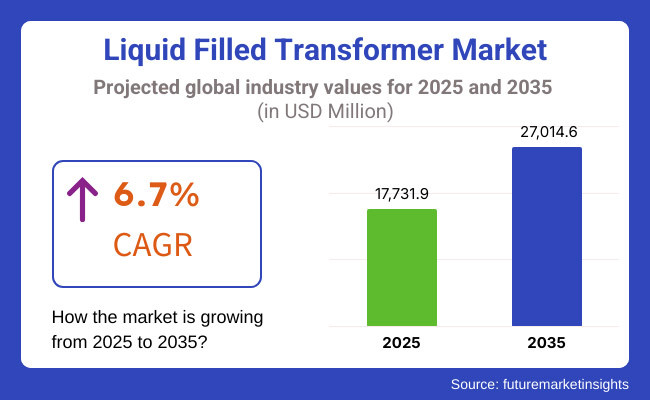

The Liquid Filled Transformer Market is set to witness substantial growth, with its market value projected to rise from USD 17,731.9 million in 2025 to USD 27,014.6 million by 2035, reflecting a CAGR of 6.7%. This growth is driven by increasing global demand for energy transmission infrastructure, the expansion of renewable energy projects, and advancements in high-voltage power distribution systems.

Liquid-filled transformers, known for their high efficiency, superior cooling capabilities, and longer operational life, are becoming the preferred choice in industrial, commercial, and utility sectors. Additionally, the rising adoption of smart grid technology and the shift toward sustainable and biodegradable insulating fluids are shaping the future of this market.

The thirst for liquid transformers is climbing the ladder due to the high urbanization, factory proliferation, and the world overdrive for the utilization of the high-efficiency energy. These transformers are the lifeguard in electricity transmission and distribution systems of power utilities, power plants, and major industries while they ensure stable electricity supply. It is due to their excellent cooling properties and the capacity to operate heavier loads that they are more effective than moisture-free transformers.

Integration of renewable energy sources including solar and wind power, which are dependent on the efficient grid infrastructure, is also enhancing the market. The cutting-edge technological developments like smart transformers, AI-powered predictive maintenance, and replaceable eco-friendly insulating oils (e.g. ester-based fluids) have formed a nexus for fresh ideas in the industry.

The compliance regulations that support energy-efficient power transmission in addition to the investments related to the transformation of the dilapidated grid infrastructure also stimulate the market growth.

Explore FMI!

Book a free demo

The North American Liquid Filled Transformer Market is on the move because of huge investments in grid renewal, connecting green energy to the grid, and electrifying industries. The USA and Canada are prioritizing upgrades in transmission networks to integrate wind and solar energy, which, in turn, increases the demand for high-capacity transformers. Societal organizations like the USA Department of Energy (DOE) are implementing strict rules on efficiency, which in turn, assists in the installation of energy-saving and environmentally friendly transformers.

The use of biodegradable insulating fluids and smart transformer technologies are other ways that the region is making to cope with climate change and dependency on fossil fuels. But still, age-old infrastructure, high substitute costs, and the disapproving supply chain are the major hurdles which can only be solved through the installation of modern monitoring systems and the application of predict maintenance technologies.

Europe is covering a solid path toward growth in the liquid-filled transformer area, due to its work on the carbon footprint, the transition of energy, and the security of the grid. The European Union's Green Deal and Fit for 55 strategies make investments on renewable energy infrastructure, step-up transformers in wind and solar farms hence, they drive the market. Countries like Germany, France, and the UK are changing the traditional transformer systems that were installed by their forefathers to high-efficiency and SF6-free substitutes.

What is more, biodegradable insulating oils and ester-based fluids are highly esteemed because of strict environmental regulations. Despite the productivity of raw materials and supply chain limits, Europe is still an innovator in the field and thus, more and more companies are offering their goods and services such as smart transformers, the digital twin technology, and AI-controlled monitoring systems.

The Asia-Pacific region is shining as it is fascinated by the liquid-filled transformer market, which is so fast-growing case in point is the rate of industrialization, urbanization, and the surge in energy needs. China, India, and Japan are subsequently laying down plans through which they will promote investments in the grid, renewables, and rural electrification investment areas. State programs such as China's Belt and Road Initiative (BRI) and India's Smart Grid Mission are putting into operation top-of-the-range transformers in power transmission and distribution networks.

Nonetheless, the region faces the issues of varying raw material prices, supply chain bottlenecks, and regulatory complexities. The increasing embrace of AI-powered grid watching, digital substations, and hybrid transformer technologies is claimed to elevate efficiency and durability in the Asian Pacific energy sector.

The Middle East & Africa (MEA) market is witnessing a surge in growth, which can be attributed to the rising electricity demand, infrastructure building, and investment in the oil & gas sector. The Gulf Cooperation Council (GCC) nations, including Saudi Arabia and the UAE, are sponsoring the development of smart grid and renewable sources of energy, particularly solar and wind farms. The demand for industrial applications power transformers is on the rise as well as the distribution transformers where these projects are implemented, thus the market is fasted by this.

Africa is seeing the electrifying stones being cast as it goes with countries like Nigeria being in the forefront with their talk of grid expansion, and transmission network upgrades. On the other hand, funding limitations, political unrest, and aging grid infrastructure are some of the chief obstacles for speedy development. Modular transformers, as well as AI-driven predictive maintenance solutions, are the likely solutions that pop to people’s minds for the problems dealt with by the transmission grid.

The liquid filled transformer market in Latin America is going on the rise mainly due to the increase in the investment of renewable energy, urbanization, and industrial growth. Brazil, Mexico, and Chile are among the countries that are currently growing their solar and wind energy sources which in turn triggers the demand for step-up transformers in the renewable energy projects. As countries are making more grid constructions to back the electricity demand and the industrial sector they are also investing in the modernization of substations.

The launch of the smart grid and the transformation of power distribution from analog to digital are two initiatives which will positively affect the market growth. On the bright side, the region has some challenges in terms of poor economic performance, a high import tax, and limited access to the advanced technologies of the period. The use of energy-efficient transformers and the inclusion of smart monitoring solutions are some of the means by which governmental schemes in the energy transition area will make an impact on Latin America’s energy future.

Challenges

High Initial Capital Costs Associated with Transformer Deployment

The high cost associated with manufacturing and installing liquid-filled transformers is mainly due to sophisticated insulation measures, involved engineering jobs, and limited compliance with energy efficiency regulations on the part of manufacturers. Furthermore, the switch to green insulating liquids, i.e., oils from natural and biodegradable sources, contributes to this fact. In addition, the integration of transformers into renewable energy grids demands massive capital outlay on the grid infrastructure, control systems, and voltage regulation technologies.

Strict the Environmental Regulations and Safety Issues

Governments across the globe are coming up with tough policies on transformer emissions, oil leakage, and materials that are dangerous to the environment. The transformation from SF6-free insulation and biodegradable oils is certainly the way to go, but this route is opposite to that of manufacturing complexity. The transformer units, on the other hand, have insulation failure, overheating, and overload as the main causes of safety issues which in turn necessitate the manager's strict inspection and preventive maintenance.

Supply Chain Disturbances and Raw Material Prices Un stabilization

The market is still going through a shortage of supplies particularly with copper, aluminum, transformer oils, and electrical steel. The increasing raw material cost and geopolitical conflicts escalate the production period and price puzzles, hindering the growth of the entire market. The single supply of transformer components from abroad is the main source of the logistics and trade policy gapping that the industry is exposed to.

Technological Improvements of Accurate Transformer and AI-Powered Surveillance

Applying AI with the help of IoT and digital twin technology in liquid state transformers is creating a major breakthrough in predictive maintenance, remote diagnostics, and grid optimization. Intelligent transformers give the functionality of measuring the voltage and performing automatic load balancing and fault detection in real-time, which in turn diminishes the operational costs and raises the efficiency.

More and more utilities are using self-regulating transformers which is a type of gear that by itself adjusts to changing grid conditions, hence it is more reliable.

Development of Renewable Energy and Grid Modernization Projects

World governments are pouring money into the wind, solar, and hydroelectric power sectors, thus pocketing the main key of laying and stepping up transformers in their pocket. The microgrid technology development, the battery storage integration, and the decentralized energy networks all of which will support the growth of the transformer industry.

The grid modernization ventures like the building of automated substations and introduced flexible AC transmission systems (FACTS) will keep growing thus creating needs for new transformer technologies.

The Rising Interest in Green and More Efficient Transformations

With the industrial trend being environmental sustainability the market has started looking for insulating oils out of plants, SF6-free transformers, and high-efficiency designs to reduce energy losses. The flip side of the coin is that the implementation of circular economy ideas like recyclable materials and remanufactured transformer parts is slowly being established. This movement seeks to be in step with international laws in cutting the emission of gases that harm the environment and also shifts to more dynamic systems in energy transmission.

The liquid filled transformer market has ensured regular expansion from 2020 to 2024, propelled by the rising quest for energy efficiency, the progress of grid technology, and the deployment of renewable energy. Utilities and industries have more and more utilized liquid filled transformers because of their prominent performance in cooling and durability against dry-type options.

The market was also affected by demands of regulatory pressures for less emissions and more effective insulation materials. The period from 2025 to 2035 will bring major changes to the market that will be represented by the integration of smart grid technologies, green insulating fluids, and digital monitoring systems.

Comparative Market Analysis:

The liquid filled transformer market has experienced uniform 2020 to 2024 fuel growth, which is the result of the ever-growing need for energy efficiency, grid modernization, and the expansion of renewable energy sources. The companies as well as the entrepreneurs have started opting for liquid filled transformers over dry-type ones to their superior cooling capability and long life. The other related factors in the arena have been emittance of lower emissions and the use of better insulation materials. The marriage of the technology of smart grid, insulating fluids that do not affect the environment, and the digital monitoring system is what is expected from 2025 to 2035 for the market to be merged.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulations focused on efficiency improvements and phase-outs of hazardous insulating fluids. |

| Technological Advancements | Adoption of ester-based fluids, enhanced cooling mechanisms, and higher voltage capacity. |

| Industry-Specific Demand | Growth in power transmission, distribution, and industrial applications. |

| Sustainability & Circular Economy | Initial adoption of environmentally friendly fluids and recycling programs. |

| Production & Supply Chain | Increased investment in production capacity and expansion of supply networks. |

| Market Growth Drivers | Rising electrification, infrastructure investments, and the need for energy efficiency. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter sustainability mandates promoting biodegradable and low-loss transformer fluids. |

| Technological Advancements | Smart transformers with IoT connectivity, AI-based monitoring, and self-healing insulation. |

| Industry-Specific Demand | Rising demand from renewable energy integration, offshore wind farms, and decentralized grids. |

| Sustainability & Circular Economy | Full transition to biodegradable liquids, advanced recycling techniques, and carbon-neutral manufacturing. |

| Production & Supply Chain | Localized manufacturing, AI-driven predictive maintenance, and resilient supply chain strategies. |

| Market Growth Drivers | Expansion of smart grids, adoption of digital twin technology, and accelerated renewable energy deployment. |

The increase in the procurement of power grid modernizing and renewable energy projects is what primarily drives the growth of the United States Liquid Filled Transformer Market. The demand is being significantly supported by governmental schemes to dismantle the old infrastructure and erect new high-voltage transmission lines. The rapid installation of solar PV and wind turbine facilities also impels the utility companies to obtain the more efficient transformers, requisite for these sources to work together with the grid.

Moreover, the constraints imposed by safety and efficiency mandates from such bodies as the Department of Energy (DOE) and the National Electrical Manufacturers Association (NEMA) encourage the adoption of environmentally acceptable insulating liquids in transformers. The electricity-consuming sectors Industry and Trade have also augmented the market trend, in the first place, companies demand continuity of power and reliability of supply, so that they are able to manage the operations. Thanks to the development of smart grids, the electric companies are more and more deploying internet-connected transformers, which makes it possible to operate them more efficiently and to monitor them in real-time.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

UK Liquid Filled Transformer Market has witnessed a boom because of the transition of the country to renewable energy sources and the modernization of smart grids. The UK government devotion to net-zero carbon emissions has thrust investments in offshore wind, solar power, and energy storage systems, which all necessitate dependable transformers for the distribution of power. In addition, the traction given by the expansion of the EV charging infrastructure and data centers has caused the high-performance liquid-filled transformers demand to boost.

The obsolete power structures of the UK are also being modernized by utilities, which switch the old transformers with the low-loss and eco-friendly technologies. The increased use of bio-based insulating fluids is in line with the sustainability objectives, which, in turn, makes the market grow even more.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.1% |

The European Union Liquid Filled Transformer Market is undergoing steady development, having strict energy efficiency regulations, the expansion of renewable energy, and the installation of new power grids as its drivers. The EU Green Deal is forcing enterprises and public utilities to move to energy solutions with low carbon consumption which is, in turn, causing the demand for high efficiency transformers to rise. The frontrunners in the venture towards smart grids and high-voltage transmission system include a number of EU countries such as Germany, France, and Italy.

The electrification of transport, industrial automation, and the increased number of energy storage systems are also key reasons for the excellent growth of the market. Lastly, the EU's determination to reduce the emissions of pollutants is forcing the environmental to change to biodegradable and environmentally sustainable transformer liquids.EU energy efficiency directives are promoting the adoption of low-loss transformers.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.2% |

The China Liquid Filled Transformer Market is showing a rapid growth, primarily due to the construction of ultra-high voltage (UHV) transmission lines in the country, industrial electrification, and renewal energy programs. China is the world's foremost country for solar and wind energy capacities and so it is investing in grid modernization on a large scale for the purpose of making these energy scavengers integrate more efficiently.

The government's Five-Year Plan is concentrating on power infrastructure renovations, which will result in the rising demand for high-performance liquid-filled transformers. Moreover, rapid urbanization and industrial sector expansion have led to an increase in electricity consumption and thus, are driving the market. The execution of smart and AI-oriented transformer monitoring systems is also adding value to the performance.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 4.8% |

The Japan Liquid Filled Transformer Market is on the rise due to the attention the country grid resilience, energy efficiency, and renewable energy development are getting. After the Fukushima accident, Japan has made the commitment to smart grid projects and energy storage systems to assure a power supply that is stable and durable. The implementation of electric vehicles and battery storage is developing the need for transformers that are able to manage the load of generation of power demand. Also, Japan being a green hydrogen and offshore-wind power investor is a major force behind the market growth.

The backing of the promotion and the protection of people from power interruptions in the technical installation is their contribution to a secure energy future. Investment in the offshore wind infrastructure has consequently led to the demand for better transformers.The making of battery storage systems more widespread is resulting in a greater uptake of transformers in battery networks. The rise of the EV charging networks is creating a demand for sophisticated power distribution. The crucial concern for the low-energy transformer technologies has guided to the appearance of low-loss models.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.0% |

The Liquid Filled Transformer Market in South Korea is following an upward trend owing to the various government programs directed toward smart grid development, renewable energy integration, and industrial electrification. The Green New Deal of South Korea is to lift the share of renewable energy in the energy mix, therefore, the integration involves the handling of efficient transformers.

Particularly, the high-end semiconductor and electronics sectors are the determinants of the demand for durable and high-efficiency power transmission systems. Additionally, the speedy rise in the EV infrastructure and the establishment of the 5G network have opened an avenue for the deployment of transformers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

The seed oil filled transformer segment is now being propelled significantly by the ever-increasing inclination to environmentally friendly and biodegradable insulation options. Seed oil, obtained from plants that have been grown using renewable resources, like soybean or rapeseed, is more advantageous than regular mineral oil since soy or rapeseed seed oil has better fire resistance, higher flash points, and less environmental impact. Besides, this segment is having a strong push in the market on account of the strict environmental regulations and the growing adoption of green energy infrastructure.

In order to meet the environmental regulations and minimize the carbon emissions, the utilities and power distribution companies are increasingly implementing bio-based liquid transformers. The North America and Europe regions are the top seed oil-filled transformers markets by far because of the strict eco-friendly policies and the investment made in renewable energy projects.

Although the tendency toward the replacement of mineral oil filled transformers with sustainable alternatives is being observed, the mineral oil filled transformer segment thrives and is still the market leader thanks to its low cost, high dielectric strength, and a well-established supply chain. These transformers dominate the residential, commercial, and industrial sectors, especially in power distribution networks and substations.

Nevertheless, the concerns raised about flammability, environmental hazards, and compliance with regulations, such as REACH and EPA, are making market participants search for alternatives like seed oil-based and ester-filled transformers. The economies in the Asia-Pacific region and Latin America, which are developing, still rely heavily on mineral oil-based transformers, which are affordable, whereas, in the developed regions, the trend is going towards greener alternatives.

After market penetration, silicone-based and ester-filled transformers, the other liquid-filled transformers part, is gradually developing and this is because these transformers benefit from increased safety and performance in extreme environments. Transformers filled with silicone oil are typically used in applications where preventing fire is a top priority, like high-temperature industrial environments.

Besides, natural and synthetic esters are often being used most widely because they are environmentally friendly and they have 10 excellent insulation properties. The need for more fire-resistant and sustainable options is the main reason for the expected growth of this segment in specific high-risk areas of application such as offshore wind farms and underground substations.

One of the major drivers of liquid-filled transformers market, the residential sector, has been boosted by urbanization, electrification programs, and smart grid initiatives. In the face of arising energy demand in nations like India, China, and Brazil, governments are investing in modernizing power distribution infrastructure, leading to the increasing deployment of liquid-filled transformers, and the renovation of existing ones.

Moreover, the employment of smart homes and the access to energy from the decentralized renewable energy (such as rooftop solar panels) is the shot in the arm that the residential market needs, in order to have transformers which are both compact and efficient, in their networks.

The commercial segment, which is made up of shopping malls, office buildings, data centers, and hospitals, is experiencing a steady rise in demand for liquid-filled transformers. As the urban infrastructure expands and the digital economy grows, the need for power distribution networks that are dependable has increased further.

Data centers, notably, do require transformers that are not only highly efficient but also have fire-resistant properties to guarantee an uninterrupted power supply and to avoid overheating. In addition, the concern with energy efficiency standards and green building certifications is increased because of the transformation to low-loss and eco-friendly transformers in commercial spaces.

The industrial sector is the one that is mainly entitled to the lion's share which brings in power-hungry machines, in turn, causing the customers' equipment to heat up faster than usual. The massive sector that is on the rise becomes the largest user of these systems due to their need for supplementary power above the grid.

For example, the presence of such factors as safety, efficiency, maintenance requirements, equipment protection, and total operating cost are the main things that influence the rising adoption of liquid-filled transformers in the industrial sector. Furthermore, the rapid pace of industrial growth in the Asia-Pacific and the Middle East regions, in addition to the investments in projects involving renewable energy and smart grids, will remain healthy for the demand for high-capacity liquid-filled transformers.

The Liquid-Filled Transformer Market has been a prominent growth factor for global development due to the enhancement of efficient power distribution, grid modernization, and green energy addition. These transformers, consisting of mineral oil, silicone, or bio-based fluids, have an added advantage of cooling efficiency, high durability, and overload capacity which is beneficial for utility, industry, and commercial applications.

The fundamental drivers are power infrastructure expansion, electricity requirements taking off, and smart grid installations. Furthermore, urbanization collaboration and renewable energy deployment are both, concluded as the top drivers for the business development of high-performance transformers. The market pioneers' attention is being turned towards advanced technologies, eco-friendly insulating fluids, and digital monitoring systems to supply efficiency, safety, and environmental compliance which are the initiatives for long-term growth as well as innovation in the power distribution sector..

