The Light Therapy Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 1.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

The Light Therapy market is experiencing significant growth driven by the increasing prevalence of mood disorders, sleep disturbances, and seasonal affective conditions, alongside growing awareness of non-pharmacological treatments. The future outlook for this market is shaped by rising consumer preference for home-based therapy solutions and the adoption of advanced light therapy devices that offer safe and effective treatment.

Continuous innovations in light technology, such as energy-efficient LED systems and customizable light intensity, have enhanced the efficacy and convenience of light therapy. The market is further supported by the rising adoption of holistic health approaches and wellness programs in both developed and emerging regions.

Increasing investments by healthcare providers and wellness companies to expand product accessibility, along with the growing focus on mental health awareness, are contributing to market expansion As individuals increasingly seek non-invasive treatments for sleep disorders and mood regulation, the Light Therapy market is expected to witness sustained growth, particularly in segments catering to homecare settings and personalized treatment options.

| Metric | Value |

|---|---|

| Light Therapy Market Estimated Value in (2025 E) | USD 1.1 billion |

| Light Therapy Market Forecast Value in (2035 F) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

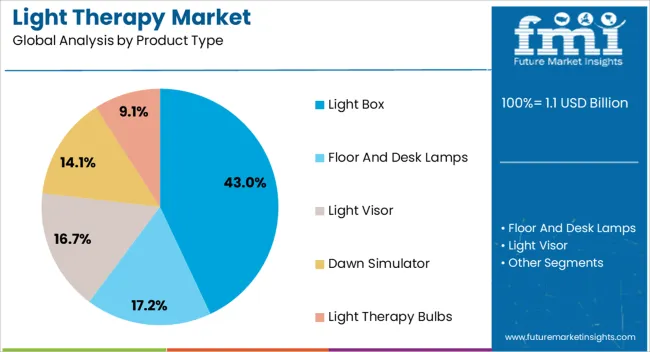

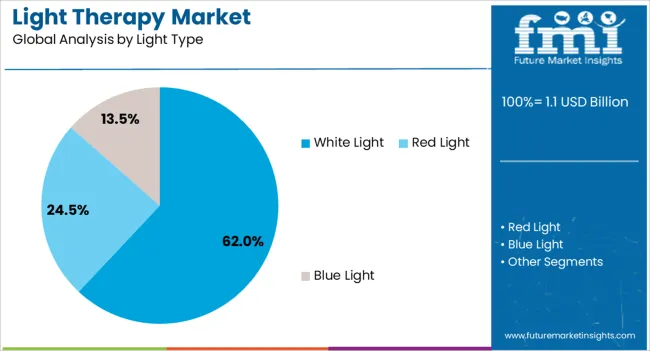

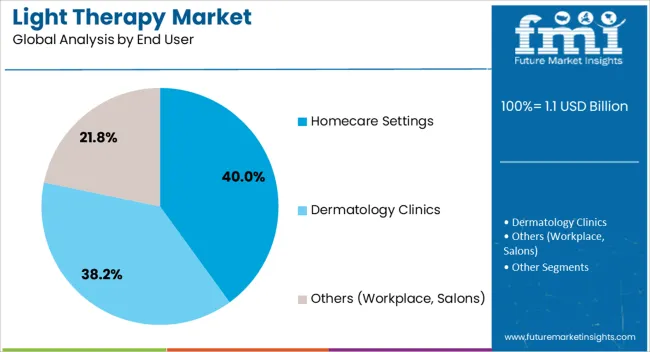

The market is segmented by Product Type, Light Type, and End User and region. By Product Type, the market is divided into Light Box, Floor And Desk Lamps, Light Visor, Dawn Simulator, and Light Therapy Bulbs. In terms of Light Type, the market is classified into White Light, Red Light, and Blue Light. Based on End User, the market is segmented into Homecare Settings, Dermatology Clinics, and Others (Workplace, Salons). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Light Box segment is projected to hold 43.00% of the Light Therapy market revenue share in 2025, establishing it as the leading product type. This dominance is driven by the proven efficacy of light boxes in managing mood disorders and seasonal affective conditions, providing controlled exposure to therapeutic light.

Their compact and portable design allows for convenient use in homecare settings, increasing consumer accessibility and adherence. The segment has benefited from technological enhancements that offer adjustable light intensity and reduced glare, improving user comfort and treatment outcomes.

The widespread adoption of light boxes is also supported by increasing awareness among healthcare providers and patients regarding non-pharmacological treatment options As a result, light boxes remain the preferred product type in both clinical and homecare applications, reinforcing their dominant position in the market.

The White Light segment is expected to capture 62.00% of the Light Therapy market revenue share in 2025, positioning it as the leading light type. This growth is driven by the effectiveness of white light in regulating circadian rhythms and improving mood, making it the most recommended option for therapeutic applications.

Advances in light technology have enhanced the intensity, uniformity, and energy efficiency of white light devices, which increases their adoption among both homecare users and clinical practitioners. The segment has also benefited from heightened awareness about mental health and sleep disorders, leading to greater demand for reliable and scientifically validated light therapy solutions.

Furthermore, white light therapy is considered safe, non-invasive, and easy to use, which has reinforced consumer trust and widespread adoption across various applications, supporting its continued growth.

The Homecare Settings end-user segment is anticipated to account for 40.00% of the Light Therapy market revenue in 2025, making it the leading end-user segment. This growth is influenced by the rising preference for home-based wellness solutions that offer convenience, privacy, and consistent treatment routines.

Homecare adoption has been supported by the availability of user-friendly light therapy devices, including portable light boxes and adjustable white light systems, which allow individuals to manage mood disorders and sleep issues without frequent clinical visits. The segment has also benefited from the increased focus on preventive healthcare and mental well-being, as consumers seek non-invasive and cost-effective alternatives to pharmacological treatments.

Additionally, the flexibility to integrate light therapy into daily routines and remote monitoring options enhances adherence and outcomes, reinforcing the prominence of homecare settings as a key growth driver in the Light Therapy market.

Rising Laser Therapies and Wellness Programs will Drive Demand

Due to the growing number of individuals who are becoming increasingly concerned with their appearance, laser surgery, and other aesthetic treatments are becoming increasingly popular.

As part of home-based medical care and after-treatment care, light therapy devices, such as handheld devices, are widely used. In the era of wearable devices that deliver personalized light therapy, quick and convenient treatment options are becoming increasingly important.

As part of holistic health programs, light treatment is also being incorporated into the programme. Light therapy sessions in spas, fitness facilities, and wellness resorts promote relaxation and well-being. A trend towards improved effectiveness and user experience has been observed with smartphones equipped with sensors and smart lighting treatments.

Light Therapy will Gain Traction with Rising Skin Disorders

Increasing consumer awareness of the therapeutic benefits of light therapy is driving the demand for light therapy market products and services. With consumers becoming more aware of light therapy's advantages, the market is poised to grow significantly.

The use of light therapy has demonstrated promising results in the treatment of a number of skin disorders, including acne, psoriasis, and eczema. As customers seek non-invasive skincare options, light therapy devices have a significant opportunity in the beauty and skincare industries.

Non-invasive light therapies are effective for treating mental disorders, skin disorders, and other medical ailments, which is expected to spur the market for light therapy products. The ongoing technological improvements are expected to stimulate the market for light therapy.

The development of light-based therapies has allowed them to be applied to a wide range of skin disorders and conditions, thus allowing them to be more effective and accessible.

Lack of Skilled Professionals and Availability will Hamper the Growth

The lack of guidelines and policies leads to a potential risk of product quality and treatment modalities being different, thus compromising patient safety. Wearable light treatment devices are becoming increasingly popular, demanding further study of long-term effects and potential risks. Affordability and accessibility remain obstacles to the widespread use of light therapy since the equipment is not always affordable.

Light therapy is not well understood by the general public, which is hindering its expansion. The limited availability of light treatment goods, particularly on the internet, is hindering their use in clinical settings. Due to the lack of qualified specialists to perform the treatments, the market's growth is slowed.

It remains difficult to treat mental health disorders and Parkinson's disease with light therapy due to biochemical, genetic, and environmental influences. In order to address possible side effects of light therapy, such as skin damage, additional research and development are required.

Over the historical period of 2020 to 2025, the global market increased by 4.1%. In 2025, a value of USD 1017.2 million was recorded for the light therapy market. In the past few years, red light therapy has been demonstrated as an effective way to treat a variety of different ailments, including tooth pain and dementia.

Research suggests that people with dementia who receive regular near-infrared light therapy may be able to retain more information, sleep better, and have less rage. In addition, red light therapy has been shown to reduce pain, clicking, and tenderness in the jaw in individuals with temporomandibular dysfunction syndrome (TMD).

Researchers at Massachusetts General Hospital's (MGH) Wellman Center for Photomedicine conducted a groundbreaking study that showed near-infrared low-level light therapy (LLLT) to be safe and effective for patients who had recently experienced moderate brain damage. In the future, trials confirming similar results may lead to light therapy becoming the first widely accepted remedy for such harm.

Technology advancements and a desire to boost effectiveness have resulted in numerous advancements in the field of home lighting.

Innovative minds are constantly experimenting and coming up with new and creative ways to use LED bulbs. Apps for smartphones and speakers with Bluetooth and Wi-Fi connectivity are examples.

Increasing interest in complementary and alternative therapies has led to the popularity of light therapy in the health and wellness industry. The industry is projected to expand at a CAGR of 4.6% over the forecast period.

A country-level forecast for light therapy is provided in the following section. Several key countries around the world are included in the report, including those in North America, Asia Pacific, and Europe.

It is expected that Canada will maintain its lead in North America until 2035 with a CAGR of 2.4%. In the South Asia and Pacific region, India is projected to experience a 4.8% CAGR during the forecast period.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 1.9% |

| Canada | 2.4% |

| Germany | 2.1% |

| United Kingdom | 2.4% |

| Malaysia | 4.1% |

| India | 4.8% |

Mental health concerns are becoming more prevalent, increasing the need for minimal treatment. India uses light therapy for mental health as part of wider efforts to improve access to treatment and mental health awareness.

With the rise in popularity of community-based mental health services in India, light therapy could help bridge the treatment gap and make mental health services more accessible.

Skin diseases, depression, and seasonal affective disorder are driving the market growth. The COVID-19 pandemic has had a positive impact on the global market for light therapy in that clinical studies are being conducted to determine how light therapy assists COVID-19 patients' recovery.

Increasing healthcare spending in emerging markets such as India and online availability of light therapy products are driving the market's expansion.

Light treatment product suppliers are expected to experience substantial growth in the United Kingdom market, particularly for treating seasonal affective disorder (SAD). The National Health Service estimates that one in 15 United Kingdom residents suffer from seasonal affective disorder (SAD) between September and April.

A number of companies on the market are offering an array of light treatment products. As dermatological issues become more prevalent and hygiene awareness increases, the market for light treatments is expected to rise significantly.

United Kingdom-based companies offer red and near-infrared light treatment equipment that is user-friendly and accessible to clients. Red light therapy has gained acceptance and interest in the United Kingdom as people share their experiences using it for treating eczema, arthritis, and chronic pain.

A dramatic expansion of the light treatment market is being seen in the United States and is expected to continue. Light therapy is becoming increasingly popular among those with dermatological conditions and seasonal affective disorders.

Bone injuries, joint discomfort, arthritis, and inflammation can all be treated by red light therapy in the United States. The use of light therapy in orthopedic medicine and pain management is widely accepted as a drug-free, natural treatment.

A variety of skin conditions can be treated, and wounds can be sped up with LED light therapy in the United States. The non-invasive nature and minimal adverse effects of light treatment make it an attractive choice for many medical facilities. Over one million Canadians and Americans receive light treatment for various skin conditions each year, according to the Canadian Dermatology Association.

This section outlines the top segments in the industry. In terms of product type, the light box segment is expected to have a market share of 43% by 2025. By light type, the white light segment is expected to hold a market share of 62% in 2025.

| Segment | Light box (Product Type) |

|---|---|

| Value Share (2025) | 43% |

Due to the rising frequency of mood disorders and sleep disorders, as well as greater awareness of light therapy's therapeutic benefits, the light box has grown enormously in recent years. Their ability to balance circadian cycles and elevate mood states makes them widely used to treat depression, SAD, and other mood disorders.

Providing light therapy that is practical and efficient, modern light boxes incorporate cutting-edge technology, such as LED light sources. With light boxes becoming lighter and more portable, integrating light therapy into daily routines and schedules has become easier. In addition, integrating smart technology enhances the customization options and user experience.

| Segment | Whitelight (Light Type) |

|---|---|

| Value Share (2025) | 62% |

As technology advances and public awareness of white light therapy grows, the white light market has grown significantly. In addition to treating seasonal affective disorder (SAD), mood issues, and sleeping problems, white light therapy can also help with a number of other ailments. A variety of visible light wavelengths are exposed to the patient in order to simulate natural sunlight.

With advances in LED technology, white light therapy has become more affordable and accessible to consumers, largely due to its robust and energy-efficient properties. With advanced features such as timers and a range of intensity levels, light therapy machines are now more convenient and more effective than ever before.

With more people becoming aware of white light therapy's therapeutic benefits, the market for white light bulbs will grow. In order to meet the needs of the market, researchers and innovators will continuously develop new and improved products.

Light therapy solutions that are customized or personalized can give you a competitive edge. Technological advancements may lead to the development of tailored treatment protocols based on the circadian rhythm, skin type, or condition of a patient.

Businesses that provide light treatment may focus on expanding their distribution networks, collaborating with merchants, or entering new geographic markets. Patients and doctors both benefit from better access to products.

Partnerships with healthcare providers and wellness centers can help companies expand their market reach. Light therapy solutions may be integrated into existing healthcare services through partnerships, collaborations, or joint product development.

Light therapy education and increasing consumer awareness require effective marketing strategies. Social media participation, advertising campaigns, and educational resources may be used by businesses to reach their target audience.

Industry Updates

In February 2025, Koninklijke Philips N.V. unveiled a groundbreaking innovation in healthcare imaging. LumiGuide, a light-based alternative to X-rays, enables doctors to navigate blood vessels without the use of X-rays.

The industry is segregated into light box, floor and desk lamps, light visor, dawn simulator, and light therapy bulbs.

In terms of light type, the industry is classified into white light, red light, and blue light.

In terms of end user, the industry has been classified into dermatology clinics, homecare settings, and others (workplace, salons)

Key countries of North America, Latin America, Western Europe, East Asia, South Asia, Eastern Europe, and the Middle East and Africa are covered.

The global light therapy market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the light therapy market is projected to reach USD 1.7 billion by 2035.

The light therapy market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in light therapy market are light box, floor and desk lamps, light visor, dawn simulator and light therapy bulbs.

In terms of light type, white light segment to command 62.0% share in the light therapy market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Light Rail Traction Converter Market Size and Share Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Lightening and Whitening Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Lightening / Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Light Control Switch Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Light Setting Spray Market Size and Share Forecast Outlook 2025 to 2035

Light-Activated Anti-Pollution Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lighting As A Service Market Size and Share Forecast Outlook 2025 to 2035

Light Duty Truck Market Size and Share Forecast Outlook 2025 to 2035

Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Light Emitting Diode (LED) Backlight Display Market Size and Share Forecast Outlook 2025 to 2035

Light Control Switches Market Size and Share Forecast Outlook 2025 to 2035

Lighting as a Service (LaaS) Market Size and Share Forecast Outlook 2025 to 2035

Light Field Market Size and Share Forecast Outlook 2025 to 2035

Lighting Product Market Size and Share Forecast Outlook 2025 to 2035

Light Field Cameras Market Size and Share Forecast Outlook 2025 to 2035

Light Resistant Containers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA