The liquid flavour system market encompasses formulated liquid flavour concentrates used across food & beverages, pharmaceuticals, nutraceuticals, and personal care products to impart or enhance taste, aroma, and sensory experience.

These systems include natural, nature-identical, and synthetic flavour compounds blended with carriers such as oils, water, or emulsifiers. The market is driven by rising demand for clean-label, customized, and regionally inspired flavours, coupled with the growth of convenience foods, functional beverages, and premium culinary products.

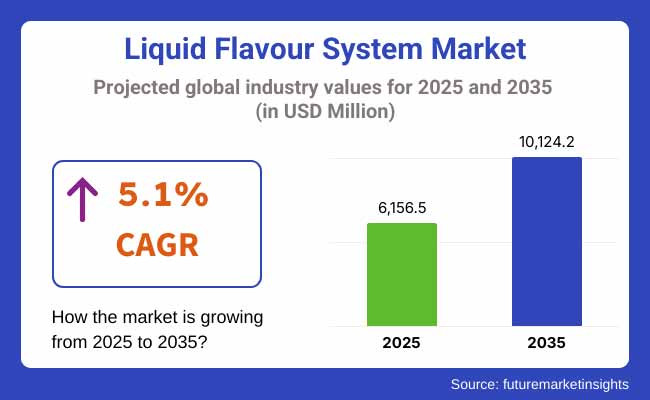

In 2025, the global liquid flavour system market is projected to reach approximately USD 6,156.5 million, with expectations to grow to around USD 10,124.2 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 5.1% during the forecast period.

The robust growth reflects increased R&D investments in sensory innovation, the rise of health-forward and plant-based formulations, and rapid adoption of encapsulated liquid flavours in ready-to-eat and ready-to-drink formats.

North America in liquid flavour system market, based on market share North America dominated the liquid flavour system market in the year of 2020 on demand basis (on the basis of demand from beverages and bakery & dairy and nutritional supplements). Natural, sugar-reducing and masking flavours used in functional beverages, protein smoothies and clean-label products are all products for which the USA and Canada are early adopters. In addition, flavour customization and private label development is driving innovation in the region.

In Europe which is a mature and highly regulated market, the UK, France and Germany are leading the way. Organic, allergen-free, and sustainability-based ingredients are in high demand across the region, thus propelling the products trends for the botanical and fruit-derived liquid flavour systems. Flavour approvals in EFSA are strict, compelling manufacturers to flavours with proven track ability of natural origin.

Asia-Pacific is anticipated to witness the highest growth rate, expanding at a CAGR, on account of growing disposable income, increasing beverage market, and the demand for region-specific flavour in countries such as China, India, Japan, South Korea, and Southeast Asia. An ingrained cultural affection for tea, herbal extracts, spiced drinks and tropical fruit goes into creating customized flavour systems for local palates. Taste techniques are also being propelled by growth in dairy substitutes and instant meal kits with similar aids.

Challenges

Stability, Shelf-Life, and Regulatory Compliance

Liquid flavour is utilized by various industries like food and beverage industries because of issues with heat-processed food such as beverage and dairy that is flavour stability, oxidation and shelf life problems. Due to the liquid: liquid can be micro-biologically polluted, so advanced preservation and packaging technology have to be applied.

Additionally, stringent regulatory practices regarding flavouring agent, solvent usage, and labeling (i.e., natural vs. Artificial) exist on a regional basis; consequently, global commercialisation strategies are also challenging to envisage at present.

Opportunities

Rise of Functional Beverages, Natural Extracts, and Customization Trends

These growing demands for natural, organic and clean-label flavour - primarily for RTD drinks, plant-based foods, sports nutrition and gourmet sauces - are driving growth in liquid flavour systems. Explore tools from the product development world like microencapsulation, water-soluble emulsions, and oil-in-water delivery systems that may improve stability, intensity and versatility.

On the other hand, there are also growing opportunities for tailored flavour solutions to accompany region-specific as well as individualized flavour experiences from personalized nutrition and AI-based taste pairing.

From 2020 to 2024, the beverage, confectionery, and dairy sectors were very active in seeking fruit extracts across citrus, botanical, and exotic fruit notes. Some of the numerous challenges during this period included disrupted supply chains, source variability of natural flavours, and regulatory scrutiny on synthetics.

And by 2025 to 2035: marketplace transformation towards sustainable sourcing, AI formulation platforms in the flavour space and health-oriented flavour profiles (i.e. adaptogenic, immune-enhancing, sugar-free enhancing). This in turn will be fueled by the growth of plant-based foods, innovation around clean-label products and development of functional food and beverage products.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, EFSA, and Codex standards for flavouring agents |

| Technology Innovations | Growth in flavour emulsions and natural essential oil blends |

| Market Adoption | Dominant in RTD beverages, syrups, dairy, and sauces |

| Sustainability Trends | Growing interest in ethically sourced botanicals and organic flavours |

| Market Competition | Led by Givaudan, Symrise, Firmenich, Kerry Group, IFF, Sensient, Mane |

| Consumer Trends | Preference for fruit-forward, nostalgic, and global flavour fusions |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter requirements for natural labeling, solvent use transparency, and clean-label claims |

| Technology Innovations | Advancements in AI-powered flavour design, microencapsulation, and smart dispersion systems |

| Market Adoption | Expansion into plant-based meats, nutrition bars, functional shots, and e-commerce meal kits |

| Sustainability Trends | Large-scale adoption of upcycled flavour compounds, carbon-labeled ingredients, and biodegradable packaging |

| Market Competition | Rise of AI flavour startups, regionally specialized flavour labs, and sustainability-focused ingredient firms |

| Consumer Trends | Growth in health-oriented, personalized, low-sugar enhancing, and adaptogen-infused flavour systems |

The United States liquid flavour market is projected to be steady because consumers are changing their tastes towards clean label, natural and personalized flavour solutions in beverages and dairy and plant-based products. Health is the new wealth, and growing health-conscious consumers are driving the demand for functional food, which means applying liquid flavour systems to wellness beverages and protein-enriched snacks as well.

Critical drivers include encapsulated liquid flavours innovation, organic-certified flavourings and flavour modulation systems for sugar and or sodium reduction. The USA also has a strong presence for R&D into technologies for flavour masking and enhancement-especially in the nutraceutical and fortified categories.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

The merits of growing demand for premium, authentic, and exotic flavour in ready-to-drink beverages, desserts, and alternative protein foods keep the UK Liquid Flavour System market upbeat. Liquid flavour systems that are allergen free and clean label are in rising demand with health conscious and vegan consumers.

Additionally, the rise of craft beverage manufacturing and private-label development are fueling demand for customizable liquid flavour concentrates, especially for mixers, low-strength drinks, and functional infusions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.9% |

High fructose and sugars alternative sweeteners demand would include systems for EU liquor preparation. France and Germany and Netherlands are an evil flavour room, particularly in dairy, bakery and confectionery segments.

The regional and organic-based extracts' and botanicals’ market grows; thus demanding the manufacturers for investing in advanced extraction and formulation technologies. Additionally, growing trends for hybrid products (ex. milk-plant Hybrid; functional waters) are driving demand for multi-tasking liquid flavour systems.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.8% |

Flavour of the house voila, at the ongoing Japanese Liquid Flavour System market, driven by the one annual year request and low fresh unique buyers, for the complex, meaty and seasonal flavours. The segments such as convenience food, ready to drink tea, and nutrition beverages have a high demand for liquid flavour systems.

Japanese companies have been investing in fermentation-derived flavour enhancers and flavour systems that enhance mouthfeel and flavour in low-calorie foods. Classic Japanese flavourings like yuzu, miso and matcha are being reinvented in liquid form for global and local markets.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

Liquid Flavour System market through South Korea is moderately growing, primarily due to the demand of functional beverages, K-snacks and the trends of canalization in foodservice. Providing global sensations, Liquid flavour systems providing bold spicy, fermented and fusion flavours are increasing in demand.

But the country’s innovation in the use of liquid flavours for instant foods, low-alcohol drinks and skin-enhancing wellness beverages is leading to rapid diversification. Moreover, due to the clean-label and halal-certified products for me, the developments have become a driver for natural and plant-based flavour systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

Organic liquid flavour has been the dominant force in the global flavour market. With consumers being more conscious these days about the food they consume, organic flavour as an important branding narrative that conveys quality, trust, and well-being is becoming essential across packaged and processed food categories owing to brand differentiation purposes and compliance requirements.

As demand has increased for genetically modified organism-free, pesticide-free, and synthetic organic-solvent-free but still natural and farm-based ingredients, so manufactures have also begun looking to replace artificial or synthetic flavours with organic flavour systems.

Consumers are scrutinizing labels for ingredients they can identify, which can imply health of body, safety of food and environmental awareness with little processing. This trend is a great match for organic liquid flavours - flavours derived from fruits, vegetables, herbs, spices and botanicals cultivated using organic methods.

Third party organic organizations (USDA Organic, EU Organic, and JAS) and blockchain based traceability platforms have been made available for food and beverage organisations for liquid flavour systems. These certifications have recently become the leading purchase drivers in channels for premium grocery, online health-food retail, and foodservice procurement.

As per the research statistics, more than 68% of the world consumer prefer food along with beverage products that uses organic / natural flavours, especially for children snack, dairy alternatives, nutritional beverages and clean-label sauces.

Liquid flavour systems has been young the most consumed flavour profiles and is one of the vital parts of consumer satisfaction processes that is still driven by sweet tastes. Nonetheless, the category is in the midst of a strategic evolution that is mixing indulgence with healthier-minded innovation. Sweet liquid flavour, which encompasses both sugar- and sugar-free (low- or zero-sugar/ calorie) offerings, meets diverse dietary and cultural needs and product occasions.

At present, sweet liquid flavour systems are double duty ranging from carbonated drinks and dairy desserts to oral care, sports nutrition and functional foods delivering palatability and health-oriented marketing hooks.

As the trend of obesity, diabetes, and metabolic syndrome is continuously evolving with the acceleration of globalisation, both regulatory commissions and global health organisations are pushing food manufacturers to undertake initiatives to implement sugar-reduction policies. As a result, manufacturers began to introduce sugar-free, nature-based sweet flavour liquid systems into their formulations based on stevia, monk fruit, erythritol, and allulose.

They mix strength of sweetness and flavour modulators that help suppress bitterness and amplify mouthfeel. “Most sugar-free drinks now add flavour-improving peptides, acidulants and aroma enhancers to most closely match the sensory profile of sugar without its caloric load.

They are changing sweet flavour delivery in low-sugar drinks, dairy-free yogurts, protein shakes and meal replacement powders. Over 55% of globally present food startups, whose products portfolio are flagship products, now have sugar-reduced or sugar-free in the product portfolio, which itself attests the systemic transformation of the marketplace.

If the health aspects of sweetness chemistry is worthy of allocation half of the sweetness overall chemistry to which it belongs, then the other half is on proxies of indulgence and enjoyment. People are still looking for comfort and nostalgia through flavour profiles such as vanilla, caramel, chocolate, strawberry and honey - especially in dairy, bakery and frozen dessert segments.

The use of liquid flavour systems allows flavour experiences to be layered, with sweet elements combined with floral, fruity or spicy flavours lending signature flavour profiles. For example, extreme RTD (ready-to-drink) cocktails, frozen yogurts and premium spreads are now packed with flavours such as vanilla-cinnamon-milk or raspberry-dark chocolate-caramel.

AI-enabled sensory mapping and consumer sentiment analysis allow brands to identify realms of emotional flavour they can tap into-comfort, joy, indulgence associations-at the level of product innovation and positioning in a much finer fashion.

High demand in food and beverage manufacturing for deeper taste profiles, clean-label products, and personalization fuels the growth of the liquid flavour system market. Liquid flavour systems are extremely soluble, allow consistent dosing and can be easily integrated into virtually any food including carbonated drinks and milk as well as sauces, bakery and confectionery. The innovation of natural and botanical extracts such as new ingredients and higher application in plant-based and fortified foods fuel the market.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Givaudan SA | 18-22% |

| International Flavours & Fragrances Inc. (IFF) | 14-18% |

| Symrise AG | 12-16% |

| Firmenich SA (Now part of DSM-Firmenich) | 10-14% |

| Kerry Group plc | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Givaudan SA | Offers liquid flavour systems for beverages, snacks, and dairy, with a focus on natural, vegan, and regional flavour trends. |

| IFF (International Flavours & Fragrances Inc.) | Develops customized liquid flavours for savory, sweet, and functional food applications, integrating enzyme and encapsulation technologies. |

| Symrise AG | Produces liquid botanical, fruit, and spice extracts tailored to health & wellness and premium product lines. |

| Firmenich SA (DSM-Firmenich) | Provides flavour modulation and masking systems for sugar and salt reduction across food categories. |

| Kerry Group plc | Offers clean-label and heat-stable liquid flavours, with application expertise in RTD beverages, soups, and plant-based foods. |

Key Market Insights

Givaudan SA (18-22%)

Givaudan is a global leader in liquid flavour systems, leveraging its extensive botanical library and AI-driven flavour innovation, with offerings for functional drinks, low-sugar snacks, and ethnic cuisines.

IFF (14-18%)

IFF combines enzyme technologies and proprietary delivery systems to deliver tailored liquid flavours for texture, aroma, and taste enhancement in complex product matrices.

Symrise AG (12-16%)

Symrise focuses on natural liquid flavour creation, especially in clean-label and health-forward product development, with solutions for gut health, immune support, and sensory optimization.

Firmenich (10-14%)

Firmenich (now part of DSM-Firmenich) offers liquid flavour systems with emphasis on sustainability, vegan formulations, and masking off-notes in protein-rich foods.

Kerry Group (8-12%)

Kerry delivers versatile and shelf-stable liquid flavouring systems, widely used in plant-based, dairy-free, and fortified foods, offering speed-to-market support and culinary innovation.

Other Key Players (26-32% Combined)

Several specialty and regional players are shaping the market with custom, artisan, or niche flavour systems, including:

The overall market size for liquid flavour system market was USD 6,156.5 million in 2025.

The liquid flavour system market is expected to reach USD 10,124.2 million in 2035.

Rising demand for enhanced taste and aroma in processed foods and beverages, growing preference for natural and clean-label flavour solutions, and increasing innovation in flavour customization will drive market growth.

The top 5 countries which drives the development of liquid flavour system market are USA, European Union, Japan, South Korea and UK.

Organic liquid flavour systems expected to grow to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquid Nitrogen Purge Systems Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Zero Liquid Discharge System Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Liquid Handling Systems Market

Africa’s Zero Liquid Discharge System Market - Size, Share, and Forecast 2025 to 2035

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

Binary High Pressure Gradient Liquid Chromatography System Market Size and Share Forecast Outlook 2025 to 2035

Liquid Processing Filter Market Size and Share Forecast Outlook 2025 to 2035

Liquid Mandrel Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Liquid Oxygen Generator Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Bag Market Size and Share Forecast Outlook 2025 to 2035

Liquid Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liquid Desiccant Natural Gas Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Liquid Packaging Board Market Size and Share Forecast Outlook 2025 to 2035

Liquid Filled Capsule Market Size and Share Forecast Outlook 2025 to 2035

Liquid Density Meters Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA