The Low Density Polyethylene market is experiencing steady growth driven by its extensive use across packaging, construction, and consumer goods industries. The future outlook for this market is largely shaped by the growing demand for lightweight, flexible, and cost-effective polymer solutions in manufacturing and packaging applications. Increasing urbanization, rising e-commerce activities, and expanding food and beverage sectors are significantly contributing to the market’s expansion.

Advancements in polymer processing technologies, along with the development of sustainable and recyclable polyethylene grades, are further enhancing its appeal across industries. Moreover, rising awareness regarding product quality and durability is fueling the adoption of LDPE in films, sheets, and molded products. The demand for efficient and versatile materials capable of supporting innovative packaging solutions is expected to continue driving the market growth.

Additionally, growing investments in infrastructure and industrial activities in emerging regions are creating new opportunities for LDPE applications Overall, the market is poised for continued expansion as industries increasingly rely on LDPE for high-performance, cost-efficient, and environmentally adaptable solutions.

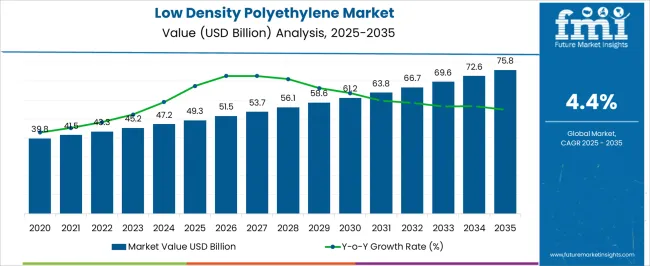

| Metric | Value |

|---|---|

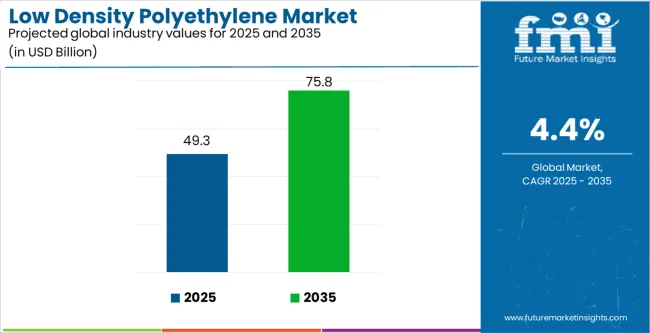

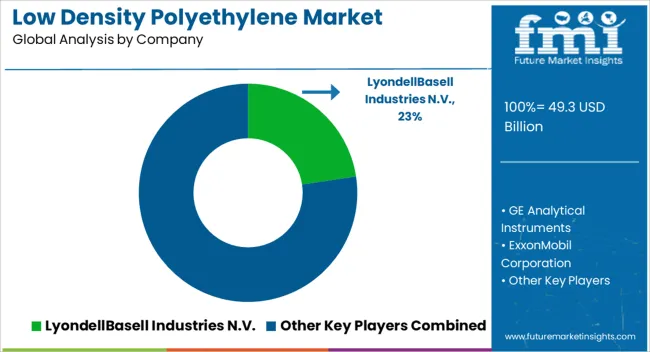

| Low Density Polyethylene Market Estimated Value in (2025 E) | USD 49.3 billion |

| Low Density Polyethylene Market Forecast Value in (2035 F) | USD 75.8 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

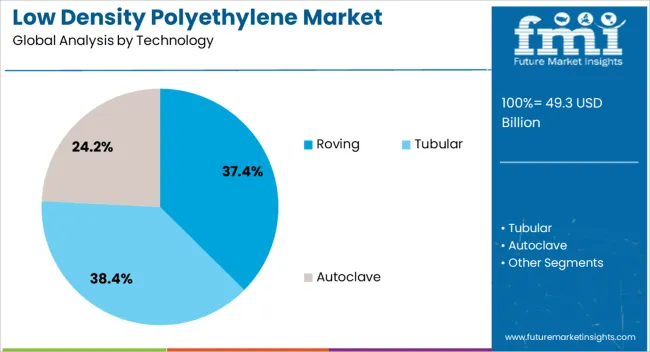

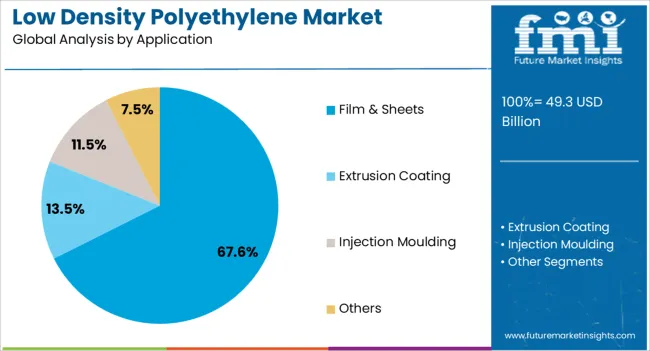

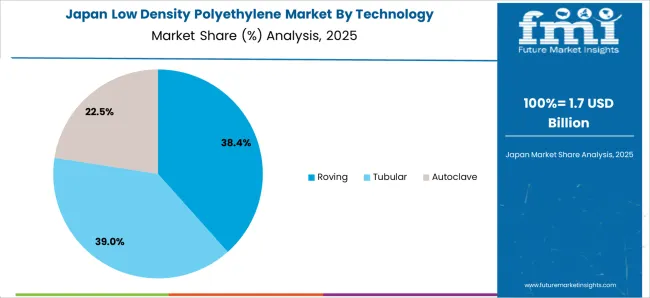

The market is segmented by Technology and Application and region. By Technology, the market is divided into Roving, Tubular, and Autoclave. In terms of Application, the market is classified into Film & Sheets, Extrusion Coating, Injection Moulding, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Roving technology segment is projected to hold 37.40% of the Low Density Polyethylene market revenue share in 2025, establishing it as a leading technology type. This segment has been driven by the consistent demand for high-strength and lightweight polymer strands that provide enhanced mechanical properties for various industrial applications.

The versatility of Roving in manufacturing processes, including extrusion and molding, has made it a preferred choice for producing robust LDPE products. Advancements in polymer formulation and processing have improved uniformity, strength, and durability of roving-based materials, thereby increasing their adoption in packaging, construction, and composite applications.

The ability to customize roving fibers for specific performance requirements, coupled with scalability in production, has further supported its prominence Additionally, the growing focus on cost-effective and high-performance materials has reinforced the adoption of the Roving technology segment, making it a critical driver of overall LDPE market growth.

The Film & Sheets application segment is expected to capture 67.60% of the Low Density Polyethylene market revenue share in 2025, positioning it as the leading application. The growth of this segment has been influenced by the extensive use of LDPE in flexible packaging, protective films, and industrial sheets, which offer lightweight, durable, and cost-efficient solutions.

The segment has benefited from innovations in extrusion and film-blowing technologies, enhancing product uniformity, clarity, and tensile strength. High demand from food packaging, retail packaging, and industrial covering applications has reinforced the adoption of LDPE in film and sheet formats.

The ease of processing, combined with superior barrier properties and adaptability for lamination, has made this segment particularly attractive Additionally, increasing emphasis on product protection, shelf life extension, and sustainable packaging solutions has accelerated the use of LDPE films and sheets, driving continued market dominance in this application category.

In the LDPE market, income is growing as demand increases which is due to convenience, sustainability, and product protection of flexible packaging in food and beverages, consumer goods, and thereby innovation and market competition amidst consumers’ preferences.

The eco-conscious LDPE market is moving towards greener solutions with the help of sustainable processes, eco-friendly alternatives, and recycling initiatives. This is done to minimize the pollution caused by plastic and also to fight the regulation challenge that is in line with consumers' demand for environmentally responsible packaging solutions, which in turn boosts market growth and innovation.

LDPE pipes as well as other construction materials are in demand in the water management, urban development, and transportation sectors of projects worldwide, as governments and developers look for durable and cost-effective solutions to the growing needs for urbanization and infrastructure, thus stimulating market growth and investment opportunities.

The healthcare sector employs LDPE in medical packaging and equipment, driving demand through sterile, lightweight characteristics necessary for infection control in hospitals and healthcare facilities. This in turn fuels the growth of the market and innovation in healthcare packaging solutions and medical devices.

The LDPE industry is benefiting from growth as consumer goods manufacturers are increasingly going for LDPE packaging solutions to meet the consumer need for convenience, robustness, and product protection in the food, beverage, and household product categories in response to which, the market expansion and the product development in the consumer packaging industry are driven.

| Segments | Estimated Market Share in 2025 |

|---|---|

| Roving | 37.40% |

| Film & Sheets | 67.60% |

The film and sheet application segment is holding a 67.60% market share in 2025, showing the diversity and appropriateness of LDPE for this application. However, these films and sheets can be utilized in a variety of industries including packaging, construction, agriculture, consumer goods and so on.

Likewise, their flexibility, moisture resistance and simplicity of production are characteristics that make them perfect for the manufacture of food packaging, construction films, trash bags and liners. The development of flexible packaging with a focus on eCommerce as well as other sectors could be the next and probable growth driver of this market segment.

The notable 37.40% of the roving technology in LDPE industry stands out for its significance in certain applications. The roving process consists of the fibers of LDPE being bundled and then merged into a material that is reinforced. These LDPE rovings, therefore, find wide applications in areas such as pipe lining and corrosion protection.

The increasing demand for infrastructure building and the fact that the pipes must be durable and cost-effective is likely to facilitate the growth of the roving technology segment in the LDPE market making them even more essential in the production of LDPE products.

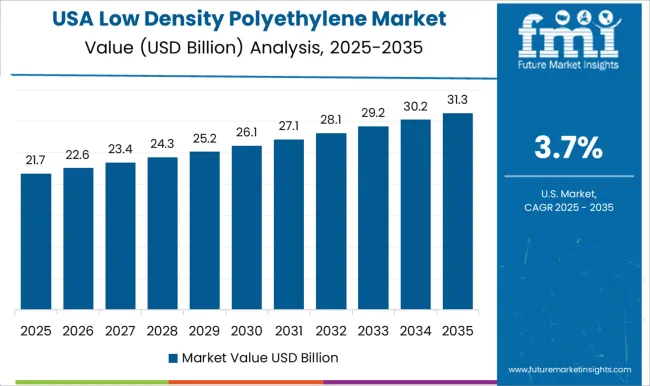

| Country | United States |

|---|---|

| CAGR till 2035 | 2.40% |

The LDPE market in the United States is projected to grow at a moderate rate of 2.4%, according to the CAGR forecast for 2035. The market saturation may be the reason, meaning the LDPE is well-established and has a lot of uses. Moreover, there is a likelihood that a country may adopt stricter environmental policies and recycling practices which would be a key factor in shifting to eco-friendly alternatives in the US.

Nevertheless, the growth of LDPE production rests on the introduction of more innovative processes and the exploration of niche sectors which can, however, offer a chance for its rebirth. In contrast to the case of China and India, the use of LDPE in the United States market grew at a slower pace since the market was too saturated.

| Country | United Kingdom |

|---|---|

| CAGR till 2035 | 1.70% |

The United Kingdom low density polyethylene market is expected to be growing at a steady rate, with a CAGR of 1.70% projected for 2035. This demonstrates that there exists a well-developed market for LDPE where it has manifold already existing applications. Environmental issues and recycling together with reclamation might add in as the passions that cause the people to adopt these substitutes.

While the introduction of LDPE technology and extensive research on its use could give a new impulse to this market in the United Kingdom, the future of this market is still uncertain. LDPE adoption in the United Kingdom displays a similar pattern to that in the United States with the slow process in the hands of developing economies with rapid speed.

| Country | Japan |

|---|---|

| CAGR till 2035 | 1.80% |

The LDPE market in Japan is predicted to maintain a steady growth rate, with a CAGR of 1.80% projected to occur by 2035. This means that LDPE has a huge share of the market with lots of end uses for LDPE. The strategy of rigorous environmental regulations and resource efficiency could lead to more sustainable alternatives being looked at in Japan.

Moreover, the Japanese market may be revitalized as a result of future research and development efforts that might lead to the discovery of some new areas of application for LDPE. Also, the Japanese are not as fast as the Americans and the British in the adoption of LDPE technology that is popular in developing countries, whose demand for these materials is higher.

| Country | China |

|---|---|

| CAGR till 2035 | 4.90% |

China, the global manufacturing superpower, is set to register a sterling 6.50% CAGR in its LDPE market by 2035. This terrific boom could be explained by a number of factors. The growing industrial areas, particularly in packaging and construction, of the country account for a huge demand for LDPE because of its versatility and cost efficiency due to the high demand.

Moreover, government policies that encourage infrastructure and urbanization growth are forecasted to gear LDPE consumption gains in China. Influencing the development of the LDPE market in China is more rapid than the developed economies which are already well established with LDPE.

| Country | India |

|---|---|

| CAGR till 2035 | 6.50% |

India's LDPE market is expected to witness a high growth rate, with a CAGR of 6.50% by the year 2035. This spectacular growth has been realized by the fact that the country's economy has been growing very fast, people are tapping more revenue and a new industrial sector is also on the rise.

The growing demand for flexible packaging, construction materials, and other consumer products is believed to be a major driver of LDPE consumption in India. The major reasons for that are due to its cost-effectiveness and the fact that it can be applied to many areas.

Although the LDPE industry remains largely the domain of established producers, new start-ups are increasingly gaining ground. These startups are nowadays becoming more and more popular as they are developing new products based on the latest technologies, especially in the domain of environmental friendliness and sports achievements.

In this context, the main focus is the manufacture of recycled LDPE using chemicals. These ventures are the ones that developed technology that can degrade LDPE waste to its fundamental chemical components and create new-grade plastic out of the waste material.

It doesn't just stop the overconsumption of virgin fossil fuels, but it also tackles the emerging problem of plastic pollution. Besides that, some companies are also researching the feasibility of producing sugarcane-based substitutes for LDPE.

Also, other startups are busy in the research and development of high-performance LDPE. This may even require the development of LDPE nanocomposite blends into the material, with the incorporation of nanoparticles to enhance the strength, heat resistance and flame retardant properties.

With these advancements, the boundaries of LDPE usage might be lifted and it might acquire more applications that require higher performance. As they stress sustainability and performance, these startups might well become game changers in the LDPE market thus working towards a circular and modular plastic economy.

The LDPE industry in its turn is a long-time established market and is being run by only a few chemical companies. These key actors own the power to control a lot and thus, are leading the market by changing and improving the way they operate.

The leading companies of the industry such as Exxon Mobil, Dow, and BASF are heavily invested in capacity expansion, particularly in countries that are showing high demand for LDPE like China and Southeast Asia. This means that they can be at the front of LDPE consumption in these emerging market countries that are industrializing at an alarming rate.

Moreover, they are working on the major processes invention for the processes’ efficiency and sustainability. This may involve the use of innovative recycling technologies or improving production processes to reduce energy consumption and decrease the level of generated waste.

What is more, they are working on the topic of life-based feedstocks for LDPE production which is becoming more and more important in the face of the need for sustainable solutions. Through emphasizing upon the building of capacities, operational efficiency & sustainability, the established companies are aiming at establishing their successful positions in the LDPE market competition.

Recent Developments in the Low Density Polyethylene Industry

The global low density polyethylene market is estimated to be valued at USD 49.3 billion in 2025.

The market size for the low density polyethylene market is projected to reach USD 75.8 billion by 2035.

The low density polyethylene market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in low density polyethylene market are roving, tubular and autoclave.

In terms of application, film & sheets segment to command 67.6% share in the low density polyethylene market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Linear Low-Density Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Linear Low Density Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Low Clearance Loaders Market Size and Share Forecast Outlook 2025 to 2035

Low Calorie Desserts Market Size and Share Forecast Outlook 2025 to 2035

Low-Grade Glioma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Power Wide Area Network (LPWAN) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA