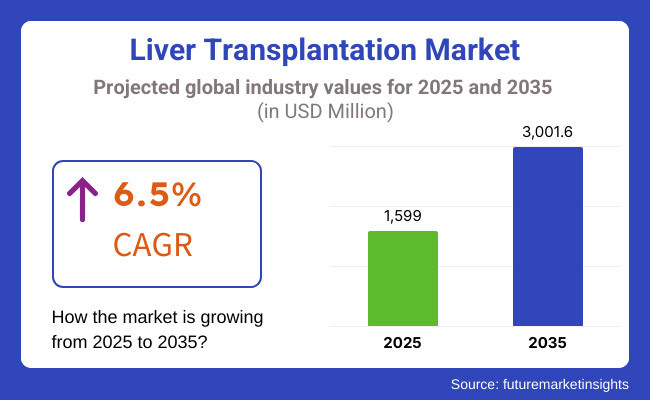

The liver transplantation market is expected to reach approximately USD 1,599.0 million in 2025 and expand to around USD 3,001.6 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.5% over the forecast period.

The liver transplant market is expected to grow a lot from 2025 to 2035. This growth is mainly due to more people getting liver diseases and better surgery techniques. There are more organ donors available too. Some key factors are the rise in liver cirrhosis, liver cancer, and fatty liver disease.

Also, organ preservation methods have improved. Living donor liver transplants are on the rise, and new artificial liver support systems are helping patients do better after surgery. But there are some challenges. There aren’t enough organ donors, the procedures can be expensive, and there can be issues after the transplant. On the bright side, new ideas like bioengineered livers and advancements in regenerative medicine show promise. Overall, there's plenty of opportunity in this field for growth and improvement.

Several notable changes occurred concerning liver transplants in the years from 2020 to 2025. The progress of newer surgical techniques and the optimal techniques for organ viability contributed a lot. Yes, COVID-19 created challenges in the first place. Critical procedures were given precedence over transplants in hospitals, with lesser donations. However, with more hospitals adjusting, for sure performance improved.

While hospitals resumed their transplant programs, telemedicine availed pre- and post-surgical patient care to patients in general. As a result, nonalcoholic fatty liver disease, with its graver form nonalcoholic steatohepatitis, found its way even among the very top causes of liver transplantation-an upward trend in comparison to hepatitis C-related cases.

This was also due to simpler treatment regimens of hepatitis C that came along with direct-acting antivirals. Coupled with rising incidences of obesity and its co-morbidities, there was a huge demand for transplants, especially in younger patients. Technology revolutionized transplant outcomes.

Machine perfusion technology was widely adopted to enhance organ viability. Normothermic and hypothermic perfusion, for example, can be used for livers from suboptimal donors. Some significant strides were achieved in regenerative medicine. Stem cells and bioartificial livers were research concerns with a promising future for new therapeutic avenues. In turn, such developments could reduce the number of individuals requiring traditional transplants.

Explore FMI!

Book a free demo

The liver transplant scene in North America is pretty strong. The healthcare system is advanced, and a lot of people are willing to donate organs. The USA is at the forefront, with major centers doing more and more transplants every year. New drugs and easier surgery techniques are helping too. Still, the system has some issues.

There are long waitlists for donor livers, and not everyone has equal access to transplants. Treatment can be expensive. On the bright side, living donor liver transplants are growing, and using AI to figure out if someone is eligible for a transplant is on the rise. There’s also more money going into stem cell research for liver health.

Europe has a robust liver transplant market, driven by stricter healthcare regulations and rising incidents of liver diseases. Germany, France, and the UK are the major countries as they have government grants for transplant programs and advanced surgical techniques. However, some obstacles hamper progress.

One includes conditions imposed by the European Medicines Agency concerning the use of animal organs. However, on the bright side, more application of artificial technologies, such as machine perfusion to maintain organs in a viable state, is increasing.

There's an increasing regional collaboration on such issues regarding transplant; application of AI in monitoring patients after surgery is also growing. Also, the rise in investment in regenerative medicine holds promise of new treatment avenues.

The liver transplant market in Asia-Pacific is said to be on a fast generate. With the growing number of people suffering from liver disease, health in general is improving, and awareness for organ donation is increasing. Key players, including countries as China, Japan, and India, are gearing up their transplant programs, government facilitating both living and deceased donation.

Challenge still exists. Procedures are not affordable by all and availability of specialized centers is lacking. Rules can meander sometimes too. There is an increase in international research partnerships and robotic surgeries. Using blockchain to track organ donations becomes a hot trend in the area.

Challenges

Organ Shortages, High Costs and Post-Transplant Risks Act as a Barrier to the Market Growth

The transplant industry for the liver has serious issues to address. Organs are insufficient, waiting lists are long, and complications such as rejection & infections may occur post-transplant. It is very costly and not always accessible to patients from lower socio-economic communities at transplant centers. Furthermore, the manner in which the donor organs are allocated is not fair in all respects.

The prevention of rejection by these drugs also carries risks. They contribute to the eventual development of infectious and other diseases. The path also has regulatory and ethical speed bumps for the medicines since the new techniques include using organs from animals or printing organs in 3D. These aspects make it difficult for new procedures to be mainstreamed.

Opportunities

Innovations in Regenerative Medicine Advancing Liver Transplantation Therapies

There is more interest in regenerative medicine and creating bioartificial livers. New work in stem cell therapy and tissue engineering could help regenerate the liver, which means fewer people would need a transplant. Robotic and less invasive surgery techniques are also making surgeries safer and recovery faster.

In addition, there is a rise in investments for smart tech that helps match donors and patients. New tracking systems for donor organs and telemedicine for aftercare can make transplants easier to access. Government programs that raise awareness and offer financial help for patients are also helping the market grow.

Cutting-edge Techniques in Organ Preservation and Machine Perfusion: Normothermic machine perfusion (NMP) is emerging as a transformative technology in organ preservation, significantly improving transplant success rates while reducing the wastage of donor organs. Unlike traditional static cold storage, NMP maintains organs at body temperature, continuously supplying oxygen and nutrients, thereby preventing ischemic injury and extending preservation times.

This technique enhances organ viability, allowing for better assessment of marginal donor organs, which can expand the donor pool. Additionally, the ability to optimize and repair organs before transplantation offers new opportunities to improve post-transplant outcomes.

Ongoing research in perfusion technologies, including the integration of regenerative therapies and ex vivo drug treatments, is further enhancing transplant efficiency. As healthcare systems worldwide face organ shortages, advancements in machine perfusion are paving the way for more effective organ utilization, minimizing rejection risks, and increasing access to life-saving transplants across different regions.

The Increasing Trend of Living Donor Liver Transplantation (LDLT): Living Donor Liver Transplantation (LDLT) is witnessing a significant rise as a preferred alternative to deceased donor transplantation, particularly in regions where organ donation rates are low. LDLT offers a viable solution to organ shortages by allowing patients to receive timely transplants, reducing waiting list mortality.

Medical advancements in liver regeneration have improved donor safety, as the liver possesses a remarkable ability to regenerate within months after partial donation. Additionally, LDLT enables precise planning of transplant procedures, leading to better surgical outcomes and lower risks of graft dysfunction compared to deceased donor transplants.

In the year 2020 to 2024, Commonly besides contributing to the growth, extensive immunosuppressive use and comprehensive coverage of transplant procedures are influencing drivers of this development. The liver transplant market is ready to witness sustained growth through the momentum of technology developments, attention on individualized and less invasive treatment strategies, and increased availability of transplantation facilities all over the world.

Market players should continue to be resilient towards changing regulatory needs and make constant investments in research and development in order to cope with changing needs of the patient undergoing liver transplant.

These include application of Artificial Intelligence in organ matching and in post-transplant care, development of new minimally invasive surgical techniques, and even more initiatives from government in organ donation and transplantation that will further add to this growth. Expansion in healthcare infrastructures across emerging markets will further increase access to transplantation services, thus complementing this market growth.

In the year 2025 to 2035, countries in Asia, particularly Japan, South Korea, and India, have embraced LDLT as a mainstream solution due to cultural and legal restrictions on deceased organ donation. The growing awareness, coupled with advancements in surgical techniques and post-transplant care, is expected to further propel the adoption of LDLT, ultimately improving global liver transplant accessibility and survival rates.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulatory Environment Focus on efficacy and safety of liver transplant procedures, with regulatory authorities streamlining approvals for new surgical methods and immunosuppressive treatments. |

| Technological Advancements | Technological Innovation Adoption of better organ preservation solution and surgical tools improving the rates of transplantation success and patient well-being. |

| Consumer Demand | Demand by the patient There has been greater awareness with increased demand for liver transplantation as a curative treatment for end-stage liver disease, with patients looking for better survival and quality of life. |

| Market Growth Drivers | Market Drivers for Growth Increased incidence of liver diseases, technological developments in transplantation practices, and encouraging government policies favoring organ donation and transplantation. |

| Sustainability | Sustainability Early initiatives for green manufacturing practices in medical devices and minimization of environmental footprints linked to transplantation processes. |

| Supply Chain Dynamics | Supply Chain Dynamics Dependence on established distribution systems guaranteeing availability of required medical equipment and immunosuppressive drugs in transplant centers and hospitals. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Adoption of complete guidelines for AI-driven transplantation procedures and minimally invasive surgical procedures, with standardized protocols and patient safety. |

| Technological Advancements | Incorporation of artificial intelligence and machine learning to ensure optimal organ matching and post-transplant surveillance, creation of minimally invasive and robotic-based surgical procedures decreasing recovery time and complications. |

| Consumer Demand | Increasing demand for less invasive and individualized treatment, with patients and doctors coming together to customize transplantation methods according to specific health profiles and technological advancements in medicine. |

| Market Growth Drivers | Entry into growing markets with evolving healthcare infrastructures, greater emphasis on early diagnosis and intervention, and collaborative agreements between medical technology firms and healthcare providers to improve transplantation accessibility and success rates. |

| Sustainability | Overall embracing of sustainable methods, such as biodegradable material use in medical consumables, efficient hospital power management, and strategies towards reducing waste and carbon footprints in transplantation processes. |

| Supply Chain Dynamics | Supply chain optimization using digital technologies and telemedicine platforms that increase transparency, efficiency, and accessibility, with timely delivery of medical supplies and remote consultations to aid patients at various geographic locations. |

Market Outlook

The field of liver transplantation has evolved progressively in America as the surgical management of conditions necessitating transplantation has progressed with surgical refinements. As cirrhosis becomes more rampant, liver failures become more frequent, and the proliferation of surgical and post-operative advances in medical science continues, the demand for transplantation rises for enhanced survival and accessibility.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.8% |

Market Outlook

India's liver transplantation market is booming, bolstered by enhanced healthcare investments and an increase in the number of liver-related ailments. Hospitals are upgrading their transplantation facilities and surgeons are adopting new techniques and expecting improved outcomes. At present, the social awareness about organ donation is improving by the day, thereby saving more lives through transplants.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 6.4% |

Market Outlook

This burgeoning market of liver transplantations in China has given much of its emphasis to health-care network development with public attention paid to treatment of liver-disease-related disorders. The countries have broadened the transplant programs in hospitals, and the handling of surgery to improve outcomes utilized advanced techniques by the surgeon.

Generally, an increased public awareness related to their health regarding the liver and to organ donation is taking place, thus helping more individuals gain timely access to transplants. Also, policies of the government are favoring medical advances and making them affordable to the public in the country, which paves a way toward getting accessibility to liver transplantations.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 5.8% |

Market Outlook

he German liver transplantation market is steadily progressing, founded on a very good healthcare infrastructure and ongoing technological advances in hepatology research. While innovations in immunosuppressive therapies and post-transplant care contribute to better patient outcomes, high-end medical institutions are perfecting transplant techniques with improvements being made through organ donation awareness and access initiatives put in place by the government.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 4.2% |

Market Outlook

This lends continued expansion to Brazil's market for liver transplantation as healthcare investments continue to grow and the number of individuals with liver diseases rises. Intervention-the improvement within the country, along with modernized surgical methodologies and additional government initiatives towards organ donation, are adding to the growth of the market. Awareness developed around transplantation and improved post-operative care is, furthermore, enhancing patient outcomes and driving access to liver transplantation across the country.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.9% |

Liver Transplantation Surgery Dominance with Rising Prevalence of Liver Diseases

Liver transplant is now the optimal and sole curative modality of therapy for ESLD, acute liver failure, and HCC. Advances generated in preservation, operative methods, and protocols utilized for donor compatibility have contributed toward an improvement of these results as well as in increasing long-term post-transplantation recovery.

The increasing demand for liver disease caused by alcohol, hepatitis infection, and NAFLD, coupled with a general increase in access to organ transplantation programs, offer a Favorable opportunity for this specific growth. Liver transplants are performed in massive numbers in North America and Europe, where generous donation rates dominate under well-established healthcare infrastructure, but the speedy growth is occurring in Asia-Pacific as a result of growing incidence of living donor transplant programs, along with governmental efforts.

Propagation of trends in the future involves AI-assisted matching of recipient-donor pairs, bioengineered liver grafts, and robotic-assisted transplantation techniques for increased surgical precision.

Tacrolimus to remain the leading Immunosuppressant in Transplantation Therapy

Tacrolimus is an immunosuppressant and the most commonly used in transplantations and is important because it prevents rejection of the organ by inhibiting T-cell activation. Tacrolimus is more preferred compared to cyclosporine because of its potency, better patient outcome, and lesser toxic effects in the case of chronic rejection rates.

The increasing volume of liver transplantations worldwide, rising preference for using calcineurin inhibitors for post-transplant therapy, and rising availabilities of extended-release formulations of tacrolimus would fuel critical demand.

North America and Europe dominate with tacrolimus adoption; that is, the growing picture indicates expansion in Asia-Pacific along with emerging access for immunosuppressive drugs with improved transplantation programs. Innovations of the future would include monitoring of immunosuppression through AI, development of personalized immunotherapy for reduced drug toxicity, and next generations of tacrolimus formulations, leading to fewer side effects.

Hospitals Acts as Primary Centers for Transplant Procedures offering Advanced Surgical Infrastructure

Hospitals, by far, are the most important users of these services because the procedure of liver transplantation is highly sophisticated and requires multidisciplinary care teams in relation to advanced surgical infrastructure and intensive post-operative management. Among these healthcare institutions specializing in comprehensive transplant services, activities include evaluation before surgery, donor-recipient matching, and long-term immunosuppressive therapy.

Factors fuelling the growth of this market segment include increased incidence of chronic liver disease, growing government expenditure on transplant programs, and increasing acceptance of these techniques of liver transplant.

North America and Europe lead in the number of liver transplants performed by hospitals, whereas Asia-Pacific shows an upward trend growing volume from increasing investments made on transplant infrastructure and campaigns for donor's awareness. Future trends include organ viability assessment through AI computation, remote real-time postoperative patient monitoring, and 3D bioprinting of liver tissues for research into transplantation.

Adult Liver Transplantation Centers to lead the Market

Adult liver transplant centers are themselves specialized facilities offering the transplant procedure for chronic liver disease. They also support patients by providing services after the transplant. Such centers specialize in live liver transplant procedures, ABO-incompatible transplants, and the more advanced transplantation methods like split-liver transplantation.

There are strong drivers propelling a market between the combined increasing incidences of cirrhosis of the liver; the ever-increasing potential for living-donor transplantation; and improvements in immunology in relation to transplantation.

North America and Europe are already underway in the development of adult liver transplant centers, whereas the region Asia-Pacific is growing at an accelerated rate primarily because of advancement in improved fortified programs for evaluation of liver donors and the improvement in regulatory environment.

Important breakthroughs that might come into play are AI-based donor-recipient compatibility algorithms, bioengineered liver scaffolds in transplant, and advanced ex vivo liver perfusion techniques that improve preservation of organ.

The liver transplantation market runs high on competition, driven by rising prevalence rates of liver ailments, progressive transplant technologies, as well as awareness of organ donation. Various companies are investing in immunosuppressive therapies, bioengineering innovations, and techniques for preserving transplants in order to provide them competitive advantage.

The market has fused well with pharmaceutical companies, transplant device manufacturers, and emerging biotech innovators to keep evolving in the liver transplantation solutions arena.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Astellas Pharma Inc. | 23.8% - 24.5% |

| Novartis AG | 19.4% - 20.5% |

| Sanofi | 12.5% - 13.5% |

| Bristol-Myers Squibb | 10.2% - 11.4% |

| BioLife Solutions | 7.5% - 8.7% |

| Other Companies (combined) | 26.4% - 27.5% |

| Company Name | Key Offerings/Activities |

|---|---|

| Astellas Pharma Inc. | Market leader offering immunosuppressants like Prograf (tacrolimus) to prevent liver transplant rejection. |

| Novartis AG | Develops immunosuppressive drugs such as Certican (everolimus) for long-term transplant success. |

| Sanofi | Provides Thymoglobulin, an anti-thymocyte globulin used in immunosuppressive therapy post-transplantation. |

| Bristol-Myers Squibb | Specializes in immunomodulators and transplant support therapies, including Belatacept (Nulojix). |

| BioLife Solutions | Offers advanced organ preservation and transport solutions to improve liver transplant outcomes. |

Key Company Insights

Astellas Pharma

Astellas is the giant in liver transplantation and spearheads the market with Prograf, a routine immunosuppressant used by transplant recipients.

Novartis AG

Novartis, offers more targeted therapies to attack immunosuppression in an effort to boost graft survival rates.

Sanofi

It specializes in immunotherapy, and it offers major post-transplant drugs that promote organ acceptance in the long term.

Bristol-Myers Squibb

It is a trailblazing transplant immunology company, which offers Nulojix, a breakthrough treatment in the field of immunosuppressive therapy.

BioLife Solutions

It is a new entrant in the field of transplant preservation, which also deals with organ transport technologies for enhancing liver viability.

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

These companies focus on expanding the reach of liver transplantation solutions, offering competitive pricing and cutting-edge innovations to meet diverse patient and healthcare provider needs.

The overall market size for Liver Transplantation Market was USD 1,599.0 million in 2025.

The Liver Transplantation Market is expected to reach USD 3,001.6 million in 2035.

Rise in Interventional Cardiology & Peripheral Vascular Procedures has significantly increased the demand for Liver Transplantation Market.

The top key players that drives the development of Liver Transplantation Market are Astellas Pharma Inc., Novartis AG, Sanofi, Bristol-Myers Squibb, Thermo Fisher Scientific.

Liver Transplantation Surgery is expected to command significant share over the assessment period.

Liver Transplantation Surgery, Post-Surgery Anti-Rejection Treatment, Cyclosporine, Tacrolimus, Sirolimus Prednisone Azathioprine and Mycophenolate Mofetil

Hospitals, Adult Liver Transplantation Centers and Ambulatory Surgical Centers

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.