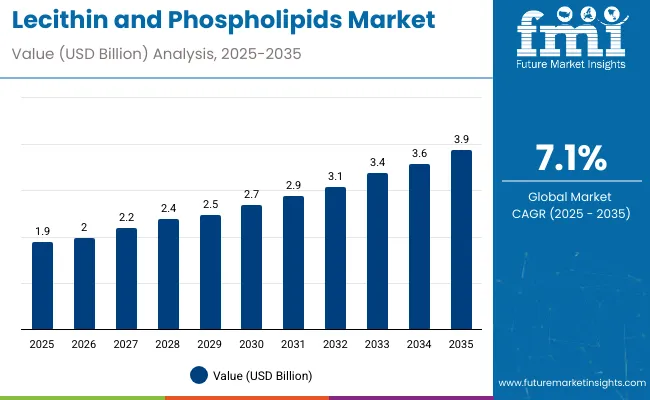

The global Lecithin & Phospholipids market in 2022 will be worth 1.6 billion USD. The market will reach USD 1.9 billion by 2025 as the demand in major industries such as food, pharmaceuticals, cosmetics, and animal feed increases. The market is projected to see CAGR of 7.1%, approximation in between the estimated period of 2025 and 2035 and will be reaching an estimated value of USD 3.9 billion in the year 2035.

Lecithin and phospholipids Market Overview: The trend of natural and clean-label ingredients is gaining traction in food products, which is propelling the growth of lecithin and phospholipids. So has their use in numerous processed foods and dietary supplements as emulsifiers, stabilizers, and nutritional additives. In addition, the increase in knowledge regarding the advantages of phospholipids for brain health, coupled with the increasing demand for functional food products, is supporting the market growth.

| Attributes | Description |

|---|---|

| Estimated Global Market Size (2025E) | USD 1.9 billion |

| Projected Global Market Value (2035F) | USD 3.9 billion |

| Value-based CAGR (2025 to 2035) | 7.1% |

Lecithin (E 322) is firmly embedded in the EU regulatory framework as an authorized additive. Its use is codified under Regulation 1333/2008, with purity criteria set in Regulation 231/2012. The EU applies a risk-managed approach, allowing lecithin broadly in foods but capping levels in sensitive categories such as infant formula at 1,000 mg/L. Safety assessments by EFSA confirm no health risks at permitted levels. Organic frameworks in Europe and globally impose stricter standards, prohibiting solvents or bleaching in lecithin production.

In the U.S., lecithin is treated with a lighter regulatory touch. The FDA affirms its GRAS status under 21 CFR, covering common sources such as soy, corn, and safflower. Enzyme-modified lecithins also fall under GRAS, extending the ingredient’s flexibility in food systems. There are no quantitative limits, only adherence to good manufacturing practices. Recent approvals, such as canola-derived lecithin via GRAS Notification 682, highlight regulatory openness to new sources. Purity is benchmarked against Food Chemicals Codex standards, ensuring consistency without adding new compliance hurdles.

The Codex Alimentarius serves as the global baseline. While not enforceable on its own, Codex guidance provides the backbone for international trade alignment and informs national authorities. Its emphasis on safety, purity, and labeling requirements underpins harmonization across jurisdictions.

Across major markets, lecithin is one of the more settled food additives. The EU applies precision with defined limits in infant nutrition, while the U.S. maintains broad flexibility through GRAS. Both are reinforced by international standards through Codex. Organic certification remains the primary constraint, with process-based restrictions that reflect consumer demand for clean-label production. For manufacturers, the regulatory picture is stable and favorable—licensing risk is low, compliance costs are predictable, and cross-border trade is supported by global benchmarks.

Growing Demand for Clean-Label Products:There is a growing consumer demand for products that are natural and organic, which will drive the demand for lecithin sourced from soy, sunflower, and rapeseed.They translate to functional foods and supplements and are gaining popularity for their cognitive and cardiovascular benefits.

Broader Use in Pharmaceuticals:Hormonal drug delivery systems utilize lecithin and phospholipids because of the availability for absorption.The growing R&D in liposomal drug delivery is also supporting the market.

Expanded Usage in Cosmetics and Personal Care:Phospholipids are used in the cosmetics industry for their emollient and skin-conditioning functions.Growing awareness among consumers for natural cosmetic products is driving the market.

The below table describes comparative study performed for Divergence of CAGR reference year (2024) v/s Current Year (2025) in ½ year and so on. This report indicates the market returns, both quality and quantity and the market evolution has been published between the time period 2023

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.4% |

| H2 (2024 to 2034) | 6.8% |

| H1 (2025 to 2035) | 7.1% |

| H2 (2025 to 2035) | 7.4% |

Based on compound annual growth rate (CAGR) food and pharmaceutical application based H1 segment of Lecithin and Phospholipids market attained nearly 7.1% from 2025 to 2035 owing to the increasing demand during this period. The rising demand of phospholipids for liposome drug delivery system is expected to tow up the phospholipids segment as natural emulsifier lecithin's application as a processed food, apart from the phospholipids derivative läkemedel and supplement per Reportlinker. Lecithin Market - In-depth Assessment of Markets in Global Region to 2023, Market Report, 22nd October 2023.

Segment attributed to technological innovations in the drug delivery systems and greater integration of cosmeceuticals, H2 Market (with HME alone) is expected to pack on relatively high CAGR of about 7.4% The increasing usage of lecithin in skin care products due to its skin moisturizing & anti-aging properties, is anticipated to further boost the growth of lecithin demand in the near future. and high profitability. This bans its players from seeing how people are just hopping off their boats.

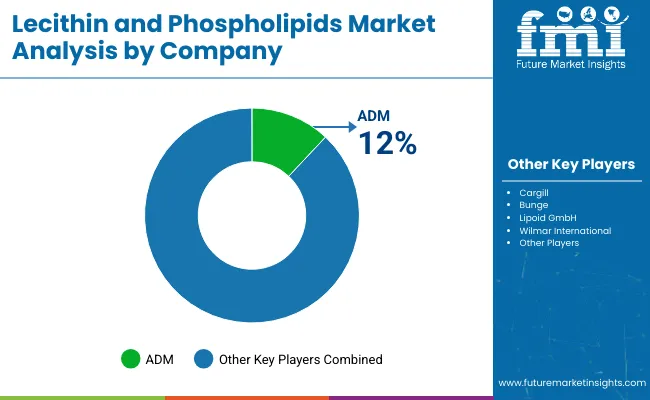

Tier 1: They have significant revenue, distribution, and brand equity around the world. They invest heavily in research and development, product innovation and marketing. They are the giants of the industry, with the ability to manufacture at giant scale and partnerships with many of the top food, pharmaceutical and cosmetic companies.

Get access to full summary of global lecithin phospholipids market: Leading Players: Cargill, Inc.: One of the largest agricultural companies in the world, Cargill offers a range of lecithins and phospholipids for food, nutraceutical and personal care uses. Its distinctive business model which is tightly coupled with distribution and innovation adds up to a big market fragmentation. They have many products and are an international company, and ADM is a leader in lecithin production in the food, beverage and pharmaceutical markets.

The company's emphasis on sustainable sourcing and product diversification enhances its market positioning. DuPont de Nemours, Inc is a prominent player in soy-based lecithin and phospholipids. Their product development and food innovation capabilities rank them as Tier 1 competitors. Bunge Limited: Bunge is an agribusiness and food corporation based in the United States that has also listed of lecithin products worldwide in the food, feed and pharmaceutical industries through the broad distribution network.

Tier 2: These companies offer moderate market spread products that focus on niche areas or lead the market in a region. They also tend to focus on quality, differentiation, and niche applications. According to dscholar. lipoid gmbh “We act globally, producing pharmaceutical-grade lecithin and phospholipids in a broad range of physical forms. Wilmar International- an expansion of market share to produce lecithin for food and industrial applications, operations are increasing in areas throughout Asia. Sime Darby Oils- Sustainable Palm Lecithin as New Growth Drivers for Food and Pharma.

Tier 3: These smaller firms focus on niche markets, which often includes a focus on innovation and creative marketing strategies. American Lecithin Company: Specializes in lecithin applications for the food and health industries, targeting niche market segments Avanti Polar Lipids, Inc.: High-purity phospholipids for pharmaceutical and research applications. That means there are European players like Stern-Wywiol Gruppe, whose customized lecithin solutions can cover food & nutrition applications.

Shift:Consumer demand increasingly drives growth in clean-label, non-GMO, and organic lecithin and phospholipids in food and dietary supplements, creating a rapidly expanding market. Increasing demand for allergen-free and food safety products, coupled with sustainable sourcing will render a positive impact on sales of sunflower and non-GMO soy lecithin. Pharmaceutical industry also contributes to segment growth as phospholipids enhance bioavailability in drug formulation. Demand for vegetarian, paraben-free cosmeceutical formulations is already increasing and the use of lecithin in skin creams, anti-aging products and hair care items is gaining momentum.

Strategic Response:To stave off the wave, Cargill introduced a new non-GMO sunflower lecithin that falls in line with the emerging trend toward cleaner-label ingredients. In addition, ADM launched a certified organic soy lecithin targeting health-conscious consumers in the United States and Europe. Lipoid GmbH has noticed the growing market demand for sustainable skin-friendly formulations containing natural phosphatidylcholine-rich ingredients for topical applications and has thus launched three natural grade-grade products.

Shift:Phospholipid products are also part of the increased demand for pre-prepared and easy ready to use lecithin products. The stabilization and bioavailability reduction properties of these phospholipids find applications in functional food and nutraceutical industry boosting the encapsulated phospholipids market. Likewise, the introduction of premade lecithin-based emulsifiers is enhancing the production operations of food makers within bakery and confectionery and dairy applications.

Strategic Response:To leverage this trend, Bunge Loders Croklaan launched its ready-to-use lecithin powders for bakery and confectionery end products in 2021, developed to improve emulsification efficiency and decrease production costs. Lecico GmbH debuted instantized phospholipid powders for potential use in functional beverages such as smoothies, shakes or diet supplements. Such advances address growth opportunities for brands to take advantage of increasing demand for functionalised or functionalised lecithin-based convenience features.

Shift:The high purity pharmaceutical-grade lecithin is in increasing demand due to the growing use of the phospholipids in drug delivery systems. Phospholipids are commonly used in liposomal formulations, lipid-based drug delivery and vaccine adjuvants because of their biocompatibility [8]. Moreover, the growing prevalence of personalized medicine and a growing biologics market is driving the growth of demand.

Strategic Response:Avanti Polar Lipids (Croda International) also developed pharmaceutical grade phospholipids to support this market evolution for liposomal drug delivery. This is in reaction to the growing application of nanotechnology in medicine. Similarly, Lipoid GmbH has formed partnerships with biopharma manufacturers to provide high-purity phospholipids for mRNA vaccines to meet the growing need for stabilizing agents in biologics.

Shift:These lecithin and phospholipid products will be available across all retail channels and through direct-to-consumer (DTC) platforms for consumers and businesses alike. However, for B2B partnerships in the food industry, giant manufacturers do absolutely move the needle in product availability. Direct collaborations with the biopharma players for increasing drug delivery solution applications of phospholipids have led the industry to substantial growth in the pharmaceutical sector.

Strategic Response:That led Cargill to partner with global food producers to market lecithin as a natural emulsifier in confection and baked goods, which grew its B2B market share. Lipoid GmbH collaborated with biopharma companies working in the drug sector to ensure a steady phospholipid supply for vaccine production. And, Nestlé Health Science launched new phospholipid-based products in DTC channels to make products more accessible to health-conscious consumers.

Shift:According to Goldschmidt et al. (2017), consumer trends toward eco-consciousness have made sustainability and traceability imperative in the lecithin and phospholipids market. Consumers and businesses alike are demanding sustainably sourced, non-GMO and ethically sourced ingredients. Manufacturers, in response, are focusing on sustainable production processes and supply chains that people can see through.

Strategic Response:As a solution to this, ADM has introduced Identity-Preserved (IP) non-GMO lecithin for which KMC provides total traceability and sustainable sourcing practices. It also launched sustainably sourced sunflower lecithin, which lowers the carbon footprint of its production methods. The cosmetic solid of Phospholipid Eco from Lucas Meyer Cosmetics in a cosmetic build has a significantly increased promotion of eco-friendly formulations.

Shift:As seen with India, Brazil and Southeast Asia among other regions, consumers and manufacturers are calling for low-cost and high-quality lecithins that are validatable for use in food and pharmaceutical products.

Strategic Response:Cargill introduced economical soy lecithin blends to help small/mid-sized food manufacturers afford soy lecithin. An equivalent, ADM, had lowered its bulk lecithin supply prices in Brazil by 15% too, which had sparked interest in purchase by the confectionery sector. For affordable availability for domestic bakery chains, Bungye had launched economical lecithin emulsifiers in Indian market.

Shift:As a result, the role of lecithin & phospholipid products is increasingly significant in online sales channels, especially in terms of health and wellness. Lecithin-based dietary supplements and functional food products are being bought from e-commerce to facilitate direct-to-consumer sales.

Strategic Response:In a particular way Now Foods developed phospholipid high dietary supplements on Amazon and different e-commerce corporations and the corporate noticed its e-up to three. Likewise, Nestlé Health Science filled such gap through the DTC model delivering lecithin-based wellness products through the DTC and subscription models which conserved customer retention.

Shift:Consumer consumption behaviour is drastically different from region to region when it comes to Dietary phospholipids and Lecithin. North America and Europe have a high demand for lecithin from non-GMO and organic sources, while low-cost soy lecithin is used particularly in the Asia-Pacific region. Because it is non-allergenic, sunflower lecithin has been used frequently in products within Latin America by the suppliers.

Strategic Response:So ADD has also expanded its North American and European portfolio with non-GMO lecithin, to respond to demand for clean-label ingredients - at least according to regional tastes. Bunge Loders Croklaan's soy lecithin that is designed to be price competitive for the Asia-Pacific market. In Latin America, Cargill introduced sunflower lecithin solutions that address the growing demand for allergen-free products in that region.

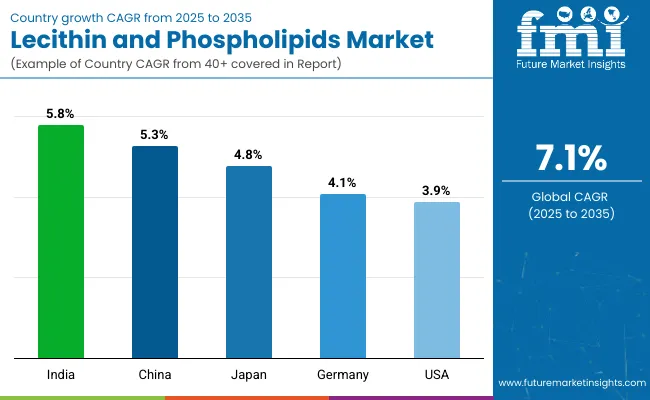

Indicative Market Dynamics The lecithin and phospholipids market in the USA is expected to witness a steady CAGR due to the clean-label trend in food manufacturing, sustainability efforts and increasing health-conscious consumers. Food & Beverage - Consumers want minimally processed foods with natural ingredients, increasing use of non-GMO and organic lecithin in bakery, dairy, and processed meats.

Convenience & Shelf Life: Due to busy lifestyles, convenience foods are highly popular, and lecithin is being extensively used in such foods as emulsifier for texture and shelf life enhancement. Sustainability: More manufacturers are going green and using sunflower lecithin, which is a more sustainable option compared to soy-based options. Animal Feed: Lecithin is used in animal feed especially in large-scale livestock production, to prevent mold, reduce spoilage, and improve nutritional absorption.

The German lecithin and phospholipids market is proliferating due to stringent food safety regulations, sustainable trends, and the growing trend in clean-label preferences. Food & Beverage: The consumer preference toward clean label products encourages the use of lecithin as a clean type of emulsifier for confectionery, baked products, and dairy.

Pharmaceuticals - Increasingly used in drug delivery/pharmaceutical applications, most notably for liposomal formations to enhance bioavailability. German manufacturers insist on eco-certified lecithin from sustainable sources as required under European sustainability initiatives. Cosmetics: The cosmetics industry adds lecithin to lotions and cream as a natural emulsifier and for its moisturizing properties.

China is going through a fast growing lecithin and phospholipids market driven by increasing urbanization, food safety regulations, and increases in livestock production. Food and Beverage: Urbanisation of the population is encouraging demand for ready-to-eat food and processed food, where lecithin is used as a natural emulsifier, contributing to the rising demand for convenient shelf-stable foods.

Livestock Feed: Since livestock farming is done on large scales, lecithin is also used on feed in order to inhibit mold formation, increase shelf life of the feed, and reduce waste.Pharmaceuticals: Growing pharmaceutical innovation fuels demand for phospholipids in drug formulations, especially for enhanced solubility and absorption.

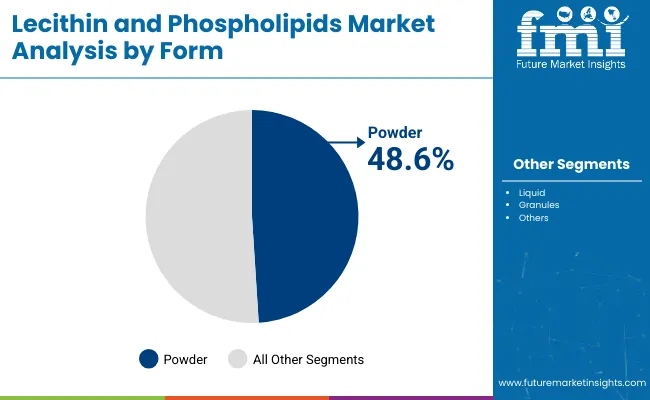

The segment of lecithin and phospholipids in powder form captures a major portion of the market due to their broad applicability, stability, and compliance with safety requirements in multiple end-user industries food, pharmaceuticals, cosmetics, etc.

| Segment | Powder( by Form) |

|---|---|

| Value Share (2025) | 48.6% |

Growing demand for Functional foods: Powdered lecithin is being widely used in fortified and functional food products such as protein bars and meal replacements or dairy substitutes. Clean label preference: There is an increasing preference among consumers for natural, non-GMO, and organic powdered lecithin in cosmetics, personal care, and dietary supplements. Pharmaceutical applications: Novel uses of phospholipids as powders in pharmaceutical formulations and lipid-mediated drug delivery systems. Powdered lecithin sees growing application in natural and organic personal care products

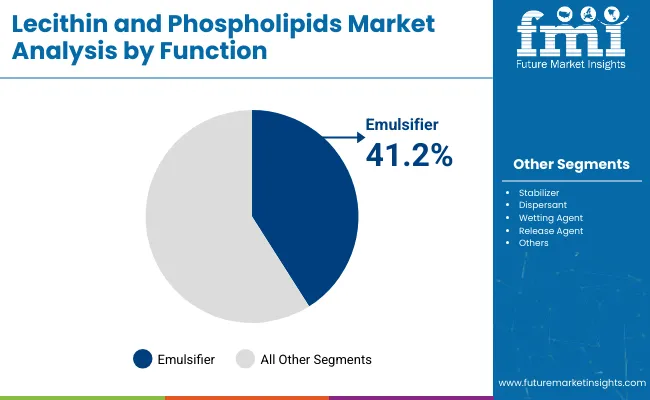

In 2025, the emulsifier segment accounts 41.2% of the total value share of the lecithin and products of lecithin and phospholipids market. Its wide usage in food, pharmaceutical, and personal care industries is leading to steady Expansion.

| Segment | Emulsifier( By Function) |

|---|---|

| Value Share (2025) | 41.2% |

Food & Beverage Applications: Emulsifiers are agents used to improve the texture, stability, and consistency of food, including bakery, confectionery, dairy, and convenience foods, to name a few. In chocolate and confectionery products, lecithin-based emulsifiers are favored as they lower viscosity, enhances flow characteristics, and minimize separation of distilled fats. Increasing demand for plant-based and clean-label products is driving a rise in the utilization of non-GMO and sunflower lecithin as natural emulsifiers.

Products based on lecithin and phospholipids are increasingly being tailored to individual industry applications in order to serve those specific client needs across the food, pharmaceutical, and cosmetic industries.

Sustainability Initiatives: People like eco-conscious consumers, so companies like Cargill and Bunge spend money on sustainable sourcing and production practices.

Strategic Partnerships: We are now seeing partnerships with pharmaceutical and food companies that is able to go even further by deepening distribution channels and expanding market presence.

Packaging and Branding: Innovative packaging and clear and helpful labeling are being used by manufacturers to make their clean-label, GMO-free products stand out to consumers.

For instance:

Bunge Limited - Works with farmers around the world who are committed to sustainable soybean production so their lecithin products are responsibly sourced. This is not just an approach in line with sustainability objectives but also a pull to green-minded customers.

The market is segmented into Unrefined Lecithin, including (Soybean, Sunflower, and Rapeseed Lecithin), Refined Lecithin and Chemically Modified Lecithin.

The market is segmented into Powder, Granules and Liquid.

The market is segmented into GMO and Non-GMO.

The market is segmented into Emulsifier, Dispersing Agent, Surfactants and Others

The market is segmented into Bakery & Confectionary ,Dairy Products, Infant & Dietetic Food Products, Meat & Poultry Items, Instant Foods, Other Processed Foods ,Dietary Supplements & Pharmaceuticals, Cosmetics, Animal Feed.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global industry is estimated at a value of USD 741.2 million in 2025.

Some of the leaders in this industry include Lecio Gmbh, Archer Daniels Midland Company, VAV Life science Pvt. Ltd., Sonic Biochem

The Asia Pacific territory is projected to hold a revenue share of 5.8% CAGR over the forecast period.

The industry is projected to grow at a forecast CAGR of 7.1% from 2025 to 2035.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 6: Global Market Volume (MT) Forecast by Form, 2017 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 8: Global Market Volume (MT) Forecast by Nature, 2017 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Function, 2017 to 2033

Table 10: Global Market Volume (MT) Forecast by Function, 2017 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 12: Global Market Volume (MT) Forecast by Application, 2017 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 14: North America Market Volume (MT) Forecast by Country, 2017 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 16: North America Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 18: North America Market Volume (MT) Forecast by Form, 2017 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 20: North America Market Volume (MT) Forecast by Nature, 2017 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Function, 2017 to 2033

Table 22: North America Market Volume (MT) Forecast by Function, 2017 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 24: North America Market Volume (MT) Forecast by Application, 2017 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Country, 2017 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Form, 2017 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 32: Latin America Market Volume (MT) Forecast by Nature, 2017 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Function, 2017 to 2033

Table 34: Latin America Market Volume (MT) Forecast by Function, 2017 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 36: Latin America Market Volume (MT) Forecast by Application, 2017 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 38: Europe Market Volume (MT) Forecast by Country, 2017 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 40: Europe Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 41: Europe Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 42: Europe Market Volume (MT) Forecast by Form, 2017 to 2033

Table 43: Europe Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 44: Europe Market Volume (MT) Forecast by Nature, 2017 to 2033

Table 45: Europe Market Value (US$ Million) Forecast by Function, 2017 to 2033

Table 46: Europe Market Volume (MT) Forecast by Function, 2017 to 2033

Table 47: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 48: Europe Market Volume (MT) Forecast by Application, 2017 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 50: East Asia Market Volume (MT) Forecast by Country, 2017 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 52: East Asia Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 54: East Asia Market Volume (MT) Forecast by Form, 2017 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 56: East Asia Market Volume (MT) Forecast by Nature, 2017 to 2033

Table 57: East Asia Market Value (US$ Million) Forecast by Function, 2017 to 2033

Table 58: East Asia Market Volume (MT) Forecast by Function, 2017 to 2033

Table 59: East Asia Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 60: East Asia Market Volume (MT) Forecast by Application, 2017 to 2033

Table 61: South Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 62: South Asia Market Volume (MT) Forecast by Country, 2017 to 2033

Table 63: South Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 64: South Asia Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 65: South Asia Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 66: South Asia Market Volume (MT) Forecast by Form, 2017 to 2033

Table 67: South Asia Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 68: South Asia Market Volume (MT) Forecast by Nature, 2017 to 2033

Table 69: South Asia Market Value (US$ Million) Forecast by Function, 2017 to 2033

Table 70: South Asia Market Volume (MT) Forecast by Function, 2017 to 2033

Table 71: South Asia Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 72: South Asia Market Volume (MT) Forecast by Application, 2017 to 2033

Table 73: Oceania Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 74: Oceania Market Volume (MT) Forecast by Country, 2017 to 2033

Table 75: Oceania Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 76: Oceania Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 77: Oceania Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 78: Oceania Market Volume (MT) Forecast by Form, 2017 to 2033

Table 79: Oceania Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 80: Oceania Market Volume (MT) Forecast by Nature, 2017 to 2033

Table 81: Oceania Market Value (US$ Million) Forecast by Function, 2017 to 2033

Table 82: Oceania Market Volume (MT) Forecast by Function, 2017 to 2033

Table 83: Oceania Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 84: Oceania Market Volume (MT) Forecast by Application, 2017 to 2033

Table 85: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 86: MEA Market Volume (MT) Forecast by Country, 2017 to 2033

Table 87: MEA Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 88: MEA Market Volume (MT) Forecast by Product Type, 2017 to 2033

Table 89: MEA Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 90: MEA Market Volume (MT) Forecast by Form, 2017 to 2033

Table 91: MEA Market Value (US$ Million) Forecast by Nature, 2017 to 2033

Table 92: MEA Market Volume (MT) Forecast by Nature, 2017 to 2033

Table 93: MEA Market Value (US$ Million) Forecast by Function, 2017 to 2033

Table 94: MEA Market Volume (MT) Forecast by Function, 2017 to 2033

Table 95: MEA Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 96: MEA Market Volume (MT) Forecast by Application, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Function, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 8: Global Market Volume (MT) Analysis by Region, 2017 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 12: Global Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 16: Global Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 20: Global Market Volume (MT) Analysis by Nature, 2017 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Function, 2017 to 2033

Figure 24: Global Market Volume (MT) Analysis by Function, 2017 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 28: Global Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 31: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 32: Global Market Attractiveness by Form, 2023 to 2033

Figure 33: Global Market Attractiveness by Nature, 2023 to 2033

Figure 34: Global Market Attractiveness by Function, 2023 to 2033

Figure 35: Global Market Attractiveness by Application, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Function, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 44: North America Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 48: North America Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 52: North America Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 56: North America Market Volume (MT) Analysis by Nature, 2017 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Function, 2017 to 2033

Figure 60: North America Market Volume (MT) Analysis by Function, 2017 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 64: North America Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 67: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 68: North America Market Attractiveness by Form, 2023 to 2033

Figure 69: North America Market Attractiveness by Nature, 2023 to 2033

Figure 70: North America Market Attractiveness by Function, 2023 to 2033

Figure 71: North America Market Attractiveness by Application, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Function, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 80: Latin America Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 84: Latin America Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 88: Latin America Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 92: Latin America Market Volume (MT) Analysis by Nature, 2017 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Function, 2017 to 2033

Figure 96: Latin America Market Volume (MT) Analysis by Function, 2017 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 100: Latin America Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Function, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 111: Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) by Function, 2023 to 2033

Figure 113: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 114: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 116: Europe Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 120: Europe Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 121: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 122: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 123: Europe Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 124: Europe Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 125: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 126: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 127: Europe Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 128: Europe Market Volume (MT) Analysis by Nature, 2017 to 2033

Figure 129: Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 130: Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 131: Europe Market Value (US$ Million) Analysis by Function, 2017 to 2033

Figure 132: Europe Market Volume (MT) Analysis by Function, 2017 to 2033

Figure 133: Europe Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 134: Europe Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 135: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 136: Europe Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 137: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 138: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 139: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 140: Europe Market Attractiveness by Form, 2023 to 2033

Figure 141: Europe Market Attractiveness by Nature, 2023 to 2033

Figure 142: Europe Market Attractiveness by Function, 2023 to 2033

Figure 143: Europe Market Attractiveness by Application, 2023 to 2033

Figure 144: Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Nature, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Function, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 150: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 152: East Asia Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 153: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 156: East Asia Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 159: East Asia Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 160: East Asia Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 161: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 162: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 163: East Asia Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 164: East Asia Market Volume (MT) Analysis by Nature, 2017 to 2033

Figure 165: East Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 166: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 167: East Asia Market Value (US$ Million) Analysis by Function, 2017 to 2033

Figure 168: East Asia Market Volume (MT) Analysis by Function, 2017 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 171: East Asia Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 172: East Asia Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 173: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 174: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 176: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 177: East Asia Market Attractiveness by Nature, 2023 to 2033

Figure 178: East Asia Market Attractiveness by Function, 2023 to 2033

Figure 179: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 180: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: South Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 183: South Asia Market Value (US$ Million) by Nature, 2023 to 2033

Figure 184: South Asia Market Value (US$ Million) by Function, 2023 to 2033

Figure 185: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 186: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: South Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 188: South Asia Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 189: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: South Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 192: South Asia Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 193: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 194: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 195: South Asia Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 196: South Asia Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 197: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 198: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 199: South Asia Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 200: South Asia Market Volume (MT) Analysis by Nature, 2017 to 2033

Figure 201: South Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 202: South Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 203: South Asia Market Value (US$ Million) Analysis by Function, 2017 to 2033

Figure 204: South Asia Market Volume (MT) Analysis by Function, 2017 to 2033

Figure 205: South Asia Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 206: South Asia Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 207: South Asia Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 208: South Asia Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 209: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 210: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 211: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 212: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 213: South Asia Market Attractiveness by Nature, 2023 to 2033

Figure 214: South Asia Market Attractiveness by Function, 2023 to 2033

Figure 215: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 216: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 217: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 218: Oceania Market Value (US$ Million) by Form, 2023 to 2033

Figure 219: Oceania Market Value (US$ Million) by Nature, 2023 to 2033

Figure 220: Oceania Market Value (US$ Million) by Function, 2023 to 2033

Figure 221: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 222: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 223: Oceania Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 224: Oceania Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 225: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 226: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 227: Oceania Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 228: Oceania Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 229: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 230: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 231: Oceania Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 232: Oceania Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 233: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 234: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 235: Oceania Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 236: Oceania Market Volume (MT) Analysis by Nature, 2017 to 2033

Figure 237: Oceania Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 238: Oceania Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 239: Oceania Market Value (US$ Million) Analysis by Function, 2017 to 2033

Figure 240: Oceania Market Volume (MT) Analysis by Function, 2017 to 2033

Figure 241: Oceania Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 242: Oceania Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 243: Oceania Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 244: Oceania Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 245: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 246: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 247: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 248: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 249: Oceania Market Attractiveness by Nature, 2023 to 2033

Figure 250: Oceania Market Attractiveness by Function, 2023 to 2033

Figure 251: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 252: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 253: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 254: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 255: MEA Market Value (US$ Million) by Nature, 2023 to 2033

Figure 256: MEA Market Value (US$ Million) by Function, 2023 to 2033

Figure 257: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 258: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 259: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 260: MEA Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 261: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 262: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 263: MEA Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 264: MEA Market Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 265: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 266: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 267: MEA Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 268: MEA Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 269: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 270: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 271: MEA Market Value (US$ Million) Analysis by Nature, 2017 to 2033

Figure 272: MEA Market Volume (MT) Analysis by Nature, 2017 to 2033

Figure 273: MEA Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 274: MEA Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 275: MEA Market Value (US$ Million) Analysis by Function, 2017 to 2033

Figure 276: MEA Market Volume (MT) Analysis by Function, 2017 to 2033

Figure 277: MEA Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 278: MEA Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 279: MEA Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 280: MEA Market Volume (MT) Analysis by Application, 2017 to 2033

Figure 281: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 282: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 283: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 284: MEA Market Attractiveness by Form, 2023 to 2033

Figure 285: MEA Market Attractiveness by Nature, 2023 to 2033

Figure 286: MEA Market Attractiveness by Function, 2023 to 2033

Figure 287: MEA Market Attractiveness by Application, 2023 to 2033

Figure 288: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lecithin Market Trends – Emulsifiers & Functional Food Ingredients 2025 to 2035

Soy Lecithin Market Size and Share Forecast Outlook 2025 to 2035

Canola Lecithin Market Analysis by Form, Available Grades, Functionality, End Use, and Region through 2025 to 2035

De-oiled Lecithin Market Size and Share Forecast Outlook 2025 to 2035

Modified lecithin Market

Fractionated Lecithin Market Growth - Source & Industry Trends

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA