The Latin America Postbiotic Pet Food market is projected to be valued at USD 702.3 million in 2025 and is expected to reach USD 1,067.5 million by 2035, expanding at a CAGR of 5.2% over the forecast period.

The market demonstrates a high concentration that is becoming more and more while the warehouses are the ones. This happens because manufacturers are looking for the best possible way to get as far as possible in general and in terms of product alone, and this way, they are involved in product innovation, capacity expansion, and strategic partnerships.

Several manufacturers are ramping up their production capabilities in a bid to cater to the increasing demand faced by their customers for postbiotic-enriched pet food. Investments made in new processing technologies and special formulations are the driving forces behind an increase in product quality and a longer shelf life.

Moreover, organizations are proffering targeted nutrition to the United Nations through the addition of the postbiotics that promote the health of pets' digestion, immunity, etc.

| Attributes | Description |

|---|---|

| Estimated Latin America Postbiotic Pet Food Business Size (2025E) | USD 702.3 million |

| Projected Latin America Postbiotic Pet Food Business Value (2035F) | USD 1,067.5 million |

| Value-based CAGR (2025 to 2035) | 5.2% |

Natural and functional ingredients are preferred more and more, which is the reason for the transformation of the industry. Pet owners who are looking for gut-health-focused products that are scientifically supported are boosting the demand for postbiotic formulations.

In light of this, the manufacturers are integrating organic and clean-label ingredients as well as positioning their products as healthy alternatives to conventional pet food.

Furthermore, these companies conduct campaigns to promote the' benefits of postbiotics to build sickrom trust and loyalty. The sourcing strategies that are sustainable and the compliance with regulations give the market the further solidifying of the positions.

Explore FMI!

Book a free demo

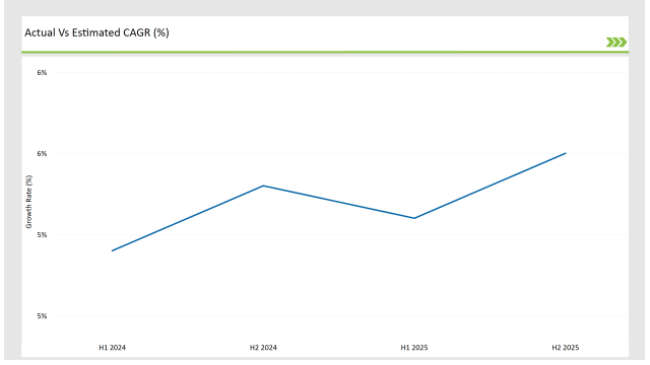

The table displays the comparative evaluation of the changes in the compound annual growth rate (CAGR) over six-month periods for the base year (2024) and the current year (2025) in the Latin America postbiotic pet food market.

This semi-annual evaluation concerns the key changes in market trends, revenue realization patterns, and the general growth trajectory of the market. The first half of the year (H1) is from January to June, while the second half (H2) is from July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

The Latin America postbiotic pet food market grew at a compound annual growth rate of 4.9% in the first half of 2024. This was the case in the first half of 2024 to 2034, but in the second half, the growth rate was at a 5.3% level due to the rise in consumer awareness and product availability.

The growth rate accelerated to 5.1% in H1 2025 to 2035, which was spurred on by an increase in production capacity and a higher adoption of postbiotics. The second half of 2025 to 2035 will contribute to an overall CAGR of 5.5%, as pet owners will go more often for functional ingredients that will provide better pet gut health which means market demand will further increase.

Improving Access with Competitive Pricing Strategies

The Latin American postbiotic pet food market is going through a price alteration where quickly organized products and conventional ones are making a difference. The small and well-established firms in the organized sector have the goal of the low price strategy, and they actively make postbiotic pets to be consumed by as many people as possible.

Marketing, bundling, and loyalty programs are the promotions that have been used a lot to encourage repeat purchases. On the other hand, typical economic products continue to be a budget-friendly choice, yet they have a market share ration that withers as pet owners are increasingly after the products with proven scientific support, i.e., necrofunctional ingredients.

Organic and natural ingredient-termed premium postbiotic pet foods appear to be acutely affected by the high manufacturing cost. Therefore, manufacturers are introducing mid-tier postbiotic products that could be both affordable and eco-friendly to the consumer.

The Shift toward Ready-to-Eat Postbiotic Pet Food

In Latin America, the converging trend of consumer preferences seems to be convenience-orientated, leading to a higher demand for ready-to-eat (RTE) postbiotic pet food. Many pet owners are now looking for feeding solutions that do not require any cooking while still providing a balanced diet.

Manufacturers are thus spurred by the trend to come up with RTE postbiotic pet food formats that can be easily served, such as preportioned meals and single-serve wash pouches. In addition, the food products are garnished with different proteins and functional ingredients, ensuring that pets get all the gut-health benefits.

The increase in the urban pet population alongside the increase in the working times of the household seems to be the engine for this demand. Hence, the brands are introducing both fresh and shelf-stable RTE alternatives that are integrated with new technology packaging for better prolonged storage and quality nutrition, which, again, in return, will up the market.

Deploying Regional Adaptation to Fortress Market Penetration

Latin America is a highly diversified region that has led to the implementation of regional adaptation strategies by manufacturers to the tastes and economic conditions of the respective localities. Sectors with a large middle-class budget have people buy posh postbiotic pet food products such as those being sold in Brazil and Mexico, while the less wealthy areas are promoted with budget-friendly brands.

Besides this, they are changing the recipes in line with the existing ingredients, therefore, including post-biotics and proteins from regional sources in such a way that they would not only mitigate costs but also promote the environment. Moreover, agreements with local schemes and animal doctors to boost the entrance in exchange for consumers' confidence will be put into effect.

Also due to the sucking pet food preference of cultures brands Joint Advertising will be done on the health advantages of postbiotics, so the path tunes to pet owner ask in every country in Latin America.

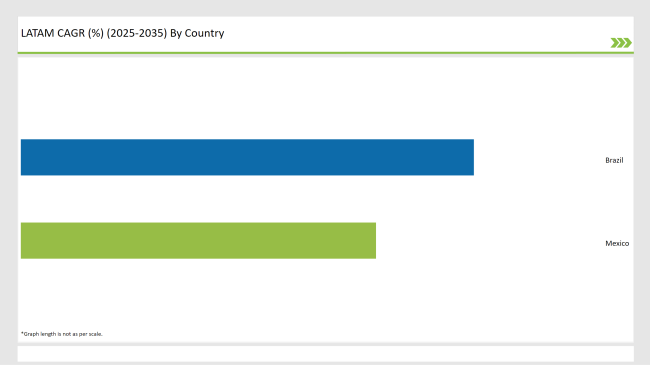

Brazil is a major player in the Latin American postbiotic pet food market, with an impressive CAGR of 12.5% between 2025 and 2035. The growth is primarily attributed to the increase in pet ownership and the trend of pet humanization that drives customers to premium health-oriented pet products.

With a higher disposable income and a growing middle-class population in the country, the situation has further been upgraded so that people can buy specialized pet products. Also, pet health and nutrition have become more educated, which has led to an increased demand for postbiotic-enriched pet foods, which are A SINCERELY POSITIVE.

Manufactured for BENEFITS. Gut health and immunity. Manufacturers are taking their chances by dedicating research and development to launching localized products that would be good for people, too.

The postbiotic pet food market in Mexico is seen growing at a CAGR of 9.8% through the same period. This scenario has been obtained as the country is witnessing urbanization and a high rise in pet adoptions, resulting in the need for nutritious air solutions.

The Mexican population is getting healthier regarding their pets, asking for pet food that gives benefits like improved digestion and other health issues. Also, the Western pet care trends that are on the loose and the presence of a huge variety of postbiotic consumer products in the market are boosting these figures, respectively.

Furthermore, strategic marketing campaigns are the high-profile companies that underscore the health of postbiotics, which entices these to Mexican pet owners.

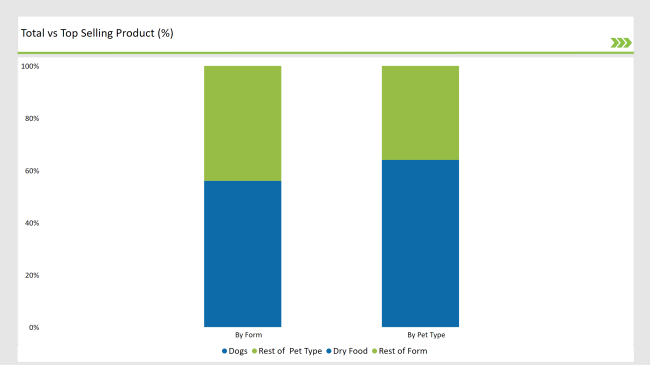

In the Latin American postbiotic pet food market, dogs are the most selling, accounting for 63.5% of the total market value in 2025. This is mainly because of the larger number of dog owners than other pets as well as the trend of increased humanization of dogs in the region.

Pet parents rank digestive health, immune system support, and overall wellness as the top priorities to take full advantage of postbiotic-enriched formulas. The preference for breed-specific, age-specific, and functional postbiotic dog food products continues to grow, with brands manufacturing tailored nutrition solutions for various dog breeds and stages of life.

Furthermore, dog owners also tend to consume premium pet food more and more frequently, which is why this segment is achieving better growth results. The promotion efforts by the leading companies and the availability of both online and specialty retail channels have also been instrumental in improving the accessibility and knowledge of postbiotic dog food items.

The most popular form of postbiotic pet food on the market is the dry one, which held 55.8% of the market share in 2025. The main reasons for this are the practicality, cheaper price, and the longer expiry period of dry food when compared to wet food and supplements. Dry postbiotic-infused products are very popular lately for their ease of handling, portion control, and oral hygiene improvements.

Along the same lines, companies are concentrating on enhancing the taste and nutritional value of their formulations by using high-quality proteins, natural fibers, and postbiotics that are beneficial for gut health. Additionally, this segment is catalyzed by the increasing range of high-quality kibbles that are grain-free and tailored to dietary restrictions.

Pet specialty stores and online platforms are the primary retail channels through which dry postbiotic pet food products, along with value-added features like customized nutrition and weight management formulas, are sold, and in this way, they further foster the segment expansion.

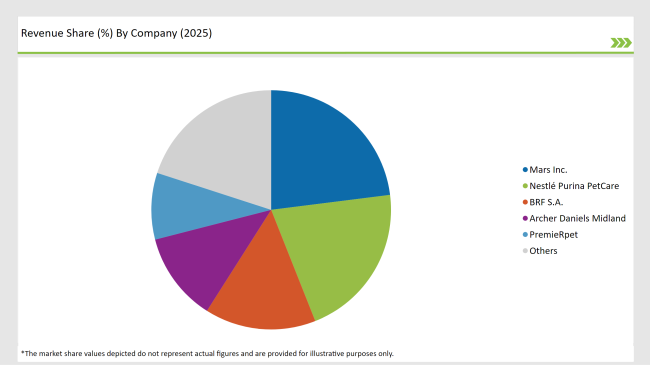

2025 Market share of Latin America Postbiotic Pet Food manufacturers

Note: The above chart is indicative in nature

The Latin American postbiotic pet food market is fiercely contended by both multinational corporations and regional players who all deserve a sale-worthy share. Nestlé Purina PetCare, Mars Inc., BRF Pet S.A., and Total Alimentos jointly control most of the market.

The tightest player in the marketplace is Nestlé Purina PetCare, which is dominating the sector with its extensive line of functional pet foods, including postbiotic-enriched formulations, that leverage its strong R&D resources.

Mars Inc. is the second one, which is investing in pet health close to them, at a slightly higher price for more premium quality that is focusing on digestive wellness. BRF Pet S.A. and Total Alimentos have cemented their positions via pipeline expansions, sourcing raw materials locally, and offering low-cost alternatives customized for the needs of Latin American pet owners.

While the big multinationals push the industry, regional firms such as Empresas Carozzi and Rações Primor have carved their niches in the market with locally adapted postbiotic pet food. Premiumization has been the driving factor for the overall market growth, along with the awareness of consumers for the pet gut health and the increase of retail distribution channels.

The Latin America postbiotic pet food market is projected to grow at a CAGR of 5.2% from 2025 to 2035, driven by increasing demand for digestive health solutions for pets.

The market is expected to reach approximately USD 1,067.5 million by 2035, up from its 2025 valuation, reflecting steady growth in consumer preference for functional pet foods.

By Form, the Dry Food segment is expected to grow the fastest due to its convenience, affordability, and rising demand for postbiotic-infused kibble for digestive health benefits.

Key factors include increasing pet humanization, rising awareness of pet gut health, growing disposable incomes, expanding retail distribution, and innovation in postbiotic formulations.

Leading companies include Mars Inc., Nestlé Purina PetCare, BRF S.A., Archer Daniels Midland, and PremieRpet, which hold a significant market share through product innovation and strong distribution networks.

The market is segmented into dogs, cats, and other pets.

Pet food is categorized into dry food, wet food, and treats & supplements.

The market is divided into pet specialty stores, online retail, veterinary clinics, and supermarkets/hypermarkets.

An Industry analysis has been carried out in key countries of Brazil, Mexico, and the Rest of Latin America.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.