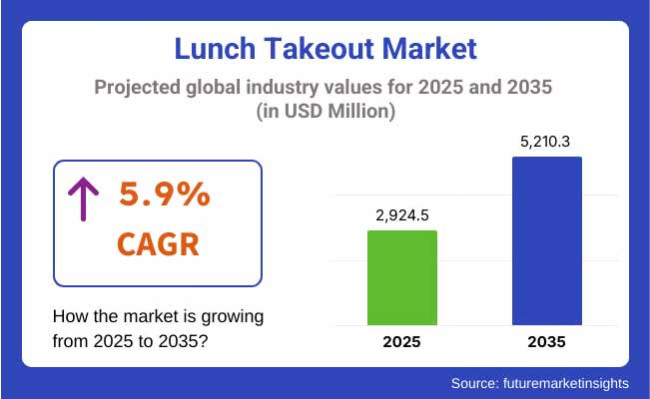

The Lunch Takeout Market will reach USD 2,924.5 million in 2025 and will grow to USD 5,210.3 million by 2035 with a CAGR of 5.9% during the forecast period. Latin America's takeout lunch market is witnessing moderate to high market concentration fueled by large chains, local foodservice groups, and new technology platforms. The market is changing fast as consumers' needs shift towards convenience, health, and online ordering.

Traditional restaurants are still influential, but food delivery platforms and cloud kitchens are transforming the business by disrupting access to food at lower operating costs. Market leaders are growing market share by menu expansion, price wars, and digitalization. Restaurants and delivery companies are using AI analytics and customer preference monitoring to optimize and personalize menus.

Using loyalty programs, AI chatbots, and mobile ordering is assisting companies in driving enhanced customer retention and engagement. Furthermore, food makers and manufacturers are simplifying supply chains and logistics through partnership with in-market farms, food manufacturers, and packaging firms for delivering fresher produce and quicker delivery. Automation of order processing, kitchen robots, and optimization of final-mile delivery have also improved speed and dependability of lunch takeout services.

With increased demand, the food chains and food enterprises are increasing capacity production by increasing outlet openings, upscaling cloud kitchen operations, and setting up central food manufacturing sites. Most of them are even targeting franchise models, which have the capacity for quick expansion across major urban and semi-urban areas.

There is significant investment in new take-away restaurants throughout Brazil, Mexico, Argentina, and Colombia on the basis of growth urbanization and lifestyle awareness. High-tech equipment food service companies are expanding business with applications of AI-based demand planning to help manage kitchen processes and food waste reduction.

Moreover, sustainability programs like biodegradable packaging and local material sourcing are helping companies expand environmentally conscious customers. Latin American consumers increasingly demand healthier, natural, and organic food.

Consumers are requesting high-protein, plant-based, and allergen-free foods, and hence takeout operators must re-imagine menus based on clean-label, preservative-free, and nutrient-dense ingredients. Fresh, minimally processed food demand has also generated a huge demand for salad bowls, grain meals, and vegan meals.

The movement toward cleaner, greener packaging and sustainable sourcing is also driving consumption behavior, leading food companies to transition to cleaner supply chain alternatives. As urbanization increases, busy lives become more prevalent, and digital penetration is on the rise, Latin America's takeout lunch market will continue growing, driven by technology, increasing health awareness, and changing lifestyles of consumers.

The following table is a comparative snapshot of six-month market change in growth between the base year (2023) and the present year (2024) within the lunch takeout business. Half-year review captures most of change in market trends and revenues and provides stakeholders with an understanding of growth trends and performance in the business. Half one (H1) covers January to June, and half two (H2) covers July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 5.7 % (2024 to 2034) |

| H2 | 5.8 % (2024 to 2034) |

| H1 | 5.9 % (2025 to 2035) |

| H2 | 6.0 % (2025 to 2035) |

These figures mirror the changing trend of market for lunch takeout, which is being driven by changing tastes, online ordering behavior, and expansions in delivery opportunities. Business companies to embrace the changing trends and challenges in the market are of utmost importance.

Tier 1 Companies are Global fast-food chains and food delivery chain restaurants control the Tier 1 market. McDonald's, Subway, Domino's Pizza, and KFC are some of the large global players with established supply chains. Brand loyalty, mass-market promotion, and technology such as mobile order, AI-driven recommendations, and reward schemes are used by them.

Additionally, the takeout chains like Uber Eats, DoorDash, and Grubhub have transformed the takeout market with plentiful restaurant choices, instant orders, and data-driven promotions. They are operation efficiency masters as well as strategic allies to restaurants.

Tier 2 Companies, Specialty restaurants and mid-regional chains are Tier 2 players. chains like Panera Bread, Shake Shack, and Chipotle are large in size but local in thought in contrast to Tier 1 behemoths. They distinguish by nichework specialization bases, e.g., organic lunch or health, and higher-end, tailor-made food display.

They've all heavily invested in technology for online ordering, self-service kiosks, and third-party delivery integration in order to offer maximum customer ease. Although they are not so well recognized overseas compared to Tier 1 businesses, they do have dominant market positions within the country as well as intensely loyal customer bases.

Tier 3 Companies are tiny street cart businesses, delis, and solo restaurants. They struggle to make ends meet on walk-in, word of mouth, and spotty delivery through Postmates or local aggregators for most of their volume. They excel at spreading special, hand-built food and one-on-one service.

They struggle with growing the business and keeping price point and delivery efficiency like the chains. The market is still growing with urbanization, homeworking, and increasing consumer demand for quick, good-quality food. Digitalization, sustainability, and shifting eating patterns are propelling competition, which is compelling organizations of every shape and size to innovate and change.

Green Packaging Solutions

Shift: As more and more become eco-aware, regulators and consumers are pressuring lunch takeout to turn green in packaging. Single-use plastic is being replaced with biodegradable, compostable, and recyclable packs.

Restaurants and takeout outlets are also exploring out-of-the-box packaging that preserves food freshness while minimizing wastage. Reusable packs are becoming increasingly popular, especially among city dwellers who care about the environment.

Strategic Action: Chains like Sweetgreen and Just Salad started reusable container initiatives in a bid to cut down on waste. Chains like Chipotle and Panera Bread are investing capital in fiber-based compostable packaging.

Companies like Notpla are leading the way with seaweed-based edible packaging, which is a replacement for plastic. Food delivery platforms like DoorDash and Uber Eats also launched campaigns urging restaurants to eliminate plastic cutlery and packaging waste, as per global sustainability goals.

Adopting E-Commerce and Subscription Models

Shift: Takeout lunch space is moving fast digital-first, with food-delivery apps and meal subscription services picking up steam. Working professionals are responding by noticing more meal subscriptions pre-ordered and ordering via apps to make lunchtime more convenient during meals. Virtual brands and ghost kitchens also remained online with increased convenience and personalization together with the takeout feature.

Strategic Action: Innovate and account with new-to-the-industry, ready-to-eat, subscription lunch food that can accommodate special diets. Chains such as McDonald's and Chipotle are surfing on AI-driven ordering and predictive analytics to drive digital engagement. Ghost kitchen firms such as CloudKitchens and Reef are maximizing for takeout restaurants, lowering costs and increasing efficiency. Big food delivery operators such as DoorDash and Grubhub are also accelerating loyalty clubs and special meal offers to generate repeat orders.

Global and Fusion Cuisine Rise

Shift: Consumers are growing more fearless about dining during lunch, and consumption of foreign and fusion fare is on the rise. Korean, Mediterranean, and Southeast Asian cuisine show up on mass-market takeout menus. Demand for robust, quirky flavor and ethnic food pride in older generations drives the trend.

Strategic Reaction: Chains like Cava and Pokeworks are riding the trend with build-your-own, international-themed bowls. Shake Shack restaurants are testing international flavors like Japanese and Korean as temporary offerings. Individual take-out places remain afloat by marketing up-and-coming fusion foods like sushi burritos and kimchi tacos to trendy consumers. Meal kit players like Blue Apron and HelloFresh are also adding globally sourced takeout-style cuisine to their portfolio with a view to tapping home demand for international taste.

Tech-Driven Efficiency and Automation

Shift: Speed and convenience of picking up lunch have driven robotics and AI-technology development. Restaurants are being pushed to adopt robot use, automatic counters, and intelligent kitchen systems because they face pressure to reduce wait times and simplify ordering. Predictive ordering based on AI is also employed in an attempt to simplify buying ingredients and reduce food waste.

Strategic Response: McDonald's and Starbucks are leveraging AI-based mobile ordering and drive-thru automation for increased efficiency. Sweetgreen has implemented salad-prep robots for speed and consistency of preparation.

Drone and robotic delivery platforms are being explored by Domino's and Uber Eats to accelerate last-mile delivery. Additionally, AI-based inventory management systems are assisting restaurants to maximize ingredient utilization and reduce operating expenses.

Functional and High-Protein Takeaway Lunches on the Rise

Transition: Along with health and wellness, functional and high-protein lunch is also on the rise. Consumers need lunch that aids in the recovery of muscle, mental performance, and even-steady energy levels for the rest of the day. This has increased the demand for protein-rich salads, grain bowls, and lean meat meals.

Strategic Action: Chains such as Chipotle and Panera are adding more protein such as grilled chicken, tofu, and quinoa bowls. Meal prep services such as Trifecta and Kettlebell Kitchen are going after athletes and serious gym rats with macro-balanced meals for competition performance at a high level. There are businesses such as Huel and Soylent that are offering more protein meal replacement foods packaged as easy, speed-of-lightning-folding-a-hammock lunches for active professionals on the move.

Artificially Intelligence-Driven Hyper-Personalized Meal Choices

Transformation: Consumers are calling for highly personalized meal recommendations according to their nutritional requirements, diet objectives, and food taste. Artificial intelligence-powered restaurant websites and apps are applying analytics to provide personalized offers of meals that calorie-optimize, allergen-optimize, and macronutrient-optimize.

Strategic Response: Food ordering apps are launching Noom and MyFitnessPal types of platforms to offer food recommendations based on the medical condition of a consumer. Additionally, technology firms are investing in AI-based smart fridge technologies, which offer home ingredient-based recommendations for takeout meals, enhancing convenience and personalized nutrition.

Increased Space for Alternative and Plant-Based Proteins

Change: Trends in plant foods have fueled the shift towards plant protein alternatives for lunch takeout. In addition to vegetable options, consumers also look for new plant proteins like jackfruit, seitan, and cell-based meat alternatives. Pressure from sustainability and greater demand for sustainable and ethical foods fuel the trend.

Strategic Response: Burger King and McDonald's, the fast food restaurants, launched plant-based nuggets and burgers to appeal to flexitarian consumers. Specialty brands such as Impossible Foods and Beyond Meat are increasing their presence in takeout chains with meat alternative products that mimic real meat. Startups in collaboration with cultivated meat such as Eat Just and Upside Foods are also waiting for regulatory approval to launch lab-grown beef and chicken into the takeout market.

| Country | CAGR, 2025 to 2035 |

|---|---|

| USA | 4.20% |

| Germany | 5.10% |

| China | 3.90% |

| Japan | 6.40% |

| India | 6.90% |

Indian food ordering and takeaway online market is projected to register a CAGR of 6.90% during the years 2024 to 2034. Expansion is driven by a humongous majority of digitally literate young people and an emerging middle class with increased disposable incomes.

Ease provided by the convenience of ordering online attracts urban residents who have hectic lifestyles and has led to a boom in food delivery websites. Additionally, the emergence of the utilization of smartphone and cheap internet has provided the customer with a convenience factor whereby the customers can compete with food ordering websites.

The food delivery and takeaway market online in Japan is projected to grow at a CAGR of 6.40% from 2024 to 2034. The aging population of Japan is reliant primarily on food delivery services as they are convenient and readily available.

Small size of city living areas and longer working days in the country also promote online food delivery as a less trouble option for most consumers. Technological adoption in everyday lives has also made these services easy to use.

The German delivery and takeaway market of online food is expected to grow at 5.10% CAGR between 2024 to 2034. This is due to online going for taking services and the arrival of foreign food chains, who have popularized the culture of delivery.

German shoppers accustomed to having all aspects of their lives now carried out via the internet are driving the upward trends. Convenient and time-efficient priority have made steadily rising uptrends in usage of food service delivery.

The US takeout restaurant market is anticipated to grow at a 5.2% CAGR during 2024 to 2035. Expansion is fueled by increasing demand for takeout services and the customer experience aspect. Growth in food delivery apps by categories and an increase in restaurants on delivery platforms fuel market expansion.

| Segment | Value Share (2025) |

|---|---|

| Digital Wallets (By Payment Type) | 38% |

The international lunch takeout industry also is experiencing a fierce digital wallet revolution, with their market share increasing to 38%. Consumers like using mobile payments as they are convenient, secure, and easy to use via restaurant and food delivery apps. Market leaders Apple Pay, Google Pay, and Alipay control markets in North America, Europe, and Asia-Pacific regions where contactless payments are prevalent.

| Segment | Value Share (2025) |

|---|---|

| Quick Service Restaurants (By Restaurant Type) | 47% |

Quick Service Restaurants (QSRs) reign supreme in the global lunch takeout market with 47% gross sales penetration. The convergence of speed of service, price, and ubiquity makes QSRs the default food of working professionals, students, and travelers alike. Global leaders like McDonald's, Burger King, and KFC are further expanding their chain with AI-driven drive-thrus, mobile app ordering, and self-service kiosks to deliver maximum convenience.

Increased usage of healthier fast foods, such as plant foods and protein foods, has also added to the popularity of QSRs. Use of third-party online food ordering services like Uber Eats, DoorDash, and Deliveroo has also grown, with food availability immediately at hand wherever. Urbanization and digitalization happening at a rapid pace, QSRs are continuing to dominate the emerging foodservice sector, and consumer demand is increasing.

Global takeaway lunch space is poised to see global expansion in 2024 by virtue of innovation and changing consumption habits. Consumers post-pandemic are seeking convenient, healthy, and varied post-pandemic diets and thus are making providers hyper-competitive.

Organizations are transforming their offerings from basic food takeaway to grocery and retail offerings, seeking loyalty from consumers as well as top line. Technological advancement, for example, use of artificial intelligence and automation, are utilized to automate operations and customer experience. Consolidation and acquisition strategy also are transforming market forces, allowing business to extend further and attract more. But there still exist problems that involve more competition, evolving regulation, and sustainability challenges that must still be innovated and refined.

For instance

Market segmented into Cash, Debit Cards, Credit Cards, Digital Wallets, and Electronic Bank Transfers.

Market segmented into Quick Service Restaurant, Self Service Restaurants, Assisted Self Service Restaurants, Full Serviced Restaurants, Fine Dining, Casual Dining, Cafes and Bars, and Street Food.

Market segmented into Chinese Cuisine, Indian Cuisine, Japanese Cuisine, Italian Cuisine, Mediterranean Cuisine, Mexican Cuisine, Turkish Cuisine, and Others.

Market segmented into Vegetarian, Non-Vegetarian, and Vegan.

Market segmented into Direct-to-Consumer and Platform-to-Consumer.

Market segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA.

The Global Lunch Takeout Market is expected to grow at a CAGR of approximately 5.9% from 2025 to 2035.

By 2035, the market is anticipated to reach a valuation of around USD 5210.3 million.

The online food delivery segment is expected to witness the fastest growth due to increasing digitalization and consumer preference for convenience.

The market is driven by factors such as the rising demand for convenient meal options, increasing urbanization, growth in the working population, expansion of online food delivery platforms, and changing consumer preferences toward ready-to-eat meals.

Some of the dominant players in the market include Uber Eats, DoorDash, Just Eat Takeaway, Deliveroo, Grubhub, and Domino’s Pizza.

Table 1: Global Lunch Takeout Market Value (US$ Mn) and Forecast by Region, 2017–2021

Table 2: Global Lunch Takeout Market Value (US$ Mn) and Forecast by Region, 2022–2032

Table 3: Global Lunch Takeout Market Value (US$ Mn) and Forecast by Product Type, 2017–2021

Table 4: Global Lunch Takeout Market Value (US$ Mn) and Forecast by Product Type, 2022–2032

Table 5: Global Lunch Takeout Market Value (US$ Mn) and Forecast by Nature, 2017–2021

Table 6: Global Lunch Takeout Market Value (US$ Mn) and Forecast by Nature, 2022–2032

Table 7: Global Lunch Takeout Market Value (US$ Mn) and Forecast by Restuarant Type, 2017–2021

Table 8: Global Lunch Takeout Market Value (US$ Mn) and Forecast by Restuarant Type, 2022–2032

Table 9: Global Lunch Takeout Market Value (US$ Mn) and Forecast by Payment Type, 2017–2021

Table 10: Global Lunch Takeout Market Value (US$ Mn) and Forecast by Payment Type, 2022–2032

Table 11: Global Lunch Takeout Market Value (US$ Mn) and Forecast by Purchase Model, 2017–2021

Table 12: Global Lunch Takeout Market Value (US$ Mn) and Forecast by Purchase Model, 2022–2032

Table 13: North America Lunch Takeout Market Value (US$ Mn) and Forecast by Country, 2017–2021

Table 14: North America Lunch Takeout Market Value (US$ Mn) and Forecast by Country, 2022–2032

Table 15: North America Lunch Takeout Market Value (US$ Mn) and Forecast by Product Type, 2017–2021

Table 16: North America Lunch Takeout Market Value (US$ Mn) and Forecast by Product Type, 2022–2032

Table 17: North America Lunch Takeout Market Value (US$ Mn) and Forecast by Nature, 2017–2021

Table 18: North America Lunch Takeout Market Value (US$ Mn) and Forecast by Nature, 2022–2032

Table 19: North America Lunch Takeout Market Value (US$ Mn) and Forecast by Restuarant Type, 2017–2021

Table 20: North America Lunch Takeout Market Value (US$ Mn) and Forecast by Restuarant Type, 2022–2032

Table 21: North America Lunch Takeout Market Value (US$ Mn) and Forecast by Payment Type, 2017–2021

Table 22: North America Lunch Takeout Market Value (US$ Mn) and Forecast by Payment Type, 2022–2032

Table 23: North America Lunch Takeout Market Value (US$ Mn) and Forecast by Purchase Model, 2017–2021

Table 24: North America Lunch Takeout Market Value (US$ Mn) and Forecast by Purchase Model, 2022–2032

Table 25: Latin America Lunch Takeout Market Value (US$ Mn) and Forecast by Country, 2017–2021

Table 26: Latin America Lunch Takeout Market Value (US$ Mn) and Forecast by Country, 2022–2032

Table 27: Latin America Lunch Takeout Market Value (US$ Mn) and Forecast by Product Type, 2017–2021

Table 28: Latin America Lunch Takeout Market Value (US$ Mn) and Forecast by Product Type, 2022–2032

Table 29: Latin America Lunch Takeout Market Value (US$ Mn) and Forecast by Nature, 2017–2021

Table 30: Latin America Lunch Takeout Market Value (US$ Mn) and Forecast by Nature, 2022–2032

Table 31: Latin America Lunch Takeout Market Value (US$ Mn) and Forecast by Restuarant Type, 2017–2021

Table 32: Latin America Lunch Takeout Market Value (US$ Mn) and Forecast by Restuarant Type, 2022–2032

Table 33: Latin America Lunch Takeout Market Value (US$ Mn) and Forecast by Payment Type, 2017–2021

Table 34: Latin America Lunch Takeout Market Value (US$ Mn) and Forecast by Payment Type, 2022–2032

Table 35: Latin America Lunch Takeout Market Value (US$ Mn) and Forecast by Purchase Model, 2017–2021

Table 36: Latin America Lunch Takeout Market Value (US$ Mn) and Forecast by Purchase Model, 2022–2032

Table 37: Europe Lunch Takeout Market Value (US$ Mn) and Forecast by Country, 2017–2021

Table 38: Europe Lunch Takeout Market Value (US$ Mn) and Forecast by Country, 2022–2032

Table 39: Europe Lunch Takeout Market Value (US$ Mn) and Forecast by Product Type, 2017–2021

Table 40: Europe Lunch Takeout Market Value (US$ Mn) and Forecast by Product Type, 2022–2032

Table 41: Europe Lunch Takeout Market Value (US$ Mn) and Forecast by Nature, 2017–2021

Table 42: Europe Lunch Takeout Market Value (US$ Mn) and Forecast by Nature, 2022–2032

Table 43: Europe Lunch Takeout Market Value (US$ Mn) and Forecast by Restuarant Type, 2017–2021

Table 44: Europe Lunch Takeout Market Value (US$ Mn) and Forecast by Restuarant Type, 2022–2032

Table 45: Europe Lunch Takeout Market Value (US$ Mn) and Forecast by Payment Type, 2017–2021

Table 46: Europe Lunch Takeout Market Value (US$ Mn) and Forecast by Payment Type, 2022–2032

Table 47: Europe Lunch Takeout Market Value (US$ Mn) and Forecast by Purchase Model, 2017–2021

Table 48: Europe Lunch Takeout Market Value (US$ Mn) and Forecast by Purchase Model, 2022–2032

Table 49: East Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Country, 2017–2021

Table 50: East Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Country, 2022–2032

Table 51: East Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Product Type, 2017–2021

Table 52: East Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Product Type, 2022–2032

Table 53: East Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Nature, 2017–2021

Table 54: East Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Nature, 2022–2032

Table 55: East Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Restuarant Type, 2017–2021

Table 56: East Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Restuarant Type, 2022–2032

Table 57: East Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Payment Type, 2017–2021

Table 58: East Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Payment Type, 2022–2032

Table 59: East Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Purchase Model, 2017–2021

Table 60: East Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Purchase Model, 2022–2032

Table 61: South Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Country, 2017–2021

Table 62: South Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Country, 2022–2032

Table 63: South Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Product Type, 2017–2021

Table 64: South Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Product Type, 2022–2032

Table 65: South Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Nature, 2017–2021

Table 66: South Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Nature, 2022–2032

Table 67: South Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Restuarant Type, 2017–2021

Table 68: South Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Restuarant Type, 2022–2032

Table 69: South Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Payment Type, 2017–2021

Table 70: South Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Payment Type, 2022–2032

Table 71: South Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Purchase Model, 2017–2021

Table 72: South Asia Lunch Takeout Market Value (US$ Mn) and Forecast by Purchase Model, 2022–2032

Table 73: Oceania Lunch Takeout Market Value (US$ Mn) and Forecast by Country, 2017–2021

Table 74: Oceania Lunch Takeout Market Value (US$ Mn) and Forecast by Country, 2022–2032

Table 75: Oceania Lunch Takeout Market Value (US$ Mn) and Forecast by Product Type, 2017–2021

Table 76: Oceania Lunch Takeout Market Value (US$ Mn) and Forecast by Product Type, 2022–2032

Table 77: Oceania Lunch Takeout Market Value (US$ Mn) and Forecast by Nature, 2017–2021

Table 78: Oceania Lunch Takeout Market Value (US$ Mn) and Forecast by Nature, 2022–2032

Table 79: Oceania Lunch Takeout Market Value (US$ Mn) and Forecast by Restuarant Type, 2017–2021

Table 80: Oceania Lunch Takeout Market Value (US$ Mn) and Forecast by Restuarant Type, 2022–2032

Table 81: Oceania Lunch Takeout Market Value (US$ Mn) and Forecast by Payment Type, 2017–2021

Table 82: Oceania Lunch Takeout Market Value (US$ Mn) and Forecast by Payment Type, 2022–2032

Table 83: Oceania Lunch Takeout Market Value (US$ Mn) and Forecast by Purchase Model, 2017–2021

Table 84: Oceania Lunch Takeout Market Value (US$ Mn) and Forecast by Purchase Model, 2022–2032

Table 85: MEA Lunch Takeout Market Value (US$ Mn) and Forecast by Country, 2017–2021

Table 86: MEA Lunch Takeout Market Value (US$ Mn) and Forecast by Country, 2022–2032

Table 87: MEA Lunch Takeout Market Value (US$ Mn) and Forecast by Product Type, 2017–2021

Table 88: MEA Lunch Takeout Market Value (US$ Mn) and Forecast by Product Type, 2022–2032

Table 89: MEA Lunch Takeout Market Value (US$ Mn) and Forecast by Nature, 2017–2021

Table 90: MEA Lunch Takeout Market Value (US$ Mn) and Forecast by Nature, 2022–2032

Table 91: MEA Lunch Takeout Market Value (US$ Mn) and Forecast by Restuarant Type, 2017–2021

Table 92: MEA Lunch Takeout Market Value (US$ Mn) and Forecast by Restuarant Type, 2022–2032

Table 93: MEA Lunch Takeout Market Value (US$ Mn) and Forecast by Payment Type, 2017–2021

Table 94: MEA Lunch Takeout Market Value (US$ Mn) and Forecast by Payment Type, 2022–2032

Table 95: MEA Lunch Takeout Market Value (US$ Mn) and Forecast by Purchase Model, 2017–2021

Table 96: MEA Lunch Takeout Market Value (US$ Mn) and Forecast by Purchase Model, 2022–2032

Figure 1: Global Lunch Takeout Market Value (US$ Mn) Forecast, 2022-2032

Figure 2: Global Lunch Takeout Market Absolute $ Opportunity (US$ Mn), 2022-2032

Figure 3: Global Lunch Takeout Market Value (US$ Mn) and % Growth by Region, 2022 & 2032

Figure 4: Global Lunch Takeout Market Y-o-Y Growth Rate by Region, 2022-2032

Figure 5: Global Lunch Takeout Market Value (US$ Mn) and % Growth by Product Type, 2022 & 2032

Figure 6: Global Lunch Takeout Market Y-o-Y Growth Rate by Product Type, 2022-2032

Figure 7: Global Lunch Takeout Market Value (US$ Mn) and % Growth by Nature, 2022 & 2032

Figure 8: Global Lunch Takeout Market Y-o-Y Growth Rate by Nature, 2022-2032

Figure 9: Global Lunch Takeout Market Value (US$ Mn) and % Growth by Restaurant Type, 2022 & 2032

Figure 10: Global Lunch Takeout Market Y-o-Y Growth Rate by Restaurant Type, 2022-2032

Figure 11: Global Lunch Takeout Market Value (US$ Mn) and % Growth by Payment Type, 2022 & 2032

Figure 12: Global Lunch Takeout Market Y-o-Y Growth Rate by Payment Type, 2022-2032

Figure 13: Global Lunch Takeout Market Value (US$ Mn) and % Growth by Purchase Model, 2022 & 2032

Figure 14: Global Lunch Takeout Market Y-o-Y Growth Rate by Purchase Model, 2022-2032

Figure 15: Global Lunch Takeout Market Attractiveness Analysis by Region, 2022-2032

Figure 16: Global Lunch Takeout Market Attractiveness Analysis by Product Type, 2022-2032

Figure 17: Global Lunch Takeout Market Attractiveness Analysis by Nature, 2022-2032

Figure 18: Global Lunch Takeout Market Attractiveness Analysis by Restaurant Type, 2022-2032

Figure 19: Global Lunch Takeout Market Attractiveness Analysis by Payment Type, 2022-2032

Figure 20: Global Lunch Takeout Market Attractiveness Analysis by Purchase Model, 2022-2032

Figure 21: North America Lunch Takeout Market Value (US$ Mn) Forecast, 2022-2032

Figure 22: North America Lunch Takeout Market Absolute $ Opportunity (US$ Mn), 2022-2032

Figure 23: North America Lunch Takeout Market Value (US$ Mn) and % Growth by Country, 2022 & 2032

Figure 24: North America Lunch Takeout Market Y-o-Y Growth Rate by Country, 2022-2032

Figure 25: North America Lunch Takeout Market Value (US$ Mn) and % Growth by Product Type, 2022 & 2032

Figure 26: North America Lunch Takeout Market Y-o-Y Growth Rate by Product Type, 2022-2032

Figure 27: North America Lunch Takeout Market Value (US$ Mn) and % Growth by Nature, 2022 & 2032

Figure 28: North America Lunch Takeout Market Y-o-Y Growth Rate by Nature, 2022-2032

Figure 29: North America Lunch Takeout Market Value (US$ Mn) and % Growth by Restaurant Type, 2022 & 2032

Figure 30: North America Lunch Takeout Market Y-o-Y Growth Rate by Restaurant Type, 2022-2032

Figure 31: North America Lunch Takeout Market Value (US$ Mn) and % Growth by Payment Type, 2022 & 2032

Figure 32: North America Lunch Takeout Market Y-o-Y Growth Rate by Payment Type, 2022-2032

Figure 33: North America Lunch Takeout Market Value (US$ Mn) and % Growth by Purchase Model, 2022 & 2032

Figure 34: North America Lunch Takeout Market Y-o-Y Growth Rate by Purchase Model, 2022-2032

Figure 35: North America Lunch Takeout Market Attractiveness Analysis by Country, 2022-2032

Figure 36: North America Lunch Takeout Market Attractiveness Analysis by Product Type, 2022-2032

Figure 37: North America Lunch Takeout Market Attractiveness Analysis by Nature, 2022-2032

Figure 38: North America Lunch Takeout Market Attractiveness Analysis by Restaurant Type, 2022-2032

Figure 39: North America Lunch Takeout Market Attractiveness Analysis by Payment Type, 2022-2032

Figure 40: North America Lunch Takeout Market Attractiveness Analysis by Purchase Model, 2022-2032

Figure 41: Latin America Lunch Takeout Market Value (US$ Mn) Forecast, 2022-2032

Figure 42: Latin America Lunch Takeout Market Absolute $ Opportunity (US$ Mn), 2022-2032

Figure 43: Latin America Lunch Takeout Market Value (US$ Mn) and % Growth by Country, 2022 & 2032

Figure 44: Latin America Lunch Takeout Market Y-o-Y Growth Rate by Country, 2022-2032

Figure 45: Latin America Lunch Takeout Market Value (US$ Mn) and % Growth by Product Type, 2022 & 2032

Figure 46: Latin America Lunch Takeout Market Y-o-Y Growth Rate by Product Type, 2022-2032

Figure 47: Latin America Lunch Takeout Market Value (US$ Mn) and % Growth by Nature, 2022 & 2032

Figure 48: Latin America Lunch Takeout Market Y-o-Y Growth Rate by Nature, 2022-2032

Figure 49: Latin America Lunch Takeout Market Value (US$ Mn) and % Growth by Restaurant Type, 2022 & 2032

Figure 50: Latin America Lunch Takeout Market Y-o-Y Growth Rate by Restaurant Type, 2022-2032

Figure 51: Latin America Lunch Takeout Market Value (US$ Mn) and % Growth by Payment Type, 2022 & 2032

Figure 52: Latin America Lunch Takeout Market Y-o-Y Growth Rate by Payment Type, 2022-2032

Figure 53: Latin America Lunch Takeout Market Value (US$ Mn) and % Growth by Purchase Model, 2022 & 2032

Figure 54: Latin America Lunch Takeout Market Y-o-Y Growth Rate by Purchase Model, 2022-2032

Figure 55: Latin America Lunch Takeout Market Attractiveness Analysis by Country, 2022-2032

Figure 56: Latin America Lunch Takeout Market Attractiveness Analysis by Product Type, 2022-2032

Figure 57: Latin America Lunch Takeout Market Attractiveness Analysis by Nature, 2022-2032

Figure 58: Latin America Lunch Takeout Market Attractiveness Analysis by Restaurant Type, 2022-2032

Figure 59: Latin America Lunch Takeout Market Attractiveness Analysis by Payment Type, 2022-2032

Figure 60: Latin America Lunch Takeout Market Attractiveness Analysis by Purchase Model, 2022-2032

Figure 61: Europe Lunch Takeout Market Value (US$ Mn) Forecast, 2022-2032

Figure 62: Europe Lunch Takeout Market Absolute $ Opportunity (US$ Mn), 2022-2032

Figure 63: Europe Lunch Takeout Market Value (US$ Mn) and % Growth by Country, 2022 & 2032

Figure 64: Europe Lunch Takeout Market Y-o-Y Growth Rate by Country, 2022-2032

Figure 65: Europe Lunch Takeout Market Value (US$ Mn) and % Growth by Product Type, 2022 & 2032

Figure 66: Europe Lunch Takeout Market Y-o-Y Growth Rate by Product Type, 2022-2032

Figure 67: Europe Lunch Takeout Market Value (US$ Mn) and % Growth by Nature, 2022 & 2032

Figure 68: Europe Lunch Takeout Market Y-o-Y Growth Rate by Nature, 2022-2032

Figure 69: Europe Lunch Takeout Market Value (US$ Mn) and % Growth by Restaurant Type, 2022 & 2032

Figure 70: Europe Lunch Takeout Market Y-o-Y Growth Rate by Restaurant Type, 2022-2032

Figure 71: Europe Lunch Takeout Market Value (US$ Mn) and % Growth by Payment Type, 2022 & 2032

Figure 72: Europe Lunch Takeout Market Y-o-Y Growth Rate by Payment Type, 2022-2032

Figure 73: Europe Lunch Takeout Market Value (US$ Mn) and % Growth by Purchase Model, 2022 & 2032

Figure 74: Europe Lunch Takeout Market Y-o-Y Growth Rate by Purchase Model, 2022-2032

Figure 75: Europe Lunch Takeout Market Attractiveness Analysis by Country, 2022-2032

Figure 76: Europe Lunch Takeout Market Attractiveness Analysis by Product Type, 2022-2032

Figure 77: Europe Lunch Takeout Market Attractiveness Analysis by Nature, 2022-2032

Figure 78: Europe Lunch Takeout Market Attractiveness Analysis by Restaurant Type, 2022-2032

Figure 79: Europe Lunch Takeout Market Attractiveness Analysis by Payment Type, 2022-2032

Figure 80: Europe Lunch Takeout Market Attractiveness Analysis by Purchase Model, 2022-2032

Figure 81: South Asia Lunch Takeout Market Value (US$ Mn) Forecast, 2022-2032

Figure 82: South Asia Lunch Takeout Market Absolute $ Opportunity (US$ Mn), 2022-2032

Figure 83: South Asia Lunch Takeout Market Value (US$ Mn) and % Growth by Country, 2022 & 2032

Figure 84: South Asia Lunch Takeout Market Y-o-Y Growth Rate by Country, 2022-2032

Figure 85: South Asia Lunch Takeout Market Value (US$ Mn) and % Growth by Product Type, 2022 & 2032

Figure 86: South Asia Lunch Takeout Market Y-o-Y Growth Rate by Product Type, 2022-2032

Figure 87: South Asia Lunch Takeout Market Value (US$ Mn) and % Growth by Nature, 2022 & 2032

Figure 88: South Asia Lunch Takeout Market Y-o-Y Growth Rate by Nature, 2022-2032

Figure 89: South Asia Lunch Takeout Market Value (US$ Mn) and % Growth by Restaurant Type, 2022 & 2032

Figure 90: South Asia Lunch Takeout Market Y-o-Y Growth Rate by Restaurant Type, 2022-2032

Figure 91: South Asia Lunch Takeout Market Value (US$ Mn) and % Growth by Payment Type, 2022 & 2032

Figure 92: South Asia Lunch Takeout Market Y-o-Y Growth Rate by Payment Type, 2022-2032

Figure 93: South Asia Lunch Takeout Market Value (US$ Mn) and % Growth by Purchase Model, 2022 & 2032

Figure 94: South Asia Lunch Takeout Market Y-o-Y Growth Rate by Purchase Model, 2022-2032

Figure 95: South Asia Lunch Takeout Market Attractiveness Analysis by Country, 2022-2032

Figure 96: South Asia Lunch Takeout Market Attractiveness Analysis by Product Type, 2022-2032

Figure 97: South Asia Lunch Takeout Market Attractiveness Analysis by Nature, 2022-2032

Figure 98: South Asia Lunch Takeout Market Attractiveness Analysis by Restaurant Type, 2022-2032

Figure 99: South Asia Lunch Takeout Market Attractiveness Analysis by Payment Type, 2022-2032

Figure 100: South Asia Lunch Takeout Market Attractiveness Analysis by Purchase Model, 2022-2032

Figure 101: East Asia Lunch Takeout Market Value (US$ Mn) Forecast, 2022-2032

Figure 102: East Asia Lunch Takeout Market Absolute $ Opportunity (US$ Mn), 2022-2032

Figure 103: East Asia Lunch Takeout Market Value (US$ Mn) and % Growth by Country, 2022 & 2032

Figure 104: East Asia Lunch Takeout Market Y-o-Y Growth Rate by Country, 2022-2032

Figure 105: East Asia Lunch Takeout Market Value (US$ Mn) and % Growth by Product Type, 2022 & 2032

Figure 106: East Asia Lunch Takeout Market Y-o-Y Growth Rate by Product Type, 2022-2032

Figure 107: East Asia Lunch Takeout Market Value (US$ Mn) and % Growth by Nature, 2022 & 2032

Figure 108: East Asia Lunch Takeout Market Y-o-Y Growth Rate by Nature, 2022-2032

Figure 109: East Asia Lunch Takeout Market Value (US$ Mn) and % Growth by Restaurant Type, 2022 & 2032

Figure 110: East Asia Lunch Takeout Market Y-o-Y Growth Rate by Restaurant Type, 2022-2032

Figure 111: East Asia Lunch Takeout Market Value (US$ Mn) and % Growth by Payment Type, 2022 & 2032

Figure 112: East Asia Lunch Takeout Market Y-o-Y Growth Rate by Payment Type, 2022-2032

Figure 113: East Asia Lunch Takeout Market Value (US$ Mn) and % Growth by Purchase Model, 2022 & 2032

Figure 114: East Asia Lunch Takeout Market Y-o-Y Growth Rate by Purchase Model, 2022-2032

Figure 115: East Asia Lunch Takeout Market Attractiveness Analysis by Country, 2022-2032

Figure 116: East Asia Lunch Takeout Market Attractiveness Analysis by Product Type, 2022-2032

Figure 117: East Asia Lunch Takeout Market Attractiveness Analysis by Nature, 2022-2032

Figure 118: East Asia Lunch Takeout Market Attractiveness Analysis by Restaurant Type, 2022-2032

Figure 119: East Asia Lunch Takeout Market Attractiveness Analysis by Payment Type, 2022-2032

Figure 120: East Asia Lunch Takeout Market Attractiveness Analysis by Purchase Model, 2022-2032

Figure 121: Oceania Lunch Takeout Market Value (US$ Mn) Forecast, 2022-2032

Figure 122: Oceania Lunch Takeout Market Absolute $ Opportunity (US$ Mn), 2022-2032

Figure 123: Oceania Lunch Takeout Market Value (US$ Mn) and % Growth by Country, 2022 & 2032

Figure 124: Oceania Lunch Takeout Market Y-o-Y Growth Rate by Country, 2022-2032

Figure 125: Oceania Lunch Takeout Market Value (US$ Mn) and % Growth by Product Type, 2022 & 2032

Figure 126: Oceania Lunch Takeout Market Y-o-Y Growth Rate by Product Type, 2022-2032

Figure 127: Oceania Lunch Takeout Market Value (US$ Mn) and % Growth by Nature, 2022 & 2032

Figure 128: Oceania Lunch Takeout Market Y-o-Y Growth Rate by Nature, 2022-2032

Figure 129: Oceania Lunch Takeout Market Value (US$ Mn) and % Growth by Restaurant Type, 2022 & 2032

Figure 130: Oceania Lunch Takeout Market Y-o-Y Growth Rate by Restaurant Type, 2022-2032

Figure 131: Oceania Lunch Takeout Market Value (US$ Mn) and % Growth by Payment Type, 2022 & 2032

Figure 132: Oceania Lunch Takeout Market Y-o-Y Growth Rate by Payment Type, 2022-2032

Figure 133: Oceania Lunch Takeout Market Value (US$ Mn) and % Growth by Purchase Model, 2022 & 2032

Figure 134: Oceania Lunch Takeout Market Y-o-Y Growth Rate by Purchase Model, 2022-2032

Figure 135: Oceania Lunch Takeout Market Attractiveness Analysis by Country, 2022-2032

Figure 136: Oceania Lunch Takeout Market Attractiveness Analysis by Product Type, 2022-2032

Figure 137: Oceania Lunch Takeout Market Attractiveness Analysis by Nature, 2022-2032

Figure 138: Oceania Lunch Takeout Market Attractiveness Analysis by Restaurant Type, 2022-2032

Figure 139: Oceania Lunch Takeout Market Attractiveness Analysis by Payment Type, 2022-2032

Figure 140: Oceania Lunch Takeout Market Attractiveness Analysis by Purchase Model, 2022-2032

Figure 141: MEA Lunch Takeout Market Value (US$ Mn) Forecast, 2022-2032

Figure 142: MEA Lunch Takeout Market Absolute $ Opportunity (US$ Mn), 2022-2032

Figure 143: MEA Lunch Takeout Market Value (US$ Mn) and % Growth by Country, 2022 & 2032

Figure 144: MEA Lunch Takeout Market Y-o-Y Growth Rate by Country, 2022-2032

Figure 145: MEA Lunch Takeout Market Value (US$ Mn) and % Growth by Product Type, 2022 & 2032

Figure 146: MEA Lunch Takeout Market Y-o-Y Growth Rate by Product Type, 2022-2032

Figure 147: MEA Lunch Takeout Market Value (US$ Mn) and % Growth by Nature, 2022 & 2032

Figure 148: MEA Lunch Takeout Market Y-o-Y Growth Rate by Nature, 2022-2032

Figure 149: MEA Lunch Takeout Market Value (US$ Mn) and % Growth by Restaurant Type, 2022 & 2032

Figure 150: MEA Lunch Takeout Market Y-o-Y Growth Rate by Restaurant Type, 2022-2032

Figure 151: MEA Lunch Takeout Market Value (US$ Mn) and % Growth by Payment Type, 2022 & 2032

Figure 152: MEA Lunch Takeout Market Y-o-Y Growth Rate by Payment Type, 2022-2032

Figure 153: MEA Lunch Takeout Market Value (US$ Mn) and % Growth by Purchase Model, 2022 & 2032

Figure 154: MEA Lunch Takeout Market Y-o-Y Growth Rate by Purchase Model, 2022-2032

Figure 155: MEA Lunch Takeout Market Attractiveness Analysis by Country, 2022-2032

Figure 156: MEA Lunch Takeout Market Attractiveness Analysis by Product Type, 2022-2032

Figure 157: MEA Lunch Takeout Market Attractiveness Analysis by Nature, 2022-2032

Figure 158: MEA Lunch Takeout Market Attractiveness Analysis by Restaurant Type, 2022-2032

Figure 159: MEA Lunch Takeout Market Attractiveness Analysis by Payment Type, 2022-2032

Figure 160: MEA Lunch Takeout Market Attractiveness Analysis by Purchase Model, 2022-2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lunch Boxes & Lunch Bags Market

Takeout Dinner Market Trends - Convenience & Gourmet Expansion 2025 to 2035

Seafood Takeout Market Size and Share Forecast Outlook 2025 to 2035

Chinese Takeout Market analysis by Product, Restaurant Type, Nature, Purchase Model, Payment Type, and Ownership

Healthy Takeout Market Trends - Convenience & Clean Eating Growth 2025 to 2035

Breakfast Takeout Market Growth – Morning Convenience & Market Expansion 2025 to 2035

Analysis and Growth Projections for Restaurant Takeout Business

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA