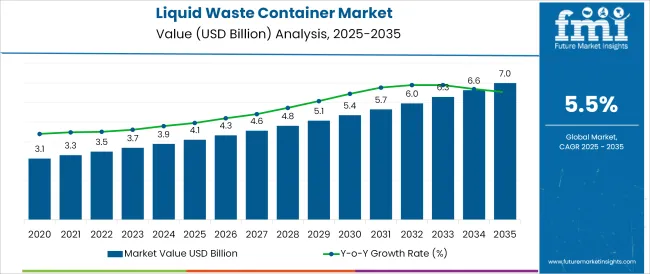

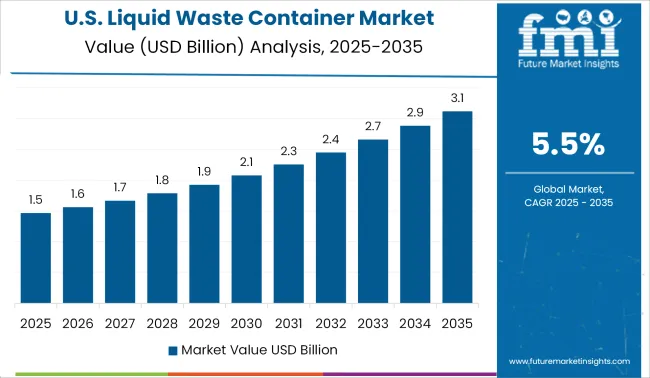

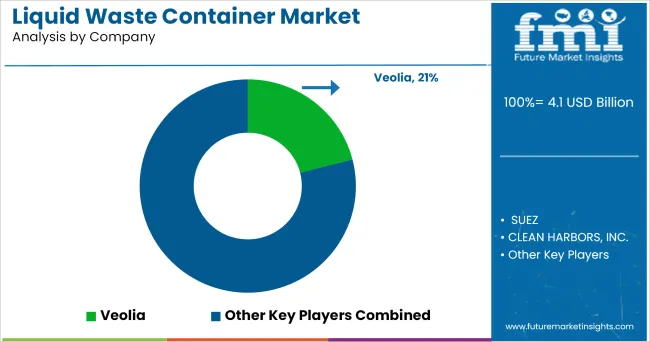

The Liquid Waste Container Market is estimated to be valued at USD 4.1 billion in 2025 and is projected to reach USD 7.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The liquid waste container market is witnessing accelerated adoption, supported by expanding industrial infrastructure, rising environmental compliance requirements, and the growing complexity of hazardous and non-hazardous liquid waste streams.

Industries are increasingly focused on containment systems that can prevent leakage, ensure regulatory compliance, and optimize handling during storage and transportation. Technological innovations in high-density polymer materials, structural reinforcements, and tamper-evident sealing mechanisms have significantly enhanced container reliability and versatility.

As circular economy principles and waste segregation norms tighten, demand for reusable, recyclable, and chemical-resistant containers is expanding. Key growth opportunities are emerging from the adoption of modular, stackable designs that support space-saving and automation in waste logistics. With industrial production scaling and environmental oversight intensifying, the market is expected to experience long-term structural growth driven by both regulatory mandates and sustainability benchmarks.

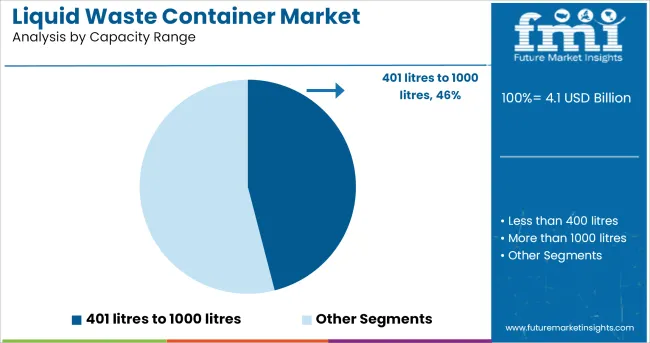

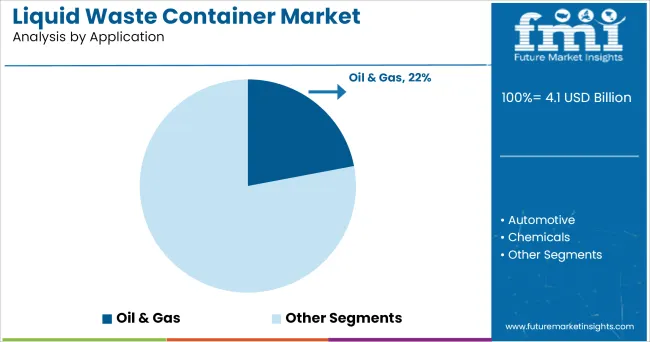

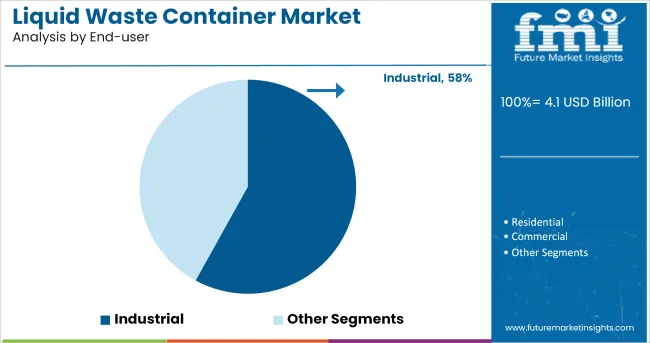

The market is segmented by Capacity Range, Application, and End-user and region. By Capacity Range, the market is divided into 401 litres to 1000 litres, Less than 400 litres, and More than 1000 litres. In terms of Application, the market is classified into Oil & Gas, Automotive, Chemicals, Iron & Steel, Healthcare, and Others. Based on End-user, the market is segmented into Industrial, Residential, and Commercial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Containers in the 401 to 1000 litres capacity range are projected to account for 46% of total market revenue in 2025, making this the leading segment by volume. This dominance is attributed to the optimal balance these containers provide between capacity, maneuverability, and compatibility with standard industrial waste collection systems.

Their size allows for efficient storage and transportation without the logistical burden of oversized units, making them ideal for mid-volume waste generation across industrial and municipal settings. These containers also meet critical safety and operational standards for hazardous liquid storage, ensuring controlled handling and minimal risk of spillage or contamination.

Additionally, their adoption is being reinforced by improvements in container design, including reinforced walls, easy-access drain valves, and forklift compatibility, which enhance user safety and operational efficiency. The segment is poised for sustained demand due to its alignment with both regulatory compliance and practical waste management needs in diverse industrial sectors.

The oil & gas segment is expected to contribute 22% of market revenue in 2025, emerging as a key application area for liquid waste containers. This segment's growth is being propelled by the high volume of fluid waste generated across exploration, drilling, production, and refining operations.

The handling of spent drilling muds, produced water, and other petroleum-based waste streams requires containers that meet stringent safety, chemical compatibility, and spill prevention standards. In offshore and remote onshore environments, the reliability of these containers becomes even more critical, driving the adoption of corrosion-resistant, impact-tested, and seal-tight models.

The heightened focus on environmental stewardship and waste traceability within the oil & gas industry is also supporting growth in this segment. As companies aim to align operations with global ESG goals and minimize ecological impact, investment in compliant, reusable waste containment solutions continues to expand solidifying oil & gas as a key end-market.

The industrial end-user segment is projected to hold a leading 58% revenue share of the liquid waste container market in 2025. This segment’s dominance is driven by the continual generation of process liquids, chemical by-products, wash-down waste, and effluents in manufacturing, metalworking, power generation, and chemical processing facilities.

Industrial operators are increasingly prioritizing safe and traceable containment solutions to comply with evolving waste management and environmental regulations. The use of specialized liquid waste containers is enabling enhanced segregation, on-site storage, and efficient transport to treatment or disposal facilities.

Additionally, the rising implementation of lean manufacturing and automation is accelerating demand for standardized container formats compatible with automated handling systems. Durability, stackability, and reusability have become critical purchasing criteria in industrial procurement processes. With operational safety, regulatory compliance, and environmental accountability at the forefront, industrial facilities are expected to remain the largest adopters of advanced liquid waste containment systems.

