The Latin America probiotic ingredients market is set to grow from an estimated USD 405.0 million in 2025 to USD 799.6 million by 2035, with a compound annual growth rate (CAGR) of 7.0% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 405.0 million |

| Projected Latin America Value (2035F) | USD 799.6 million |

| Value-based CAGR (2025 to 2035) | 7.0% |

Functional foods and beverages are becoming more popular among Latin American consumers as tools to help them improve general health and wellness, particularly in the wake of the COVID-19 pandemic. Products that are enriched with probiotics such as probiotic dairy drinks, alternative milk, and functional juices are in demand.

The presence of Lactobacillus and Bifidobacterium probiotics such as these, which are sometimes consumed to benefit digestive health, immunity and gut microbiota balance, fuel the increasing popularity of the drinks with fortifying properties in the area.

Brazil, Mexico, and Argentina have become the seeds of the probiotic market growth, so they are actively promoting this by formulating precise regulation for probiotic components in foods and drinks. These rules are based on food safety laws, thus, they guarantee that the product is safe and of high quality, which in turn, affects the trust of consumers.

When probiotic strains are regulated well, they are set to international standards which bring a permanent framework for the producers and, thus, improve product reliability on the market.

Explore FMI!

Book a free demo

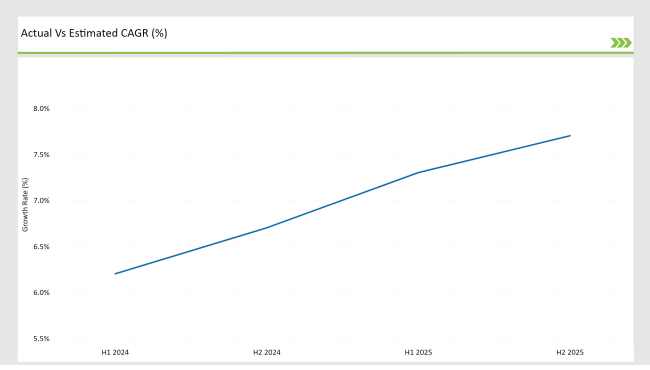

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Latin America probiotic ingredients market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin America probiotic ingredients market, the is predicted to grow at a CAGR of 6.2% during the first half of 2024, with an increase to 6.7% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 7.3% in H1 and is expected to rise to 7.7% in H2.

This pattern reveals a decrease of 18 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 22 basis points in the second half of 2025 compared to the second half of 2024.

Probiotics for Infants: Promoting Gut Health and Immunity from the Start

Increased attention to baby and infant nutrition in Latin America has brought about an increase in demand for probiotics in baby foods, infant formulas, and supplements. Probiotics like Lactobacillus are now more commonly infused in these foods to improve gut health, the brain's most important connection to the immune system and the best digestion. Probiotic-enriched formulas take the lead by microbiota balance, thus, gastrointestinal problems, colic, and allergies are the greatest risks among the young children.

The ongoing trend among more parents in Latin America to choose natural and health-centered alternatives for their children has a positive effect on the growth of infant nutrition with probiotic bases which also strengthen the market for probiotics in the region.

Technological Advancements in Probiotic Delivery Formats

A major transformation in the market of ingredients is being witnessed through the rise of the probiotic delivery methods such as stick packs, chewables and gels. These formats answer to the propensity of the consumer to opt for more than convenient portable and easy to consume products that trigger digestive health and immunity problems.

Younger customers and busy professionals are the most attracted by the solutions that probiotics which could be carried along on the move offer, because they provide a fast and trouble-free way to integrate the support of the gut into their routines.

The use of chewable tablets and gels has also risen mainly because they are more acceptable to both children and grownups. This new delivery system of probiotics not only enhances user compliance but also promotes the expansion of the probiotics market throughout Latin America.

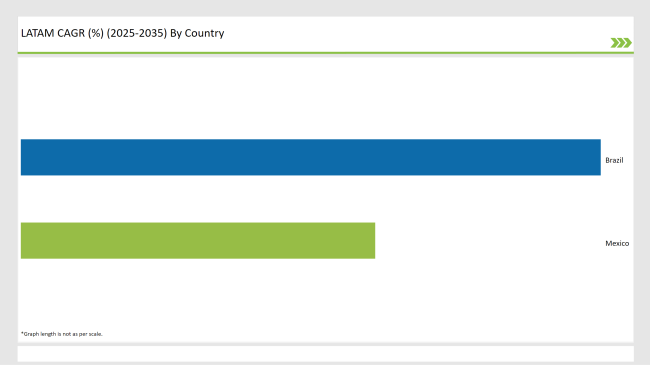

The following table shows the estimated growth rates of the top two markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

Brazil's ANVISA (National Health Surveillance Agency) has become the cornerstone in the current probiotic market by the transparent and straightforward guidelines it offers for the use of probiotic ingredients in food and dietary supplements.

It is because of these regulations that the quality, efficacy, and safety of products are maintained; thus, they all contribute to the fact that consumers' confidence in the product is not only reinforced but also the market environment is made more stable.

Consequently, probiotic companies in Brazil are allowed to put into their products the approved probiotic strains with the conviction that it is in accordance with the directives set by their health authority. The clarity in the regulations regarding the use of specific probiotic strains is ascribed to the rise of probiotic-based food products in Brazil and is an additional factor to the food demand for functional products.

The Mexican dairy sector is advancing noticeably, because of products such as yogurts, dairy drinks, and fermented foods, which are increasingly combinations with probiotics for more and better health benefits. The most representative example of the probiotics is Lactobacillus and Bifidobacterium, which are being used in functional dairy products to improve gut flora and strengthen immunity.

An additional point is the increase in the demand for plant-based and non-dairy alternatives as more consumers like the lactose-free and vegan options. Probiotics have now found a way to be included in products like plant-based milks, cheese substitutes, and vegan snacks, thus imitating the health benefits of traditional dairy products, and so they are once more the reason for the growth of the market for probiotic ingredients.

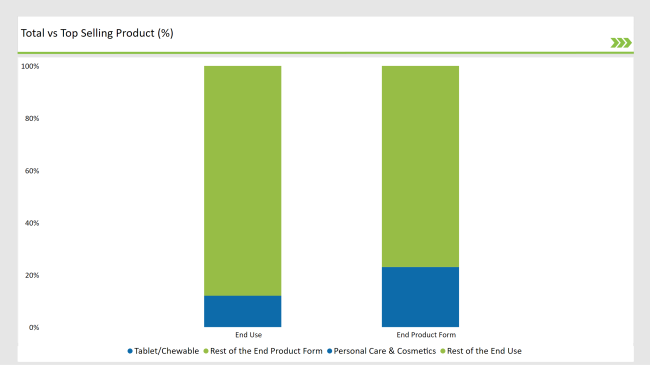

% share of Individual categories by End Use and End Product Form in 2025

The inclusion of probiotic ingredients in the formulations has become a necessity in Latin America, where the search for effective anti-aging skincare products is going on. Probiotics, for example, Lactobacillus and Bifidobacterium, are very familiar and have a high reputation for their ability to assist collagen production, enhance the elasticity of the skin, and also, help the healing of the skin.

Thus, the demand for probiotic-infused lotions, serums, and cleansers which are not only to protect but also nourish the skin, while visible signs of aging like fine lines and wrinkles have been addressed has increased tremendously. At the same time, the regulatory boost for probiotics in personal care and cosmetics is expanding.

With the acknowledgment of probiotic ingredients' natural origins and being safe for consumers, the administrations in Latin America are coming up with clearer rules that will push the trust of consumers. The regulations sanction the infusion of probiotics in skincare only if certain safety and efficacy standards are met, thus encouraging wider consumer acceptance.

The increasing requirement for the chewable and tablet forms of probiotics in the region of Latin America is because of their easy and convenient consumption. These formats are being popularized due to the busy timetable of city dwellers and office goers which makes it easy for people on the move to take care of their stomach health.

Unlike liquids or powders these forms of probiotics do not use water or refrigeration hence they are ideal for consumers who want to avoid complicated procedures when taking probiotics. Chewable types are especially attractive to children and to those who have trouble swallowing tablets thus making them a flexible option to a wider public.

The rise of the online pharmacies and e-commerce has also been a big factor in the distribution of tablet and chewable probiotics. As more buyers are demanding the convenience and ease of purchasing, these products are made unavailable in educational and retail environments, especially among millennials and youth adults who put convenience and quality of product first.

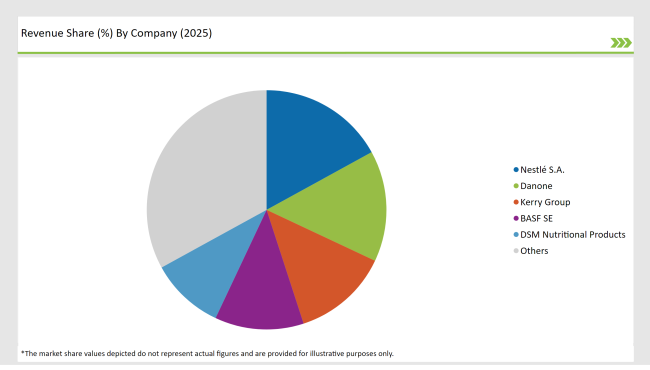

2025 Market share of Latin America Probiotic Ingredients Manufacturers

Note: above chart is indicative in nature

The Latin American probiotic ingredient market is showing a trend towards moderate consolidation with the primary firms who assert their dominance in this field namely Nestlé, Danone, and Chr. Hansen. These combinations make use of their intellectual property by acquiring developmental projects that amount to the highest of the stake.

At the same time, their work on innovations in probiotic formulations, alongside the expansion of food products that include probiotics, keeps them abreast of the growing needs of consumers regarding gut health and immune support.

Furthermore, regionally, the Yakult and Probi AB also deal with special requests by supplying specific probiotics for dairy products, beverages, and dietary supplements, which are the factors that shape the market.

The Latin America probiotic ingredients market is projected to grow at a CAGR of 7.0% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 799.6 million.

Governments in Brazil, Mexico, and Argentina are actively fostering the growth of the probiotic market by establishing clear regulations for probiotic ingredients in foods and beverages.

Leading manufacturers Nestlé S.A, Danone, Kerry Group, BASF SE, and DSM Nutritional Products.

As per Product Type, the industry has been categorized into Bacterial (Lactobacillus, Bacillus, Enterococcus, Bifidobacterium, Streptococcus, Others) and Yeast (Saccharomyces Cerevisiae, Saccharomyces Boulardii.

As per End Use, the industry has been categorized into Food & Beverages Processing (Bakery & Confectionery, Breakfast Solutions, Cultured Dairy Products, Ice Cream & Frozen Desserts, Snacks & Bars, Infant Nutrition, Beverages & Dairy Drinks), Dietary Supplements (Immune Health, Gut & Digestive Health, Women's Health), Personal Care & Cosmetics and Animal Feed.

As per End Product Form, the industry has been categorized into Powder, Suspension, Granule, Capsule, Stick Pack, Tablet/Chewable, and Gel.

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Comprehensive Analysis of Pet Dietary Supplement Market by Pet Type, by Product Type, By Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.