The Latin America Potato Flakes sales is set to grow from an estimated USD 274.9 million in 2025 to USD 501.6 million by 2035, with a compound annual growth rate (CAGR) of 6.2% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 274.9 million |

| Projected Latin America Value (2035F) | USD 501.6 million |

| Value-based CAGR (2025 to 2035) | 6.2% |

The Latin America potato flakes industry a largely positive growth trajectory is expected to demonstrate from 2025 to 2035, due to the increased demand for convenience food, animal feed, and industrial applications as the main reasons.

Potato flakes are achieving very well in both households and foodservice sectors due to the rise of consumer preference for healthy, ready-to-eat, and easy-to-cook meals, instant mashed potatoes, and snacks. The growing numbers of companies that are producing these products are expected to contribute to the market expansion in Brazil, Mexico, and Argentina.

The animal feed segment is benefitting from the use of potato flake as a valuable ingredient since it is rich in carbohydrates, which helps to improve the nutrition of livestock. This area of livestock products is expected to be on the rise due to the growing livestock population and the changing demand for nutrition.

The industrial application of the potato flakes in the manufacture of packaging materials, adhesives, and biodegradable plastics is also anticipated to rise in the future due to the sustainability-related change over the global outlook.

Explore FMI!

Book a free demo

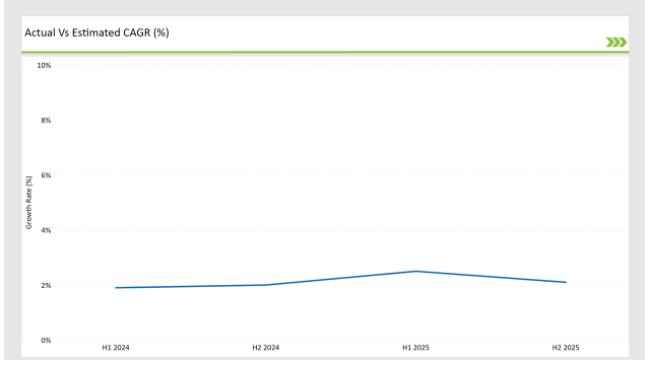

The table below reflects a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Latin American Potato Flakes market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 1.9% (2024 to 2034) |

| H2 2024 | 2.0% (2024 to 2034) |

| H1 2025 | 2.5% (2025 to 2035) |

| H2 2025 | 2.1% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

H1 refers to the phase from January to June, while H2 refers to the period from July to December. For the potato flakes market in Latin America, it is projected to grow at a CAGR of 1.4% in the first half of 2023, and subsequently, it will rise to 2.5% in the latter half of the same year. In 2024, the growth rate is expected to slightly decrease to 3.4% in H1 but then it is predicted to grow up to 4.5% in H2.

| Date | Development/M&A Activity & Details |

|---|---|

| 2019 | McCain Foods, a global leader in frozen french fries and potato specialties, has announced the acquisition of a 70% stake in Sérya, a Brazilian food company in 2019. And recently completed the process for this |

| 2021 | McCain Foods announces a USD 100 million investment in its first French fry factory in Brazil. |

Demand for Convenience Foods Surging

Urban population growth in Latin America has been dramatically accelerating the transition to the popular fast foods that are easy and quick meal solutions. A constantly busy lifestyle, broadly talking about workers and parents, has been one of the crucial drivers for products like instant mashed potatoes that are both needing and quick to cook.

Potato flakes are regarded as a solution with the right aspect since they have the ability to store for a long time as well as to be cooked easily of which one main thing is multiplicity. Besides, these can serve in various snacks, soups, and baked goods. This convenience aspect strongly drives the market in Brazil, Mexico, and Argentina which has the quickest growth in convenience food consumption.

Health and Wellness Trends

The healthy choice of food for the consumer is increasingly becoming the trend in the food sector in Latin America. Consumers are becoming more educated on how green and healthy diets are important and that is why the demand for organic, gluten-free, and low-sodium potato flakes is increasing. Potato flakes are being marketed as a healthy ingredient for meals, as they are aligned with the trend of clean-labels that have a strong foothold in the market.

The issue regarding source sustainability and transparency is contributing to the emergence of organic and eco-friendly potato flakes. Manufacturers are the main ones innovating through developing products that correlate with health and wellness trends thereby promoting the market for potato flakes further.

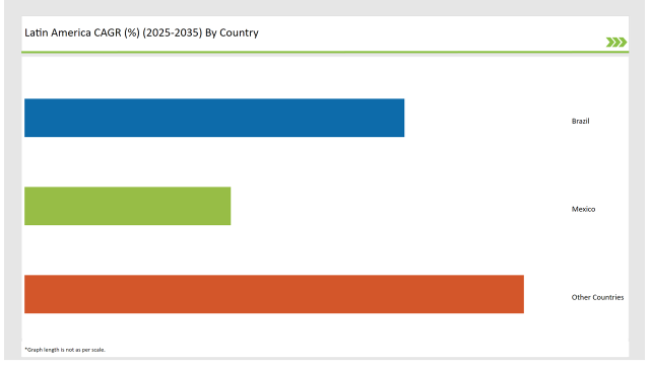

The following table displays the estimated growth rates of the key countries during the coming years. The four markets are identified as having high consumption and are thus considered the main contributors to the overall CAGR in the segment through 2035.

| Countries | Market Share (%) |

|---|---|

| Brazil | 35% |

| Mexico | 19% |

| Other Countries | 46% |

Brazil has topped the Latin American potato flakes market with a market share of 35%. The driving factor behind that is the booming food processing sector through the fast-growing consumer demand for processed and convenience foods.

In addition, the advancing greater demand for potato flakes of higher quality and fewer costs from products such as instant potato, snack foods, pre-packaged meals, and other ready-to-eat foods are being introduced on the market.

At the same time, Brazil’s large-scale agricultural activities will guarantee the supply of potatoes which in turn will facilitate the production and subsequently will drive potato flakes to the end-user market. The above discords indicate that, Brazil will keep its status as a major potato flakes hub in the region.

Mexico, with a 19% market share in the potato flakes industry, is witnessing a huge growth in its retail sector, especially in urban areas. The supermarkets, hypermarkets, and the convenience stores are seeing an increase in the sale of processed potato products. All these factors are driving the demand for potato flakes for use in both foodservice and household applications.

The retail sector is further propelled by quick meal solutions and processed snacks which have become more popular among the consumers, as they are looking for easy-to-prepare options. The rise in disposable income and the shift towards convenience foods are driving the retail sector in Mexico, thus, it is anticipated that the demand for potato flakes will witness a rising trend.

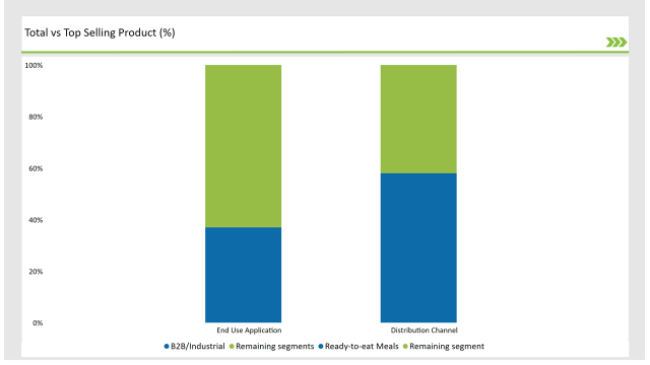

% share of Individual Categories a and End-Use Application in 2025

| Main Segment | Market Share (%) |

|---|---|

| Distribution Channel (B2B/Industrial | 58% |

| Remaining segments | 42% |

Dominance of the B2B/Industrial Distribution Channel

The B2B/industrial distribution channel holds the most significant share of 58% in the potato flakes market in Latin America. The strong trader is driven by the supplying demand from the main industry players, who are food manufacturers, foodservice, and snack companies needing bulk potato flakes for their production process.

The food processing sector has been on the rise, especially in Brazil and Mexico, where the food manufacturing and processing industries are booming. This ultimately leads to a strengthened B2B/industrial channel. Besides, as food manufacturers are inclining towards cost-effective and flexible ingredients like potato flakes to meet the retail and foodservice market demand the distribution channel would likely continue to be a key driver for market growth.

| Main Segment | Market Share (%) |

|---|---|

| End Use Application (Ready-to-eat Meals) | 37% |

| Remaining segments | 63% |

Rise of Ready-to-Eat Meals

The increasing demand for ready-to-eat meals is a significant driver for the potato flakes market, which accounts for 38% of the end-use application segment. Changing lifestyles, particularly among working professionals and urban dwellers, have led to a surge in demand for convenient, quick-to-prepare meal solutions.

Potato flakes are increasingly being used in the production of ready-to-eat meal products such as instant mashed potatoes, soups, and snacks, due to their ease of use, long shelf life, and nutritional value. As the preference for fast, convenient meals continues to rise across Latin America, this segment will drive continued demand for potato flakes.

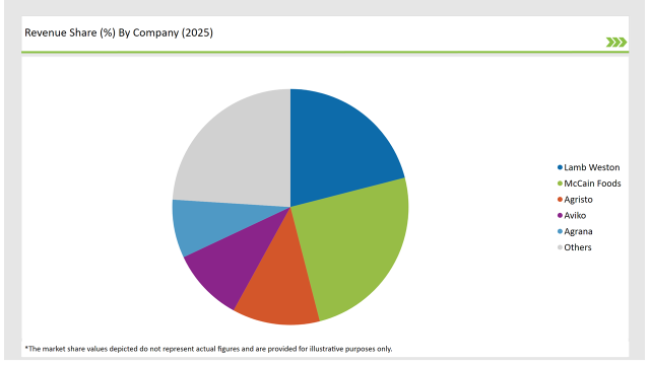

2025 Market share of Latin America Potato Flakes manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Lamb Weston | 21% |

| McCain Foods | 25% |

| Agristo | 12% |

| Aviko | 10% |

| Agrana | 8% |

| Others | 24% |

Note: The above chart is indicative in nature

The potato flakes market in Latin America is moderately concentrated, with a mix of global food processing giants and regional manufacturers competing for market share. The industry is driven by the increasing demand from the food processing sector, foodservice providers, and retail consumers, with the B2B/industrial segment accounting for 58% of the distribution share.

While multinational players dominate due to their advanced production capabilities and extensive distribution networks, local manufacturers compete by offering cost-effective and regionally tailored products.

Key players in the market include McCain Foods, which has expanded its presence in Latin America through its recent acquisition of a majority stake in Sérya, Brazil. Other major companies such as Lamb Weston Holdings, Idahoan Foods, Emsland Group, and Agrarfrost GmbH supply potato flakes for various food applications. Nestlé S.A. also plays a significant role in the market, utilizing potato flakes in ready-to-eat meals and instant food products.

The competitive landscape is shaped by factors such as mergers, acquisitions, product innovation, and expansion strategies. To stay ahead, companies are focusing on sustainability, organic offerings, and improved processing technologies, catering to the evolving preferences of consumers and food manufacturers in the region.

The Latin America Potato Flakes market is projected to grow at a CAGR of 6.2% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 501.6 million.

The market is driven by the rising demand for convenience foods, the expansion of the food processing industry, and the increasing adoption of potato flakes in ready-to-eat meals, snacks, and instant foods. The B2B/industrial sector plays a major role, accounting for a 58% market share.

Brazil leads the market with a 30% share, followed by Mexico at 12%. The growing food manufacturing sector in Brazil and the expansion of retail and convenience food consumption in Mexico are key drivers.

Companies are increasingly focusing on sustainable sourcing, eco-friendly packaging, and organic potato flakes to meet consumer demand for healthier and more environmentally friendly products.

As per Form Type, the industry has been categorized into Standard Flakes, Mashed Potato Pellets, Powder/Granules, and Specialty Flakes.

As per End Use Application, the industry has been categorized into Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, and Others.

As per Distribution Channel, the industry has been categorized into B2B/Industrial, Wholesale, Retail, and Online.

As per Nature, the industry has been categorized into Conventional, and Organic.

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America

Fish Waste Management Market Analysis by Source and End Use Industry Through 2035

Kelp Protein Market Analysis by Form and End Use Through 2035

Fish Soup Market Analysis by Form, Format, Packaging and Sales Channel Through 2035

Fish Silage Market Analysis by Fish, Fish Type, Application and Form Through 2035

Fish Roe Enzymes and Extracts Market Analysis by Type, Source and Application Through 2035

Edible Seaweed Market Analysis by Product Type, End Use Application, Extraction Method and Form Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.