Liquid waste is getting a major problem day by day as 70% surface of Earth is covered in water. Animals and Human Beings are main producers of liquid waste. Thus, there is a rise in awareness about waste disposal, which is fueling the growth of liquid waste container.

Toxic chemicals are released due to the increasing manufacturing activities. Also there is a rapid growth in the pharmaceutical and healthcare industry, which is expected to fuel the market of liquid waste container.

A variety of cleaning fluids are used by most labs, shops and warehouses in their daily operations. They need a temporary way to store these wastes of liquid and such need is fueling the demand of liquid waste container. Safety Cans companies are offering liquid waste disposal cans in different materials, colours and sizes to dispose combustible, flammable, or corrosive liquids properly. Such need is creating many opportunities for liquid waste container.

The most profitable industry is oil and gas, as the demand of industries such as households, and transportation, and other sectors is fulfilled by it. There are concerns regarding the environment with wastewater, which is faced by oil & gas industry.

This industry generates a good amount of wastewater in various operations such as in hydrostatic testing water as the rate of water consumption is high. The water often gets contaminated, which is used in the process and there is a need to treat it for disposing or for reuse.

There is very high rate of water consumption in refineries for distilling crude into its various fractions, such as gasoline, diesel, jet fuel, and kerosene. Therefore, factors mentioned above are expected to drive the demand of liquid waste container in upcoming years.

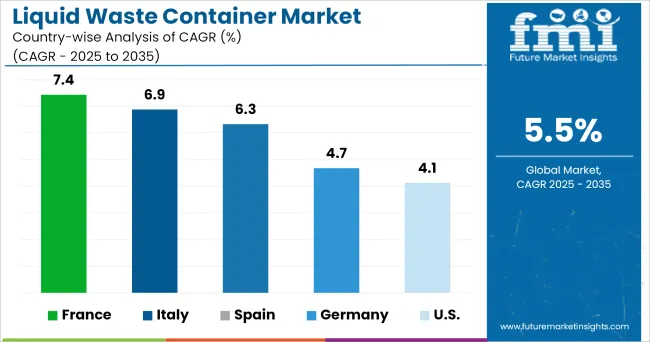

The global market of liquid waste container is currently dominated by North America as most of the key players located in the country have a solid competition among the new players. Many key players in the country are aiming for collaboration, acquisition and new product strategies to escalate their business presence.

The companies in United States and Canada are focusing on low manufacturing cost as they have advanced equipment or strong R and D capability. The growth of liquid waste container is also driven by region, owing to penetration in residential, commercial, and industrial segments.

All the major industries such as automotive, Iron & steel, Oil & Gas, Pharmaceutical, textile and others are moving towards the adoption of liquid waste container solutions. There is a good number of research projects going on waste management.

There many waste management companies in the region to collect all type of waste. This can impel the expansion of liquid waste container market in Europe. Due to rise in liquid waste from various industries, it will attribute to the availability of more liquid waste container solutions in the upcoming years.

Some of the leading vendors of liquid waste container include

are some of the key players in the market. These vendors are adopting various key strategies, to increase their customer base and market shares. They are also partnering with other local vendors to dominate significant portion of the market.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global liquid waste container market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the liquid waste container market is projected to reach USD 7.0 billion by 2035.

The liquid waste container market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in liquid waste container market are 401 litres to 1000 litres, less than 400 litres and more than 1000 litres.

In terms of application, oil & gas segment to command 22.0% share in the liquid waste container market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquid Waste Management Market

Bulk Liquid Containers Market

Medical Waste Liquid Collection Device Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

Liquid Processing Filter Market Size and Share Forecast Outlook 2025 to 2035

Liquid Mandrel Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Waste Heat Power Generation Boiler Market Size and Share Forecast Outlook 2025 to 2035

Liquid Oxygen Generator Market Size and Share Forecast Outlook 2025 to 2035

Waste Wood Recycling Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Bag Market Size and Share Forecast Outlook 2025 to 2035

Liquid Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Container-based Firewall Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Waste-derived Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Wastewater Heavy Metal Treatment Agent Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA