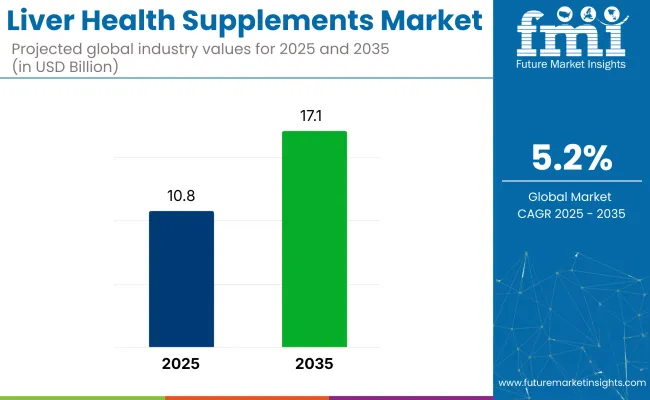

The global liver health supplements market is valued at USD 10.8 billion in 2025 and is projected to reach USD 17.1 billion by 2035, growing at a CAGR of 5.2%.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 10.8 billion |

| Projected Value (2035) | USD 17.1 billion |

| CAGR (2025 to 2035) | 5.2% |

The market will be driven by rising consumer demand for natural and organic supplements, personalized nutrition, and the increasing prevalence of liver-related diseases such as NAFLD and hepatitis. In addition, a shift towards plant-based ingredients like milk thistle and turmeric, alongside rising health awareness, will continue to propel market expansion over the forecast period.

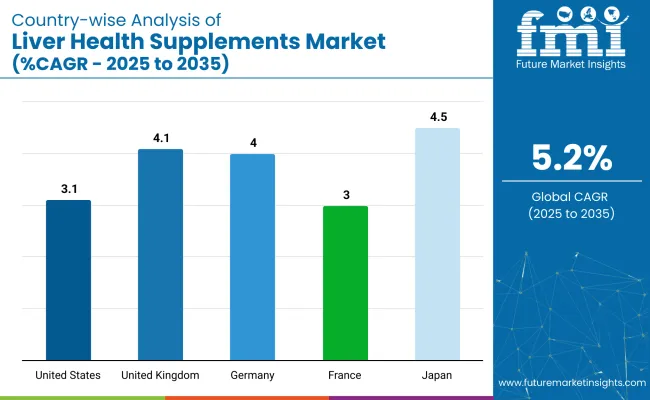

In 2025, the United States will remain the largest market for liver health supplements, contributing to the largest share globally, expanding at a CAGR of 3.1%. In contrast, Japan and the UK are likely to register the fastest growth with CAGRs of 4.5% and 4.1% respectively. By nature, the organic segment accounts for 55% of the market share, while by form, tablets hold a prominent share of 42.7% in 2025.

The liver health supplements market holds a small yet significant share in its parent markets. It represents a fraction of the dietary supplements market, likely around 5-7%, due to its niche focus on liver health. In the functional foods market, liver supplements contribute around 2-3%, given their specific health benefits within a broader category. In the herbal supplements market, liver supplements, especially plant-based options, may hold approximately 4-5%.

The nutraceuticals market sees liver health supplements comprising roughly 3-4%. Overall, while liver health supplements form a smaller portion of these larger markets, their growth is steadily rising with increased consumer interest in holistic health.

Looking forward, innovations in bio-based ingredients, the rise of personalized supplements, and advancements in online retailing will continue to drive market growth. Governments worldwide, especially in North America and Europe, are implementing stricter regulations on ingredient sourcing and labeling, which will further promote the use of high-quality, sustainable, and safe products.

As a result, the market will witness the introduction of cutting-edge liver health formulations designed to enhance both efficacy and consumer trust. Additionally, growing consumer awareness around liver health and prevention will fuel demand for these advanced, scientifically backed products, further strengthening market expansion.

The global market for liver health supplements can be analyzed across various segments, including form, nature, source, end user, distribution channel, and region. Under form, the major categories are dry, tablet, powder, and liquid. For nature, the market is segmented into organic and conventional. Source includes vitamins, minerals, botanicals, and others.

End user segments include human nutrition and animal nutrition. For the distribution channel, the market is divided into online retailers, specialty stores, and supermarkets/hypermarkets. Finally, regional analysis covers North America, Latin America, Europe, East Asia, South Asia, Oceania, the Middle East and Africa.

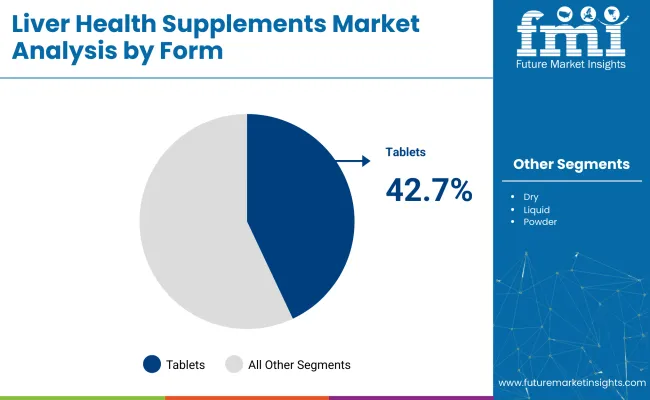

The tablet segment is expected to dominate, with a market share of around 42.7% in 2025. Tablets are preferred for their ease of consumption and precise dosage, making them highly convenient for consumers. Dry forms will also experience significant growth due to their long shelf life and storage ease, while powders and liquids will remain less popular due to the need for additional preparation.

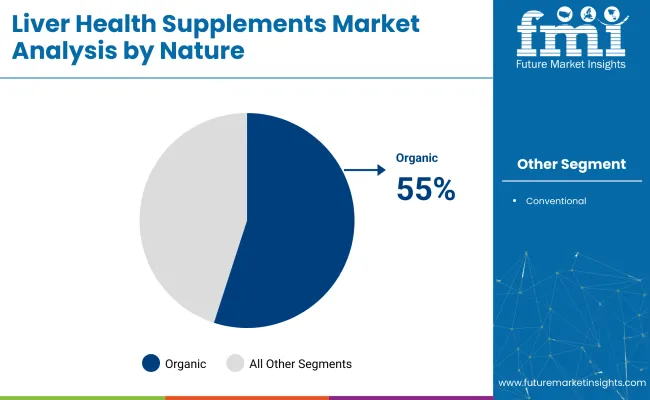

The organic segment is projected to experience the highest growth within the natural category, accounting for a prominent market share of nearly 55%, driven by rising demand for natural, chemical-free supplements.

As consumer preferences shift towards sustainable and eco-friendly products, organic liver health supplements are becoming more popular. Conventional supplements will still maintain a strong market presence due to their lower cost, but organic options are expected to dominate the market gradually.

Botanicals are anticipated to be the most lucrative source, accounting for 40% of the market share among all. Ingredients like milk thistle, dandelion root, and turmeric become more sought after for their liver-protective properties. Botanicals have been gaining popularity due to their natural healing properties and the increasing consumer demand for plant-based supplements. Vitamins and minerals remain significant but are less likely to experience as fast growth.

The human nutrition segment will continue to lead, driven by the rising focus on preventive health and the increasing prevalence of liver diseases. The segment accounts for a significant share of 80%. The animal nutrition segment is also growing, with supplements formulated for pet health seeing increased demand, particularly for pets with liver health issues. Human nutrition, however, is expected to account for the bulk of the market share.

Online retailers are expected to remain the top distribution channel, with a market share of 38.6% in 2025. The growth of e-commerce platforms makes it easier for consumers to access liver health supplements from the comfort of their homes. Specialty stores and supermarkets/hypermarkets will also see consistent demand, particularly as consumers seek trusted local and in-person options.

Recent Trends in the Liver Health Supplements Market

Challenges in the Liver Health Supplements Market

The growth rates of liver health supplements in key markets show a varying pace. Japan leads with a projected CAGR of 4.5% from 2025 to 2035, driven by increasing liver conditions like hepatitis and strong demand for functional foods. The UK follows closely with a 4.1% CAGR, spurred by growing health awareness and preference for natural remedies.

Germany shows steady growth at 4.0%, supported by its health-conscious population and regulatory environment. The USA grows at 3.1%, benefiting from robust e-commerce and a focus on organic ingredients. France experiences more moderate growth at 3.0%, driven by holistic health trends.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA liver health supplements revenue is projected to grow at a CAGR of 3.1% from 2025 to 2035. Growth will be driven by a rising health-conscious population, increasing prevalence of liver-related diseases like NAFLD and hepatitis, and a robust demand for preventive healthcare.

The liver health supplements market in the UK is expected to grow at a CAGR of 4.1% from 2025 to 2035. This growth is driven by increasing health awareness, especially in managing liver diseases, and a growing preference for natural, herbal remedies.

Germany is expected to see steady growth in the liver health supplements market, with a projected CAGR of 4.0% from 2025 to 2035. The country’s strong economy, health-conscious population, and demand for high-quality supplements will drive the market.

The French liver health supplements market is projected to grow at a CAGR of 3.0% from 2025 to 2035. This growth is attributed to a rising interest in holistic health and the increasing prevalence of liver diseases. France’s health-conscious population, coupled with its focus on preventive care, is driving demand for liver supplements.

Japan’s liver health supplements market is expected to grow at a CAGR of 4.5% from 2025 to 2035. With a highly health-conscious population, Japan is witnessing a surge in demand for liver health products due to increasing cases of liver conditions like hepatitis. Consumers in Japan are increasingly looking for supplements that provide liver protection and overall wellness.

The liver health supplements market is highly competitive, with several prominent players occupying substantial shares of the market. Leading companies like NOW Foods, Glanbia PLC, Nestlé (Nature's Bounty), Jarrow Formulas, and Swisse have maintained their market dominance by leveraging strong portfolios of natural and organic supplements.

These companies differentiate themselves by focusing on product innovation, emphasizing the use of botanical extracts like milk thistle and turmeric, which have gained popularity due to their hepatoprotective properties. Additionally, they are focusing on expanding their reach through digital platforms and retail partnerships, ensuring broad accessibility of their products.

Recent Liver Health Supplements Industry News

In December 2023, Balchem completed a major expansion of its manufacturing facility for VitaCholine, its leading choline brand, increasing output by 50% to meet rising demand for this essential nutrient, which is well-known for its role in cognitive, liver, and overall health.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 10.8 billion |

| Projected Market Size (2035) | USD 17.1 billion |

| CAGR (2025 to 2035) | 5.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 - 2024 |

| Projections Period | 2025 - 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in Units |

| By Form | Tablets, Dry, Liquid, Powder |

| By Nature | Organic, Conventional |

| By Source | Botanical, Vitamins, Minerals, Others |

| By End User | Human Consumption, Pet Nutrition |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Balchem Corporation, Amway Corp., GNC, Enzymedica , Sanofi, America’s Finest Inc., Banyan Botanicals, Himalaya Herbal Healthcare, NUTRALife , Gaia Herbs, Jarrow Formulas, Inc., Swisse , Thompson, Blackmore, Nestle (Nature's Bounty), Now Foods |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis, and distribution channel analysis |

As per form, the market has been categorized into dry, tablet, powder, and liquid.

This segment is further categorized into organic and conventional.

This segment is further categorized into vitamins, minerals, botanicals, and others.

As per end user, the market has been categorized into human nutrition, and animal nutrition

Different distribution channels include online retailers, specialty stores, and supermarkets/hypermarkets.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The liver health supplements market is valued at USD 10.8 billion in 2025.

The market is forecasted to reach USD 17.1 billion by 2035, reflecting a CAGR of 5.2%.

Tablets are expected to lead the market with a 42.7% market share in 2025.

Online retailers are projected to hold a 38.6% market share in 2025.

Japan is anticipated to be the fastest-growing market with a CAGR of 4.5% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liver Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Liver Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

The Liver Transplantation Market is segmented by Treatment type and End User from 2025 to 2035

Liver Fibrosis Treatment Market - Innovations & Future Trends 2025 to 2035

Liver Fluke Treatment Market

Delivery Management Software Market Size and Share Forecast Outlook 2025 to 2035

Delivery Tracking Platform Market Size and Share Forecast Outlook 2025 to 2035

IOL Delivery Systems Market Size and Share Forecast Outlook 2025 to 2035

Fatty Liver Treatment Market - Trends & Forecast 2025 to 2035

Gas Delivery Systems Market Growth - Trends & Forecast 2025 to 2035

Drug Delivery Technology Market is segmented by route of administration, and end user from 2025 to 2035

Drug Delivery Solutions Market Insights - Growth & Forecast 2025 to 2035

Stent Delivery Systems Market Size and Share Forecast Outlook 2025 to 2035

Drone Delivery Service Market Analysis by Delivery Distance, Propeller Type, End User, and Region, and Forecast from 2025 to 2035

Parcel Delivery Vehicle Market Size and Share Forecast Outlook 2025 to 2035

The dental delivery system market is segmented by modality, and end user from 2025 to 2035

Oxygen Delivery Units Market

Service Delivery Automation Market Size and Share Forecast Outlook 2025 to 2035

Content Delivery Network Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Content Delivery Network Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA