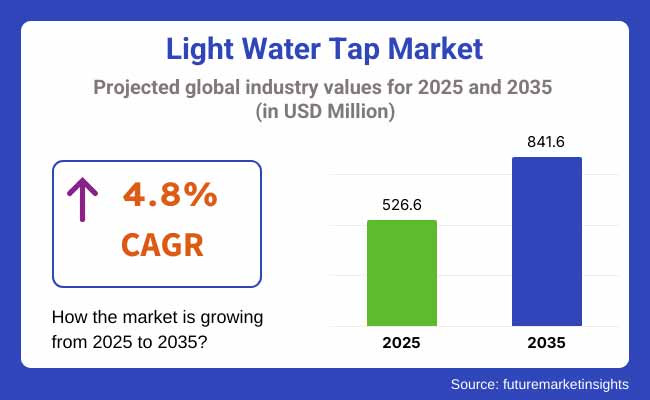

The market is set to hit USD 526.6 million in 2025 and should grow to USD 841.6 million by 2035 with a growth rate of 4.8% each year. Smart bathroom technology is on the rise, as more people want touchless faucets and water systems that use the Internet of Things, the industry is changing fast. Rules from the government supporting water-saving methods and more funds for green home options are helping too.

The Light Water Tap Market ought to see steady growth from 2025 to 2035. This is due to more people wanting smart home gadgets, a focus on saving water, and new sensor-based faucets with LED lights. Taps with LED lights, temperature sensors, and no-touch operation are popular in homes, businesses, and hotels because they look nice, save power, and are clean.

North America should lead the light water tap market. This is due to the rise in smart home systems, growing focus on saving water, and many top bathroom fixture makers. The USA and Canada are at the forefront due to government support for water-saving gear. The demand for fancy bathroom setups and more upgrades in hotels and office buildings are other factors.

The rise in touchless and LED temperature faucets, the boom in smart kitchen and bathroom remodels, and the addition of voice-activated taps increase market demand. Also, rules pushing for low-flow and sensor taps help the market grow.

Europe is a big part of the light water tap market. Countries like Germany, the UK, France, and Italy are leaders in green plumbing and stylish home designs. The EU’s strict water rules, people wanting fancy smart home items, and more interest in touch-free taps in businesses are making the market grow.

More people are using water-saving LED taps at home and in hotels. Also, personalized design taps with lights and smart plumbing are forming new trends. Europe's push for eco-friendly materials and energy-saving gadgets is driving new product ideas.

The Asia-Pacific area is set to see the fastest growth in the light water tap market. This is due to fast city growth, more spare money, and bigger spending on smart city plans. Nations like China, Japan, India, and South Korea lead in smart bathroom use and tall building projects.

In China, the strong real estate and smart home sectors, rising rules on saving water, and a need for LED faucets in upscale homes push the market. India’s growing luxury home market, more knowledge of water-saving tech, and wider use of touch-free taps in offices help the market grow. Also, smart home systems in Japan and South Korea, with internet-linked bathroom tools, boost the area market.

Challenges

High Cost of Smart Fixtures and Compatibility Issues

One major challenge in the light water tap market is the high price of smart taps which might limit their use in budget-conscious areas. Also, issues with fitting them into current pipes and needing a professional to install can make it harder to spread in the market. Worries about sensors failing, LED lights lasting long, and upkeep costs are also problems for keeping them in homes and businesses over time.

Opportunities

AI-Powered Water Management, Sustainable Faucets, and IoT Integration

Though there are challenges, the light water tap market is growing a lot. New AI systems can now check water use and leaks in real-time. This helps save water and use it better. Eco-friendly taps are also in demand. They use recycled parts, have solar lights, and filter water. These taps sell well.

Smart home taps are growing too. They work with home helpers and can be voice-controlled. This opens new ways for makers to earn money. Also, more taps are now in airports, malls, and hospitals. These touch-free taps are cleaner and easier to use. This stimulates market growth.

From 2020 to 2024, the light water tap market saw big growth. More people wanted nice and new kitchen and bathroom taps. This boom came from more city living, better water cleaning technology, and a stronger need to save water. People wanted taps that worked well and looked good too.

In the years 2025 to 2035, the market is set to change even more. Smart tech, like touch-free taps and IoT links, will become normal. People will use voice commands or apps to control water flow and temperature. Being green will stay important. Makers will use eco-friendly materials and tech that save water to meet strict rules. Families will also get more taps they can customize to match their taste and home style.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Implementation of standards to ensure the safety and effectiveness of intelligent packaging in critical applications, particularly in food and pharmaceuticals. |

| Technological Advancements | Development of packaging with embedded sensors to monitor product conditions. |

| Industry Applications | Predominant use in food and beverages, pharmaceuticals, and logistics to enhance product quality and supply chain efficiency. |

| Adoption of Smart Equipment | Initial integration of automation in manufacturing processes to improve precision and reduce human error. |

| Sustainability & Cost Efficiency | Focus on improving the durability and functionality of packaging to reduce waste. |

| Data Analytics & Predictive Modeling | Limited use of data analytics, primarily focusing on quality control and defect detection during manufacturing. |

| Production & Supply Chain Dynamics | Reliance on traditional manufacturing techniques with established supply chains, facing challenges due to geopolitical tensions and trade restrictions. |

| Market Growth Drivers | Driven by increasing demand for product safety and quality, technological advancements in packaging materials, and the need for supply chain transparency. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Introduction of global standards focusing on sustainability and environmental impact, encouraging the use of eco-friendly materials and processes. |

| Technological Advancements | Integration of nano-enabled materials and IoT technologies to create more efficient and interactive packaging solutions. |

| Industry Applications | Expansion into consumer electronics and retail sectors, requiring interactive and informative packaging solutions. |

| Adoption of Smart Equipment | Widespread adoption of smart manufacturing techniques, including AI-driven quality control and predictive maintenance, enhancing production efficiency. |

| Sustainability & Cost Efficiency | Emphasis on using recyclable materials and energy-efficient production methods to align with global sustainability goals, thereby reducing costs and environmental impact. |

| Data Analytics & Predictive Modeling | Advanced analytics employed to predict consumer behavior, optimize supply chains, and enhance product traceability, leading to improved efficiency and customer satisfaction. |

| Production & Supply Chain Dynamics | Shift towards localized production using additive manufacturing, reducing dependency on global supply chains and mitigating risks associated with geopolitical factors. |

| Market Growth Drivers | Growth propelled by the proliferation of IoT devices, expansion of e-commerce, and a global emphasis on sustainability and environmental protection. |

The light water tap market in the USA is growing well. More people want smart home gadgets. Water-saving items are on the rise, with folks liking touchless and LED taps more. The USA Environmental Protection Agency (EPA) and the WaterSense Program set rules to save water. They push for eco-friendly taps.

LED temperature taps are on the rise. Sensor water taps in homes and public places are spreading. More money goes into taps that clean themselves and kill germs. Smart home links and IoT taps are setting the trends for the future. These factors help the market grow and evolve.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.0% |

The light water tap market in the UK is growing fast. There's more focus on saving water and using energy-smart home gadgets. People want clean, touch-free taps. Groups like WRAS and BPEC make sure taps meet water-saving and hygiene rules.

More people now use LED taps that show water temperatures. Motion-sensor taps are popular in public restrooms. There's also a trend of spending more on fancy bathroom items. Smart water meters and digital tools to find leaks are also becoming popular.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

The market for light water taps in the European Union is growing well. This is because of strict water rules, focus on smart bathroom tools, and more people wanting clean water. The European Water Label and Ecodesign Directive push low-flow and sensor taps.

Germany, France, and Italy are top places for touchless taps and LED taps. They are also leading in fancy home upgrades and making taps with coatings that kill germs. More money is being put into smart kitchen and bathroom tech, which is making the sector more innovative.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.8% |

The light water tap market in Japan is growing. People want high-tech home stuff. Money is going into smart bathrooms. Laws push for saving water. The Japanese government watches water use and plumbing rules.

Makers in Japan build smart faucets. They use AI to cut water flow. Some taps light up with temperature sensors. There are touchless taps too, for public and home use. Automatic kitchens and bathrooms are also making more people want these advanced taps.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.9% |

The market for light water taps in South Korea is growing fast. This is because more people are moving to cities. Many people prefer smart home gadgets. Plus, the government wants to save water. The South Korean Ministry of Environment and Korea Water Resources Corporation (K-water) make rules to save water and ensure quality taps.

Different things are shaping the market trends. People like infrared sensor taps and smart bathroom tech. LED lights in taps add both looks and safety. Eco-friendly and germ-fighting tap materials are also becoming popular.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

The light water tap market is growing fast. More people move to cities, and they want taps that save water. They also want taps that look nice in homes and offices. Mixer taps and wall-mounted taps are very popular. These taps make life easier, save water, and use space well.

Mixer taps are common in kitchens, bathrooms, and public restrooms. They let you perfectly mix hot and cold water with one spout. You can get them in manual, touchless, and smart sensor types, which makes them popular in modern homes and fancy places.

More people like mixer taps because they are stylish, save water, and have new touch-free technology. New things like ceramic discs, smart flow control, and germ-free coatings make them last longer and stay clean.

Mixer taps can be more expensive, hard to install, and might not fit with your old water setup. But, new ideas like smart water flow, leak sensors, and green aerators are likely to make them better and more popular.

Wall taps on the wall are more loved in fancy baths, tight spots, and new kitchens. They look neat, save room, and are easy to clean. You see them a lot in hotels, nice restaurants, and fancy homes. These places like simple but good looks and smart designs.

More folks want wall taps now because people spend more on fancy looks inside homes, more use hidden pipes, and want clean taps that are easy to wash. Better finishes that fight rust, taps with sensors, and ways to control water well are making them work better and last longer.

Yet, hard ways to set them up, more costs to keep them working, and not many choices for old houses are tough problems. Still, new ways to make setting them up easy, taps that clean themselves, and taps that clean water too will help make them more popular and handy.

It is the end-user requirement that drives the demand for light water taps, with the commercial and domestic sectors at the forefront. They are the most common types of taps in use today, known for their water efficiency and modern aesthetics and, of course, durability.

Light water taps in places like hotels, offices, malls, and public restrooms need to work well and save water. These taps usually have touchless sensors, control flow, and durable coatings.

More places are using these taps due to rising water conservation awareness, the need for automatic clean solutions, and advances in smart plumbing. Also, new features like self-cleaning nozzles, germ-free tap surfaces, and smart water tracking tools are making these taps cleaner and more efficient.

Although beneficial, challenges include high start-up costs, complex upkeep, and meeting water-saving rules. New ideas in self-adjusting water systems, AI-based usage tracking, and easy-to-fix tap parts are set to make these taps greener and cheaper to run.

Home taps for water are used in many places at home, like the kitchen, bathroom, and outside. They are popular because they look nice and work well. More people are now choosing taps with custom finishes, water-saving features, and temperature controls. These taps make life easier and help save energy.

The need for home water taps is growing. People like the way smart home tech can be added to water taps. The government also supports using water-saving taps. There are easy kits for do-it-yourself people, eco-friendly water controls, and LED temperature lights. These all make taps better to use and good for the planet.

There are some problems though. Old plumbing might not fit new taps. Different water pressures can be an issue. And fancy models may need a pro to install. Still, with new ideas like adjustable water flow, smart systems to find leaks, and eco-friendly materials, more people will use these taps. The market for them will grow.

The market for light water taps is growing due to higher demand for smart home options, water-saving tech, and stylish kitchen and bathroom fixtures. This surge comes as more people use LED light taps, no-touch and sensor-based faucets, and better water filters. Firms now focus on taps that save energy, show water temperature, and use UV light to clean.

These taps make life easier, cleaner, and greener. Top brands in sanitary ware, smart plumbing solutions, and water filters all help bring new ideas. They make taps that turn on when you move, change colour with LED lights, and connect to the internet to track water use.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| LIXIL Group Corporation (Grohe, American Standard) | 18-22% |

| Kohler Co. | 14-18% |

| Delta Faucet Company (Masco Corporation) | 12-16% |

| Moen Incorporated | 8-12% |

| Hansgrohe SE | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| LIXIL Group Corporation | Develops LED-lit water taps with temperature indication, touchless activation, and integrated filtration. |

| Kohler Co. | Specializes in smart faucets with voice control, motion sensors, and water-saving LED indicators. |

| Delta Faucet Company | Manufactures Touch2O® technology faucets with LED temperature-responsive lighting. |

| Moen Incorporated | Provides U by Moen™ smart faucets with app control and customizable LED lighting features. |

| Hansgrohe SE | Focuses on modern, eco-friendly LED water taps with temperature-based color variations. |

Key Company Insights

LIXIL Group Corporation (18-22%)

LIXIL leads the light water tap market, offering smart LED-lit taps with built-in filtration and temperature-responsive lighting.

Kohler Co. (14-18%)

Kohler specializes in high-end digital faucets, integrating touchless technology and customizable LED displays.

Delta Faucet Company (Masco Corporation) (12-16%)

Delta Faucet Company provides intelligent kitchen and bathroom faucets, featuring temperature-sensitive LED lights and smart control.

Moen Incorporated (8-12%)

Moen focuses on app-controlled and voice-activated taps, ensuring enhanced convenience and water efficiency.

Hansgrohe SE (6-10%)

Hansgrohe is known for aesthetically designed, eco-friendly LED faucets, enhancing bathroom and kitchen usability.

Other Key Players (30-40% Combined)

Several sanitary ware brands, home automation firms, and water conservation technology providers contribute to advancements in smart faucets, LED-enabled taps, and touch-free solutions. These include:

The overall market size for the Light Water Tap Market was USD 526.6 Million in 2025.

The Light Water Tap Market is expected to reach USD 841.6 Million in 2035.

Increasing demand for smart home solutions, rising adoption of sensor-based and LED temperature-indicating taps, and growing consumer preference for water-efficient fixtures will drive market growth.

The USA, China, Germany, Japan, and India are key contributors.

LED temperature-indicating taps are expected to dominate due to their convenience, energy efficiency, and enhanced user safety features.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Light Therapy Market Forecast and Outlook 2025 to 2035

Light Rail Traction Converter Market Size and Share Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Lightening and Whitening Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Lightening / Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Light Control Switch Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Light Setting Spray Market Size and Share Forecast Outlook 2025 to 2035

Light-Activated Anti-Pollution Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lighting As A Service Market Size and Share Forecast Outlook 2025 to 2035

Light Duty Truck Market Size and Share Forecast Outlook 2025 to 2035

Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Light Emitting Diode (LED) Backlight Display Market Size and Share Forecast Outlook 2025 to 2035

Light Control Switches Market Size and Share Forecast Outlook 2025 to 2035

Lighting as a Service (LaaS) Market Size and Share Forecast Outlook 2025 to 2035

Light Field Market Size and Share Forecast Outlook 2025 to 2035

Lighting Product Market Size and Share Forecast Outlook 2025 to 2035

Light Field Cameras Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA