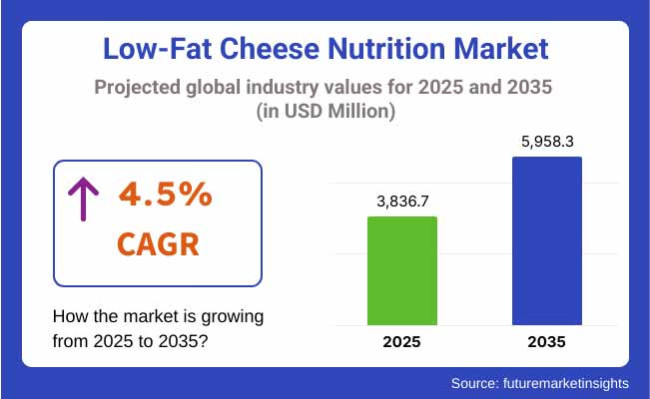

The low-fat cheese nutrition market is expected to grow steadily between 2025 and 2035, fueled by increasing health consciousness, rising prevalence of obesity and cardiovascular conditions, and expanding demand for protein-rich, reduced-calorie dairy alternatives. The market is projected to be valued at USD 3,836.7 million in 2025 and is anticipated to reach USD 5,958.3 million by 2035, reflecting a CAGR of 4.5% over the forecast period.

Low-fat cheese products carefully formulated to reduce some of the saturated fat while retaining taste and nutrition are attracting considerable interest, not just from thin people but from consumers concerned about weight, active lifestyles, and cholesterol.

The market shows promise but has hurdles to jump, including taste perception issues and limitations around texture, and it is often more expensive to produce than its full-fat counterparts. Product diversification provides sensation in competition and has gone beyond product from salted to lactose-free and plant-based low-fat cheese alternatives to fortified-t cheese with probiotics.

North America retains its position as a primary low-fat cheese nutrition market, and as demand for healthy snacking, functional dairy, and low-calorie meal ingredients continues to grow. The to 20S. is the innovator of high protein, low fat cheese sticks, shreds, dips, heavily adopted by fitness-conscious consumers and the elderly. In Canada, it’s growth via wellness-oriented private label brands, and fortified dairy on foodservice menus. The region’s established dairy infrastructure enables ongoing reformulation and product innovation.

Growth in Europe is fueled by public health campaigns, nutritional labelling mandates and a growing consumer emphasis on heart-healthy diets. Germany, France, UK, Italy and Netherlands are markets where organic low-fat cheeses, reduced-sodium products, and sustainable dairy sourcing are significant areas of interest. Looking at the big picture, EU regulations are also urging producers to reform full-fat cheeses to achieve sodium and saturated fat thresholds, which helps speed innovation throughout the segment.

The fastest growing market is Asia-Pacific due to increasing western dietary influence, urbanization and the change in lifestyle in China, India, Japan and Australia. Millennials and younger consumers are looking for healthy dairy snacks that include protein-enriched cheese slices and functional cheese powders.

Japan has the highest research and development on fermented low-fat cheeses, whereas in India consumption of packaged paneer substitutes with low fat and cholesterol is growing. Lifestyle diseases are also encouraging low-fat dairy consumption, particularly at the regional level.

Challenges

Taste, Texture, and Cost Barriers

A major hurdle in the production of low-fat cheese is to reduce fat without compromising flavour and texture in a way that meets consumer acceptance, as fat provides mouthfeel which is an important factor in cheese acceptability. The need for stabilizers to counter high production costs and limited shelf life for some formulations pose challenges to scaling, particularly in price-sensitive markets.

Opportunities

Functional Fortification and Clean Label Trends

Such opportunities include probiotic and calcium-enriched low-fat cheeses, plant-based hybrid formulations and low-fat offerings with high protein-to-calorie ratios. And innovations like enzyme-based fat reduction, fermentation tech, and optimization of salt-fat ratios are allowing for improved sensory profiles.

New value channels are forming with growing demand for snack-sized portions, meal-prep cheese kits, and personalized nutrition platforms. Health-driven cheese sustainability trends like carbon-neutral dairy and biodegradable packaging offer branding benefits too.

The low fat cheese nutrition market is projected to have steady growth between 2020 and 2024 driven by an increasing emphasis on health and wellness among consumers emphasizing on weight management and cardiovascular health. Growing interest in high-protein, low-calorie dairy drove innovation in mozzarella, cheddar, and cottage cheese with lower fat content.

Lactose-free and plant-based adaptations also rose, meeting changing dietary preferences. Although the health argument works in their favour, various factors including taste perception, texture quality, and spoilage potential impede wider mass-market adoption for this food substitute.

From a perspective of 2025 to 2035, the market will be developing via precision nutrition, purposeful food integration, and smart food tech. The combination of advances in fermentation science, plant-dairy hybrids, as well as AI-assisted product development will result in low-fat cheese products enhanced with probiotics, vitamins, and bioactive compounds.

Wearable health tech and microbiome analysis will lead to personalized nutrition plans influencing consumer choices even more. In fact, sustainability issues will spur innovation in clean-label formulations, eco-intelligent packaging, and circular dairy supply systems, making low-fat cheese a functional and eco-synergistic component of the diet.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, EFSA, and other national food labeling and fat content standards. |

| Technological Innovation | Use of fat replacers, ultra-filtration, and cultured dairy enzymes to retain flavour and protein content. |

| Industry Adoption | Widely adopted in weight-loss-focused consumer segments and health-conscious urban populations. |

| Smart & AI-Enabled Solutions | Limited to digital diet trackers and smart packaging innovations. |

| Market Competition | Dominated by traditional dairy giants and health-food-focused dairy cooperatives. |

| Market Growth Drivers | Increasing lifestyle diseases, demand for high-protein low-fat snacks, and fitness-centric diets. |

| Sustainability and Environmental Impact | Early steps in biodegradable packaging and local sourcing practices. |

| Integration of AI & Digitalization | Minimal digital integration into product development or marketing. |

| Advancements in Product Design | Sliced, shredded, and spreadable low-fat cheese with basic flavour variants. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global nutrient transparency rules, front-of-pack health scoring, and AI-driven compliance for fortified low-fat dairy. |

| Technological Innovation | Biotech-driven precision fermentation, AI-guided formulation optimization, and CRISPR-enhanced dairy protein customization. |

| Industry Adoption | Mass-market penetration through integration in meal kits, functional snacks, school programs, and hospital nutrition menus. |

| Smart & AI-Enabled Solutions | AI-personalized cheese recommendations, microbiome-compatible formulations, and IoT-enabled freshness monitoring. |

| Market Competition | Rising competition from personalized nutrition startups, precision fermentation food-tech firms, and clean-label hybrid dairy brands. |

| Market Growth Drivers | Growth driven by DNA-based diet personalization, gut-health-oriented cheese innovation, and functional food-based preventive nutrition. |

| Sustainability and Environmental Impact | Carbon-positive dairy operations, regenerative farming-based dairy ingredients, and circular packaging innovations. |

| Integration of AI & Digitalization | AI-enhanced product testing, dynamic nutrition labeling, and real-time user feedback loops for customized dairy nutrition solutions. |

| Advancements in Product Design | Fortified, probiotic-rich, snack able formats with custom flavours, portion-controlled pods, and dual-function nutrition profiles. |

The to 20S. is recorded as the highest on-demand low-fat cheese nutrition account on the back of rising health consciousness, uptrend in demand for high-protein snacks and growing consequent rates of the lifestyle-linked metabolic disorders such as obesity and heart disease. Due to their fitness and weight management goals, consumers are actively looking out for dairy alternatives.

Retailers are broadening selection of low-fat mozzarella, cheddar and string cheeses, especially in single-serve and on-the-go formats. Improvements in flavour retention and texture manipulation are making low-fat alternatives competitive with the full-fat versions. Interest is also coming from foodservice operators that are reformulating menus with healthier cheese options.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.7% |

UK Low fat cheese nutrition market developing at a healthy pace as the consumers gradually shift towards a healthy dairy option but without giving up with taste. The trend is bolstered by public health campaigns encouraging lower saturated fat consumption as well as reforms in product labeling to emphasize nutritional content.

Supermarkets and specialty grocers are expanding offerings to include low-fat versions of classic British cheeses like red Leicester and double Gloucester. Reduced-fat plant-based and hybrid cheese blends are also on the rise, attracting flexitarians and calorie-conscious consumers alike.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.4% |

The main European Union low-fat cheese nutrition markets are Germany, France, and the Netherlands, thanks to strong dairy traditions and a growing meteor in preventive health Older consumers and wellness-focused younger demographics are interested in functionally fortified cheese formats sprouting with calcium, probiotics, or vitamin D.

While encouragement from regulators to reformulate high-fat foods is propelling the adoption of lower-fat cheese variants across both retail and institutional catering. Game tethers are seeking to replicate these flavours, and EU-based producers are investing in clean-label, low-fat formulations that employ traditional aging methods to retain taste and texture.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.5% |

Japan's low fat cheese nutrition market is growing as consumers look for healthier snacking options and ingredients high in protein in their daily meals. Particularly in demand are portion-controlled cheese sticks, low-fat cream cheese spreads and processed cheese slices used in home cooking.

Japanese food producers are rolling out low-fat cheese offerings aimed at school lunches, bento boxes and convenience stores. New techniques, like enzymatic fat reduction and fermentation-based flavour enhancement in dairy processing, are rising to meet the demand for both health and taste.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

The market for low-fat cheese nutrition in South Korea is growing explosively, bolstered by the increase in Western diet preferences, fitness culture and nutritional education. Whether it’s low-fat string cheese, shredded cheese, or individually wrapped snack cubes, these healthy snacks are becoming more popular with working professionals and health-focused families.

Low-fat cheese was used for some fusion dishes as side dishes of local brands are also being released in Korea with K-food style meals. Online grocery platforms and health-food stores are emerging as centrepieces of the distribution channels. Now: Dairy producers are also riding the clean-label trend by reducing artificial ingredients and promoting natural fermentation technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.8% |

Type Market Share (2025)

| Type | Value Share (%) |

|---|---|

| Natural Low-Fat Cheese Nutrition | 59.6% |

On the basis of product type, super low-fat cheese is anticipated to witness the highest market value share by 2025, accounting for 59.6% of value share. This segment’s growth is driven by an uptick of consumer demand for clean-label, minimally processed dairy fit with health and wellness trends. As consumers are increasingly concerned about their health, nutritional profiles are increasingly being valued for high protein and calcium content while low fat and sodium content low as well, all features of natural low-fat cheese.

Cheese Products like low-fat mozzarella and feta fall within this category and are the real thing without looking for too many additives and preservatives. They serve consumers seeking to stay healthy without giving up taste or mouthfeel. Additionally, natural low-fat cheeses are making their way more into salads, sandwiches, and light-prep meals, further driving their popularity with fitness-conscious and weight-conscious consumers.

The increasing focus toward the natural and organic ingredients, especially in North America and Europe, has stimulated the demand for the natural low fat cheese. Foodservice providers are also adopting this segment, along with culinary professionals to cater to changing dietary habits of the consumer base. The dominance of low-fat cheese over the overall low-fat cheese market is a direct result of this preference for transparency, nutrition, and culinary flexibility.

Product Type Market Share (2025)

| Product Type | Value Share (%) |

|---|---|

| Mozzarella | 47.8% |

Mozzarella is expected to dominate the product type segment of the low fat cheese nutrition market, with a revenue share of 47.8% in 2025. Its popularity is fueled by its use in global cuisines, versatility in cooking, and popularity among health-conscious consumers. Low-fat mozzarella has a good nutritional profile but still has the creamy texture and mild flavour consumers expect from traditional mozzarella.

It is a core ingredient of many foods, pizzas, salads, sandwiches and baked dishes. At home and in foodservice, low-fat mozzarella is more frequently being used as a substitute for full-fat cheese, thanks to the gather momentum of health-oriented food offerings and protein-driven diets. It's frequently touted for being high in calcium and protein, giving it a certain appeal for those looking for a healthy-but-not-necessarily-indulgent alternative.

Mozzarella has also benefited from product innovation, with manufacturers producing shredded, sliced and block formats to meet different culinary applications. Its superior leanness also makes it perfect for inclusion in school meals, diets served in hospitals, and wellness-focused meal kits, adding to its versatility across institutional channels.

As consumers continue to value good taste, utility, and nutrition in their food choices, mozzarella is still the top pick among the low-fat cheese category, which propels its sustained growth in both the domestic and international markets.

Low-fat cheese is made from a reduced fat content through several methods. Innovation in taste, texture, and shelf stability has further fueled the market; low-fat cheese appeals to both health-focused and mainstream consumers. Growth drivers are increasing interest in functional foods, clean-label product development, high-protein snacking trends and retail, foodservice and online grocery channel expansion.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Arla Foods amba | 18-22% |

| Lactalis Group | 14-18% |

| The Kraft Heinz Company | 12-16% |

| FrieslandCampina | 9-13% |

| Saputo Inc. | 7-10% |

| Others | 20-28% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Arla Foods amba | In 2024, Arla launched a new line of Arla® Protein Lite Cheddar Slices, offering 40% less fat and 20g protein per serving, targeting fitness-focused consumers. |

| Lactalis Group | As of 2023, Lactalis expanded its Président® Light range with Mediterranean-style low-fat cheese blocks, catering to the Middle East and European retail sectors. |

| The Kraft Heinz Company | In 2025, Kraft introduced Velveeta Lite™ for the USA market, featuring reduced fat and sodium levels with a creamier melt profile for home cooking and meal prep. |

| FrieslandCampina | In 2023, FrieslandCampina enhanced its Frico® Light cheese portfolio with probiotic-enriched gouda and edam variants aimed at gut health-conscious consumers. |

| Saputo Inc. | As of 2024, Saputo rolled out its LightLife™ Mozzarella Shreds for foodservice, featuring a 50% fat reduction without compromising meltability or flavour. |

Key Market Insights

Arla Foods amba (18-22%)

Leads in health-oriented dairy with high-protein, low-fat formats that appeal to athletes, dieters, and clean-label consumers in Europe and North America.

Lactalis Group (14-18%)

Combines traditional taste profiles with light formulations, offering regional variations and Mediterranean influence in its low-fat cheese selections.

The Kraft Heinz Company (12-16%)

Focuses on household convenience and mainstream appeal, with low-fat cheese variants designed for cooking, snacking, and family meal applications.

FrieslandCampina (9-13%)

Innovates in gut-health and functional nutrition space, blending traditional cheese with added probiotics and micronutrients.

Saputo Inc. (7-10%)

Caters to both foodservice and retail markets with shredded, sliced, and block cheese formats designed to balance fat reduction with sensory performance.

Other Key Players (Combined Share: 20-28%)

An expanding group of regional and specialty brands is contributing to product innovation in organic, lactose-free, and plant-integrated low-fat cheese offerings, including:

The overall market size for the low-fat cheese nutrition market was USD 3,836.7 million in 2025.

The low-fat cheese nutrition market is expected to reach USD 5,958.3 million in 2035.

The demand for low-fat cheese nutrition products will be driven by growing health consciousness among consumers, rising prevalence of obesity and cardiovascular conditions, increasing adoption of high-protein and low-calorie diets, and advancements in food processing technologies offering better taste and texture.

The top 5 countries driving the development of the low-fat cheese nutrition market are the USA, Germany, France, the UK, and Canada.

The mozzarella-based low-fat cheese segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cheese Packaging Market Forecast and Outlook 2025 to 2035

Cheese Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Cheese Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Cheese Color Market Size and Share Forecast Outlook 2025 to 2035

Cheese Market Size and Share Forecast Outlook 2025 to 2035

Cheese Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Cheese Flavor Market Size, Growth, and Forecast for 2025 to 2035

Cheese Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cheese Powder Market Size, Growth, and Forecast for 2025 to 2035

Cheese Alternatives Market Analysis - Size, Share, and Forecast 2025 to 2035

Cheese Analogue Market Insights - Growth & Demand Analysis 2025 to 2035

Cheese Liners Market

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Cream Cheese Market Analysis – Size, Share, and Forecast 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Nacho Cheese Warmers Market – Hot & Fresh Cheese Dispensing 2025 to 2035

Spray Cheese Market Analysis by Flavours, Distribution Channel and Region through 2035

Analysis and Growth Projections for Halal Cheese Market

Frozen Cheese Market Size and Share Forecast Outlook 2025 to 2035

Understanding Market Share Trends in String Cheese Production

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA