The Low-fat Low-calorie Desserts Market is projected to witness steady growth between 2025 and 2035, driven by the rising consumer preference for healthier food alternatives and an increasing focus on weight management and diabetes-friendly diets.

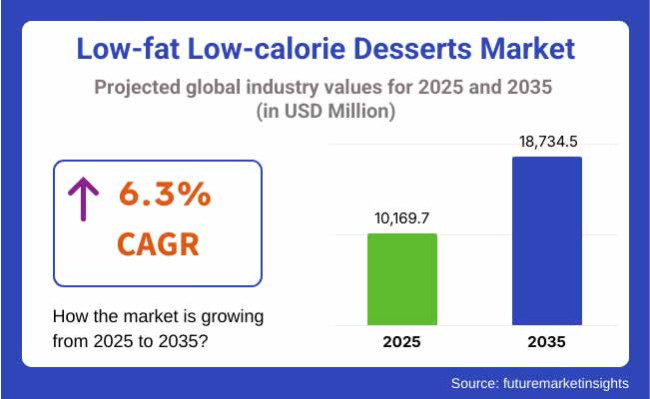

The market is estimated to be valued at USD 10,169.7 million in 2025 and is expected to reach USD 18,734.5 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.3% over the forecast period.

A key driver fueling market expansion is the growing awareness of sugar-related health issues, including diabetes and obesity. As more consumers opt for low-sugar, high-protein, and plant-based desserts, manufacturers are introducing sugar substitutes, fiber-enriched formulations, and functional ingredients to cater to evolving dietary preferences. Additionally, clean-label and organic product innovations are further propelling market demand.

Ice Cream is the market leader with strong consumer appeal as a guilt-free treat Firms are expanding portfolios to meet diverse nutrition needs, with innovations in plant-based, dairy-free, and keto-trend friendly iterations. Sales in the category have soared, with demand for low-calorie frozen desserts rising in the past few years, particularly among healthy millennials and gym-goers.

Within Flavor there is Chocolate, which remains the most popular so long as it can be thought of in a healthy direction since, in this case, Chocolate can be perceived as a healthy choice if made with dark chocolate or non-caloric sweeteners.

Functional chocolates boosted with protein and probiotics, continue to boost sales of stevia-based and sugar-free chocolate desserts There is appeal of chocolate low-calorie dessert among age groups which the market share of these products is anticipated to sustain in the coming forecast period.

Increasing health-consciousness, rising incidence of obesity and diabetes and high interest of the consumers for improved-for-you treats will make the North America market of low-calorie dessert a premium market.

In the USA and Canada, there was a growing demand for sugar-free, keto and plant-based desserts, with large food companies spending money on creative formulations with natural sweetening agents like stevia, monk fruit and erythritol.

In addition, the clean-label trend is also driving the switch to less artificial-desserts and preservatives. This, alongside a rise in functional desserts such as protein-enriched, fiber enriched and probiotic-enriched desserts, caters further to market growth in this region.

Europe holds the largest market share in the low-calorie desserts market, with high demand for the products among health-conscious consumers in countries like Germany, France, and the UK With the region being increasingly wellness-focused, interest in health and the government's push for reduced sugar consumption, there has been a rise in demand for healthier alternatives in the dessert market.

The vegan and dairy-free dessert category is growing even more specifically, as people swap out traditional finds in favor of plant-based minus the sacrifice on taste.

To accommodate the growing lactose-intolerant denomination as well as the vegan dietary lifestyles, European food producers are betting on new formulations based on oat, almond or coconut derived ingredients. Moreover, stringent EU regulations on sugar in processed food are driving brands to rework their formulations with natural sweeteners and other ingredients.

Asia-Pacific is expected to dominate the low-calorie desserts market during the forecast years thanks to increasing awareness of health, fast urbanization, and lifestyle changing dietary patterns.

Increasing disposable income and the growing incidence of lifestyle diseases like diabetes and obesity are driving demand for sugar-free and low-fat desserts in markets such as China, India, Japan, and South Korea. Deserts in Japan and South Korea are getting a makeover, using less sugar and other healthier ingredients, to entice more fitness-focused eaters.

The booming health and wellness sector of India further boosts the market, since food startups to established food businesses are considering the launch of new range of low calorie desserts such as millet dessert and natural desserts made of fruits. Brands will need to take care of affordability and consumer doubt about artificial sweeteners in order to truly find widespread success of their products.

Challenge: Taste and Texture Concerns

The keys to making low-calorie desserts taste and feel like the real thing and not how tasted a generation ago explain some of the major obstacles facing the low-calorie dessert industry today. This leads to an eventual aversion of consumers towards the shift towards healthier products due to the fact that they always associate low-calorie products with substandard taste.

Remaking desserts to be healthy but still decadent take when-consuming-the-whole-slice rethinking and large-scale R&D, and the new use of ingredients from sugar alcohols to plant fats to fiber-fortified bases.

Companies handling the onus of their products meeting at the very least consumers' expectations while maintaining an efficient cost structure without watering them down with cheap ingredients is no easy feat either.

Opportunity: Growth of Plant-Based and Functional Desserts

The greatest opportunity of the low calorie desserts segment is rising demand for functional and plant-based desserts key insights of the report. That trend for guilt-free pleasures that provide added health benefits think high protein, probiotic-friendly and immunity-boosting ingredients is starting to catch on with consumers.

Desserts are also going in the plant-based direction, with dairy-free, plant-based ice creams, vegan cheesecakes, and nut desserts giving standard desserts a run for their money. In markets where the health and wellness trends feed into the consumer, businesses which invest in clean-label, healthy and innovative dessert products, will no doubt see their slice of market share grow.

Between 2020 and 2024, the low-calorie desserts market experienced significant growth, driven by rising health consciousness, increasing prevalence of obesity and diabetes, and the growing demand for guilt-free indulgence.

Consumers increasingly sought healthier alternatives to traditional sweets, fueling demand for sugar substitutes, protein-infused desserts, and plant-based formulations. The surge in ketogenic, paleo, and vegan diets further boosted market expansion.

Between 2025 and 2035, the low-calorie desserts market will undergo a transformative shift driven by personalized nutrition, AI-powered ingredient optimization, and sustainable food innovations.

The adoption of 3D-printed desserts, lab-grown dairy alternatives, and precision-formulated sugar replacements will redefine consumer experiences. The integration of functional and nutraceutical ingredients will further enhance the market, creating a new category of desserts that promote digestive health, cognitive function, and metabolic wellness.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter sugar reduction policies, natural sweetener regulations, and clean-label ingredient mandates. |

| Technological Advancements | AI-assisted food formulation, precision fermentation for sweeteners, and texture-enhancing ingredients. |

| Industry Applications | Sugar-free bakery, dairy-free frozen desserts, and protein-infused sweet snacks. |

| Adoption of Smart Equipment | AI-driven taste profiling, advanced texture modification, and precision blending for sugar substitutes. |

| Sustainability & Cost Efficiency | Sustainable sweetener sourcing, plant-based ingredient integration, and eco-friendly packaging. |

| Data Analytics & Predictive Modeling | AI-driven consumer taste preference analysis, nutritional optimization algorithms, and predictive market trend tracking. |

| Production & Supply Chain Dynamics | COVID-19-induced supply chain disruptions, increased demand for alternative sweeteners, and production delays. |

| Market Growth Drivers | Growing demand for low-calorie alternatives, rising diabetes and obesity rates, and advancements in sugar substitutes. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered food safety compliance, block chain-based nutritional transparency, and sustainability-driven regulations. |

| Technological Advancements | 3D-printed desserts, enzymatic sugar breakdown technology, and AI-driven hyper-personalized nutrition. |

| Industry Applications | Expansion into lab-grown dairy desserts, bioengineered sugar alternatives, and gut-health-focused functional desserts. |

| Adoption of Smart Equipment | Smart packaging with real-time nutritional tracking, AI-powered vending solutions, and portion-controlled dessert dispensers. |

| Sustainability & Cost Efficiency | Carbon-neutral dessert production, upcycled ingredient utilization, and biodegradable smart packaging solutions. |

| Data Analytics & Predictive Modeling | Quantum-enhanced food formulation, AI-powered dietary tracking, and blockchain-verified food labeling. |

| Production & Supply Chain Dynamics | AI-optimized ingredient sourcing, decentralized dessert manufacturing using smart robotics, and blockchain-driven quality assurance. |

| Market Growth Drivers | AI-powered personalized nutrition, sustainable low-calorie dessert innovations, and expansion into precision-formulated functional treats. |

The USA low-calorie desserts market is expanding owing to rising health consciousness, increasing demand for sugar-free and low-calorie desserts, and the rising use of plant-based sweeteners.

The influx of large food & beverage players, transforming food technology, and the growing trend of functional and keto desserts are also propelling growth in the global market. Well-established retail distribution systems such as supermarkets, specialty health stores, and online websites also increase availability of healthier dessert alternatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

The growth of low-calorie desserts in the UK continues to be steady, spurred by an increasing fear of obesity and diabetes and government strictness on sugar content, coupled with the rising trend of organic and clean-label dessert products.

Thus is the surging popularity of dairy-free replacements for desserts and food products is also propelling market demand along with high consumer need for lower calorie chocolate, ice creams, and baked products. An increase in the range of low-sugar desserts purchasable in general food shops is also helping growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.2% |

Factors such as strong pro-sweetener regulation toward sugar reduction, increased consumer demand for healthy indulgence, and the launch of new organic and functional dessert goods are helping to grow the European low-calorie treats market.

In terms of product innovation, Germany, France and Italy hold the top three positions for these products in public awareness, including products such as low-fat dairy desserts, sugar-free chocolates, and high-protein snack bars. Also, the rise of private-label brands and grocery chain stores with low-cost low-calorie products is enhancing penetration in the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.5% |

Japan is supported in the low-calorie desserts market with high health and wellness consciousness coupled with demand for functional foods as well as using alternative sweet-enable revenue like stevia and monk fruit.

This is in line with the Japanese love of portion-controlled and low-sugar desserts like mochi, pudding and yogurt-based sweets, which fit in with the country’s focus on balanced diets. Ongoing food innovation and government initiatives to control sugar consumption also support the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.4% |

The market of low-calorie desserts in South Korea is growing very fast due to the increasing health-conscious consumers, demand for the sugar-free and diabetic desserts and rising trends of western desserts.

The trend for protein-heavy, keto and plant-based desserts is also impacting market growth. In addition, online platforms and health food stores that specialize in these products are making them readily accessible to urban audiences.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.3% |

ice cream has emerged as one of the most surging market segment in the low calorie desserts, which helps consumers to send a balance between indulgent and responsible eating. Unlike the traditional high-calorie variants of ice cream products that are primarily based on sugar, these low-calorie ice-cream products focus on reduced sugar, high-protein alternatives, and the combined use of natural ingredients.

Increasing demand for better-for-you frozen desserts has seen a rise in the consumption of ice cream as consumers seek portion-controlled, low-fat and sugar-free options. Protein-blended, keto-safe, and plant-based varieties of ice cream have also spawned their own flavors, inducing trends through greater market demand and appealing to a broader consumer base with diet-specific and health-conscious interests.

The combination of AI-driven flavor innovation, such as consumer-led recipe preference, AI-based flavor optimization, and digital ingredient trend analysis has also increased adoption, ensuring continual innovation in fresh, trendy flavors of ice cream.

The invention of dairy-free and allergen-friendly low-calorie ice-cream, including varieties using oat milk, almond milk and coconut, has captured the maximum dairy-free post-expansion of the market and ensured more inclusivity for lactose-intolerant and vegan consumers.

Segments like biodegradable ice cream containers, edible spoons and compostable packaging wraps have added to the growth of varieties available while maintaining consistency with green-sensitive consumer preferences.

And despite its positive health cachet, dietary flexibility and guilt-free pleasure, the ice cream category is not without its obstacles, including the textural limitations of sugar-free options, regulatory scrutiny of artificial sweeteners and supply chain disruptions for plant-based ingredient sourcing.

However, advancements in precision fermentation technology for dairy-free alternatives, AI-optimized texture, and also block chain-secured supply chain tracking are improving taste quality, safety, and ingredients traceability, creating a sustainable growth opportunity for low-calorie ice cream brands across the globe.

Chocolate is launching to strong market acceptance, particularly amongst consumers who seek for sugar-free, functional and antioxidant products. Low-cal chocolate products with natural sugar substitutes, high cocoa content, and added functional ingredients such as fiber, collagen, and adaptogens have taken the place of traditional chocolates.

Increase in demand for low sugar and high cacao percentage chocolate, with organic, bean-to-bar, and ethically produced ingredients has driven adoption as consumers look for clean-label and health-oriented confectionery products.

This has been accompanied by the rise of functional low calorie chocolate with added nootropics, protein fortification, and mood enhancers, strengthening overall demand in the marketplace and ensuring more tailored and health and wellness-oriented chocolate realities.

The inclusion of AI-driven formulation innovations from precision sweetening and flavor balance checks to digital personalization has further steered ingression, assuring best taste without the compromise on low calorie content.

The use of sustainable chocolate packaging, such as compostable wrappers, plastic-free boxes, and incorporating recycled materials, has driven market growth, ensuring alignment with sustainable consumer values.

However, even with all its strengths in functional, sugar reduction and ethical sourcing, the category faces headwinds in the form of consumer skepticism around artificial sweeteners, rising cocoa prices and regulatory hurdles for clean label products.

However, innovations in the fermentation of natural sweeteners, cocoa-free chocolate substitutes, and block chain-backed ingredient traceability are elevating transparency, sustainability, and product legitimacy, ensuring increased demand for low-calorie chocolate brands worldwide.

The vanilla flavor segment has emerged as one of the most widely adopted options for low calorie desserts, offering consumers a familiar, comforting, and adaptable taste profile across various dessert formats. Unlike bold or exotic flavors, vanilla maintains widespread appeal and pairs seamlessly with various functional and dietary dessert formulations.

The rising demand for organic and natural vanilla extract, featuring fair trade and sustainable vanilla sourcing, has fueled adoption, as consumers prioritize clean-label and authentic ingredient profiles.

Despite its advantages in versatility, clean-label compatibility, and consumer familiarity, the vanilla segment faces challenges such as rising vanilla bean prices, synthetic vanilla perception concerns, and regulatory constraints on natural flavor labeling.

However, emerging innovations in lab-grown vanilla synthesis, AI-optimized vanilla blending, and block chain-verified vanilla sourcing are improving affordability, authenticity, and supply chain transparency, ensuring continued market growth for vanilla-flavored low calorie desserts worldwide.

The strawberry flavor segment has gained strong market adoption, particularly among consumers seeking refreshing, vitamin-rich, and naturally sweet low calorie desserts. Unlike heavier dessert flavors, strawberry provides a light, fruit-forward profile that aligns with health-conscious preferences and seasonal dessert trends.

The rising demand for real fruit inclusions in low calorie desserts, featuring freeze-dried strawberry pieces, fresh puree infusions, and probiotic strawberry blends, has driven adoption, as consumers favor natural sweetness and added nutritional benefits.

Despite its advantages in natural sweetness, vitamin content, and refreshing appeal, the strawberry segment faces challenges such as flavor inconsistency in artificial variants, perishability in fresh fruit applications, and supply chain constraints in organic strawberry sourcing.

However, emerging innovations in AI-powered flavor replication, extended shelf-life fruit preservation, and block chain-secured fruit traceability are improving taste stability, sustainability, and ingredient transparency, ensuring continued expansion for strawberry-flavored low calorie desserts worldwide.

The Low-Calorie Desserts Market is experiencing substantial growth due to the increasing consumer preference for healthier food options. As concerns over obesity and diabetes rise, demand for desserts with reduced sugar, low fat, and fewer calories has surged. Innovations in natural sweeteners, plant-based ingredients, and portion-controlled desserts are driving market expansion.

The food and beverage industry is adapting by offering a variety of low-calorie alternatives, including ice creams, cakes, and puddings, to cater to health-conscious consumers. Leading companies are investing in product innovation, strategic partnerships, and marketing initiatives to strengthen their market positions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Pinnacle Foods Group, LLC | 18-22% |

| General Mills Sales Inc. | 14-18% |

| J&J Snack Foods | 10-14% |

| Stanmar International | 8-12% |

| The Jel Sert Company | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Pinnacle Foods Group, LLC | Produces a range of frozen low-calorie desserts and snacks. |

| General Mills Sales Inc. | Offers low-calorie yogurt, ice cream, and baked goods. |

| J&J Snack Foods | Specializes in frozen and pre-packaged low-calorie treats. |

| Stanmar International | Manufactures sugar-free and diet-friendly dessert options. |

| The Jel Sert Company | Develops low-calorie gelatin and pudding products. |

Key Company Insights

Pinnacle Foods Group, LLC (18-22%)

As a market leader in the low-calorie dessert segment, Pinnacle Foods is committed to frozen desserts and snacks. The firm relies on innovative formulations of ingredients to preserve taste and minimize calorie intake. Strategic buying and building up its healthy dessert line propel its market share.

General Mills Sales Inc. (14-18%)

General Mills leads the health-conscious dessert market with a variety of low-calorie products, ranging from yogurt to baked foods and ice cream. Its established brand name and R&D investment have helped it stay ahead of the competition.

J&J Snack Foods (10-14%)

Reputed for its wide range of frozen and pre-packaged snacks, J&J Snack Foods has built a good presence in the low-calorie desserts segment. The organization's thrust is convenience and innovation with products targeting health-conscious consumers.

Stanmar International (8-12%)

A company that offers sugar-free and diet desserts catering to a small niche market, Stanmar International uses natural sweeteners and functional ingredients to serve the increasing trend towards healthier indulgences.

The Jel Sert Company (6-10%)

With a focus on gelatin and pudding products, The Jel Sert Company offers low-calorie options targeting health-conscious and diabetic consumers. The company invests in clean-label products and natural ingredient sourcing.

Other Key Players (30-40% Combined)

The low-calorie desserts market is also supported by several emerging and regional companies, including:

The overall market size for Low-fat Low-calorie Desserts Market was USD 10,169.7 Million in 2025.

The Low-fat Low-calorie Desserts Market is expected to reach USD 18,734.5 Million in 2035.

The rising consumer preference for healthier food alternatives and an increasing focus on weight management and diabetes-friendly diets fuels Low-fat Low-calorie Desserts Market during the forecast period.

The top 5 countries which drives the development of Low-fat Low-calorie Desserts Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of type, ice cream to command significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthy Low-Fat Desserts Market Growth – Innovations & Trends 2025 to 2035

Vegan Desserts Market Analysis by Unflavoured, Vanilla, Chocolate and Other Categories Through 2035

Frozen Desserts Market Growth Share Trends 2025 to 2035

Competitive Landscape of Frozen Desserts Providers

Low Calorie Desserts Market Size and Share Forecast Outlook 2025 to 2035

Oral Clinical Nutrition Desserts Market Analysis - Size, Growth, and Forecast 2025 to 2035

Dry Mix Base for Frozen Desserts Market

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Layered Verrine‑Style Desserts in France Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA