The evolution pace in the logistics packaging industry is changing with a gradual focus on durability, sustainability, and improved supply chain efficacy. Since e-commerce continues to increase, worldwide trade and industrial developments, manufacturers increasingly shift towards lightweight, impact-resistant, and reusable packaging. Automation, RFID tracking, and biodegradable materials are incorporated to improve security, reduce waste, and optimize logistic operations.

Manufacturers are hence developing AI-driven packaging designs, moisture-resistant coatings, and smart labels for real-time tracking and visibility in the supply chain. Increased emphasis on fiber-based protective packing coupled with tamper-evident security seals and collapsible bulk containers give an understanding of the changing face of logistics and warehousing ramp operations.

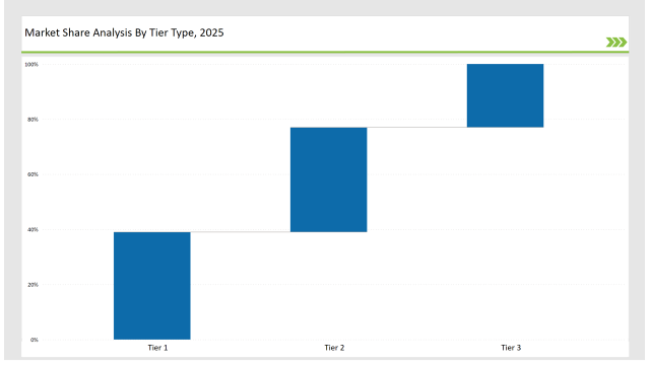

39% of the market is held by tier 1 players Amcor, DS Smith, and Smurfit Kappa, mainly because they lead in industrial-grade packaging, automated logistical solutions, and global distribution networks.

38% of total market pie comes from tier 2 players like Mondi Group, Schoeller Allibert, and Orbis Corporation, providing cost-friendly, high durability, and reusable transit packages to all sectors.

Tier 3 players hold 23% of the market-consists of area-specific and niche players engaged in manufacturing sustainable pallets, shock-resistant protective packaging, and digital tracking systems. The companies concentrate on localized production, new material, and improved packaging durability.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, DS Smith, Smurfit Kappa) | 19% |

| Rest of Top 5 (Mondi Group, Schoeller Allibert) | 12% |

| Next 5 of Top 10 (Orbis Corporation, Greif Inc., Nefab Group, Sealed Air, UFP Technologies) | 8% |

The logistics packaging sector caters various industries where parameters such as toughness, convenience, and security are held paramount. High-performance packaging development is thus taking place in order to enhance supply chain operations and minimize product damage. Temperature-controlled packaging will be adapted for moving perishable items. Businesses are also using smart sensors in their packaging to monitor real-time conditions and disruptions.

Manufacturers have taken steps to improve logistics packaging with smart tracking, sustainable materials, and automation-driven efficiency. They have further improved their methods by integrating predictive analytics powered by AI into the inventory management systems to reduce operational costs. Firms have incorporated machine learning algorithms to identify where inefficiencies exist in the supply chain. Furthermore, companies now have automated sorting systems that improve packaging accuracy and shipping precision.

Sustainable and automated changes are reshaping the logistics packaging industry arena. Now companies have begun to adopt AI-powered inventory management and digital labeling with some automated packaging systems that optimize productivity. There is also development of fiber-based protective packaging that replaces plastic void fillers. Now manufacturers are also seeing the introduction of collapsible and returnable packaging to reduce material waste. On top of all this, firms are now investing in blockchain technology to achieve better supply chain transparency and authentication.

Technology suppliers should focus on automation, sustainability, and digital integration to support the evolving logistics packaging market. Partnering with logistics providers and e-commerce brands will accelerate innovation.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, DS Smith, Smurfit Kappa |

| Tier 2 | Mondi Group, Schoeller Allibert, Orbis Corporation |

| Tier 3 | Greif Inc., Nefab Group, Sealed Air, UFP Technologies |

Top manufacturers of the world are innovating logistics packaging through the implementation of AI-powered tracking, smart automation, and sustainability materials. They have also developed ultra-durability and reusability packaging to minimize waste and maximize savings in cost. Firms are also introducing biodegradable protective layers that ensure environmental compliance, while safe for product protection. In addition, manufacturers are exploring the use of digital twin technology to simulate and optimize packaging performance in real-time supply chain scenarios.

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Launched lightweight fiber-based transit packaging in March 2024. |

| DS Smith | Developed fully recyclable returnable transit packaging in April 2024. |

| Smurfit Kappa | Expanded tamper-proof and smart tracking packaging in May 2024. |

| Mondi Group | Released durable collapsible bulk packaging in June 2024. |

| Schoeller Allibert | Strengthened RFID-enabled smart tracking solutions in July 2024. |

| Orbis Corporation | Introduced impact-resistant reusable packaging in August 2024. |

| Greif Inc. | Pioneered biodegradable industrial-grade packaging in September 2024. |

The competing logistics packaging market is witnessing change as companies pour money into automation, eco-friendly materials, and AI-based tracking. They are busy developing predictive maintenance systems to augment packaging strength and improve lifecycle productivity. On the other hand, firms are in the process of incorporating real-time monitoring of shipments to curtail risks associated with transit and guarantee faster and safer deliveries.

The future will see integration of AI-powered automation, blockchain authentication, and green material in the industry. Manufacturers will, therefore, further put efforts on enhancing collapsible design packaging that uses storage space more efficiently. Firms will use RFID tracking to make inventory management smarter. Firms will produce compostable protective packaging that will eradicate the single-use plastics. Ships will be fitted with smart labels that would provide real-time monitoring of the consignment, thus minimizing loss and delay. In addition, companies will integrate advanced machine learning predictive analytics into the supply chain for operational efficiency, price effectiveness, and sustainability in the logistics offerings.

Leading players include Amcor, DS Smith, Smurfit Kappa, Mondi Group, Schoeller Allibert, Orbis Corporation, and Greif Inc.

The top 3 players collectively control 19% of the global market.

The market shows medium concentration, with top players holding 39%.

Key drivers include automation, sustainability, smart tracking, and durable materials.

Korea Industrial Electronics Packaging Market Analysis by Material Type, Product Type, Packaging Type, and Province through 2035

Japan Industrial Electronics Packaging Market Analysis by Material Type, Packaging Type, Product Type, and City through 2035

Green Packaging Film Market by Product Type, End Use, Material, and Region 2025 to 2035

Automatic Banding Machine Market Insights – Growth & Forecast 2025 to 2035

Market Share Breakdown of Protective Packaging Industry

Market Share Breakdown of Paper-Based Laminate Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.