As of 2024, the global liquid filtration industry continued to experience steady growth driven by increasing industrial demand and technological advancements. The demand for high-efficiency filtration systems in sectors like food and beverage, pharmaceuticals, and water treatment significantly contributed to this growth.

Notably, in the water treatment industry, stricter regulatory standards for water quality, especially in emerging industries, spurred the adoption of advanced filtration technologies, such as membrane filtration and activated carbon solutions. The food and beverage industry also saw a notable shift towards filtration systems that ensure product quality and safety, particularly for dairy, beer, and juice manufacturers.

A key trend in 2024 was the rise in demand for eco-friendly filtration systems, as sustainability continued to be a priority across industries. Companies focused on developing reusable and energy-efficient filters, with several players introducing biodegradable filter materials.

Looking ahead to 2025, the industry is expected to maintain its upward trajectory, growing at a CAGR of 7.9%. Technological innovations in filtration efficiency and automation will continue to be crucial, particularly in sectors with complex filtration needs like pharmaceuticals and chemical processing. Additionally, an increasing emphasis on water scarcity and sustainability will likely drive more investments in innovative liquid filtration solutions, reinforcing long-term industry growth through 2035.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3,100 Million |

| Projected Industry Value (2035F) | USD 6,400 Million |

| CAGR (2025 to 2035) | 7.9% |

Explore FMI!

Book a free demo

Surveyed Q4 2024, n=450 stakeholder participants evenly distributed across manufacturers, distributors, industrial operators, and regulators in the USA, Western Europe, Japan, and South Korea

Regional Variance

High Variance

Convergent and Divergent Perspectives on ROI

USA: 77% of stakeholders found investment in IoT-enabled filtration solutions to be “worth the cost,” while Japan showed lower adoption due to cost-consciousness.

Consensus

Polypropylene and Stainless Steel: Selected by 63% globally for their durability and resistance to chemical corrosion.

Regional Variance

Shared Challenges

87% cited rising raw material costs as a significant concern affecting pricing and profitability.

Regional Differences

Manufacturers

Distributors

End-Users (Industrial Operators)

Alignment

70% of global manufacturers plan to invest in smart filtration systems that offer real-time data analysis, energy efficiency, and predictive maintenance capabilities.

Divergence

High Consensus:

Safety compliance, sustainability, and cost pressures are universal concerns in the liquid filtration industry.

Key Variances:

Strategic Insight: A one-size-fits-all approach will not succeed in the global liquid filtration industry. Regional adaptations (e.g., IoT solutions in the USA, sustainability in Europe, and cost-effective compact solutions in Asia) will be essential for effective industry penetration.

| Countries | Impact of Policies and Regulations |

|---|---|

| USA |

|

| UK |

|

| France |

|

| Germany |

|

| Italy |

|

| South Korea |

|

| Japan |

|

| China |

|

| India |

|

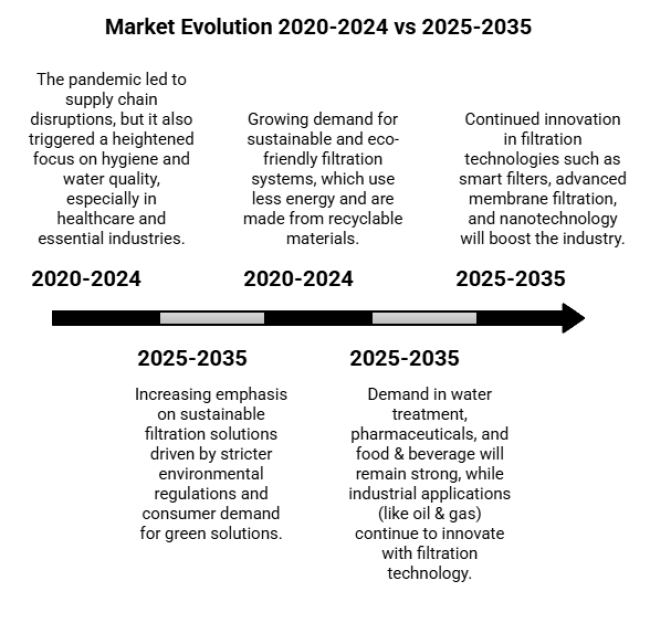

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The pandemic led to supply chain disruptions, but it also triggered a heightened focus on hygiene and water quality, especially in healthcare and essential industries. | The industry will continue to benefit from improved focus on hygiene and water purification in various sectors, including healthcare, food & beverage, and water treatment. |

| Increasing demand for clean water, stricter regulations, and advancements in filtration technology (e.g., nanofiltration and membrane technology). | Continued innovation in filtration technologies such as smart filters, advanced membrane filtration, and nanotechnology will boost the industry. |

| Growing demand for sustainable and eco-friendly filtration systems, which use less energy and are made from recyclable materials. | Increasing emphasis on sustainable filtration solutions driven by stricter environmental regulations and consumer demand for green solutions. |

| Rising demand in industries such as oil & gas, pharmaceuticals, and food & beverage for filtration solutions that meet stricter quality standards. | Demand in water treatment, pharmaceuticals, and food & beverage will remain strong, while industrial applications (like oil & gas) continue to innovate with filtration technology. |

The fabric material used in liquid filtration systems plays a critical role in determining the system’s performance and durability. Polyester is one of the most widely used materials in liquid filtration due to its excellent chemical resistance and durability. It is an economical option and is commonly used in water treatment, food and beverage filtration, and industrial filtration applications.

The projected CAGR for the Polymer segment is approximately 7.1%. Nylon, known for its high strength and flexibility, is especially used in applications that require fine filtration, such as in pharmaceuticals and chemicals. It also offers resistance to abrasion, making it ideal for harsh environments. Polypropylene is another popular choice due to its excellent corrosion resistance, low cost, and versatility. It is particularly used in water treatment and wastewater filtration.

Stainless steel, being durable and resistant to high temperatures, is preferred for high-end filtration systems in critical applications like pharmaceutical liquid filtration and oil and gas. The projected CAGR for the Nonwoven segment is approximately 6.8%. Woven fabrics, made from synthetic materials like polyester and nylon, are used for coarse to medium filtration processes, particularly in industries such as mining, chemical processing, and water filtration.

The filter media used in liquid filtration systems refers to the materials that separate solids from liquids. Membrane filtration is commonly used for applications requiring fine filtration, such as in reverse osmosis (RO), ultrafiltration (UF), and microfiltration (MF). Membranes are gaining popularity in water purification, wastewater treatment, and desalination due to their ability to separate even dissolved solids.

Granular filter media like sand, gravel, and activated carbon are widely used in municipal water treatment plants for their cost-effectiveness and efficiency in removing large particles. Nonwoven media, made from materials like polyester, polypropylene, and nylon, are flexible and can be moulded to various shapes and sizes.

These are preferred in applications that require fine filtration, such as in the pharmaceutical, food and beverage, and industrial sectors. Woven media, typically made from synthetic fibres, is commonly used for medium to coarse filtration applications, especially in industries that require durability and flexibility, such as chemical and petrochemical manufacturing.

The end-use applications of liquid filtration systems span several industries, including water treatment, food and beverage, pharmaceuticals, chemicals, oil and gas, mining, and automotive. The water treatment sector is one of the largest consumers of filtration systems, driven by the increasing need for clean and safe drinking water, as well as the treatment of wastewater.

Municipalities and industries worldwide rely on liquid filtration systems to meet regulatory requirements and ensure the removal of impurities from water. In the food and beverage industry, filtration systems are crucial for ensuring product quality, hygiene, and safety.

These systems are used to purify water, filter out contaminants in beverages, and remove solids from food processing liquids. The pharmaceutical sector also requires efficient filtration systems to ensure the purity of liquids used in drug production, vaccine manufacturing, and biotechnological processes.

In the chemical industry, filtration systems are employed to separate solids from liquids during chemical processing, ensuring high product quality and safety. The oil and gas industry relies on filtration systems for separating contaminants from crude oil and produced water during extraction and refining processes. filtration systems in applications such as fuel filtration, coolant filtration, and engine oil filtration, with the growing focus on electric vehicles (EVs) driving further innovation in this space.

The United States is projected to experience a CAGR of 7.8% in the Liquid Filtration Market from 2025 to 2035. This growth is largely driven by the increasing demand for advanced filtration technologies across diverse industries such as water treatment, chemicals, pharmaceuticals, and food & beverage. As the USA continues to invest in environmental sustainability and health-conscious policies, the need for efficient liquid filtration solutions is growing.

In addition, stricter environmental regulations, the emphasis on clean water, and advancements in industrial filtration technologies are contributing to the growth. The trend towards digitization and smart technologies in manufacturing and industrial processes also drives the adoption of more advanced liquid filtration systems. The USA remains a global leader in industrial innovation, and as industries continue to adopt automation and energy-efficient solutions, the demand for liquid filtration will rise steadily in the coming decade.

The United Kingdom is expected to witness a CAGR of 7.6% in the Liquid Filtration Market from 2025 to 2035. The UK's industrial transformation towards more efficient and sustainable operations is increasing the need for advanced filtration technologies. As industries, such as automotive, energy, and chemicals, adapt to cleaner and greener processes, the demand for efficient liquid filtration systems becomes more critical.

The UK’s push for carbon neutrality, water conservation efforts, and growing investment in the green economy is further boosting the demand for filtration solutions. Moreover, as the country embraces Industry 4.0, the integration of digital technologies into manufacturing processes will increase the need for filtration systems that can maintain the quality and consistency of products. The UK government’s focus on sustainability and regulation of waste treatment processes will support the growth of liquid filtration systems in the long run.

France’s industrial sector is embracing digitalization and automation, increasing the demand for high-quality liquid filtration systems. The country’s focus on Industry 4.0 and adoption of IoT-enabled filtration solutions in key industries, such as chemicals, pharmaceuticals, food & beverage, and water treatment, are driving significant growth in the market.

The French government’s commitment to sustainability, energy efficiency, and emission reduction is encouraging industrial sectors to adopt cleaner and more efficient filtration systems. France is also investing heavily in supporting green technologies, and as industrial automation accelerates, so does the demand for sophisticated liquid filtration systems to support efficient manufacturing processes and ensure compliance with environmental standards.

Germany, a global leader in precision engineering and manufacturing, is expected to see significant growth in the Liquid Filtration Market, with a projected CAGR of 7.9% from 2025 to 2035. Industries in Germany, including automotive, chemicals, and pharmaceuticals, are at the forefront of adopting digital manufacturing technologies that improve process efficiencies, reduce waste, and enhance product quality. These changes are driving the need for advanced liquid filtration solutions.

Germany’s emphasis on sustainability, supported by the Energiewende (energy transition) initiative, has increased demand for efficient filtration technologies. The German government’s regulatory framework for reducing industrial emissions and energy usage is pushing industries to seek more reliable and cost-effective filtration systems. As the country continues to innovate in automation and smart manufacturing technologies, the need for more effective liquid filtration solutions will continue to grow.

Italy’s manufacturing base, which spans industries from textiles and apparel to automotive, food processing, and chemicals, is transitioning towards more automation and digitalization. This trend is propelling the demand for sophisticated liquid filtration systems to support sustainable practices and enhance process efficiency.

The Italian government’s commitment to energy efficiency and sustainability is fostering the growth of advanced filtration technologies. As industries increasingly focus on reducing energy consumption and minimizing industrial waste, there will be greater demand for liquid filtration solutions that can meet stringent environmental standards. Italy’s alignment with the EU's green production goals will drive the market for liquid filtration solutions in the coming years.

South Korea is projected to experience a CAGR of 7.5% in the Liquid Filtration Market between 2025 and 2035. The country’s industrial sectors, including semiconductors, automotive, and manufacturing, are rapidly embracing automation and smart technologies, which directly impacts the demand for advanced liquid filtration systems.

Government regulations focused on energy efficiency and sustainable growth are driving industries to adopt eco-friendly filtration technologies. As industries continue to optimize their operations and reduce their carbon footprint, the need for reliable filtration systems that can ensure cleaner processes and meet environmental standards is on the rise. The integration of AI and IoT into industrial processes will further accelerate the adoption of liquid filtration systems in South Korea.

Japan is expected to witness a CAGR of 7.8% in the Liquid Filtration Market from 2025 to 2035. Japan’s highly advanced manufacturing sector, particularly in electronics, automotive, and robotics, is increasingly adopting automation technologies to improve process efficiency and quality control. This transformation is driving the demand for state-of-the-art liquid filtration systems.

The Japanese government’s emphasis on energy-saving manufacturing practices and sustainability is creating strong demand for filtration solutions that can reduce waste, improve product quality, and support environmentally-friendly production. As Japan continues to innovate in industrial automation and digital technologies, the need for efficient liquid filtration systems to optimize production processes will rise steadily in the next decade.

China, as the world’s largest manufacturing hub, is projected to grow at a CAGR of 7.8% in the Liquid Filtration Market from 2025 to 2035. Rapid industrialization, coupled with increasing government investments in smart manufacturing, is fueling the demand for advanced filtration systems in industries such as chemicals, electronics, automotive, and food & beverage.

China’s commitment to sustainability, energy efficiency, and the reduction of industrial emissions is driving the adoption of liquid filtration technologies that can optimize production processes and reduce environmental impact. As the country continues to modernize its industrial sectors and adopt more automated processes, the need for efficient liquid filtration solutions will continue to grow.

India’s industrial sector is rapidly modernizing, with increasing investments in automation technologies and digital transformation. As industries such as chemicals, pharmaceuticals, and textiles adopt more advanced manufacturing processes, the demand for efficient liquid filtration systems is growing.

India’s focus on improving industrial productivity, reducing energy consumption, and adopting sustainable practices is driving the need for advanced liquid filtration solutions. With the government’s emphasis on clean and efficient industrial processes, the market for liquid filtration systems is expected to grow rapidly as industries seek solutions to optimize production, reduce waste, and ensure compliance with environmental standards.

In 2024, major players in the liquid filtration industry made significant strides through innovation and strategic expansions. Pentair focused on sustainability with energy-efficient filtration technologies and expanded its footprint in the Asia-Pacific region to address water scarcity and growing industrial demand.

3M introduced new filtration solutions for the food & beverage and pharmaceutical sectors, emphasizing quality control and environmental efficiency. Similarly, Pall Corporation enhanced its offerings for life sciences and industrial water treatment, launching advanced solutions for pharmaceutical sterilization and water purification, solidifying its leadership in high-precision filtration applications.

Meanwhile, Filtration Group grew its industry share by acquiring smaller firms with advanced filtration technologies, expanding its reach in both industrial and municipal water treatment. Parker Hannifin introduced AI-powered filtration systems, focusing on predictive maintenance and real-time monitoring to boost efficiency in sectors like oil & gas and chemicals. Donaldson Company also made notable advancements, enhancing filtration systems for industries like aerospace and automotive while prioritizing sustainability, further strengthening its competitive position in the industry.

Market Share

3M Company

Freudenberg Filtration Technologies

Donaldson Filtration Solutions

Ahlstrom-Munksjo

Berry Global, Inc

Clear Edge

Fibertex Nonwovens

American Fabric Filter

Autotech Nonwovens

Eagle Nonwovens Inc.

These systems are utilized in various sectors including food & beverage, pharmaceuticals, chemicals, oil & gas, and the environment for liquid filtration to ensure clear product quality by removing impurities and contaminants in wastewater treatment.

For decontamination of the water, filtration technologies are varied depending on the purity level needed. Healthcare industries utilize high precision filters whereas the food & beverage sector often demands filters that affect taste and safety while industrial sectors need a cost-effective robust solution.

Advanced filtration solutions contribute to water waste recycling and compliance with sustainability initiatives by reducing waste through water reuse and efficient waste management. They also minimize the reliance on harmful chemicals and help ensure compliance with environmental regulations.

Smart filters powered by AI for predictive maintenance, membrane tech such as nanofiltration for reducing plastics.

Increasing industrialization, water scarcity, stricter environmental regulations, and a growing focus on sustainability are key factors driving the demand for advanced liquid filtration systems.

Polymer, Cotton, Metal.

Nonwoven, Woven, Mesh.

Industrial treatment, Municipal treatment.

North America, Latin America, Europe, Asia Pacific, Middle East and Africa.

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Aerospace Valves Market Growth - Trends & Forecast 2025 to 2035

United States Plastic-to-fuel Market Growth - Trends & Forecast 2025 to 2035

Power Generator for Military Market Growth – Trends & Forecast 2025 to 2035

Immersion Heater Market Growth - Trends & Forecast 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.