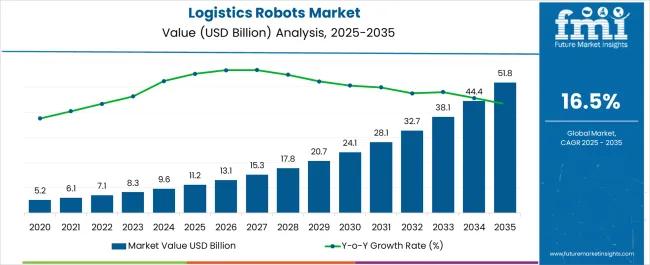

The Logistics Robots Market is estimated to be valued at USD 11.2 billion in 2025 and is projected to reach USD 51.8 billion by 2035, registering a compound annual growth rate (CAGR) of 16.5% over the forecast period.

| Metric | Value |

|---|---|

| Logistics Robots Market Estimated Value in (2025 E) | USD 11.2 billion |

| Logistics Robots Market Forecast Value in (2035 F) | USD 51.8 billion |

| Forecast CAGR (2025 to 2035) | 16.5% |

The logistics robots market is witnessing rapid expansion driven by the surge in e commerce, rising demand for automation in warehouses, and the need for operational efficiency across supply chains. Increasing labor shortages and rising labor costs have accelerated the shift toward automated solutions that enhance throughput and reduce operational risks.

Integration of robotics with artificial intelligence, computer vision, and IoT has improved navigation, precision, and task execution in complex warehouse environments. Regulatory focus on workplace safety and industry adoption of sustainable practices are further supporting the deployment of automated systems.

The future outlook is highly positive as logistics robots continue to evolve into indispensable assets for improving efficiency, scalability, and accuracy across industries with strong demand in both developed and emerging economies.

The automated guided vehicles segment is projected to hold 46.70% of total market revenue by 2025 within the type category, making it the leading segment. Growth is being driven by their ability to streamline material handling, reduce manual intervention, and enhance efficiency in warehouse operations.

Their scalability, low error rate, and capability to operate continuously in structured environments have reinforced their demand.

Integration with advanced navigation systems has expanded their use in both large scale distribution centers and smaller facilities, further establishing automated guided vehicles as the dominant type in logistics robots.

The palletizing and de palletizing segment is expected to account for 52.30% of overall market revenue by 2025, positioning it as the top application. This growth is attributed to the increasing need for fast, accurate, and safe handling of goods in warehouses and distribution centers.

Automation in palletizing processes reduces workplace injuries, optimizes space utilization, and ensures consistency in operations. The rising demand for bulk order fulfillment in industries such as retail, food and beverage, and pharmaceuticals has further accelerated adoption.

The segment’s dominance is reinforced by its ability to deliver efficiency, cost savings, and operational safety in high volume logistics environments.

The e commerce segment is estimated to contribute 43.80% of total revenue by 2025 under industry verticals, establishing it as the leading sector. Growth is being driven by the exponential rise in online shopping, which has created high demand for rapid order fulfillment and last mile delivery optimization.

Logistics robots support efficient inventory management, faster picking, and reliable package handling, addressing the challenges of fluctuating demand and increasing order volumes. The competitive nature of e commerce has encouraged major players to adopt advanced robotic solutions to reduce delivery times and operational costs.

As consumer expectations for speed and accuracy continue to grow, the e commerce segment is set to maintain its leadership in driving adoption of logistics robots.

Robotic technology is mainly adopted for two factors: reduced cost and faster operations. These objectives are also prominent in transportation and logistical operations. FMI describes the primary factors and restraints of the logistics robots market in detail

Drivers

These are the factors that are expected to garner logistics robotics market growth.

Restraints

Booming eCommerce Industry along with the Strict Logistical Norms around Specific Industries are boosting Regional Growth

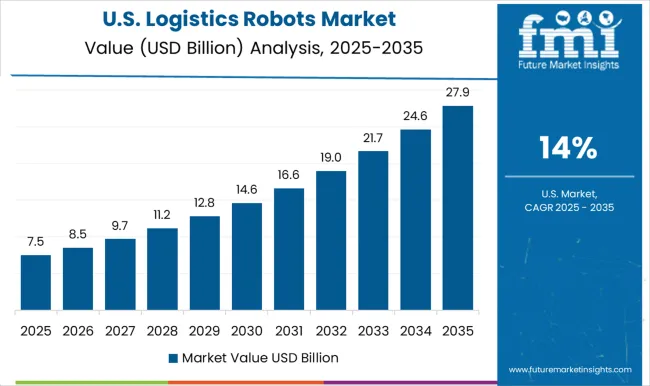

The North American logistics robots market is expected to hold a significant space in 2025.

The growth is attributed to the growing construction activities along with the rapidly expanding e-commerce businesses. The growth in sectors like automotive and pharmaceutical are pushing companies to adopt the latest technology to enhance their productivity. Stringent norms around manufacturing, production, and logistical operation promote the use of logistics operations. These norms are especially applicable to the production and manufacturing of hazardous substances and gases. Furthermore, the presence of e-commerce giants like Walmart and Amazon is expanding the logistics robots market.

Rising cases of accidents in warehouses and storage units are anticipated to fuel the growth of this region.

Higher Population and Rapidly Building Infrastructure is Fueling Regional Growth

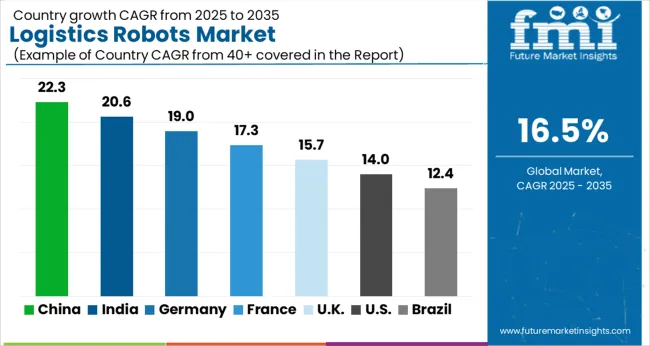

The Asia Pacific region, with its emerging economies like China and India, is penetrating each technologically advanced market. The application of logistics robot systems has increased in the region with the increase in small and medium-sized businesses. Furthermore, China is one of the significant consumers of the market owing to its aging population. China also plans on replacing its labors with robots for higher accuracy and reduced cost. The higher robot density in China is proof of the success of the logistics robots market in the region.

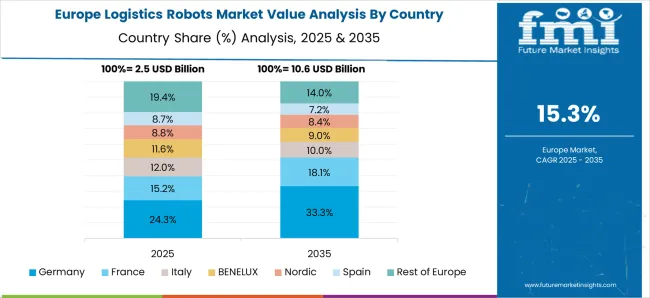

Higher Application in Automotive and Construction Sector are likely to Transform the Market Dynamics

With the wider verticals, logistics robots are being used at a higher rate in automotive manufacturing. This is due to the presence of automotive giants in the region. Companies like Audi, BMW, and Volkswagen are automating their production facilities. Companies also integrate technology with artificial intelligence so that it can function with a human touch while being accurate. The expanding packaging and transportation industry in the region is also likely to contribute to market growth.

Lastly, the emergence of industry 5.0 and industrial automation is likely to draw a new picture of modern industries. The elements like AI, robotics, and cloud storage are anticipated to act like boosters.

| Segment | Top Sub-segment |

|---|---|

| Top Industry | eCommerce |

| Top Application | Palletizing |

Based on industry, the eCommerce segment gains the most traction as it has the highest consumption. The growth is attributed to the higher smartphone and internet access that delivers easy shopping options with discounted prices and higher availability. Furthermore, advanced eCommerce robotic technology such as drones, rovers, and other robots are increasing the demand in the e-commerce industry. The other segments, like healthcare and automotive, are also significant industries that are increasing the use of robotic technology in their production process.

By application vertical, the transportation segment holds a significant share. The growth of this segment is directly affected by the increasing accidents, jams, and expanding packaging sector. The option of pick and place, along with the rising labor cost, is fueling the market growth. Furthermore, the addition of new transportation channels along with industrial automation garners the growth of the logistics robots market.

The key players focus on adding new elements and features to the robots so that they become multi-working prospects. The players also integrated artificial intelligence, machine learning, and cloud storage. The use of sensory technology according to the industrial requirement is likely to fuel the demand for logistics robots while expanding the sales channels.

Market Developments

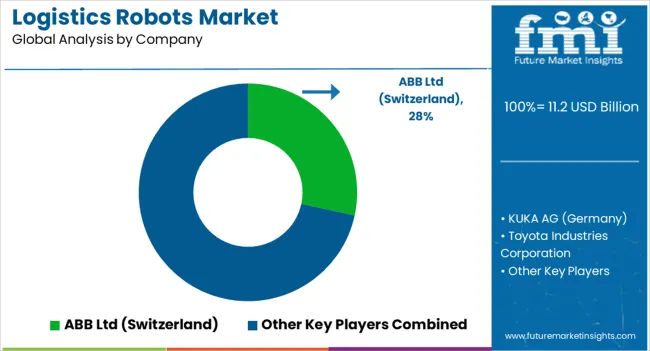

The global logistics robots market is estimated to be valued at USD 11.2 billion in 2025.

The market size for the logistics robots market is projected to reach USD 51.8 billion by 2035.

The logistics robots market is expected to grow at a 16.5% CAGR between 2025 and 2035.

The key product types in logistics robots market are automated guided vehicles, autonomous mobile robots, robot arms and others (uavs).

In terms of application, palletizing & de-palletizing segment to command 52.3% share in the logistics robots market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Autonomous Mobile Robots for Logistics and Warehousing Market Size and Share Forecast Outlook 2025 to 2035

Logistics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Logistics Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Logistics Packaging Industry

Logistics Outsourcing Market Analysis - Growth & Forecast 2025 to 2035

Logistics Visualization System Market

Logistics Automation Market

Cash Logistics Market Size and Share Forecast Outlook 2025 to 2035

Rail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Intralogistics Automation Solutions Market Size and Share Forecast Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Smart Logistics Services Market Size and Share Forecast Outlook 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Cloud Logistics Market Insights – Demand & Growth Forecast 2025 to 2035

Timber Logistics Market Size and Share Forecast Outlook 2025 to 2035

Retail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Secure Logistics Market Size and Share Forecast Outlook 2025 to 2035

Sea Air Logistics Market Size and Share Forecast Outlook 2025 to 2035

Defence Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA