The USA laundry facilities and dry cleaning services industry is experiencing tremendous evolution due to the changing preferences of customers toward convenience, sustainability, and digital integration. With busier lifestyles, people look at saving time solutions and professional laundry and dry cleaning services inevitably become a need. Contactless payment solutions, app-based pickup and delivery for laundry, and dry cleaning based on eco-friendly processes are leading innovations in the game.

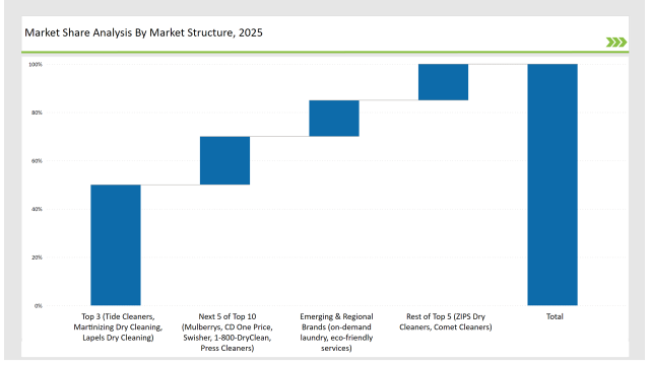

50% Market share Leading brands account for market share based on brand recognition and sheer volumes of franchises. Independents and regional laundromats and dry cleaners constitute 30%, that are appealed mainly to the local markets and customized offerings. Only recently have started to take off, accounting for 20% of market share: on-demand app-based laundry services, and eco-friendly cleaning solutions

Explore FMI!

Book a free demo

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (Tide Cleaners, Martinizing Dry Cleaning, Lapels Dry Cleaning) | 50% |

| Rest of Top 5 (ZIPS Dry Cleaners, Comet Cleaners) | 15% |

| Next 5 of Top 10 (Mulberrys, CD One Price, Swisher, 1-800-DryClean, Press Cleaners) | 20% |

| Emerging & Regional Brands (on-demand laundry, eco-friendly services) | 15% |

2025 The U.S. laundry facilities and dry cleaning services market in 2025 is moderately concentrated, with the top players accounting for 40% to 55% of the total market share. Leading service providers such as Martinizing Dry Cleaning, Tide Cleaners, and Lapels Dry Cleaning dominate the segment, while independent laundromats and eco-friendly cleaning alternatives add competitive diversity. This market structure reflects strong brand influence while allowing space for sustainable cleaning solutions and digital service integrations.

Brick-and-Mortar Laundromats & Dry Cleaners is the most prominent in sales market as most of the customers are going to the store to get their clothes professionally cleaned at a high percentage of 55%. On-Demand & App-Based Laundry Services will constitute 30% with increasingly popular digital platforms and the rise of the gig economy. Corporate & Hotel Laundry Services will add up to 10% because the hospitality sector requires large quantities and high sanitation. Last but not least, Subscription-Based Laundry & Dry Cleaning is an emerging opportunity at 5% because companies are piloting membership plans that include unlimited washes for a flat fee.

The biggest service type is Dry Cleaning & Specialty Garment Care at 40%, for the high-end and professional have more fragile items. The Self-Service & Coin-Operated Laundry account for 30% because laundromats can service apartment residents or those with no in-house washing machine. The Wash & Fold Services is 20%, also driven by the demand for convenience in urban markets. Lastly, 10 percent Eco-Friendly & Organic Cleaning Solutions, as consumers have increased their preferences for non-toxic, biodegradable detergents and techniques that save water. Who Shaped the Year As changes in consumer preference happened, the companies came up with smart strategies whether old or new that transformed the laundry and dry cleaning industries as well.

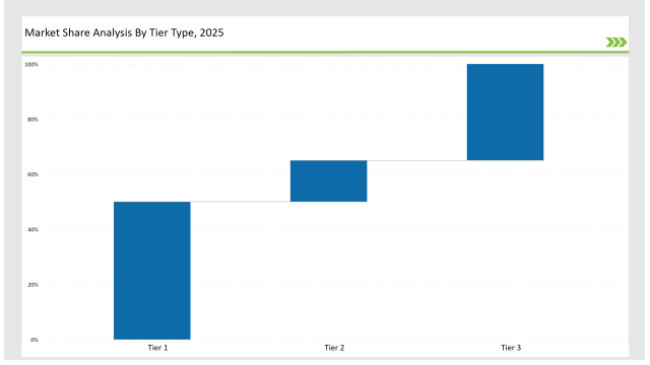

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Tide Cleaners, Martinizing Dry Cleaning, Lapels Dry Cleaning |

| Market Share (%) | 50% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | ZIPS Dry Cleaners, Comet Cleaners |

| Market Share (%) | 15% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Mulberrys, CD One Price, Swisher, 1-800-DryClean, Press Cleaners |

| Market Share (%) | 35% |

| Brand | Key Focus Areas |

|---|---|

| Tide Cleaners | App-based scheduling & corporate laundry partnerships |

| Martinizing Dry Cleaning | Eco-friendly dry cleaning solvents & sustainable operations |

| Lapels Dry Cleaning | Electric delivery fleet & water conservation |

| ZIPS Dry Cleaners | AI-powered garment care & precision stain removal |

| Emerging Brands | On-demand laundry & subscription-based services |

On one hand, in the USA laundry and dry cleaning industries, there shall be growth via continuous technological upgrading, green novelties and changes in demands from consumers' side. On the other side, business practices will become increasingly digitalized; companies that do consider sustainability may enjoy customer's loyalty long into the future while the future shall be comfort-driven, 'green-consciousness', and online optimized.

Leading players such as Tide Cleaners, Martinizing Dry Cleaning, and Lapels Dry Cleaning collectively hold around 50% of the market.

Independent laundromats and local dry cleaners contribute approximately 30% of the market.

Digital-first laundry startups specializing in app-based pickups and deliveries hold about 20% of the market.

Subscription-based models represent around 5% of the market, but this segment is rapidly growing.

High for companies controlling 50%+, medium for 30-50%, and low for those under 30%.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.