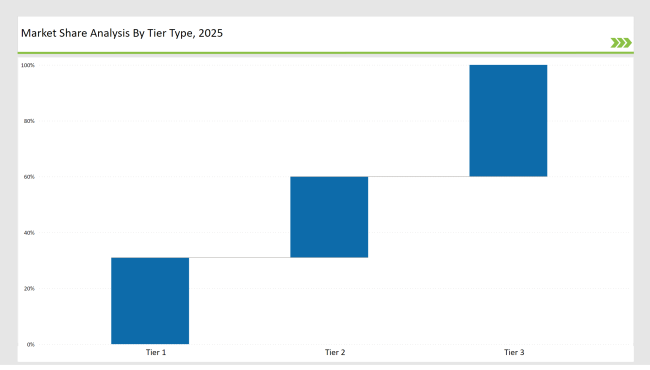

The liquid pouch packing Machine Market is categorized into three tiers depending upon the market presence and competitive strategy. Tier 1 consists of Nichrome India, Bosch Packaging Technology, and Tetra Pak with a 31% market share. Economies of scale, most advanced R&D, and best developed global distribution networks are characteristics of Tier 1 companies.

Their investments in automation, high-speed efficiency, and sustainability have them positioned as the market leader in food & beverage, pharmaceutical, and personal care sectors. The company has developed innovative aseptic packaging and energy-efficient pouch filling solutions to enhance its competitive advantage.

Tier 2 players, including Viking Masek, GEA Group, and Spack Machine, account for around 29% of the market. These companies target the mid-sized and regional brands in terms of flexible liquid pouch packaging at a lower cost, focusing on new market entry because of operational efficiency, material innovation, and respect for food safety and environmental laws.

Tier 3, corresponding to 40% of the market, is comprised of regional manufacturers and niche start-ups that specialize in localized demands with innovative, affordable, and sustainable packaging machines for liquid pouches. They are agile and respond quickly to changes in consumer preference and to the changes in regulations on eco-friendly packaging solutions

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Nichrome India, Bosch Packaging Technology, Tetra Pak) | 13% |

| Rest of Top 5 (Viking Masek, GEA Group) | 10% |

| Next 5 of Top 10 (Spack Machine, Universal Pack, Synda Pack, Turpack, Hayssen) | 8% |

The Liquid Pouch Packing Machine Market has seen the changing face of this industry led by Nichrome India, Bosch Packaging Technology, Tetra Pak, Viking Masek, and GEA Group. In responding to increasing food safety regulations, these companies introduced high-speed pouch filling systems that have improved in energy efficiency, enhanced automation levels, and increased their portfolios.

Improvements toward fully automated, IoT-integrated packaging solutions reflect the industry's paradigm towards smart manufacturing and sustainability.

Year-on-Year Leaders

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Nichrome India, Bosch Packaging Technology, Tetra Pak |

| Tier 2 | Viking Masek, GEA Group, Spack Machine |

| Tier 3 | Universal Pack, Synda Pack, Turpack, Hayssen |

| Manufacturer | Latest Developments |

|---|---|

| Nichrome India | Expanded aseptic packaging technology for extended shelf-life products (May 2024) |

| Bosch Packaging Technology | Introduced AI-driven predictive maintenance systems (April 2024) |

| Tetra Pak | Developed lightweight, recyclable liquid pouch materials (March 2024) |

| Viking Masek | Launched high-speed, multi-lane pouch packing machines (June 2024) |

| GEA Group | Focused on modular, flexible liquid pouch packing solutions (July 2024) |

Nichrome India, Bosch Packaging Technology, Tetra Pak, Viking Masek, and GEA Group.

The top five manufacturers collectively control 40% of the market, while the top ten account for 31%.

Medium, as the top players hold between 30% and 60% of the industry share.

They contribute 13% of the market by offering specialized and regional solutions.

Automation, food safety regulations, and sustainable packaging solutions.

BOPP Film Market Analysis by Thickness, Packaging Format, and End-use Industry Through 2025 to 2035

Korea Tape Dispenser Market Analysis by Material, Product Type, Technology, End Use, and Region through 2025 to 2035

Medical Transport Box Market Trend Analysis Based on Material, Capacity, End-User and Regions 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.