The global Latin America Plant-Based Preservatives Market is projected to be valued at USD 840.8 million in 2025 and is expected to reach USD 897.13 million by 2035, expanding at a CAGR of 6.7% over the forecast period.

| Attributes | Description |

|---|---|

| Estimated Latin America Plant-Based Preservatives Business Size (2025E) | USD 840.8 million |

| Projected Latin America Plant-Based Preservatives Business Value (2035F) | USD 897.13 million |

| Value-based CAGR (2025 to 2035) | 6.7% |

The market is becoming more and more concentrated as manufacturers of various products are implementing different strategies to expand their market share through product innovation, capacity growth, and the integration of stronger supply chains.

To respond to the growing demand, several manufacturers in Latin America are boosting their production capabilities, whereby they will be increasingly involved in the augmentation of extraction and processing facilities for plant-based preservatives derived from herbs, fruits, and essential oils.

At the same time, companies are engaging in research and development to bring into the market multi-functional preservatives that will be able to prolong the shelf life of food without compromising its quality.

Also, the trend of using clean-label and natural ingredients is a further cause of the rush for plant-based preservatives. Consumers have shown signs of increasing interest in the alternatives that are free from chemicals, which has led companies to the need to be more open and honest in their labeling and source sustainable raw materials.

Aside from that, in the course of time manufacturers are switching from conventional practices and are cooperating with the food and beverage industry to incorporate the use of plant-based preservatives in more products like dairy alternatives, baked goods, and ready-to-eat meals.

The combination of the already high level of customer consciousness and the advancement in the law underwriting natural additives really sets up the stage for the further growh of the market in this domain.

Explore FMI!

Book a free demo

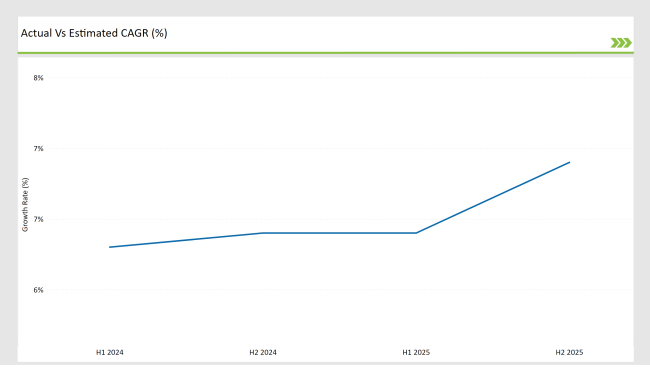

The table below provides a comparative assessment of the compound annual growth rate (CAGR) changes over six-month periods for the base year (2024) and the current year (2025) in the Latin America Plant-Based Preservatives Market. This analysis helps stakeholders understand market fluctuations, revenue realization trends, and overall growth trajectory. The first half (H1) covers January to June, while the second half (H2) spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

The Latin America Plant-Based Preservatives Market was able to witness stable growth in 2023, with a shift from 6.3% in H1 to 6.4% in H2. In 2024, H1 & H2 are projected to report a further increase in the CAGR of the market by 6.4% & 6.9%. This is a result of the rising consumer interest in the natural methods of food preservation, the legislation support for the clean-label products, and the inflow of money into the construction of new facilities.

Firms are stepping up their R&D to increase the efficacy of the plant-based preservatives and spread their use in the food and beverage sector. The upward trend is a recommendation for the additional expansion of the market by the introduction of innovative green solutions and the changing of traditional methods of food preservation.

Pricing Dynamics of Organized vs. Conventional Products

The backdrop of pricing change for natural preservatives in Latin America is the quest for natural and clean-label products by the end-users. Organized players that run on the latest processing technologies and the most efficient supply chains can offer lower-cost product solutions which help in making plant-based preservatives widely popular. On the contrary, conventional products that are mostly sourced from local markets with relatively fewer regulations are cheaper and, therefore, inhibit the advancement of price-sensitive consumers.

It should be noted that the premium pricing of plant-based preservatives is becoming more of a norm as production begets scale. Further, the applications in the dairy alternative and plant-based meat markets have distinct pricing details.

The organic food preservation sector drives price premiums, whereas bakery and beverages outlets benefit from more competitive pricing for bulk sales. The pointed shift in the market denotes that a change in the price gap between the organized and conventional products is about to happen that will boost the consumer switching.

The Trend Towards Ready-to-Eat Products (RTE)

The rise of busy urban lifestyles in Latin America is fuelling the demand for ready-to-eat (RTE products, thus increasing the need for plant-based preservatives. Consumers are actively looking for natural substitutes for synthetic preservatives in packaged meals, snacks, and drinks.

The health-conscious trend and food safety concerns are forcing the manufacturers to refocus their RTE offerings to plant-based solutions that are like rosemary extracts, antioxidants from citrus, and fermented ingredients. The shift is particularly noticeable in big cities where the consumer wants practicality and a clean-label view during purchasing.

Consequently, the producers have to change their methods of preservation for the sake of extending the shelf life while keeping the product fresh. Now, as the plant-based preservatives come in both a regulatory and consumer-preferred natural, sustainable food preservation form, they are set to play a crucial role in the growth of the sector.

Sustainability and Ethical Sourcing as a Competitive Edge

Sustainability is becoming a major driver in the Latin America Plant-Based Preservatives Market with the emphasis manufacturers are putting on ethical sourcing and environmentally friendly production practices.

The companies are investing in the creation of traceability out of their supply chains with the intention that their plant-based ingredients, for example, herbal extracts and essential oils, would, in turn, be sourced responsibly.

Initiatives on ethical sourcing, like fair trade partnerships and sustainable farming programs, are also affecting the brand image positively and ensure that the consumers will trust them. Furthermore, the return of packaging is also playing a role by bringing biodegradable and recyclable solutions that are in line with the needs of environmentally conscious consumers.

Manufacturers that take the right steps in the area of sustainability will not only ride the wave but also companies that interleave ethical sourcing and stylish products. This move is encouraged furthermore by government policy and corporate agreements to reduce carbon footprints in the food industry.

Brazil is the top plant-based preservative market in Latin America, with a significant CAGR of 7.2% from 2025 to 2035. This rise can be attributed to the growing food and beverage industry, which directly benefits from the acceptance of natural face additives that the end consumers want in clean-label products.

Fostering local production and innovation, Brazil's biodiversity is full of native plants that its people can collect and use to produce natural preservatives. The government is at the forefront of supporting organic agriculture and the use of natural ingredients, which are the main drivers of this market.

The food framework for the country's trading and innovation also leads to the adoption of green alternatives by the local manufacturers of plastics. More and more Brazilian consumers are giving up products with synthetic additives in favor of plant-based preservatives, which they use now in a variety of food sectors.

Mexico's predicted growth in the area of plant-based preservatives is remarkable; the CAGR of 6.8% through 2025 to 2035 makes it possible. The mainstay of the food processing industry is following the path of sustainability using methods of preservation that do not harm the environment. Traditional Mexican cuisine that contains spices and plant extracts provides a basis for the acceptance of plant-based preservatives.

Along with the great geographic location, the country enjoys a strong legal framework with a wide range of trade agreements that enable natural preservative companies to penetrate the North American markets easily and that, in turn, encourage local manufacturers to switch to more plant-based ingredients. The government supports the market with its initiative to reduce the use of chemical additives, while the consumers are happy to adopt the situation.

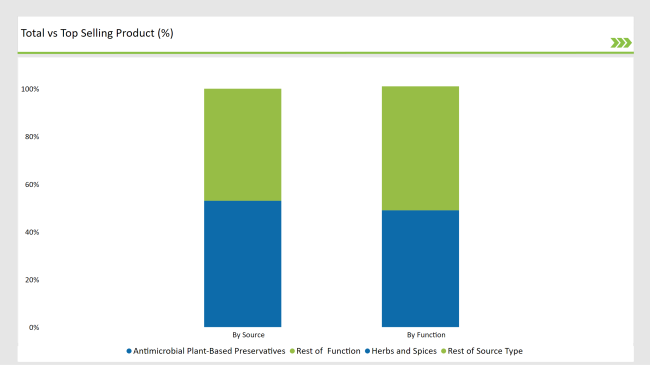

In terms of function, antimicrobial plant-based preservatives control the segment, with a market share of approximately 48.5% in 2025. The increased focus on food safety and longer shelf lives, particularly in meat, dairy, and ready-to-eat products, is driving demand for antimicrobial solutions.

Consumers in Latin America have been increasingly aware of the dangers posed by chemical additives, thereby making food producers recompose their goods to incorporate plant-derived antimicrobials such as rosemary extracts, citrus bioflavonoids, and oregano oil.

In addition, the promotion of environmentally friendly methods of food preservation is the reason for the innovations in this segment. As the worries of bacterial contamination and spoilage are rising, the choice of antimicrobial plant-based preservatives among varied food categories is also increasing, ensuring both product quality and adherence to health regulations.

The main category under the source of herbs and spices is leading with 55.2% in the market potentially to be reached in 2025. Traditional Latin American cuisine is rich in herbs such as thyme, oregano, and basil, which are therefore naturally accepted as preservatives in local food processing.

These plant-based preservatives not only prolong shelf life but also add taste and nutrients to food products. A considerable part of the demand goes to the preservation of meat, bakery, and snack foods where herbs play a dual role of both antioxidants and antimicrobials.

On top of that, the environmental movement is pushing manufacturers to mix in more herbal extracts in their recipes apart from growing the desire for organic and non-GMO products. This is because companies are embarking on the path of sustainability by ethically sourcing herbs.

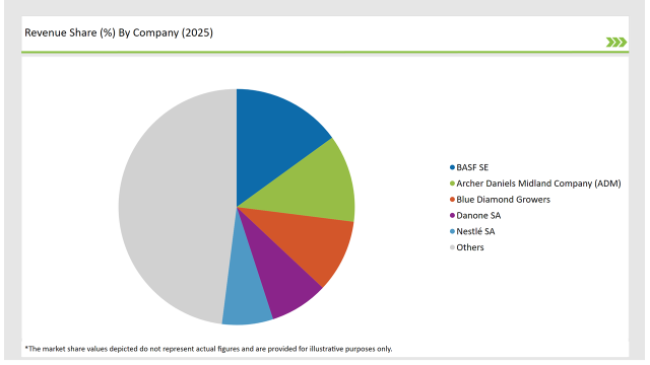

2025 Market share of Latin America Plant-Based Preservatives manufacturers

Note: The above chart is indicative in nature

The Latin American market for plant-based preservatives is highly competitive, characterized by the presence of both multinational and regional players battling for a share of the market. Companies such as BASF SE, Archer Daniels Midland Company (ADM), and Albemarle Corporation have significant positions in the market, supporting their strong product portfolios and vast distribution channels.

For instance, BASF SE drew on its chemical expertise to create unique plant-based preservative solutions, thus responding to the fast-growing market for natural additives. Likewise, because of focusing on the sustainable and plant-derived era, ADM has established itself in the market.

The food and beverage industry has seen the involvement of big players like Danone SA and Nestlé SA pushing plant-based preservatives into their product lines, keeping in line with their customers' requests for clean labels and natural products.

The introduction of plant-based ingredients in Danone's production is the result of the company's commitment to health and sustainability while incorporating those elements across the board. Nestlé's invention of plant-based food staples demonstrates the turn of the industry in the direction of natural preventive techniques.

In addition to that, local companies also play a significant part not only by providing culturally acceptable solutions for the customers but also through low-cost products addressing specific consumer wants in Latin America.

The combination of global and local players creates an active market where competitors spur on each other with innovation, and thus they successfully satisfy the wide-ranging demands of health-conscious consumers.

The market is anticipated to grow at a CAGR of approximately 6.7% over the forecast period.

While specific figures for Latin America are not provided, the global plant-based preservatives market is projected to reach USD 897.13 million by 2035.

The antimicrobial plant-based preservatives segment is expected to witness significant growth due to increasing demand for natural food preservation methods.

Factors include rising consumer preference for natural and clean-label products, health consciousness, and regulatory support for natural additives.

Major players include BASF SE, Archer Daniels Midland Company (ADM), Blue Diamond Growers, Danone SA, and Nestlé SA.

The market is segmented into antimicrobial plant-based preservatives, antioxidants plant-based preservatives, and plant-based food preservatives for other functions.

This segment includes herbs and spices, and fruit juices.

Applications encompass seafood, meat & poultry, bakery products, dairy products, snacks, beverages, fruits & vegetables, and other applications.

An Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.