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ABB Ltd. | 12-15% |

| Siemens Energy | 10-13% |

| Schneider Electric | 8-11% |

| General Electric (GE) | 7-9% |

| Eaton Corporation | 5-7% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| ABB Ltd. | Leading provider of liquid-filled transformers with advanced cooling systems, smart monitoring, and energy-efficient designs. |

| Siemens Energy | Offers sustainable transformer solutions with biodegradable insulating fluids and digital monitoring technologies. |

| Schneider Electric | Specializes in eco-friendly liquid-filled transformers, focusing on smart grid compatibility and industrial automation. |

| General Electric (GE) | Develops high-performance power transformers for renewable energy integration and grid stability. |

| Eaton Corporation | Provides liquid-filled transformers with fire-resistant insulating fluids for industrial and utility applications. |

Key Company Insights

ABB Ltd.

ABB is a premier company in the global field of transformer technology, particularly in the liquid-filled transformer technology, and specializes in energy-efficient and high-performance solutions for power transmission and distribution. The firm is inclined toward the digitization of smart monitoring systems, digital integration, and sustainability, the three hallmarks of the ABB environmental management program, which include biodegradable insulation fluids and low-loss designs.

Transformers from ABB come in handy for utilities, industries, and the renewable energy sector. In its effort to strengthen the grid, the company continues to invest in IoT-based transformer diagnostics that help improve grid stability and operational efficiency.

Siemens Energy

Siemens Energy stands ahead of the pack with its premium liquid-filled transformers utilizing biodegradable insulating fluids, digital monitoring systems, and high-efficiency designs. The company is a leader in smart grid integration, concentrating primarily on renewable energy implementations and grid upgrading. Siemens Energy is broadening its range of green transformers, cutting environment pollution through low-emission cooling solutions and recyclable materials. With the backbone of a strong global presence, Siemens is consistently elevating transformer resiliency and performance.

Schneider Electric

Schneider Electric is a specialist in liquid-filled transformers with a firm primary focus on sustainability, digitalization, and industrial automation. The company applies smart monitoring systems and remote diagnostics to drive energy saving and reliability. Schneider Electric is a pioneer in the manufacture of eco-friendly transformer fluids, which will cut the risks of fire and reduce the carbon footprint significantly.

Its solutions serve the industrial, commercial, and renewable energy sectors, as a result of which, they are instrumental in the innovation of next-generation power distribution.

General Electric (GE)

GE has been a valuable partner in the production of high-performance liquid-filled transformers, which find their primary use in renewable energy, industrial, and power grid applications. The firm has injected capital into the use of novel insulation technologies, AI-based transformer analytics, and digital twin simulations which are expected to raise the performance level and extend the product lifetime.

Being a supporter of stability in the grid and energy efficiency, GE stands out as one of the main agents contributing to the modern power systems revolution that has to address the growing need for sustainable energy solutions.

Eaton Corporation

Eaton is a provider of fire-resistant liquid-filled transformers employing silicone and ester-based insulation fluids for improved safety and durability design features. The company's focus is industrial, utility, and commercial power applications with a unique offering of compact and efficient transformer solutions.

Eaton is expanding its product line with low-emission, high-efficiency transformer models, which are targeting urban power networks and energy-intensive industries. By actively pursuing both environmental and regulatory compliance missions, Eaton is anticipated to show steady growth.

The global Liquid Filled Transformer market is projected to reach USD 17,731.9 million by the end of 2025.

The market is anticipated to grow at a CAGR of 6.7% over the forecast period.

By 2035, the Liquid Filled Transformer market is expected to reach USD 27,014.6 million.

The power utilities segment is expected to dominate due to increasing electricity demand, grid modernization, and investments in renewable energy infrastructure.

Key players in the Liquid Filled Transformer market include Siemens Energy, ABB Ltd., Eaton Corporation, General Electric, Schneider Electric, and Toshiba Energy Systems & Solutions Corporation.

Power Tool Gears Market - Growth & Demand 2025 to 2035

Surge Tanks Market Growth - Trends & Forecast 2025 to 2035

Radial Drilling Machine Market Growth & Demand 2025 to 2035

External Combustion Engine Market Growth & Demand 2025 to 2035

Motor Winding Repair Service Market Growth - Trends & Forecast 2025 to 2035

Industrial Linear Accelerator Market Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.