The Latin America Prenatal Vitamin Supplement market is projected to be valued at USD 50.73 million in 2025. It is expected to reach USD 102.24 million by 2035, expanding at a CAGR of 7.3% over the forecast period.

| Attributes | Description |

|---|---|

| Estimated Latin America Prenatal Vitamin Supplement Market Size (2025E) | USD 50.73 million |

| Projected Latin America Prenatal Vitamin Supplement Market Value (2035F) | USD 102.24 million |

| Value-based CAGR (2025 to 2035) | 7.3% |

The market concentration is still stable, as several main actors are strengthening their market positions through capacity expansions, product innovations, and strategic distribution partnerships.

The manufacturers are making a fast move to implement the increase in production capacities to satisfy the rising demand. They ensure the availability of products in retail and e-commerce channels by following this path.

In addition, many of them are diversifying their product lines with special offerings such as enrichments of iron, additive folic acid, and vegetable sugars to fulfill particular customer requirements. The market is seeing a transition from synthetic to organic and natural ingredients, as more and more health-conscious consumers are asking for products with clean labels, non-GMO, and plant-based options.

To increase their share in the market, the firms are mainly channeling their resources into research and development. They aim to introduce advanced prenatal formulas that are characterized by higher bioavailability and better absorption.

Furthermore, the brands are making marketing campaigns relevant by focusing on digital interactions, influencer collaborations, and endorsement by health professionals. The increase in private labels at supermarkets and pharmacies has also led to escalating competition by making available budget-friendly options next to premium ones. The mentioned factors allow us to conclude that the market is dynamic and possesses the potential for continuous growth in the near future.

Explore FMI!

Book a free demo

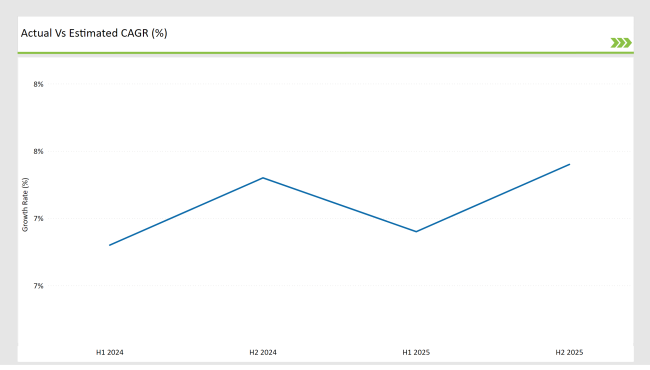

The table below provides a comprehensive comparison of the changes in compound annual growth rates (CAGR) over six months in the base year (2024) and the present year (2025), specifically for the Latin America Prenatal Vitamin Supplement market.

This half-year analysis illustrates some critical changes in the market and outlines revenue realization patterns that give stakeholders a clearer understanding of the growth trajectory in the year. The first half of the year, H1, includes January to June, while the second half, H2, includes July to December.

H1 signifies the period from January to June, H2 signifies the period from July to December.

For the Latin America Prenatal Vitamin Supplement market, the sector is estimated to attain a CAGR of 6.8% during the first half of 2024 to 2034 and 7.3% growth in the second half of the same year.

According to the predictions for 2025 to 2035, the growth rate is expected to hit 6.9% in H1 and then 7.4% further in H2. This increase is driven by the growing need for prenatal health solutions, the movement toward natural ingredients, and the expansion of distribution networks.

Competitive Pricing Strategies to Increase Possibilities

The Latin America Prenatal Vitamin Supplement market is seeing substantial price differentiation for premium, organic, and conventional products. The well-established brands are strategically utilizing their strength in launching cost-effective product lines to face the competition with local and private-label brands, thus increasing their accessibility among a wider range of consumers.

Regular pastas always have competitive prices; however, organic and specialized formulations will be more expensive because of the abundance of requests for clean-label and plant-based ingredients. Furthermore, pricing models based on volume and bulk purchase incentives are being offered by big companies seeking to attract the attention of bargain-hunting consumers.

E-commerce has introduced subscription models for prenatal supplements, too, by which they manage to keep the price stable and ensure affordable options through long-term commitments. Altogether, the combination of these strategies leads to a flexible pricing environment, which in turn affects the buying behavior of the consumers across various income segments in Latin America.

Demand Grows for Ready-to-Consume Prenatal Nutrition

There is an observable shift of consumers in Latin America who move towards the more convenient ready-to-eat supplements, like gummies, chewables, and liquids. This transformation is a result of fast urbanization, tougher lifestyle challenges, and the fact that some consumers have difficulties swallowing traditional tablets or capsules.

Compared to other methods of supplementation, ready-to-eat fetal vitamins are essentially better tasting, which is their main selling point with younger consumers and those who are pregnant for the first time.

Plus, fortified meal replacement shakes, which come with prenatal nutrients, are environments that are being adopted more widely; they are regarded as a substitute for the classical formats of supplements.

Producers are riding the wave of trend with the launch of new products that incorporate multiple essential ingredients in a more consumer-friendly form, like soft capsules or potentially even powder forms. This change fits with a larger trend towards functional and convenient nutrient consumption, thereby expanding the market for prenatal products in the Latin American area away from only pill-based ones.

Sustainability and Ethical Sourcing on the Rise

Sustainability and Ethical sourcing are becoming the critical differentiating factors in the Latin America Prenatal Vitamin Supplement market, as consumers are more interested in environmentally friendly and responsibly sourced products. The demand for plant-based and sustainably harvested omega-3 supplements is building, which is replacing fish oil-derived alternatives.

Manufacturers are looking for biodegradable or recyclable packaging as part of their strategy to target environment-conscious customers. Companies are increasingly adopting fair-labor practices and are using ingredients that are fair-trade-certified, such as organic folic acid and iron, which are proving to have a major impact on purchase decisions.

Transparency is joining the sustainability strategy, with companies promoting their initiatives through the footprint carbon labeling and ingredient traceability. Such shifts show a preference of encompassing more and more consumers for products that not only address health but also environmental and social issues, leading to a growing innovation in the industry for the sustainable development of prenatal supplements.

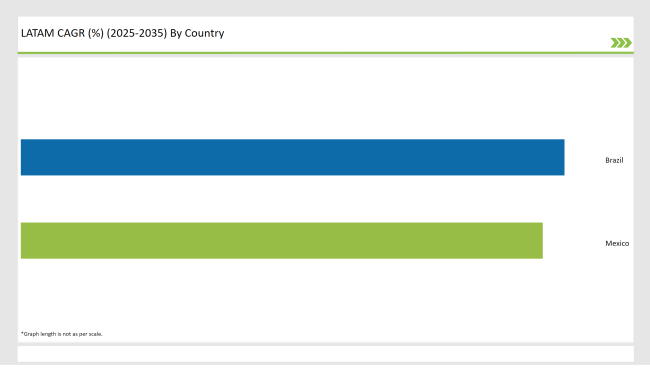

The prenatal vitamin supplement industry in Brazil is estimated to flourish with a compound annual growth rate (CAGR) of 7.5% from 2025 to 2035. This considerable growth is mainly attributed to the increase in knowledge of maternal health and prenatal nutrition treatment among pregnant women.

Government programs promoting maternal and child health have served as a major push for the demand for prenatal supplements. Furthermore, the rise of the middle class with increased disposable income has resulted in the greater allocation of resources to various health products, including the consumption of prenatal vitamins.

The broad distribution of products in both offline and online channels has facilitated the easy accessibility of prenatal vitamin supplements to customers, thus increasing the market. On top of that, the partnerships between healthcare givers and supplement producers to inform females about prenatal nutrition have had little effect on the market.

According to the DEA, the prenatal vitamin supplement market in Mexico is slated for growth with an estimated CAGR of 7.2% during the projection timeline. Changes in the country's healthcare infrastructure and a boost in the knowledge of prenatal care among the people have also had a very good effect on the market.

Government initiatives that are aimed at reducing the incidence of maternal and infant deaths have stressed the importance of using prenatal nutrition, which has consequently led to the rise in the use of prenatal supplements. The process of urbanization and the increase in the population are also a part of the problems related to environmental sustainability, creating a demand for portable and functional prenatal vitamins.

Moreover, both multinational companies and local businesses with a large product assortment have given customers a variety of possibilities to choose from, which can target different preferences and price brackets. The healthcare experts also have taken part in marketing campaigns that promoted the benefits of prenatal vitamins, and as a result, the market has grown well in Mexico.

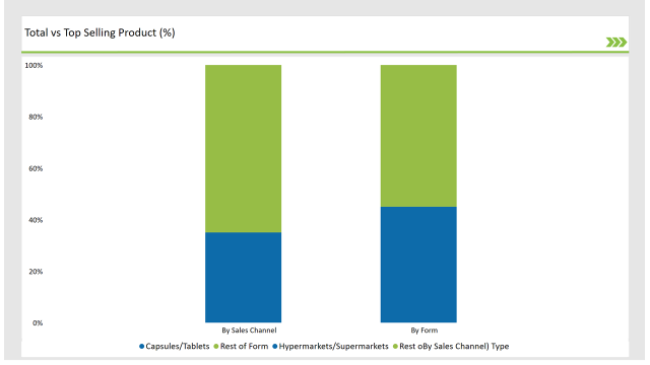

The main participants in the prenatal vitamins format in Latin America are still capsules and tablets, with a 45% share of total volume. Their position at the top of the market is mainly explained by the low price, best storage parameters, and long duration of shelf life as opposed to other forms like gummies or liquids.

Druggy providers tend to endorse capsules and tablets as they are the most precise and stable dosage forms, which are thus especially chosen during pregnancy. Thanks to the strengthened knowledge about maternal health and a greater number of prenatal care programs, pharmaceutical companies are turning to more advanced drug dosage formulations like time-release tablets for better nutrient absorption.

The trend of organic and plant-based tablets is also very popular in the market, leading some brands to offer vegetarian and no-GMO options. The slow and steady growth of the capsules and tablets segment in Latin America is likely to be sustained as the healthcare sector keeps developing, especially in Brazil and Mexico.

Hypermarkets and supermarkets are the biggest market channels (35%) for prenatal vitamin supplements in the USA. This issue is strong under-belt retail outlets in the region that help consumers reach a large variety of prenatal supplements easily.

People like these stores for discount offers, the ability to compare the products more easily, and the sense of product authenticity. Several companies join forces with leading retail chains to ensure product visibility and improve distribution reach.

The buildup of private label prenatal supplements in supermarkets is also an element that plays a role in the market's expansion, as it introduces cheaper alternatives to branded products. The urbanization of Latin America and the resultant increase in disposable income have led to a greater presence of hoards of traffic in modern retail establishments. Therefore, it has further pushed sales growth in this segment.

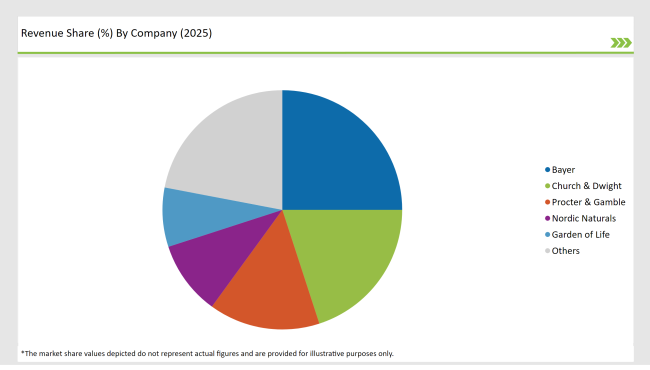

2025 Market share of Latin America Prenatal Vitamin Supplement manufacturers

Note: The above chart is indicative

The Latin American prenatal vitamin supplement market is extremely competitive, being an arena where there is a mixture of multinational corporations and regional players. Bayer, Church & Dwight, Procter & Gamble, and Nordic Naturals combine to hold considerable market share and may do this thanks to factors like strong brand presence, financial power, and wide distribution networks.

Bayer is the frontrunner in the segment due to its published studies, which support works on the professional prenatal formula, followed by Church & Dwight, which has been recognized as the company emphasizing a variety of supplements.

Procter & Gamble prioritizes its research on new technologies, especially concerning the release of nutrients that the body does not need to absorb. At the same time, Nordic Naturals is a leader in the premium prenatal omega-3 segment.

Even though international ones dominate the leading companies, the local producers are successfully setting themselves apart with specific market segment products that focus on being economical and are tailored to the local market; an example of such products would be plant-based and organic supplements.

Another factor that alters the competitive landscape is the rise in e-commerce sales, the extension of private-label brand products, and customers' choice of environment-friendly and ethically sourced ingredients.

The market is foreseen to keep on changing with the introduction of even more innovative products, the forming of new strategic partnerships, and the entrance into the Latin American market by companies that were not there before due to broader accessibility.

The market is projected to grow at a CAGR of 7.3% during the forecast period.

The market is expected to reach USD 102.24 million by 2035.

Gummies in the form segment is anticipated to grow the fastest due to increasing consumer preference for convenient and easy-to-consume supplements.

Rising awareness of maternal health, increasing demand for organic and plant-based supplements, and expanding retail and e-commerce channels are key growth drivers.

Major players include Bayer, Church & Dwight, Procter & Gamble, Nordic Naturals, and Garden of Life among others.

The market is segmented into capsules/tablets, gummies, powders, liquids, and others.

The market is divided into online, drug stores and pharmacies, hospitals & clinics, hypermarkets/supermarkets, convenience stores, health and wellness stores, specialty stores, and departmental stores.

An Industry analysis has been carried out in key countries of Brazil, Mexico, and the Rest of Latin America.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.