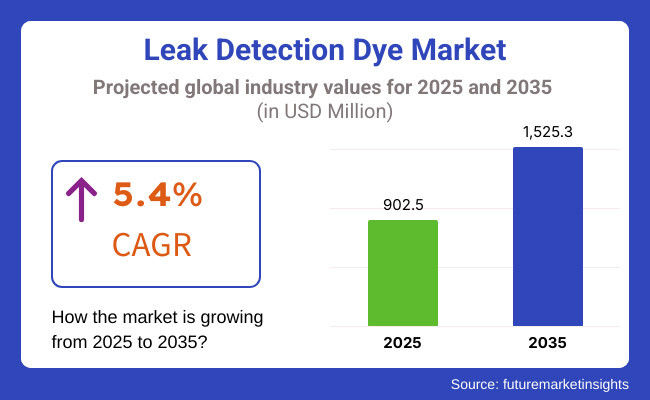

The global leak detection dye market is projected to experience steady growth between 2025 and 2035, driven by increasing industrial safety regulations, growing demand for preventive maintenance solutions, and rising adoption of leak detection technologies across multiple industries. The market is estimated to reach USD 902.5 million in 2025 and is expected to expand to USD 1,525.3 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.4% over the forecast period.

Indigo detection dyes are essential to the identification of leaks in a number of industrial applications, including cooling systems, hydraulic systems, HVAC units, pipelines, and fuel tanks across diverse sectors, including automotive, aerospace, oil & gas, chemical processing, manufacturing, and water treatment. The increasing focus on energy efficiency, cost-effective maintenance methods, and ecological sustainability is resulting in the growing requirement for high-quality fluorescent and UV-reactive leak detection dyes. As well, the rise of modern infrastructures, such as pipelines, and the imposition of strict ecological regulations are some factors leading to the acceptance of up-to-date forms of leak detection.

In conjunction with industries continuing the stress pops on predictive maintenance production and equipment reliability, the companies are innovating with eco-friendly non-toxic and biodegradable leak detection dyes for the sustainability-oriented sectors. The synergy of proper sensors, UV inspection systems, and automated leak detection solution is additional force that dynamically propels market growth.

The high demand for leak detection technologies in HVAC systems, refrigeration, automotive diagnostics, and oil & gas pipelines is one of the significant factors impacting the market positively. Furthermore, the introduction of new formulations for leak detection dye that are environmentally friendly and water-soluble is broadening the market with opportunities.

Explore FMI!

Book a free demo

North America is still a major market for leak detection dyes, the reason being it is backed by the strict environmental regulations, well as the industrial safety compliance and the rapidly growing preventive maintenance solutions sector. The USA and Canada are home to the oil and gas pipelines, HVAC systems, and automotive manufacturing, among others, where leak detection is heavily utilized to ensure that the systems do not break down and incur expensive costs due to downtime. The United States Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA) were the ones that required the application of strict leak detection regulations especially in the oil and gas as well as in the chemical processing sector. Furthermore, it is worth mentioning that the use of innovative UV dye-based detection systems in HVAC maintenance and refrigeration diagnostics has become a further driver of the market expansion.

The leak detection dyes' European market is supported by the steady growth trend, which is driven by the rise in industrial automation, stricter environmental laws, and the broader use of energy-efficient maintenance practices. Germany, the UK, and France are the countries that are putting money into the leak detection technologies in order to achieve the goal of energy loss minimization in HVAC and refrigeration systems. The European Union's emission control legislation and the water sustainability guide for industries are the main driving forces for the industry to use environment-friendly and biodegradable leak detection dyes. Furthermore, the automotive sector's strong embrace of fluid system diagnostics and the abundant outlay for intelligent building technologies is additionally encouraging market expansion.

The leak detection dye market is experiencing a rapid growth in the Asia-Pacific region owing to the factors such as rapid industrialization, increasing HVAC system installations, and rising investments in manufacturing and energy infrastructure. The countries that are the main drivers in this market development are China, India, and Japan that are actively expanding their industrial and commercial sectors and therefore are the main consumers of leak detection solutions in fluid handling systems and pipeline maintenance. The surge in China’s automotive and chemical industry production along with the increasing HVAC market is the reason behind the rise in the fluorescent and UV dye-based leak detection systems. The adoption of leak detection technologies in water treatment plants, food processing units, and refrigeration systems continues to grow in India. In the meantime, Japan and South Korea are implementing smart maintenance solutions like automated leak detection and fluid system monitoring.

The MEA (Middle East & Africa) area is undergoing a boom in the usage of leak detection dyes, especially in oil & gas, petrochemical, and HVAC applications. Pipeline monitoring systems and industrial maintenance technologies which are being procured by states like Saudi Arabia, UAE, and South Africa, are pointing towards the need for high-performance leak detection dyes. Grown since the focus is on power saving and on infrastructural safety, industries in the area are looking for performant leak detection systems to cut down on the operational risks and the environmental damage. In addition, the expansion of the commercial HVAC infrastructure and the proliferation of the HVAC system in building development also are the factors which further that market growth.

Regulatory Restrictions on Chemical-Based Dyes

The leakage detection dye market is mainly faced with the challenge of government regulations that prevent the use of chemical dyes in industries. A number of these leak detection dyes, mainly the ones used in automotive and refrigeration cooling systems have fluorescent additives and chemical compounds that are quite harmful to both the environment and human health. Organizations like EPA and EU REACH along with the Food and Drug Administration (FDA) have made law-like rules governing the use of artificial dyes in leak detection systems, especially in food processing, pharmaceutical, and water treatment applications. Therefore, manufacturers have to find ways of coming up with non-toxic, biodegradable options which could lead to added research and production costs. In addition, meeting industry-specific safety standards through regular testing and certification often makes it difficult for new entrants to compete with established companies.

High Cost of Advanced Leak Detection Systems

The steep expense for advanced leak detection systems due mainly to the closure of certain companies that integrate UV-based detection, AI-assisted diagnostics, and automated monitoring solutions is yet another issue in the market. While traditional dye-based leak detection is cost-effective and widely used, industries are shifting toward real-time monitoring systems that provide instant leak detection and predictive maintenance capabilities. Nevertheless, the initial capital outlay for these sophisticated leak detection systems is a hurdle for small and mid-sized enterprises (SMEs). The need to have UV bulbs, specialized equipment, and training to effectively carry out the task of leak identification only adds to the operational costs. The oem's are now focusing on the development of easy-to-use, non-proprietary, and inexpensive leak detection dye formulations to promote acceptance in thrift-kind consumers.

Advancements in Eco-Friendly and Biodegradable Leak Detection Dyes

The necessity of eco-friendly leak detection options is paving the path for manufacturers to create effective bio-, water-soluble, and non-toxic leak detection dyes. In addition to the high environmental governance on chemical additives, businesses are also moving to fluorescent leak detection dyes that are made with plant-based and biodegradable materials. Top companies are pouring resources into formulation ingenuity that will improve UV reactivity, durability of fluorescence, and use in several fluid systems. Furthermore, the merging of green chemistry practices in dye production is likely to promote the spread of environmentally-friendly leak detection in HVAC, automotive, and industrial applications.

Growing Demand in HVAC, Automotive, and Pipeline Industries

The sales of leak detection dyes are greatly influenced by the growth of HVAC systems, refrigeration units, and industrial cooling systems. A lot of maintenance teams are resorting to these dyes for their benefits in Leak detection fluid losses, refrigerant leaks, and operational failures. In addition, battery cooling systems, hydraulic circuits, and thermal management applications are driving the demand for leak detection solutions with the introduction of electric and hybrid automobiles. The worldwide building of oil &gas pipeline networks is also the reason for the creation of these special leak detection dyes, which in turn, facilitate the early leak detection and reduction of environmental damage.

The period from 2020 to 2024 saw the leak detection dye market being on the rise, propelled by the necessity of more preventive maintenance, the implementation of stricter environmental laws, and the progress made in industrial safety measures. The requirement of leak detection dyes became a significant factor in various fields such as HVAC, automotive, oil and gas, plumbing, and industrial equipment maintenance, where regular replacement of parts or repairs is prevented through detecting leaks in time to avoid excessive costs and environmental damage. The view of UV as a fluorescent and tracer dye-based detection technology increased the efficiency of leak detection. Although, the market expansion was affected by the disruptions in the supply chain, restrictions imposed by regulators on certain chemical-based dyes, and low awareness even in emerging markets.

Observing 2025 to 2035, the leak detection dye market will be revolutionized by AI-driven predictive maintenance, using eco-friendly biodegradable dyes, and advanced nanotechnology-based tracers. The smart leak detection system, which is integrated with blockchain, internet of things (IoT) and digital technology, this will completely change the way these industries use them. Moreover, the introduction of the hydrogen-based system, the association of AI in the leak mapping of industries, and the project of a water infrastructure that is environmentally safe will push the market for the next generation of leak detection dyes.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Industrial Equipment & HVAC System Monitoring | Prospective usage of fluorescent and ultraviolet leak detection dyes for HVAC systems, refrigeration units, and compressors |

| Automotive & Aerospace Leak Detection Advancements | Growth in dye-based leak detection for automotive AC, fuel, and hydraulic systems. |

| Eco-Friendly & Biodegradable Leak Detection Solutions | Initial shift toward low-toxicity, water-soluble dyes for environmental safety. |

| Oil & Gas & Pipeline Safety Regulations | Increased use of tracer dyes in offshore and onshore pipeline inspections to prevent environmental spills. |

| Water & Wastewater Infrastructure Leak Detection | Adoption of dye-based solutions in municipal water systems, sewage lines, and industrial wastewater plants. |

| Chemical Industry & Fluid System Monitoring | Use of specialized dyes for industrial fluid leaks in manufacturing plants. |

| Market Growth Drivers | Growth fueled by preventive maintenance strategies, industrial safety regulations, and expansion of HVAC and automotive sectors. |

| Market Shift | 2025 to 2035 |

|---|---|

| Industrial Equipment & HVAC System Monitoring | Real-time HVAC systems monitoring based on AI, nanotechnology-loaded ultra-sensitive dye leak detection, and cloud-integrated predictive maintenance tools |

| Automotive & Aerospace Leak Detection Advancements | Smart leak detection with AI-enhanced UV sensors, non-toxic hydrogen tracers, and blockchain-based vehicle maintenance tracking. |

| Eco-Friendly & Biodegradable Leak Detection Solutions | Full-scale adoption of biodegradable, plant-based leak detection dyes with AI-powered emission tracking. |

| Oil & Gas & Pipeline Safety Regulations | Integration of AI-assisted pipeline monitoring, drone-based leak detection with fluorescent dye sensors, and AI-powered risk assessment systems. |

| Water & Wastewater Infrastructure Leak Detection | Expansion of smart water leak detection networks, IoT-based dye sensors for real-time leak mapping, and blockchain-based water security tracking. |

| Chemical Industry & Fluid System Monitoring | AI-driven self-reporting fluid leak detection systems, advanced quantum-dot-based leak detection dyes for ultra-precise monitoring. |

| Market Growth Drivers | Market expansion driven by AI-integrated leak detection, sustainable dye alternatives, and demand for precision fluid monitoring in next-gen industrial systems. |

The United States dye detection of the leaking sector is showing a constant surge due to the increasing need for leak detection in HVAC systems, automotive diagnostics, and industrial pipeline maintenance. The fluorescents and UV leak detection dyes in HVAC and refrigeration systems the EPA sees are more adopted are the environmental protection agency (EPA) insists on the stricter refrigerant leakage regulations are being violated. The automotive business is another essential force, since the producers and service providers are more and more using leak detection dyes in air conditioning (A/C) systems, fuel lines and hydraulic systems to raise productivity. Simultaneously, the sectors, for instance, oil, gas, and power plants are employing tracer dyes for the primary leak in pipelines causing a lot of trouble and indeed safety problems to the storage tanks. The spectrum of biodegradable and chemical-friendly dyes is the demand for non-toxic, and water-based formulas is growing especially in food processing and pharmaceutical manufacturing.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.6% |

The United Kingdom leak detection dyes market demonstrates a steady growth rate, significantly driven by environmental regulations, automotive and HVAC service industry extension, and the need for industrial safety applications. GU Environment Agency and DEFRA (Department for Environment, Food & Rural Affairs) decisively regulate leakage of both refrigerants and water, and thereby indirectly growth of companies that have to invest in high-visibility leak detection dyes. The marketing of leak detection tools as indispensable parts for the maintenance of residential and business facilities has sprung with mass take-up of heat pumps and more sophisticated HVAC systems. Moreover, the UK automotive service and maintenance sphere being strong is concurrently applying UV and fluorescent dyes more in particular to the fluid leak detection in hybrids and electric vehicles (EVs).

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.2% |

The leak detection dyes market in the European Union is on the rise as a result of the imposition of stringent measures for the protection of the environment, speeding up industrial development, and an upsurge in the application of leak detection products, especially in the automotive, HVAC and oil & gas sectors. For example, countries like Germany, France, and Italy that have been at the forefront of employing non-toxic, biodegradable, and solvent-free leak detection dyes are on the right path to align with the EU environmental sustainability goals. The European F-Gas Regulation that is responsible for the compulsory cuts in emissions of the fluorinated greenhouse gas is in no other way the greatest motivator for the superlative kinds of leak detection dyes being used in refrigeration and air conditioning systems. Moreover, the intensifying concentration on industrial safety and the control of workplace hazards has resulted in the proliferation of ultraviolet fluorescent dyes in chemical plants, sewage treatment facilities, and underground pipe surveillance. The automotive sector, in particular, the one located in Germany and Sweden, is the leader in the development of the dye-based leak detection technology in electric vehicle chillers, fuel injection lines and hydraulic systems.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.4% |

The Japan leak identification dyes field is flourishing owing to the advancements in manufacturing technology, the automotive sector, and the growing investments in leak detection technologies for semiconductor and electronics industries. Japan is facing strict company safety regulations, hence the need for non-invasive and non-corrosive dyes for leak detection in chemical, food, and cleanroom environments has increased. Hybrid, and Electric Vehicle manufacturers group is extensively using the ultraviolet, and infrared leak detection dyes for battery cooling, maintaining fuel cells, and checking the operation of the transmission system. The demand for pipeline leak detection dyes in the underground transport network is also high due to the fast-growing high-speed rail and metro infrastructure.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

The South Korea leak detection dyes market is flourishing primarily driven by the advances in semiconductor manufacturing, the growing usage of leak detection in electric vehicles, and the shift to safety regulations in the industrial branch. The trailblazing electronics and chip fabrication sectors in South Korea need the highest standard of leak detection solutions to ward off chemical leaks and to keep the cleanroom intact. Since South Korea is the hub of EV battery manufacturing, leak detection systems based on dyes are the primary way to cool the battery and maintain hydrogen fuel cells. On top of that, the HVAC and smart home technology sector is also expanding with fluorescent leak detection dyes for refrigerant systems now being an additional option. The government's focus on workplace safety as well as on industrial emissions reduction has brought about the spread of automated, AI-integrated leak monitoring systems in massive factories and power plants.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

The leak exhibit juices market is basically remitted to the oil-based leak detection dyes, as they are the most-used type of these lighting materials in sectors like automotive, industrial machinery, and hydraulic systems. The oils used are custom-made to dissolve in accordance with the fluids specifically used in the industrial process, thus facilitating the quick spotting of the leaks in the engines, transmissions, and industrial equipment using the UV or fluorescence detection methods by the technicians. The automobile and transportation sector utilize oil-based leak detection dyes a lot for preventive maintenance, engine diagnostics, and leak repairs in coolant, fuel, and air-conditioning systems. In comparison, solvent-based, and water-based dyes, oil-based variants are the best because they easily mix with petroleum- based fluids, can be seen better under UV light, and are more durable in high-temperature environments. Apart from that, oil-based dyes are also applied in industrial pipelines and manufacturing facilities for the proper functioning of lubrication systems and thus protect the systems and equipment from costly breakdowns.

Water-soluble leak location dyes are at the top of the list for most popular items, especially in HVAC and refrigeration systems, water supply networks, and pipes. These strong for dyes that dissolve in water are particularly well-suited for leak detection in chillers, cooling towers, and municipal water pipelines. Unlike oil-based dyes, water-based leak detection dyes are non-toxic, environmentally friendly, and safe for use in potable water systems. The HVAC & refrigeration industry is a key consumer of these dyes, as they help identify micro-leaks in refrigeration coils, condenser units, and evaporator systems. Moreover, sewer treatment plants, plant maintenance staff, and plumbing contractors resort to water-based dyes as a fully reliable instrument for locating hidden leaks in underground pipes, septic tanks, and drainage systems without causing any harm to health and the environment.

The largest end-user segment of the automotive and transportation sector is still the automotive sector due to the effective leak detection solutions required in vehicle engines, cooling systems, and air conditioning units. Leak detection dyes are extensively utilized in OEMs, auto repair shops, and fleet maintenance operations which in turn allow a mechanic to find leaks quickly by the use of UV-enhanced fluorescent technology. The rise of electric vehicles (EVs) and hybrid cars is an additional factor which is driving the demand for non-invasive, chemical-free leak detection methods in battery cooling systems, electric drivetrains, and thermal management circuits. Vehicle manufacturers, who are concentrating more on the augmentation of efficiency and the reduction of environmental impact, are the ones that leak detection dyes are now being formulated to meet low-toxicity and biodegradable fluid standards.

The oil & gas field is registering high demand for leak detection dyes which are mainly used in pipeline integrity monitoring, offshore drilling platforms, and refinery inspections. Solvent-based and oil-based dyes are utilized in pressurized pipeline networks, fuel storage tanks, and petrochemical processing units to reveal repeatable leaks in liquid hydrocarbons, crude oil transport lines, and slumping articles. Because of the advent of environmental protection and the require for pipeline safety, the oil & gas operators are also turning to advanced UV-visible leak detection dyes that are capable together with oils and greases to detect even the smallest air- or fluid leaks. Progress has also been made in the fields of remote sensing, automated leak detection and, AI-integrated dye tracing technologies that have an impact on the improvement of pipeline safety and operational efficiency in the oil & gas sector.

Surge of the leak detection dyes market at the international level is mainly due to the high demand for preventive maintenance products, increasing use of these products in the industrial sector, and the latest developments in the non-destructive testing (NDT) technologies. HVAC systems, automotive cooling systems, pipelines, hydraulic machinery, and refrigeration units which use leak detection dyes for the prompt and effective leak detection are the major areas in which this chemical is used. The market is influenced by the developing environmental regulations on leak prevention, the growing use of fluorescent and UV leak detection dyes, and the urgent need for early detection solutions in critical systems. The leading companies leverage their operations by focusing on the production of high-performance dyes, environmentally friendly formulations, and the incorporation of UV tracer technology that increases the productivity of leak detection in various fields like automotive, aerospace, and industrial manufacturing.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

| Spectronics Corporation | 10-12% |

| Tracer Products (UView Ultraviolet Systems Inc.) | 9-11% |

| Dürr Technik | 8-10% |

| LeakTronics | 6-8% |

| Prism Industries | 5-7% |

| Other Companies (combined) | 51-61% |

| Company Name | Key Offerings/Activities |

| Spectronics Corporation | A global leader in UV fluorescent leak detection dyes, offering precision-engineered tracers for HVAC, automotive, and industrial applications. |

| Tracer Products (UView Ultraviolet Systems Inc.) | Specializes in high-visibility fluorescent dyes, integrating UV leak detection kits for automotive and HVAC systems. |

| Dürr Technik | Develops eco-friendly and non-toxic leak detection dyes, ensuring high-performance tracing solutions for fluid systems. |

| LeakTronics | Provides advanced leak detection kits, integrating acoustic and dye-based tracing solutions for water systems and pipelines. |

| Prism Industries | Manufactures oil, fuel, and hydraulic leak detection dyes, catering to aerospace, power generation, and manufacturing industries. |

Spectronics Corporation

Spectronics Corporation is the largest in the leak detection dye market, giving out fluorescent UV leak detection solutions for HVAC, automotive, and industrial systems. The company's Tracerline series is an array of high-performance leak detection dyes, which, thanks to UV-enhanced visibility, ensures quick system leak detection. Spectronics is working on the formulations of dye that are eco-friendly thus, are mitigating environmental effects and simultaneously increasing the compatibility with the new refrigerants and the lubricants of the systems.

Tracer Products (UView Ultraviolet Systems Inc.)

Tracer Products is a company that focuses on the production and provision of fluorescent leak detection equipment and thus, they manufacture ultra-precise tracer dyes that are used in various applications such as in automotive air conditioning, fuel systems, and engine coolant diagnostics. The company's CoolSeal and Dye-Lite series contain highly-visible UV detection technology that helps automotive mechanics to detect leaks rapidly. Tracer Products is growing its automated leak detection systems ensuring the fast and effective maintenance solutions.

Dürr Technik

The company Dürr Technik is a big name in the field of industrial leak detection dyes. It provides non-toxic, biodegradable tracing solutions for problems related to hydraulic systems, water and refrigeration pipelines. The company is using the low-viscosity high-contrast dyes for their customers making the identification of fluid leaks in the critical systems very simple. The company is also involved in the research of the long-lasting leak detection formulations that are tailored to the energy-efficient HVAC and industrial fluid applications.

LeakTronics

LeakTronics is the space that provides outstanding leak detection technology by providing a mix of acoustic and dye-based tracing techniques for water, plumbing, and underground pipe networks. The company delivers high-quality Pipe Probe and FlashDye models that contain the most visible leak detection dyes thus ensuring the precise location of the hidden water system leaks. Through the continuous investments made, smart leak detection kits that include AI-driven diagnostics and digital monitoring systems are being integrated at LeakTronics.

Prism Industries

Prism Industries is an essential producer of oil, fuel, and hydraulic leak detection dyes that are tailored to the needs of its customers in the aerospace, power generation, and industrial manufacturing sectors. The company's high-temperature-resistant tracer dyes demonstrate their commitment to precise leak detection even in extremely difficult operational settings. Prism Industries is embarking on the path of innovation with its low-toxicity, environmentally friendly dyes, which are in line with the promotion of sustainable maintenance practices in energy-dense industries.

The global leak detection dyes market is projected to reach USD 902.5 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.4% over the forecast period.

By 2035, the leak detection dyes market is expected to reach USD 1,525.3 million.

The oil-based segment is expected to dominate due to its widespread use in automotive, HVAC, and industrial machinery applications where efficient leak detection is crucial for system performance and maintenance.

Key players in the leak detection dyes market include Spectronics Corporation, Tracer Products, LeakTronics, Primalec, and Chromatech Incorporated.

Oil based, Water based, Solvent based

Fluorescent Dyes, Non-Fluorescent Dyes

Automotive & Transportation, HVAC & Refrigeration, Industrial Pipelines, Water & Plumbing Systems, Oil & Gas Pipelines, Marine, Others

North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa

Anti-seize Compounds Market Size & Growth 2025 to 2035

Industrial Pipe Insulation Market Trends 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.