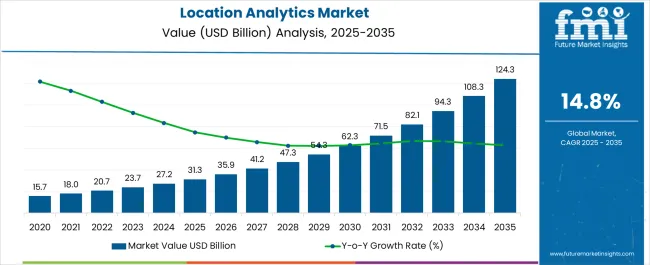

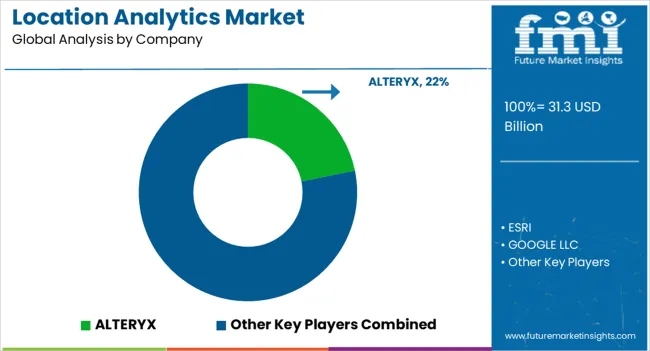

The Location Analytics Market is estimated to be valued at USD 31.3 billion in 2025 and is projected to reach USD 124.3 billion by 2035, registering a compound annual growth rate (CAGR) of 14.8% over the forecast period.

| Metric | Value |

|---|---|

| Location Analytics Market Estimated Value in (2025 E) | USD 31.3 billion |

| Location Analytics Market Forecast Value in (2035 F) | USD 124.3 billion |

| Forecast CAGR (2025 to 2035) | 14.8% |

The location analytics market is witnessing robust growth driven by the rapid adoption of geospatial intelligence, smart devices, and IoT-enabled technologies across industries. Organizations are increasingly leveraging real time location data to optimize operations, enhance customer engagement, and support data driven decision making.

The integration of AI and machine learning into analytics platforms has strengthened predictive capabilities, enabling businesses to anticipate demand patterns, assess risk, and enhance asset management. Governments and enterprises are also investing in advanced mapping solutions for urban planning, logistics, and public safety, further accelerating market adoption.

Regulatory emphasis on data security and the growing importance of contextual insights in supply chain management and retail strategies are shaping future growth opportunities. The outlook remains promising as enterprises prioritize operational efficiency, improved customer experience, and actionable intelligence derived from spatial data.

The solution segment is projected to hold 54.20% of total market revenue by 2025, making it the leading component. Its dominance is supported by widespread adoption of integrated analytics platforms that combine data visualization, mapping, and real time monitoring.

Organizations are relying on solutions to derive actionable insights from massive volumes of location-based data generated by connected devices and sensors. Investments in cloud-enabled platforms and user friendly dashboards are further strengthening adoption across industries.

The ability of solutions to deliver scalability, operational efficiency, and seamless integration with enterprise systems has reinforced their market leadership.

The outdoor positioning segment is expected to account for 62.30% of market revenue by 2025 within the location positioning category, establishing itself as the largest segment. Growth is being driven by the widespread use of GPS, satellite-based technologies, and mobile connectivity in transportation, logistics, and urban mobility.

Outdoor positioning supports accurate navigation, fleet management, and route optimization, which are critical for industries seeking cost savings and operational visibility. Increased demand for smart city applications and connected vehicle ecosystems has further boosted reliance on outdoor positioning.

The segment continues to dominate due to its broad applicability and role in enabling real time geospatial intelligence.

The risk management application segment is projected to contribute 49.70% of total market revenue by 2025, making it the most prominent application. Its growth is being propelled by increasing demand for tools that enable enterprises to assess operational vulnerabilities, mitigate risks, and ensure regulatory compliance.

Location analytics has been applied to monitor supply chain disruptions, identify security threats, and evaluate environmental risks. The ability to combine predictive analytics with spatial data has enhanced organizational resilience, supporting proactive decision making.

Industries including finance, insurance, logistics, and energy have increasingly adopted risk management applications to strengthen business continuity strategies. This focus on operational security and sustainability has reinforced the segment’s leadership in the market.

From 2020 to 2025, the global location analytics market registered a comparatively higher CAGR of 17.2%. The market was positively affected by the pandemic as corporate and business management extended their service and advanced their consumer-based marketing tactics. The expansion of global positioning systems (GPS) and social media channels has also fueled the demand for location analytics.

Companies adopting advanced business strategies are likely to deliver steady growth during this period. The highly competitive market systems demand powerful solutions for location mapping and regional data analysis. These services are found in the integrated location analytics systems. The market is likely to grow steadily between 2025 and 2035.

The expanding international businesses coupled with the elements introduced by location analytics, such as location sensors and mobile devices. The enhanced capabilities such as location-specific, optimized business practices and predictions. The location analytics market is anticipated to thrive at a CAGR of 14.8% between 2025 and 2035.

The increasing competition and rising application of spatial data are fueling the demand for location analytics tools. Furthermore, the proliferating usage of location-based features and applications is anticipated to drive market growth. Location analytics is widely used as a predictive technology in disaster management applications. The wider range of verticals, coupled with the rising requirement for geographic predictive analytics, is expanding the location analytics market size.

Integration of location-based mapping services with business intelligence modules is also gaining traction in the market. More people installing applications and games that deal with location tracing and analytics is likely to fuel the growth of the location analytics market. Collaboration and mergers between technology giants and location analytics experts to work on research and development and personalized solutions are anticipated to transform the location analytics market.

The main restraints for the market are the limited return on investment (ROI), costly initial deployment, and lower regulatory norms. Furthermore, the lower penetration of 5G, GPS, and smartphone technology in some parts of the world limits the market growth.

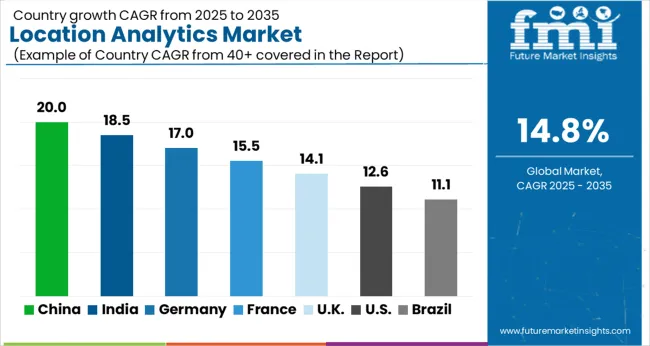

Higher Competition across Businesses along with a Large Smartphone Consumer Base is propelling the Regional Growth

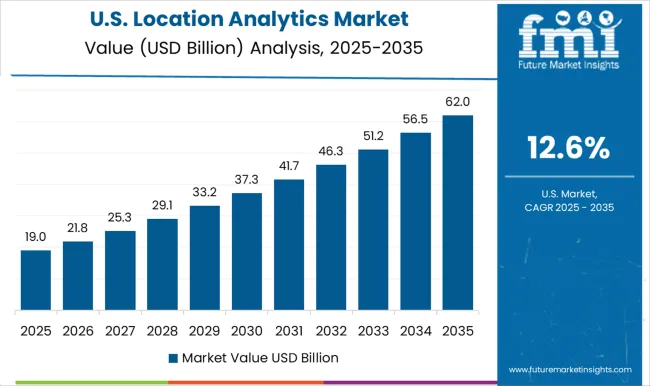

The North American location analytics market is expected to hold the prominent space in 2025.

The United States is expected to dominate the North American region with the higher penetration of smartphones and expanding location-based applications. Risk management and remote monitoring are in high demand across all verticals. The integration of business intelligence systems with location-based analytics tools is delivering fruitful results for enterprises. This further supports the marketing campaigns of companies as they hold more information about the regional market scope.

The application of these systems in analyzing disaster management programs and location-based mapping is helping the government and authorities across the country. Thus, geographical applications are also fueling the demand for location analytics systems.

Expanding Geospatial Applications along with Higher Smartphone Consumer Base is propelling the Regional Growth

The Asia Pacific region, with its emerging economies like China and India, is penetrating each technologically advanced market. The application of location analytics systems has increased in the region with the proliferating businesses and startups. Furthermore, the government authorities applying these systems in geographical research and climate analysis is likely to fuel the market growth. The huge population of this region is also expected to contribute to location-based markets such as real-time location systems, GPS markets, and location-based analytics markets. The research and development programs integrating the technology with artificial intelligence and IoT are also fueling the sales of location analytics systems.

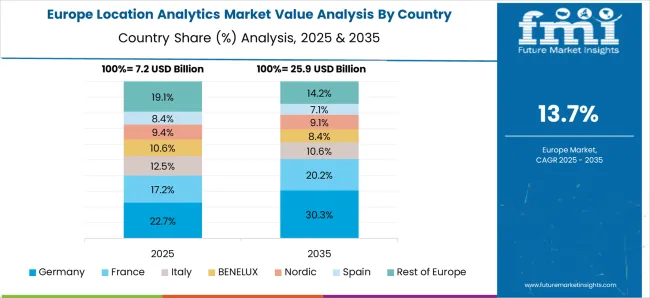

Increased Tourism with Higher Penetration of Automotive Applications of Location Analytics Are Propelling the Regional Growth

Expanding European businesses and an increased footfall of tourists in countries like Germany, France, Spain, and Poland are fueling the adoption of location analytics systems. Furthermore, the advanced road norms and technology implemented consume a significant chunk of the location analytics market due to its integration with sensory technology that makes traffic management easy. Furthermore, Germany is expected to hold a significant share of the market in the European region. The growth is attributed to expanding transport, communication, delivery system, and logistic services. These elements influence businesses positively.

| Segment | Top Application |

|---|---|

| Top Sub-segment | Remote Monitoring |

| Attributes | 10% gains through 2035 |

| Segment | Top Industry Vertical |

|---|---|

| Top Sub-segment | Transportation and Logistics |

| Attributes | 25% of the global share |

The remote monitoring segment leads in the application category with an estimated gain of 10% by 2035. This growth is attributed to the higher penetration of remote businesses with locations around the world. International businesses with different locations for different tasks are fueling the demand for remote monitoring applications of location analytics. Utilization of personal spaces for saving the time and space of businesses while saving the workspaces from potential hazards are factors for the growth of this segment.

By industry vertical, the transportation and logistics segment is expected to hold a global share of 25% by 2035. The growth of this segment is directly affected by the increased logistics operations of expanding businesses that use location analytics to figure out the consumer base and delivery options. The systems also help to ensure the delivery status of any package. The location analytics system also helps in finding a courier vehicle, like a truck or a van.

The key players focus on creating a system that can be customized according to the need of the enterprise. Furthermore, the target is to provide an accurate location and add other important elements like density, number, and other data in the analytical report. The market players tie hands with the technology giants to make their products and service more trackable and safer.

Market Developments

The global location analytics market is estimated to be valued at USD 31.3 billion in 2025.

The market size for the location analytics market is projected to reach USD 124.3 billion by 2035.

The location analytics market is expected to grow at a 14.8% CAGR between 2025 and 2035.

The key product types in location analytics market are solution, _geocoding & reverse geocoding, _thematic mapping & spatial analysis, _reporting & visualization, service, _professional service and _managed service.

In terms of location positioning, outdoor positioning segment to command 62.3% share in the location analytics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Location Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Location-Based Marketing Services Market Trends - Growth & Forecast through 2035

Colocation Edge Data Center Market Size and Share Forecast Outlook 2025 to 2035

Tip Location Device Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Micro-location Technology Market Size and Share Forecast Outlook 2025 to 2035

Indoor Location Market Size and Share Forecast Outlook 2025 to 2035

Retail Colocation Market Size and Share Forecast Outlook 2025 to 2035

Real Time Location System (RTLS) Market Size and Share Forecast Outlook 2025 to 2035

Hazardous Location Limit Switches Market

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Analytics Of Things Market Size and Share Forecast Outlook 2025 to 2035

Analytics as a Service (AaaS) Market - Growth & Forecast 2025 to 2035

Analytics Sandbox Market

Ad Analytics Market Growth - Trends & Forecast 2025 to 2035

HR Analytics Market

AI-Powered Analytics – Transforming Business Intelligence

NFT Analytics Tools Market Size and Share Forecast Outlook 2025 to 2035

App Analytics Market Trends – Growth & Industry Forecast 2023-2033

Dark Analytics Market Size and Share Forecast Outlook 2025 to 2035

Text Analytics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA