The Latin America sports nutrition market is set to grow from an estimated USD 2,240.2 million in 2025 to USD 7,429.8 million by 2035, with a compound annual growth rate (CAGR) of 12.7% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 2,240.2 million |

| Projected Latin America Value (2035F) | USD 7,429.8 million |

| Value-based CAGR (2025 to 2035) | 12.7% |

The Latin America sports nutrition market is currently experiencing a strong increase in sales that is supported by a greater recognition of fitness and wellness among the people. The advent of health-conscious consumers and the unprecedented number of gyms and fitness centers in the region make Brazil, Mexico, Argentina, and Chile the leaders.

The market comprises the products like protein powders, energy drinks, protein bars, and fat burner supplements. Both local and global brands are expanding the range of products they offer, thus, the sports nutrition market is now making the leap from being a specialty product to a general consumer item.

According to a report, by the end of 2025, the value of sports nutrition is likely to go up to USD 2,240.2 million and for the next ten years it is expected to grow at an annual rate of 12.7%. Among the most cherished competitive sports in Latin America can be found soccer, tennis, and running. The demand for energy drinks, hydration products, and endurance-based supplements is therefore increasing among both professional and amateur athletes.

The development of online retail platforms, like Mercado Libre and Amazon, has drastically increased the availability of sports nutrition products in the rural and semi-urban areas in Latin America that were previously not accessible to them.

The increasing popularity of social media influencers and fitness content creators who are marketing the use of protein powders, energy drinks, and other supplements because their benefits are being promoted effectively has resulted in a growing demand for these products among fitness enthusiasts and health-conscious consumers in previously underserved regions.

Explore FMI!

Book a free demo

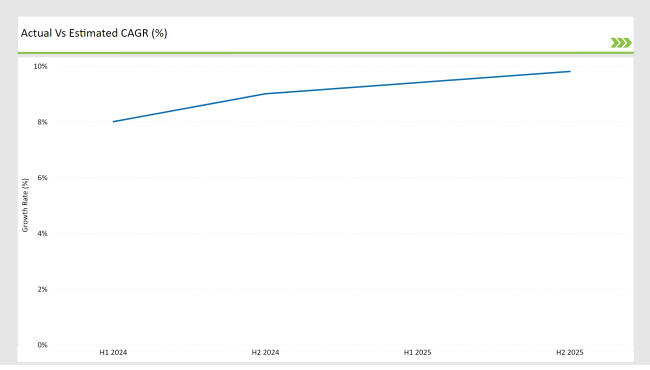

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Latin America sports nutrition market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin Americaan sports nutrition market, the sector is predicted to grow at a CAGR of 11.6% during the first half of 2024, with an increase to 12.0% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 12.4% in H1 and is expected to rise to 12.9% in H2.

This pattern reveals a decrease of 14 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 22 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| July 2024 | NotCo, a leading plant-based food tech company in Latin America, expanded its portfolio by introducing "Not Shake Protein," a range of zero-sugar protein-enriched sports drinks. The product line features unique flavors such as Banana Pancakes with Cinnamon and Strawberry with Dates, alongside classics like chocolate, coffee caramel, and vanilla with coconut. |

| October 2024 | Brazilian company Duas Rodas showcased new products in the sports nutrition and supplements industry at The Food Tech Summit & Expo Mexico. These launches align with the growing consumer demand for healthier, more natural, and functional products, a trend that saw an average annual growth of 18% in global product launches between July 2021 and June 2024. |

Flavored Protein Bars and RTD Shakes Transforming Latin America’s Fitness Market

The introduction of ready-to-drink (RTD) protein shakes and energy bars is the main driver behind the revolution of the Latin American sports nutrition market, which is caused by the trends of on-the-go consumption. RTD protein shakes are providing an alternative to the classical powdered supplements.

Consumers, particularly fitness enthusiasts and busy professionals, are looking for the faster and most efficient ways that fit into their fast-paced lifestyles. RTD protein shakes present a no-brainer and quick solution to that concern as they deliver immediate nourishment without any preparation.

Also, organism-friendly protein bars with such functions as, muscle recovery, weight management, and energy boost are offered for sale more frequently at convenience stores and modern retail outlets.

Popular flavors such as chocolate, vanilla, and fruit-based options reinforce the product's attractiveness, thus, they are the preferred choice of the consumers, who want to eat healthy and satisfying snacks which support their fitness goals while they are enjoying them.

Beyond Protein: The Rise of Functional Sports Nutrition in Latin America

The Latin American sports nutrition market is now undergoing a significant move to functional nutrition, as the target benefits of the consumers are becoming more sophisticated than just usual protein intake. Therefore, athletes, fitness fans, and consumers who are less regular at the gym also show interest in these products.

The most requested health benefits involved in the products are energy boosting, muscle recovery, hydration, and weight control. Among the most preferred products are the BCAA (Branched-Chain Amino Acids) and creatine-based supplements available in the market as pre-workout and post-workout formulations.

These components contribute to muscle fatigue reduction, recovery acceleration, and performance stamina increase thus, the benefits that are gained from them are conditioning the athletes and others to achieve maximum results. In addition, the use of hydration-focused supplements and electrolyte-infused sports drinks is gaining popularity among the endurance athletes.

With the lessening of the challenges stated above, the consumers are seeking science-based supplementation that has performance-enhancing capabilities, thus the brands are making the necessary efforts to create multi-functional blends that are specific to fitness targets.

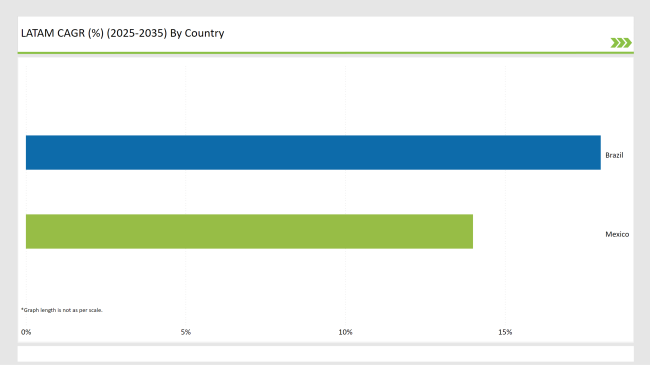

The following table shows the estimated growth rates of the top two markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

Occupying a highlighted position as a key market for the sports nutrition products in Brazil is the discovery of the country as the home of more than 30,000 gyms. The increasing rise of CrossFit, bodybuilding, and functional training has led the people to require supplements, which is high-performance such as protein powders, BCAAs, and pre-workouts that fitness freaks purchase with an aim of better muscle recovery and endurance.

As the RTD (ready-to-drink) protein shake sector is also increasing at a rapid pace, Brazilian brands are jumping on board with locally influenced flavors such as açaí, coconut, and Brazilian chocolate as a way to catch the consumers attracted.

Alongside this, sports drinks which have been fortified with protein such as protein-infused juices and electrolyte sports drinks, endure increasing popularity among endurance athletes and the general gym-goers, respectively. These offer quick nutrition solutions as they help people with hydration, recovery of the muscles, and energy for the active lifestyle.

Youth fitness training, immigration, and tourism have been recurrent factors influencing innovation in Mexico's sports nutrition market. For example, team sports such as soccer along with endurance sports such as marathons, cycling, and triathlons are responsible for a great deal of the market growth in Mexico.

Athletics and fitness buffs are progressively embracing water, electrolyte beverages, and endurance conditioning supplements as additional allies in conquering the triangle of bad performance and slow recovery in hard physical activity.

Endurance athletes have specific preferences in products that these supplements help with, replenishing electrolytes, increasing energy and avoiding fatigue. Trekking the add-on lines, CK nutrition focuses on local flavors, for example, its protein shakes and bars are flavored with tangy tamarind, traditional horchata, and fun chocolate abuelita. These products stand out in flavor while appealing worldwide to the user's cognition of produced goods having met global nutritional standards.

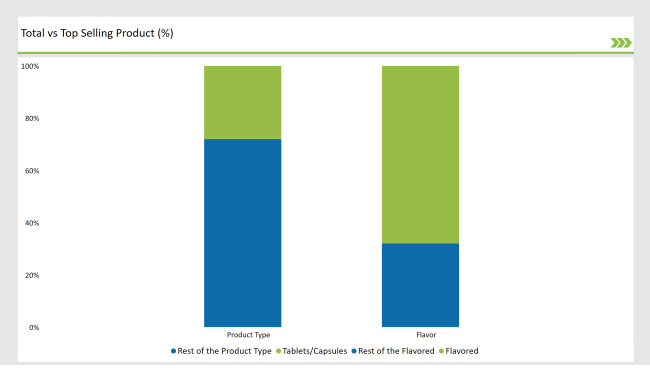

% share of Individual categories by Product Form and Flavor in 2025

The apt delivery of tablets and capsules, the reason for their rising popularity in Latin America's sports nutrition market, as they provide the specific amount of energy per serving and thus are more efficient to consume.

Furthermore, they ensure the delivery of the exact amounts of nutrients such as BCAAs, creatine, vitamins, and minerals, which are necessary for the improvement of pre- or post-workout performance. For both athletes as well as fitness fans, the correctness of dosage is of paramount importance in achieving target fitness objectives such as muscle recovery, endurance improvement, and energy gain, thus making tablets and capsules the first choice.

What is more, the lifting of regulatory burdens has acted as a catalyst to the increase in demand for tablets and capsules. Proponents of the Truth Campaign argued that unlike powders and ready-to-drink products, tablets and capsules often face fewer regulatory hurdles, in Latin America, where brands can speedily launch formulations with novel ingredients, hence the process is streamlined.

This frees up the way for innovation and compliance, enabling manufacturers to keep pace with changing consumer preferences and to follow local requirements.

Focusing on local tastes and cultural preferences has energetically propelled the flavored sports nutrition products market in Latin America as brands attune themselves to the part. Adding regionally-derived flavors including açaí, tamarind, horchata, and chocolate abuelita have made things more palatable for the companies that produce protein powders, bars, and ready-to-drink (RTD) shakes.

Those flavors that echo to local traditions play a very crucial role in making sports nutrition products stay aside in the market that is already competitive while giving clients the impression of being close to home. Furthermore, the new packaging format has seen the massive introduction of product lines like flavored RTD protein shakes and energy bars, which now offer considerable convenience to busy consumers.

Such lifestyle accessories could be smoothly blended with the dynamic lifestyles of fitness fans as a result of this unique capability. Additionally, the unification of unusual tastes with the practicality of transportation has, in fact, resulted in increased demand in urban and semi-urban areas, thus creating a broader consumer base.

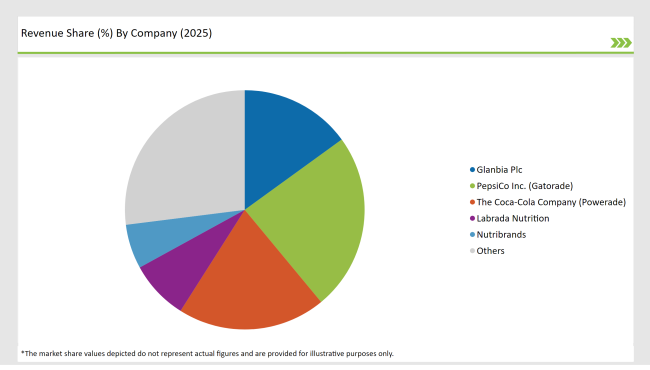

2025 Market share of Latin America Sports Nutrition Manufacturers

Note: above chart is indicative in nature

The Latin America sports nutrition market shows moderate consolidation with leading players like Integralmédica, Probiótica, and PepsiCo (Gatorade), who owe their market dominance to wide distribution networks, great product portfolios, and innovative marketing strategies.

These corporations exploit their research and sales channels to expand through localizing products affinities to regional tastes, like a protein shake with a flavor of açaí. On the other hand, multinational companies such as Glanbia and Labrada Nutrition are emphasizing premium and performance-driven products, whereas regional players such as Max Titanium are offering low-budget solutions to price-sensitive customers.

The market is further fueled by the entry of smaller brands targeting niche segments such as plant-based proteins, and ready-to-drink (RTD) nutrition which is evolving with the preferences of health-conscious buyers.

The Latin America sports nutrition market is projected to grow at a CAGR of 12.7% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 7,429.8 million.

By incorporating regionally inspired flavors such as açaí, tamarind, horchata, and chocolate abuelita, companies are making protein powders, bars, and ready-to-drink (RTD) shakes more appealing to consumers.

Mexico and Brazil are key regions with high consumption rates in the in the Latin America sports nutrition market.

Leading manufacturers include Glanbia Plc, PepsiCo Inc. (Gatorade), The Coca-Cola Company (Powerade), Labrada Nutrition, and Nutribrands.

B2B

As per Ingredient Type, the industry has been categorized into Plant-derived Ingredient (Soy Protein, Rice Protein, Pea Protein, Potato Protein), Animal-derived Ingredient (Creatine, Milk Protein, Whey Protein Concentrates, Casein, BCAA (Branded Chain Amino Acid), and Blends

As per Nature, the industry has been categorized into Organic and Conventional.

B2C

As per Function, the industry has been categorized into Energizing Products, Rehydration, Pre-Workout, Recovery, and Weight Management.

As per Product Form, the industry has been categorized into Ready-to-drink, Energy & Protein Bar, Powder, and Tablets/Capsules.

As per Flavour, the industry has been categorized into Regular, Flavored (Fruit Punch, Berries, Citrus, Chocolate, Vanilla, and Others).

As per Sales Channel, the industry has been categorized into Modern Trade, Convenience Store, Specialty Store, Pharmacy Store, Online Retail, and Other Sales Channel.

As per Price Range, the industry has been categorized into Economic and Premium.

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.