Limited and Ceapro Inc. are advancing their competitive positions through investment in extraction technologies and scalable peptide production systems. Certification-led procurement models are supporting expansion into organic cosmetics, anti-aging formulations, and premium personal care products. Market performance will remain anchored in regulatory compliance, bioactivity validation, and sustainable sourcing benchmarks.

The market holds around 38% of the plant-based peptides market, driven by its bioactive properties and ability to inhibit matrix metalloproteinase, making it ideal for anti-aging products. It captures 28% of the cosmetic peptides market due to its role in collagen synthesis and clean-label appeal. Additionally, it contributes 22% to the natural cosmetic ingredients segment and 18% to the botanical extracts market, with a 25% share in organic cosmetics, especially for premium skincare and anti-aging formulations.

The market is experiencing a structural transformation, fueled by increasing demand for natural and sustainable cosmetic ingredients. Advanced techniques like enzyme hydrolysis and membrane filtration have improved peptide purity and effectiveness, enhancing their application in anti-aging skincare. Manufacturers are launching standardized extracts and functional blends for both cosmetic and nutraceutical use. Strategic partnerships between suppliers and formulators have driven growth, while online retail channels have expanded consumer reach, compelling conventional peptide producers to shift toward more innovative and eco-conscious solutions.

Lupine peptides’ proven matrix metalloproteinase inhibition properties, collagen synthesis enhancement, and natural origin make them an attractive alternative to synthetic anti-aging ingredients in premium cosmetic formulations.

Growing awareness of clean-label cosmetics and natural skincare solutions is further propelling adoption, especially in organic personal care products and anti-aging treatments. Consumer demand for sustainable ingredients, along with innovations in extraction technology, are also enhancing product quality and bioactivity profiles.

As the global cosmetics industry continues to prioritize natural ingredients and anti-aging efficacy, the market outlook remains favorable. With consumers and manufacturers prioritizing sustainability, ingredient transparency, and proven bioactivity, lupine peptides are well-positioned to expand across various cosmetic and nutraceutical applications.

The market is segmented by nature, form, source, end use, and region. By nature, the market includes organic and conventional. Based on form, the market is divided into powder and liquid. Based on source, the market covers flower-derived and seed-derived extracts. In terms of end use, the market includes cosmetics and personal care, hair care, skin care, cosmetics, nutraceuticals, and pharmaceuticals. Regionally, the market is analyzed across North America, Latin America, Europe, East Asia, South Asia and Pacific, Oceania, and the Middle East and Africa.

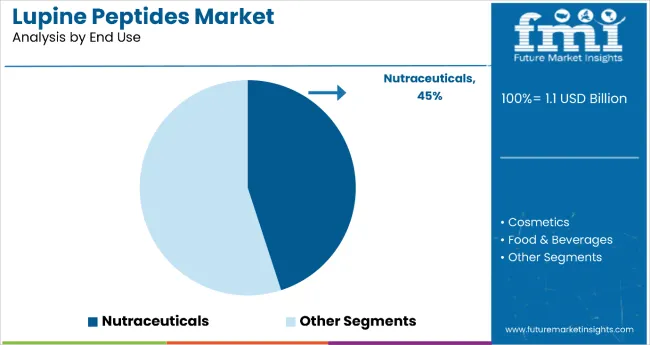

The nutraceuticals segment leads with 45% of the market share, making it the most prominent application area for lupine peptides. This dominance is attributed to their growing use in dietary supplements, protein powders, and wellness-enhancing formulations that support preventive health strategies.

Key functional benefits such as appetite regulation, muscle recovery, and blood sugar control position lupine peptides as a valuable ingredient in plant-based sports nutrition and general wellness supplements. Demand is especially strong in North America and Europe, where consumers are actively seeking natural, plant-sourced health solutions.

Manufacturers are focusing on improving bioavailability and clinical efficacy through advanced research and formulation innovation. The segment continues to expand as clean-label trends and proactive healthcare consumption drive the integration of functional plant proteins into everyday nutrition.

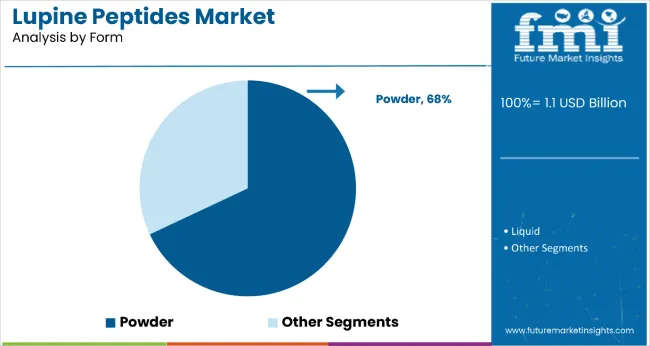

The powder segment holds a leading 68% share in the form category, reflecting its wide adoption in both cosmetic and nutraceutical formulations due to superior stability, shelf life, and formulation flexibility. Powdered lupine peptides minimize moisture-related degradation, allowing for greater control during product development and storage.

Advanced processing techniques such as spray drying and freeze drying are being employed to improve peptide integrity and solubility, making powder an ideal format for diverse application needs.

Its compatibility with various delivery systems, such as capsules, sachets, and dry blends, supports the segment’s continued dominance. As demand rises for stable, cost-effective, and bioactive ingredients, the powder form is expected to remain the format of choice across expanding health and beauty product portfolios.

In 2024, the global lupine peptides market experienced steady growth, driven by their expanding application in anti-aging skincare and functional cosmetic formulations. Rising demand for sustainable, plant-based bioactives and growing consumer preference for clean-label beauty products are positioning lupine peptides as a highly desirable ingredient.

While growth is being supported by strong efficacy validation and sustainability trends, challenges remain in terms of consistent sourcing and production scalability. Key trends include organic certification integration, traceable sourcing, and advanced peptide refinement technologies that enhance formulation effectiveness. These developments are helping cosmetic brands differentiate their offerings, meet environmental standards, and strengthen consumer trust in naturally derived anti-aging solutions.

Key Drivers Fueling Lupine Peptides Market Expansion

The primary driver of market growth is the increasing demand for anti-aging cosmetic products, fueled by the aging global population and rising consumer awareness around skin health. In 2024, dermatological research validating the efficacy of lupine peptides in inhibiting matrix metalloproteinase enzymes elevated their status as a trusted bioactive in premium skincare. As a result, cosmetic manufacturers are incorporating high-purity lupine peptides into anti-wrinkle, firming, and collagen-boosting formulations.

The market is also benefitting from broader industry adoption of sustainable ingredient sourcing strategies. From 2025 onward, manufacturers began prioritizing organic certification and traceability in response to rising consumer demand for environmentally responsible and ethically sourced ingredients. Suppliers offering certified organic lupine peptides with sustainable production practices are becoming strategic partners for brands looking to align with global sustainability commitments.

These combined factors are positioning lupine peptides as a core ingredient in future-facing cosmetic innovation, particularly within the premium and clean beauty segments.

Major Restraints Challenging Lupine Peptides Market Development

Despite positive momentum, the market faces several restraints related to ingredient sourcing, processing costs, and production scalability. Producing high-purity bioactive lupine peptides requires specialized extraction and refinement techniques, which can increase cost and limit output capacity. As cosmetic brands demand verified sustainable and organic sourcing, suppliers must invest in certification processes and traceable infrastructure, adding complexity to the supply chain.

Additionally, consistent raw material availability is dependent on agricultural factors and regional harvesting conditions, which may affect long-term supply planning. Emerging brands may also struggle with access to premium lupine peptide suppliers, as large-scale manufacturers secure exclusive partnerships for high-performance ingredients. These factors create adoption barriers for smaller companies and could limit rapid market penetration.

Emerging Key Trends Influencing Lupine Peptides Market Direction

The integration of sustainability into ingredient sourcing strategies is emerging as a key trend in the lupine peptides market. Cosmetic brands are embedding certification systems and traceability platforms directly into procurement operations, enabling real-time verification of sustainable practices and boosting transparency throughout the supply chain. These developments are enhancing brand equity and providing competitive advantages in the clean beauty space.

Formulation innovation is another critical trend, with manufacturers investing in bioactive peptide enhancement technologies to increase solubility, skin penetration, and efficacy. As consumers prioritize both performance and sustainability, clean-label, plant-based anti-aging solutions are gaining traction globally.

Regionally, Europe is leading in sustainable cosmetic ingredient adoption, while Asia Pacific is showing strong potential due to increasing skincare awareness and demand for plant-based formulations. These shifts indicate a growing market opportunity for lupine peptide suppliers who can deliver both clinical efficacy and sustainable sourcing credentials.

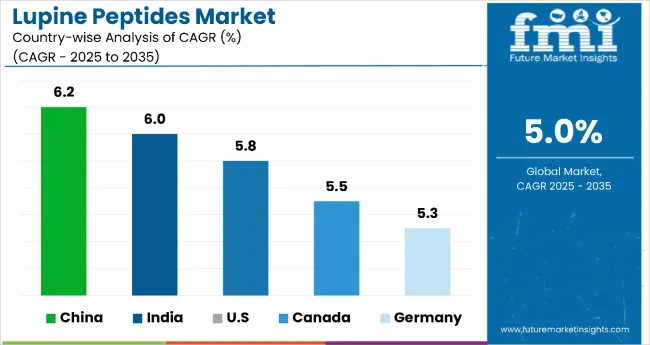

In the lupine peptides market, China leads with the highest projected CAGR of 6.2%, driven by rapid growth in premium cosmetics and sustainable sourcing. India follows at 6.0%, fueled by Ayurvedic integration and rising urban demand. The USA, the largest market, is expected to grow at 5.8% due to strong clean-label and nutraceutical trends. Canada shows steady growth at 5.5%, supported by organic product demand. Germany and France both forecast 5.3% CAGR, backed by strict organic standards, while the UK grows at 4.9%, driven by clean beauty preferences and regulatory shifts post-Brexit.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

Sales of lupine peptides in China are expected to lead with a CAGR of 6.2%, fueled by rapid expansion in domestic cosmetics manufacturing and increasing consumer preference for natural anti-aging ingredients. Premium skincare brands are incorporating lupine peptides into anti-aging formulations targeting urban consumers. Local manufacturers are focusing on sustainable extraction technologies and organic certification to meet both domestic and export requirements.

In India, lupine peptides revenue is projected to grow at 6.0% CAGR, supported by traditional medicine integration and rising demand for natural cosmetic ingredients. Adoption of lupine peptides in Ayurvedic skincare formulations is increasing among domestic brands. Growing middle-class disposable income and awareness of anti-aging solutions are driving market expansion in metro and tier-2 cities.

Sales of lupine peptides in Germany are forecast to expand at a 5.3% CAGR, driven by stringent organic cosmetic regulations and consumer preference for certified natural ingredients. Advanced biotechnology companies are developing standardized lupine peptide extracts for premium skincare applications. Strong regulatory framework supports quality assurance and sustainable sourcing practices.

The USA lupine peptides demand is expected to remain the largest market, driven by rising demand for plant-based proteins, functional foods, and advanced skincare formulations. A projected CAGR of 5.8% is anticipated over the forecast period, supported by the country's mature nutraceutical industry and strong clean-label movement. USA manufacturers are increasingly incorporating lupine peptides in anti-aging, sports nutrition, and vegan-friendly products to cater to health-conscious and sustainability-driven consumers.

The Canada lupine peptides revenue is projected to grow at a CAGR of 5.5%, underpinned by the country’s emphasis on organic, non-GMO, and sustainable product development. Canadian cosmetic and nutraceutical brands are incorporating lupine peptides into holistic wellness and skincare offerings. Government support for clean technology and sustainable agriculture further enhances the appeal of lupine-based ingredients among manufacturers and consumers.

The market is moderately fragmented, featuring specialized ingredient suppliers with varying degrees of extraction expertise and market positioning. Celsie Limited and Ceapro Inc. lead the biotechnology-focused segment, supplying high-purity peptides for premium cosmetic applications and pharmaceutical research. Their strength lies in advanced extraction technologies and regulatory compliance capabilities.

Austrade Inc. differentiates through sustainable sourcing solutions, including organic certification and traceability systems that cater to premium cosmetic brands seeking verified natural ingredients. Lupina LLC and Inveja SAS - lup'ingredients focus on commercial-scale production and cost-effective extraction methods, addressing growing demand for affordable natural peptides in mainstream cosmetic formulations.

Regional players emphasize local sourcing advantages and specialized extraction techniques, ensuring quality consistency and supply chain reliability for domestic markets. Meanwhile, established ingredient suppliers are investing in lupine peptide production capabilities to diversify their natural ingredient portfolios.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Nature | Organic and Conventional |

| Form | Powder and Liquid |

| Source | Flower and Seed |

| End Use | Cosmetics and Personal Care, Hair Care, Skin Care, Cosmetics, Nutraceuticals, and Pharmaceuticals |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa , Australia, and 40+ countries |

| Key Companies Profiled | Celsie Limited, Ceapro Inc., Austrade Inc., Lupina LLC, Inveja SAS - lup'ingredients , Botaneco Inc., Croda International Plc, Symrise AG, Givaudan Active Beauty, Bioiberica S.A.U. |

| Additional Attributes | Dollar sales by nature and end-use sector, growing usage in anti-aging and cosmetic applications for premium skincare products, stable demand in nutraceutical and pharmaceutical applications, innovations in extraction technology and bioactivity enhancement improve purity, efficacy, and regulatory compliance |

The global lupine peptides market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the lupine peptides market is projected to reach USD 1.8 billion by 2035.

The lupine peptides market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in lupine peptides market are organic and conventional.

In terms of form, powder segment to command 62.7% share in the lupine peptides market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tuna Peptides Market – Growth, Demand & Functional Benefits

Plant Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Endocrine Peptides Test Market Size and Share Forecast Outlook 2025 to 2035

Cocoa-Derived Peptides For Skin Repair Market Size and Share Forecast Outlook 2025 to 2035

Fish Collagen Peptides Market Analysis by Source, Application and Region Through 2035

Antimicrobial Peptides Market

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Collagen-Boosting Biomimetic Peptides Market Size and Share Forecast Outlook 2025 to 2035

Smart-Technology Anti-Wrinkle Peptides Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA