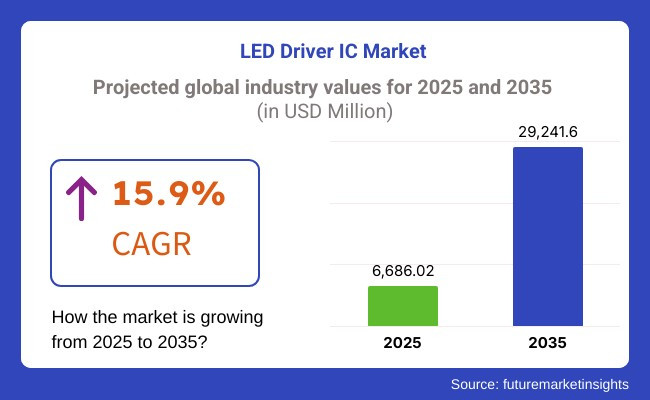

The global sales of LED Driver IC are estimated to be worth USD 6,686.02 million in 2025 and are anticipated to reach a value of USD 29,241.6 million by 2035. Sales are projected to rise at a CAGR of 15.9% over the forecast period between 2025 and 2035. The revenue generated by LED Driver IC in 2024 was USD 5,768.7 million. The market is anticipated to exhibit a Y-o-Y growth of 15.9% in 2025.

The LED Driver IC market encompasses semiconductor integrated circuits designed to regulate power supply and control the operation of LED lighting systems. These ICs convert electrical energy into a suitable voltage and current required for optimal LED performance, ensuring energy efficiency, longevity, and stability. They are widely used in applications such as general lighting, automotive lighting, display backlighting, and industrial lighting.

Growth is driven by the increasing adoption of energy-efficient lighting solutions, government regulations promoting sustainable technologies, and advancements in smart lighting systems. These ICs are available in constant current and constant voltage types, catering to various lighting needs. Innovations such as dimmable and programmable LED drivers further enhance expansion. The industry is crucial for enabling high-performance LED solutions across residential, commercial, and industrial sectors.

Globally, the industry is experiencing significant growth, driven by rising demand for energy-efficient lighting solutions across residential, commercial, and industrial sectors. Government regulations promoting sustainable and low-power consumption technologies, coupled with rapid urbanization and smart city initiatives, are key growth drivers. The increasing adoption of LED lighting in automotive, consumer electronics, and display backlighting applications further fuels expansion.

Advancements in smart lighting, IoT-enabled LED solutions, and dimmable LED drivers are enhancing product innovation. The segmentation is by type (constant current and constant voltage), application (general lighting, automotive, backlighting, and others), and region.

Asia-Pacific leads due to high LED production in China, Japan, and South Korea, followed by North America and Europe. Challenges include price competition and complex integration with advanced lighting systems. However, ongoing R&D efforts and government incentives continue to support long-term growth.

Explore FMI!

Book a free demo

The global market is growing with the increasing use of energy-efficient lighting solutions across various industries. Consumer electronics focus on small, power-efficient driver ICs to boost display performance in smartphones, TVs, and laptops.

Automotive usage emphasizes high-power ICs to power advanced headlamps, taillamps, and interior lighting systems with increased robustness. Industrial lighting requires rugged and heat-tolerant drivers to maintain efficiency in factories and warehouses.

Commercial buildings require economical and dimmable LED drivers to reduce energy usage. Street lighting solutions are enhanced by high-reliability LED drivers that ensure long operation life and reduced maintenance costs.

The push for smart lighting, IoT-interconnected controls, and high-power LED applications is generating innovation. Complimentary support for energy efficiency standards (IEC, Energy Star, RoHS) and high-voltage, constant current, PWM-controlled driver requirements are driving purchase decisions.

| Company/Entity | Contract Value (USD Million) |

|---|---|

| Texas Instruments | Approximately USD 80 |

| ON Semiconductor | Approximately USD 65 |

| Infineon Technologies | Approximately USD 90 |

| NXP Semiconductors | Approximately USD 70 |

In 2024 and early 2025, there has been substantial growth driven by strategic partnerships and technological advancements. Texas Instruments' collaboration with an automotive manufacturer to supply advanced ICs for electric vehicles underscores the critical role of energy-efficient components in the evolving automotive industry.

Similarly, ON Semiconductor's contract with a global smartphone manufacturer highlights the demand for improved display technologies and extended battery life in consumer electronics. Infineon Technologies partnership to develop customized ICs for industrial lighting applications reflects the industry's shift towards smart factory solutions that enhance operational efficiency.

Additionally, NXP Semiconductors' integration of these ICs into smart home lighting systems showcases the growing consumer interest in connected and controllable home environments. These developments indicate a robust and evolving LED Driver IC market, poised to support advancements across various sectors.

Between 2020 to 2024, globally, the industry expanded aggressively with increasing energy-saving lighting needs, smart lighting system installations, and consumer electronics and automotive developments. Governments worldwide implemented energy-saving initiatives, promoting the conversion of traditional to LED-based systems.

Smart home and IoT installations drove programmable IC demand, improving user control and efficiency. Automakers applied these ICs in adaptive headlights and ambient lighting systems. Firms, while grappling with challenges like semiconductor supply uncertainty and complex circuit design, focused on miniaturization, better thermal management, and improved power efficiency to achieve the best product performance.

AI-powered lighting control, 6G-based intelligent infrastructure, and eco-friendly designs. From 2025 to 2035, the expansion of AI-powered ICs will be fueled by real-time brightness adjustment and color adjustment based on environmental demands as well as user choices.

Smart cities and 6G network connectivity will provide centralized lighting control, enhancing energy efficiency and city infrastructure control. Thin and flexible driver ICs will drive next-generation automotive, wearables, and building lighting. Environmentally friendly materials and energy-efficient manufacturing processes will reduce environmental impact. Wireless energy harvesting technology and wireless charging will also help to increase LED driver efficiency and lifespan.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Experienced high uptake in automotive lighting, smart lighting, and consumer electronics. Energy efficiency legislation triggered high demand. | AI-based smart lighting solutions, human-centric lighting (HCL), and higher horticulture and UV-C disinfection applications penetration drive growth. |

| Government policies (EU Ecodesign, USA DOE standards) increased energy efficiency and lowered carbon footprint. | Stringent sustainability requirements dictate recyclable components in LEDs, low power dissipation, and less hazardous substance content in ICs. |

| Technical innovations in the development of flicker-free driver ICs upgraded the quality of light. Implementing GaN-based driver ICs increased efficiency. | Integration with AI and IoT into these ICs enables smart lighting or adaptive lighting. Mini-LED and quantum dot backlighting technology upgrades display devices. |

| The adoption of EV and ADAS increased the need for high-efficiency ICs for auto interior and exterior. | High-power LED demand is propelled by autonomous mobility and smart cities. Micro-LEDs and laser-based headlights revolutionize auto lighting. |

| LED driver ICs were embraced by smart homes and industrial IoT applications with wireless control and automation. | 5G-enabled lighting solutions allow real-time adaptive brightness, predictive maintenance, and seamless integration with connected environments. |

| Increased mini-LED backlight growth in laptops, TVs, and tablets drove high-precision driver IC demand. | Micro-LED technology goes mainstream with ultra-high efficiency, high-frequency driver ICs required in wearable display and AR/VR. |

| UV-C disinfectant units and med lighting applications were led by LED driver ICs through the pandemic. | Advanced medical imaging, photodynamic therapy, and AI-led surgical lighting through tunable ICs. |

| The supply chains of these ICs and the manufacturing of LED drivers were affected due to chip shortages and geopolitical hostilities. | Regionalized production and AI-driven predictive models for supply chains reduce dependency on risky global supply chains. |

| Growing LED penetration in residential, commercial, and automotive markets. Emergence of smart city programs and IoT-enabled lighting. | Expansion driven by autonomous infrastructure, AI-driven lighting ecosystems, and the emergence of energy-efficient, sustainable lighting technologies. |

The industry faces several risks. They are technological, economic, and regulatory challenges. Environmental compliance and control of hazardous substances in the production of Integrated Circuits (ICs) are also some of the challenges.

There are issues in the supply chain. This industry is strongly dependent on semiconductor parts, which are historically vulnerable to shortages, geopolitical issues, and raw material price variations. Production delays and extra costs result from wafer fabrication or chip manufacturing disruptions. CNC cuts also depend on all these machining errors, as well as many other accompanying problems.

Governments worldwide set stringent energy efficiency and safety standards for LED lighting. The manufacturers need to prove that their ICs are compliant with changing standards such as RoHS (Restriction of Hazardous Substances), and Energy Star certifications. Otherwise, they face penalties and get banned.

Competition is also a problem, as a number of companies are constantly in the race regarding cost, effectiveness, and integration features. Low-class manufacturers especially from Asia are aggressive about pricing which creates a very big issue. This makes other leading brands not to enjoy the profits they should get.

The last concern to be discussed is about the life span of the product. Over the years LED technology has made a tremendous transformation which has greatly affected the customers who now want longer lifetimes and better efficiency. The concern is that companies must find the balance between cost-effective production and long-run durability and reliability, or else they will reroute their share to the more superior choices.

Tier 1 Texas Instruments, STMicroelectronics, and ON Semiconductor are the Tier 1 companies. These industry leaders have established a significant global presence, offering comprehensive portfolios of LED driver ICs catering to various applications, including automotive, industrial, and consumer electronics. Their extensive research and development capabilities enable them to innovate and adapt to emerging trends, such as smart lighting and energy-efficient solutions.

Additionally, their robust distribution networks and strategic partnerships with major OEMs ensure widespread adoption of their products across diverse industries. Their financial strength and brand recognition further solidify their positions as top-tier companies in the industry.

Tier 2 Analog Devices, NXP Semiconductors, and Infineon Technologies fall into the Tier 2 category. These companies maintain strong positions and offer a wide range of ICs, focusing on specific applications and regional markets. They invest considerably in R&D to enhance their product offerings and address niche industry needs, such as automotive lighting and industrial automation.

While they may not have the same industry share as Tier 1 companies, their specialized expertise and targeted strategies allow them to compete effectively. Their collaborations with regional distributors and system integrators enable them to penetrate emerging markets and expand their customer base.

Tier 3 Maxim Integrated, ROHM Semiconductor, Toshiba, and Microchip Technology are classified as Tier 3 companies. These firms typically focus on specific segments or regions, offering specialized IC solutions tailored to particular applications, such as consumer electronics or specialized industrial equipment. Their presence is more localized, and they may have limited global reach compared to higher-tier companies.

However, their agility and ability to cater to specific customer requirements provide them with competitive advantages in their chosen niches. By concentrating on specialized industries and leveraging their technical expertise, these companies maintain relevance and profitability within the LED Driver IC industry.

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 15.6% |

| France | 14.7% |

| The UK | 15.2% |

| China | 16.8% |

| India | 17.7% |

The USA is a leading country with widespread adoption of smart lighting solutions in residential, commercial, and industrial markets. Government policies towards energy efficiency, such as ENERGY STAR and Department of Energy (DOE) regulations, are driving the use of LEDs. Leadership by major semiconductor firms such as Texas Instruments, ON Semiconductor, and Analog Devices forms the market.

The increasing use of networked lighting in smart buildings, IoT-connected infrastructure, and automotive systems further boosts the demand for advanced ICs. Stringent green regulations and emphasis on renewable energy solutions ensure continuous investments in LED technology.

FMI is of the opinion that the USA market is slated to grow at 15.6% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Government Policies | ENERGY STAR and DOE policies favor energy efficiency and the adoption of LEDs. |

| Smart Lighting Growth | Increased usage in smart buildings, industrial automation, and IoT-based infrastructure. |

| Semiconductor Industry | The leadership of leading semiconductor players ensures supply chain stability and innovation. |

| Environmental Regulations | Good sustainability practices encourage the adoption of LEDs. |

China boasts the largest market share because of its vast number of semiconductor players and government policies that support energy-efficient lighting. China is the biggest manufacturer of LED components, with an in-built supply chain, low-cost production, and enormous R&D investments.

Government initiatives like the National Green Lighting Program drive incandescent-LED substitution. Additional applications of LED technology in smart cities, industrial automation, and electric vehicles drive growth. With increasing advancements toward semiconductor independence and local consumption, China continues to be a giant in the industry.

FMI is of the opinion that China is slated to grow at 16.8% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Industry Leadership | China is the world's largest producer of LED components, facilitated by low production costs. |

| Government Policies | National Green Lighting Program encourages energy-efficient lighting. |

| Smart City Development | Large-scale use of LED lights in smart city developments. |

| Electric Vehicle Expansion | Increasing demand for LED usage in the auto sector. |

India is expanding by leaps and bounds due to urban growth, infrastructure growth, and government energy efficiency initiatives. Initiatives like UJALA (Unnat Jyoti by Affordable LEDs for All) and Make in India have encouraged the application of LEDs for domestic, commercial, and industrial purposes.

The demand for energy-efficient and economical lighting products, particularly in rural areas, is driving the demand for economical ICs. Smart city development and increasing penetration of IoT-enabled lighting solutions are key drivers for growth. With a growing middle class and rising electricity costs, India presents a good prospect for manufacturers.

FMI is of the opinion that India is slated to grow at 17.7% CAGR during the study period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Government Initiatives | UJALA and Make in India encourage the use of LEDs in domestic manufacturing. |

| Urbanization Development | Increased application in LED lighting for smart cities and infrastructure. |

| Low-Cost Solutions | Low-cost driver ICs for low-cost markets. |

| IoT Penetration | Growing application in internet-based light solutions. |

France is witnessing steady growth because of strict energy efficiency regulations and green policies. France's initiatives to reduce carbon emissions have seen an increase in LEDs being used in commercial and public property markets.

France's established automotive industry also uses LED technology in energy-efficient products. Government subsidies and incentives for electricity installation using LEDs for residential and industrial applications also fuel growth. Smart city initiatives and IoT-based LED lighting solutions increase the demand for ICs.

FMI is of the opinion that France is slated to grow at 14.7% CAGR during the study period.

Growth Factors in France

| Key Drivers | Details |

|---|---|

| Energy Efficiency Policies | Government policies drive the adoption of LEDs in the public and private sectors. |

| Automotive Integration | LED technology is used extensively in energy-efficient automotive applications. |

| Smart City Projects | Growth in IoT-based LED lighting adoption. |

| Sustainability Goals | France is seeking to reduce carbon emissions via LED solutions. |

The UK is witnessing growth due to the demand for smart lighting and green energy schemes. Energy-efficient building government policies have compelled governments to adopt LEDs in residential and commercial structures.

IoT-based lighting and developing smart city infrastructure fuel the demand for advanced ICs. In an effort to reduce energy consumption and carbon footprint, the UK continues to invest in green light technology.

FMI is of the opinion that the UK is slated to grow at 15.2% CAGR during the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Energy Efficiency Regulations | Regulations encouraging the adoption of LED lighting for new development. |

| Smart City Infrastructure | Extensive utilization of smart lighting and IoT-based solutions. |

| Renewable Energy Integration | Increased utilization of LED technology within solar and wind energy schemes. |

| Government Incentives | Economic incentives to use LED lighting for residential and commercial purposes. |

| System | Share (2025) |

|---|---|

| Step-Down (Buck) | 21.1% |

Based on segment type, the market for Step-Down (Buck) LED Driver IC is anticipated to account for about 21.1% of the share in 2025. The step-down (buck) LED Driver IC is small, efficient, and inexpensive to operate. These integrated circuits are ideal for high-voltage scenarios where the input voltage is significantly higher than the operating voltages needed for LEDs and, therefore, are well-suited for use in commercial industrial and automotive lighting.

Buck converters are good current regulators that dissipate minimal power and produce low heat, fitting high-power LED applications. And with the growing prevalence of smart cities, outdoor lighting, and IoT-integrated lighting solutions, their dominance is only set to increase. Regulatory momentum toward energy efficiency, such as the EU's Ecodesign Directive and the USA Department of Energy's LED lighting standards, is turbocharging demand.

Such features include precision dimming, thermal management, and smart lighting functions and are pushing the automotive sector's development of adaptive headlights forward, as well as smart building systems from major suppliers such as Texas Instruments, Infineon, and ON Semiconductor.

The segment for Step-Up (Boost) LED Driver IC is expected to occupy 18.6% of the share in 2025 due to its increased capability of significantly increasing battery-powered device voltage, portable lighting, and automotive applications. These converters are required in smartphones, EV headlights, and emergency lighting, where stable voltage regulation is important.

As more energy-efficient electronics are desired, more power management features are implemented within boost drivers used by Texas Instruments, Analog Devices, and ROHM Semiconductor to improve battery life and thermal performance. EV adoption and smart device proliferation are only expected to grow, keeping the boosting segment healthy.

| Application | Share (2025) |

|---|---|

| Consumer Electronics | 34.2% |

Consumer electronics is expected to dominate the LED Driver IC Market and created 34.2% of share overtaking the remaining segment in 2025. The explosion of smartphones, tablets, laptops, smart TVs, and home automation products has created a demand for high-performance products.

The need for compact, energy-efficient, high-brightness LED drivers has increased as a result of the use of OLED, mini-LED, and micro-LED screens in high-end electronics. The share has grown even more after RGB and smart wearables were added to gaming accessories, along with IoT-enabled lighting solutions. For portable systems, manufacturers like Texas Instruments, Analog Devices, and ON Semiconductor are designing lead frame topologies in advanced, low-power ICs to deliver superior battery life and display efficiency.

As AI-based smart lighting and edge-lit LED displays increase, the consumer electronics segment will remain. It will also contribute to maintaining the leading position.

The Aerospace & Defense segment is to hold 9.8% of the market in 2025; surging adoption of high-efficiency LED lighting solutions in aircraft, military vehicles, and space exploration systems is contributing to the growth of this segment.

Military-grade night vision systems, ruggedized tactical equipment, cockpit displays, and cabin lighting all make heavy use of LED driver-integrated circuits. Quality, high-performance LED driver ICs are becoming increasingly necessary in the aircraft industry as major manufacturers like Boeing, Airbus, and Lockheed Martin have started implementing LED lighting to improve visibility and lower power consumption.

The LED Driver IC market section expands with time owing to the need for more energy-efficient lighting, intelligent lighting solutions, and automotive LED applications. Industries such as consumer electronics, industrial automation, and IoT-enabled lighting are the forebearers of market momentum with superior miniaturized high-efficiency driver ICs.

Currently, Texas Instruments, STMicroelectronics, ON Semiconductor, Analog Devices, and Infineon Technologies offer integrated, high-performance, power-efficient LED driver solutions. Yet there are several mid-tier companies like Maxim Integrated, ROHM Semiconductor, Toshiba, and Microchip Technology that concentrate on special applications, including automobile, industrial, and high-brightness LED lighting.

Market development is enhanced with the advancement of dimmable, programmable, wireless-controlled LED drivers, which are incorporated into smart lighting and the IoT ecosystem. Asia-Pacific, with China, Japan, and South Korea, is one of the world's top manufacturing regions, as companies across the globe invest in regional expansions and strategic alliances. The strategic elements for the competition include energy efficiency and cost-effectiveness, as well as adherence to national and international regulatory efficiencies in lighting.

Recent Developments

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Texas Instruments | 18-22% |

| STMicroelectronics | 14-18% |

| ON Semiconductor | 12-16% |

| Analog Devices | 10-14% |

| Infineon Technologies | 8-12% |

| Other Companies (Combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Texas Instruments | High-efficiency DC-DC and AC-DC LED drivers with smart dimming and adaptive power control. |

| STMicroelectronics | Advanced automotive-grade LED driver ICs for adaptive headlights, industrial lighting, and smart city applications. |

| ON Semiconductor | Power-efficient LED drivers with thermal management solutions for consumer electronics and general lighting. |

| Analog Devices | Precision LED drivers for medical, automotive, and high-performance industrial lighting applications. |

| Infineon Technologies | IoT-enabled LED driver ICs with wireless connectivity and intelligent lighting control features. |

Key Company Insights

Texas Instruments (18-22%)

Its performance LED driver ICs offer intelligent power management for commercial, automotive, and industrial applications.

STMicroelectronics (14-18%)

One of the leading innovation companies when it comes to automotive LED lighting applications, especially adaptive driving beam technology, energy-efficient industrial applications were taken into consideration.

ON Semiconductor (12-16%)

Strong presence in lighting applications for consumers and general lighting, especially providing power-efficient and thermally optimized LED drivers.

Analog Devices (10-14%)

Its high-precision LED drivers lead in very specialized applications like medical and high-performance industrial lighting.

Infineon Technologies (8-12%)

the pioneer in IoT-enabled LED driver ICs that integrate wireless control, energy management, and smart home lighting solutions.

Other Key Players (25-35% Combined)

The global LED Driver IC industry is projected to witness CAGR of 15.9% between 2025 and 2035.

The global LED Driver IC industry stood at USD 6,686.02 million in 2025.

The global LED Driver IC industry is anticipated to reach USD 29,241.6 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 16.5% in the assessment period.

The key players operating in the global LED Driver IC industry include Texas Instruments, STMicroelectronics, ON Semiconductor, Analog Devices, NXP Semiconductors and others.

In terms of Product Type, the segment is categorized into Buck-boost, Current Sink, Inductorless (Charge Pump), Step-down (Buck), Step-up (Boost), Multi-topology, and Others.

In terms of Application, the segment is classified into Consumer Electronics, Aerospace & Defence, Healthcare & Medical Devices, Automotive, Telecommunications, Industrial, and Others.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East and Africa (MEA) have been covered in the report.

Sustainable Finance Market Trends - Growth & Forecast 2025 to 2035

Mobile Wallet Market Insights – Demand & Growth Forecast 2025 to 2035

Telecom Managed Service Market Trends - Growth & Forecast 2025 to 2035

Push-to-Talk Market Trends - Demand & Growth Forecast 2025 to 2035

Network Engineering Service Market Trends – Demand & Forecast 2025 to 2035

Sports Analytics Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.