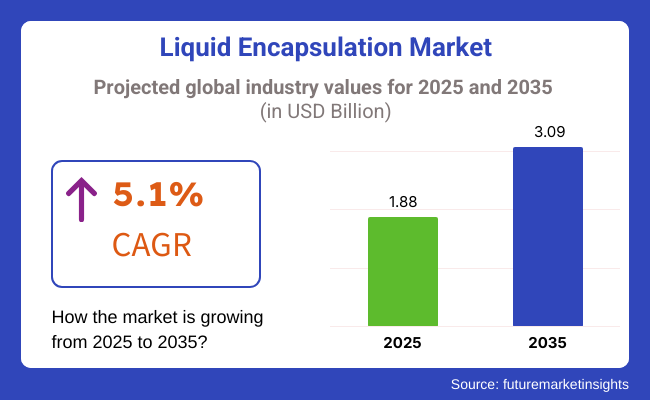

The liquid encapsulation market is anticipated to experience steady growth from 2025 to 2035, driven by increasing demand for advanced packaging solutions for semiconductor, electronic, and optoelectronic applications. The industry size is anticipated to grow from USD 1.88 billion in 2025 to USD 3.09 billion by 2035 at a compound annual growth rate (CAGR) of 5.1% from 2025 to 2035.

As microelectronics develops rapidly, LED packaging and MEMS (Micro-Electro-Mechanical Systems) evolve, and liquid encapsulation has become increasingly dominant because of its better thermal performance, increased mechanical protection, and improved reliability.

The trend towards miniaturization, high-performance electronic components, and economical semiconductor packaging also drives the industry. Advances achieved in epoxy resins, silicones, and hybrid encapsulant materials are enhancing encapsulation efficiency and longevity as well.

The changes in the market will be primarily driven by advances in AI-aided material development, automation of encapsulation, and innovations in thermal/mechanical protection. Application areas are broadening with the introduction of self-healing materials, UV-curable encapsulants, and high-temperature-resistant coatings.

Strategic factors under consideration include growing compliance with stringent environmental regulations, demand for higher-reliability semiconductor packaging, and advances in encapsulation automation transforming competitive differentiation. In keeping up with the rapid growth, companies will focus mainly on developing cost-effective, sustainable, and high-performance encapsulation materials.

Explore FMI!

Book a free demo

The liquid encapsulation market is booming, with semiconductors, automotive, consumer electronics, and medical devices being the key drivers of its growth. The semiconductor industry highly values the durability of the material, resistance to moisture, and the level of precision that those properties give when protecting microchips from external contaminants.

The automotive sector, on the other hand, is driven by lightweight and cost-effective features, particularly in the context of the rapidly evolving field of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). Consumer electronics are particularly focused on small size, low cost, and protection against mechanical stress, all of which are critically required for the manufacture of smartphones and wearable devices.

On the other hand, the medical device manufacturers are the ones that look for strict regulatory compliance as well as quality and reliability, for example, encapsulated components in implants, biosensors, resourceful diagnostic equipment. With the introduction of epoxy resins, silicone-based materials, and hybrid polymers, there is a move toward stronger, weightless, and more affordable encapsulation systems that would be needed to achieve product longevity and reliability.

| Company | Contract Value (USD Million) |

|---|---|

| 3M | Approximately USD 50 - 60 |

| Henkel | Approximately USD 40 - 50 |

| Dow | Approximately USD 30 - 40 |

| BASF | Approximately USD 45 - 55 |

| Sika | Approximately USD 35 - 45 |

Between 2020 and 2024, the market developed progressively due to demand for enhanced semiconductor packaging, MEMS, and the lifetime of LEDs. The growth in semiconductors has increased the use of epoxy resins and silicone in IC and microchip protection.

MEMS sensors applied to industrial automation and ADAS utilized high-stress and vibration-proof encapsulation. The market for LEDs utilized encapsulated liquid to enhance heat transfer and strength. AI-based defect inspection and autonomous manufacturing streamlined manufacturing through 2024.

The decade 2025 to 2035 will see industry expansion with eco-materials, AI-powered quality control, and nano-engineered encapsulants. Strengthened nanoparticle resins will provide improved mechanical and thermal performance for 3D packaging and wearables.

Predictive maintenance and AI-based defect detection will boost productivity. Biodegradable resins and green encapsulants will move into the green manufacturing phase. Ultra-pure encapsulation will be essential for quantum computing and future chips to stabilize, enabling developments in AI and neuromorphic processing.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| More stringent industry regulations (RoHS, REACH, and ISO) necessitated environmentally friendly, non-toxic materials for electronic and the medical field uses. | Blockchain-based, AI-driven material tracing guarantees real-time regulatory compliance, green material compliance, and auto-auditing of regulation for encapsulation solutions. |

| AI-powered material discovery optimized encapsulation properties for better thermal management and durability in semiconductor packaging. | AI-integrated, nano-engineered liquid encapsulants provide self-healing properties, adaptive conductivity, and ultra-thin, high-performance protection for next-gen microelectronics. |

| Demand for liquid encapsulants grew in microelectronic packaging, enhancing protection against thermal, chemical, and mechanical stresses. | AI-optimized encapsulation technologies enable ultra-miniature, high-density packaging of semiconductors, making them more efficient for AI chips, quantum computing, and 3D ICs. |

| Encapsulation materials improved biocompatibility, ensuring long-term strength for implantable medical sensors and drug delivery devices. | AI-based adaptive encapsulation helps in regenerative medicine, smart drug delivery, and self-sensing biomedical implants with real-time diagnostic capabilities. |

| Companies created biodegradable, non-toxic liquid encapsulants to replace traditional polymer-based materials. | AI-based, bio-inspired encapsulation materials adopt green chemistry, self-degrading coatings, and carbon-neutral manufacturing for environmentally friendly microelectronics. |

| The shift towards electric vehicles (EVs) accelerated demand for power electronics encapsulated, promoting heat dissipation and long-term reliability. | AI-enhanced encapsulation solutions enable ultra-high-performance battery protection, adaptive thermal regulation, and longer lifespan for solid-state EV batteries and autonomous vehicle sensors. |

| The rollout of 5G networks increased the need for advanced liquid encapsulants that reduce signal interference and improve performance in RF modules. | AI-controlled, auto-tuning encapsulation material dynamically adapts to high-frequency processing, making uninterruptable integration of terahertz and quantum com devices possible. |

| Liquid encapsulation was taken up by the marketplace for tamper-evident microelectronics in secure monetary transactions, defense technology, and trusted communication. | AI-controlled, auto-destruction quantum-encrypted encapsulation systems keep sensitive electronic materials safeguarded against reverse engineering, cyber attack, and hardware tampering. |

| Encapsulation-protected flexible displays, smart fabrics, and next-generation wearables from humidity, impact, and mechanical stress. | AI-optimized, ultra-flexible encapsulation allows for stretchable, foldable, and self-healing electronic surfaces, improving human-machine interfaces, AR/VR wearables, and digital health applications. |

| Firms aimed at minimizing carbon footprints through optimizing encapsulation manufacturing processes and minimizing material waste. | AI-powered, carbon-free encapsulation systems employ renewable materials, intelligent recycling loops, and AI-driven manufacturing efficiencies for eco-friendly microelectronics packaging. |

The industry is vulnerable to many risks like material supply, technological progress, compliance with regulations, production scalability, and competition. Their development is necessary for the growth and innovation of various sectors such as semiconductors, pharmaceuticals, food, and cosmetics.

A major issue is material supply and cost variations. Depending on the material of the encapsulation method, it is necessary to expect that the materials such as epoxy resins, silicones, and polyimides are subject to the characteristic supply chain disturbances. For example, the shortage of raw materials, geopolitical instabilities, and trade barriers can seriously affect the output and costs involved.

Another important risk is technology which is brought by the need for continuous improvement and more performance. The miniaturization demand in the electronics sector and better delivery systems for drugs force the companies to produce the latest encapsulation models. The companies that are behind these innovations risk of falling out and the consequent decline of competitiveness.

Regulatory compliance is one of the other main obstacles, especially in the case of pharmaceutical and food-related issues. Encapsulation systems have to exceed the environmental safety, health, and tough regulations imposed by the FDA, EMA, and ISO. The failure to meet the requirements could bring lawsuits, product retakes, and denigration of image.

Production scalability is also a factor; manufacturers have to manage the double-edged sword of efficiency and quality control. The duplicity of the encapsulation process while integrating precise regulation, stability, and repeatability is a complicated task, especially in the microelectronics and biotechnology sectors, where even minor errors can cause significant failures.

Stakeholders of the industry must deal with these risks through raw material source diversification, R&D investment, legally regulatory compliance, production efficiency enhancement, and strategic collaboration scheme implementation.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 10.5% |

| The UK | 10.1% |

| European Union | 10.3% |

| Japan | 10.2% |

| South Korea | 10.7% |

The liquid encapsulation market in the USA is growing with tremendous demand for next-gen semiconductor packaging, growth in IoT applications, and implementation of MEMS technology. Vendors are developing solutions to improve heat management, provide more durability, and better guard electronic components.

Investments in artificial intelligence-based material optimization and nano-coating solutions are driving innovation, further increasing semiconductor performance and lifespan. Autonomous vehicles, AI computing, and 5G infrastructure emergence drive the growth further. Major players such as Henkel, Shin-Etsu Chemical, and Dow Inc. are working on epoxy-based encapsulation, liquid resin molding, and UV-curable encapsulation to improve semiconductor performance and reliability.

FMI is of the opinion that the USA market is slated to grow at 10.5% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Semiconductor Packaging Development | Makers are innovating to improve heat dissipation and protect chips from environmental stress. |

| IoT and MEMS Technology Growth | Growth is being driven by increased utilization in healthcare, industrial automation, and smart home. |

| Government and Industrial Investments | The United States Department of Energy is making investments in R&D on AI-optimized material and high-performance encapsulants. |

| 5G and AI-Powered Computing Development | AI chips and next-generation communications need high-performance, rugged encapsulation solutions. |

The UK market for liquid encapsulation is rising steadily on the back of R&D spending in semiconductors, rising adoption of high-performance microelectronics, and state-sponsored innovation in nanotechnology. Miniaturization, high-reliability electronics, and eco-friendly encapsulation solutions are driving industry trends.

The UK Department for Business, Energy & Industrial Strategy (BEIS) is encouraging innovative material research, AI-driven microelectronics manufacturing, and high-durability encapsulation processes.

Rising uses of MEMS-based industrial automation, AI-driven medical sensors, and automotive electronics are fueling the need for better technologies. Electrolube, Lord Corporation, and Panasonic Electronic Materials are focusing on silicone-based encapsulation, UV-blocking paint, and self-healing polymer technology.

FMI is of the opinion that the UK market is slated to grow at 10.1% CAGR during the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Investment in Semiconductor R&D | Government and private sectors are investing more, leading the charge to innovate. |

| Electronics Miniaturization | A sustained demand for high-performing, small devices is driving encapsulation technology development. |

| Development of AI-Based Sensors | MEMS and artificial intelligence-driven healthcare and industrial applications necessitate long-term encapsulation durability. |

| Sustainable Solution Focus | The development of green encapsulants is gaining momentum. |

The European Union's liquid encapsulation market is growing on the back of semiconductor initiatives, with growing electronic miniaturization needs and a higher take-up of advanced encapsulation technologies. EU Horizon Europe program and semiconductor financial support policies are driving high-performance encapsulation innovation.

Germany, France, and the Netherlands are at the forefront of AI-based material innovation, high-reliability automotive electronics, and next-generation consumer devices. Expanded 5G network deployment, AI-based medical diagnosis, and IoT integration are also driving growth. BASF, Evonik, and Wacker Chemie are investing in heat-resistant encapsulants and environmentally friendly liquid coatings.

FMI is of the opinion that the European Union market is slated to grow at 10.3% CAGR during the study period.

Growth Factors in the European Union

| Key Drivers | Details |

|---|---|

| EU Semiconductor Initiatives | Horizon Europe is funding research and development. |

| 5G and IoT Growth | Future networks require additional encapsulation levels. |

| AI-Controlled Vehicle Electronics | Electric and autonomous vehicle demand for high-durability encapsulation is increasing. |

| Sustainability and Material New Development | Companies are making encapsulation technology greener. |

Japan's liquid encapsulation market is transforming with government-supported semiconductor development, enhanced adoption of AI-controlled microelectronics, and improved high-density circuit packaging. The Ministry of Economy, Trade, and Industry (METI) is investing in AI-based defect inspection technology, high-performance encapsulation material, and new liquid coating technology.

Industrial electronics based on AI, medical sensors based on MEMS, and miniaturized wearables are propelling adoption. Sony, Shin-Etsu Chemical, and Toray Industries are key firms developing high-durability polymer coatings and semiconductor protection through nanomaterials.

FMI is of the opinion that Japan market is slated to grow at 10.2% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Government Semiconductor Investment | METI is funding next-generation material science and artificial intelligence-based quality inspection. |

| Rise of Wearables and Medical Devices | Rising high-density package technologies are making devices more rugged and reliable. |

| AI-Based Industrial Electronics | Growing automation is driving demands for robust encapsulation technologies. |

| High-Density Circuit Packaging | Ultra-slim liquid encapsulation is researched in Japan as a future semiconductor technology. |

South Korea's liquid encapsulation market is expanding robustly with the growing size of semiconductor plants, production increases in AI-enabled electronics, and demands for high-performance encapsulation. MOTIE is investing in AI-enabled semiconductor testing, future-generation chip package encapsulation, and material technology.

The growing use of IoT consumer electronics, AI-enabled sensors, and flexible electronics is exposing them to more stringent stresses on high-reliability encapsulation. Firms such as Samsung Electronics, LG Chem, and SK Innovation are engaged in the development of thermal-resistant encapsulation, artificial intelligence-driven reliability testing, and ultra-thin protective films.

FMI is of the opinion that the South Korean market is slated to grow at 10.7% CAGR during the study period.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| Semiconductor Manufacturing Growth | Investments in chip fabrication and packaging are fueling growth. |

| AI-Driven Electronics Manufacturing | The need for smart devices is creating rising encapsulation complexities. |

| IoT and Flexible Electronics Growth | High-reliability encapsulants enable shifting industrial and consumer applications. |

| Government-Supported Innovation | MOTIE is investing in semiconductor encapsulation R&D and AI-driven testing. |

In 2025, epoxy resin, which has good mechanical strength, corrosion resistance, and thermal stability, is expected to hold the largest share of 37.0%. Due to their properties, these materials are ideal for the encapsulation of power electronics, micro-electromechanical systems (MEMS), and integrated circuits (ICs).

As the semiconductor industry continues its journey towards smaller and higher-performing devices, epoxy-based encapsulants are critical to the reliability of these devices for long-term performance. These next-generation electronics define precisely where Henkel, Sumitomo Bakelite and Hexion push the boundaries of their low-stress, high purity and thermally conductive epoxy formulations, in order to keep up with the performance improvements these parts deliver.

Meeting these properties leads to the potential for epoxy-modified resins to capture a 25-28% portion of the overall industry by 2025. Those properties tend to make them an especially good match for LED packaging, automotive electronics, and high-reliability consumer devices in which protection against moisture, thermal cycling, and mechanical stress is important. The increasing demand for durable, low-viscosity, and eco-friendly encapsulants is pushing an assay into this industry.

Demand for traditional and modified epoxy resins is central to the electronic encapsulation process, and the continued adoption of these resins is expected to have long-term prospects that span a decade.

Integrated Circuits (ICs) are expected to hold the largest application segment within liquid encapsulation, contributing 35.6% of the revenue share in 2025. As encapsulating materials are a critical component in consumer electronics, automotive, and industrial applications, the demand for high-performance encapsulating materials is likely to rise unceasingly.

As 5G, AI and IoT-enabled devices multiply, new encapsulation solutions must be developed which offer even greater durability, thermal stability and environmental protection. The trade-offs for chip performance have unleashed a demand for new low-stress, high-purity, thermally conductive epoxy-based materials to keep chips running deeper into advanced technologies, led by Intel, TSMC, Texas Instruments, and STMicroelectronics.

The market primarily coincided with its increased demand in the segment, inducing driving solutions in autonomous vehicles and industrial automation and perspective offers of additional input in healthcare, specifying that 27.4% of the industry contributed through the sensor segment. Sensors require a ruggedized encapsulation to protect from moisture, physical trauma, and extreme temperature so that they can operate for long periods in hazardous environments.

Your targets are the developers and manufacturers of advanced protective encapsulation solutions-like Bosch, Honeywell, Infineon Technologies, and Analog Devices-tuning the performance of their sensors for smart infrastructure, wearable health-device, and safety-critical automotive systems.

With increasingly stringent requirements for miniaturization, reliability, and efficiency across many areas of commerce, encapsulation technologies are central to facilitating new semiconductor and sensor devices. The marketplace continues to adapt in light of technological advancement, sustainability efforts, and a growing online presence within the business and consumer space.

The Liquid Encapsulation Market is very much witnessing a boom since industries are demanding the newest high-end protective solutions for semiconductors, microelectronics, and industry-related components. Liquid encapsulation confers properties of durability and thermal reliability, as well as mechanical strength; hence, it is increasingly becoming vital for electronic packaging, medical devices, and pharmaceutical applications.

The rising demand for miniaturized electronics as well as high-performance semiconductors is the direct cause behind the new developments of encapsulating materials, which include epoxy resins, silicones, and high-performance polymers.

The market is dominated by some leading players, including Sumitomo Bakelite, Panasonic, Shin-Etsu Chemical, Henkel, and Nitto Denko. They develop high-performance encapsulants and advanced resin formulations, as well as tailor-made solutions for electronics and industrial applications. Meanwhile, innovators that are set to compete in niche areas include startups and small businesses geared towards bio-based polymers, nanocomposite encapsulation, and eco-friendly alternatives.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Henkel AG & Co. KGaA | 20-25% |

| Panasonic Corporation | 15-20% |

| Shin-Etsu Chemical Co., Ltd. | 12-16% |

| Sumitomo Bakelite Co., Ltd. | 10-14% |

| Nitto Denko Corporation | 6-10% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Henkel AG & Co. KGaA | Develops epoxy resins for semiconductors as well as automotive applications. |

| Panasonic Corporation | Mainly produces liquid encapsulants with high thermal conductivity for electronics. |

| Shin-Etsu Chemical Co., Ltd. | Experts in advanced silicone-based encapsulation for microelectronic protection. |

| Sumitomo Bakelite Co., Ltd. | Innovates in epoxy mold compounds for IC packaging and thermal protection. |

| Nitto Denko Corporation | Provides high-reliability liquid encapsulation materials for industrial applications. |

Key Company Insights

Henkel AG & Co. KGaA (20-25%)

Henkel leads the liquid encapsulation market with cutting-edge epoxy-based materials that offer superior heat resistance, mechanical durability, and long-term semiconductor protection.

Panasonic Corporation (15-20%)

The focus is on high-performance liquid encapsulants. They also ensure that specific solutions are delivered for electronic components and the protection of LEDs.

Shin-Etsu Chemical Co., Ltd. (12-16%)

Shin-Etsu is a key player working on innovating silicone-based encapsulation, enhancing thermal stability, dielectric properties, and long-term reliability for microelectronics.

Sumitomo Bakelite Co., Ltd. (10-14%)

Mainly produce epoxy mold compounds, providing state-of-the-art solutions for high-temperature applications, IC packaging, and automotive electronics.

Nitto Denko Corporation (6-10%)

Experts in high-reliability encapsulation materials, integrating innovative polymer technologies for semiconductors as well as industrial electronics.

Other Key Players (20-30% Combined)

The industry is slated to reach USD 1.88 billion in 2025.

The industry is predicted to reach a size of USD 3.09 billion by 2035.

Key companies include Henkel AG & Co. KGaA, Panasonic Corporation, Shin-Etsu Chemical Co., Ltd., Sumitomo Bakelite Co., Ltd., Nitto Denko Corporation, and other companies.

South Korea, driven by advancements in semiconductor manufacturing and encapsulation technologies, is expected to record the highest CAGR of 10.7% during the forecast period.

Epoxy resin remains one of the most widely used materials in the liquid encapsulation industry due to its high durability and protective properties.

In terms of material, the market is categorized into epoxy resin, epoxy-modified resin, and others.

In terms of products, the market is segmented into integrated circuits, sensors, discrete semiconductors, and optoelectronics.

In terms of region, the market spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

Catenary Infrastructure Inspection Market Insights - Demand & Forecast 2025 to 2035

Category Management Software Market Analysis - Trends & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Heat Interface Unit Market Analysis - Size, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.