The Latin America Oral Clinical Nutrition Supplement Market is valued to be around USD 1,212.4 million in 2025 and is projected to grow to USD 2,049.4 million by 2035, with a CAGR of 7.0% from 2025 to 2035.

| Attributes | Description |

|---|---|

| Estimated Latin America Oral clinical nutrition supplement Industry Size (2025E) | USD 1,212.4 million |

| Projected Latin America Oral clinical nutrition supplement Industry Value (2035F) | USD 2,049.4 million |

| Value-based CAGR (2025 to 2035) | 7.0% |

Oral clinical nutritional supplements are specialized formulations designed to meet specific dietary and medical needs, supporting patients with conditions that limit adequate nutrient intake.

These supplements play a crucial role in maintaining nutritional status for individuals with conditions such as renal and hepatic failure, oncology nutrition, diabetes, swallowing disorders, inflammatory bowel disease (IBD), neurological disorders, and respiratory diseases. Typically administered under medical supervision, they help ensure proper usage and optimal health outcomes

Key players in the clinical nutrition market are Danone Nutricia, Abbott Nutrition, Nutrition Medica, and Medifood International, which hold significant market shares due to their extensive product portfolios and distribution networks.

Market growth is driven by increasing awareness of nutrition’s role in disease management, an aging population, and evolving health needs. Advances in nutritional science, along with the demand for condition-specific formulations and improved taste profiles, are further fueling innovation and expansion in this sector.

Explore FMI!

Book a free demo

For the Latin America Oral Clinical Nutrition Supplement market, the sector is predicted to grow at a CAGR of 1.4% during the first half of 2024, with an increase to 2.5% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 3.4% in H1 but is expected to rise to 4.5% in H2.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 2.5% (2024 to 2034) |

| H2 2024 | 3.0% (2024 to 2034) |

| H1 2025 | 3.4% (2025 to 2035) |

| H2 2025 | 3.5% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin America Oral Clinical Nutrition Supplement market, the sector is predicted to grow at a CAGR of 1.4% during the first half of 2024, with an increase to 2.5% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 3.4% in H1 but is expected to rise to 4.5% in H2.

Innovations in Dysphagia-Focused Nutrition

Dysphagia, particularly prevalent among the elderly and individuals with medical conditions affecting swallowing, has driven companies to develop specialized products to ensure safe and adequate hydration. Dehydration is a critical concern for dysphagia patients, as swallowing difficulties increase the risk of inadequate fluid intake, leading to severe health complications. In response, leading brands are launching pre-thickened hydration solutions that provide safe and easy consumption while minimizing the risk of aspiration and choking.

For instance, Nutricia’s Nutilis Aqua is a pre-thickened drink designed specifically for dysphagia patients, available in various flavors to enhance palatability. As awareness of dysphagia-related health risks grows, the demand for clinically designed hydration products continues to expand, positioning this segment as a key area for business growth.

Expanding Market for Food Allergy Nutrition

The increasing prevalence of cow’s milk allergy (CMA), particularly in infants, is driving demand for specialized nutritional formulas that provide essential nutrients while minimizing allergic reactions. Extensively hydrolyzed formulas have gained prominence as a critical solution, as they break down allergenic proteins, reducing sensitivity and preventing adverse reactions.

In response to this growing need, Danone Nutricia has introduced Aptamil Pepti SYNEO, an extensively hydrolyzed infant formula designed for the dietary management of mild-to-moderate cow’s milk allergy.

This formula includes a unique probiotic and prebiotic blend that supports gut health while ensuring complete and safe nutrition for infants with milk intolerance. The rising diagnosis rates of food allergies and increased parental awareness are driving growth in this category, spurring innovation in allergy-friendly clinical nutrition.

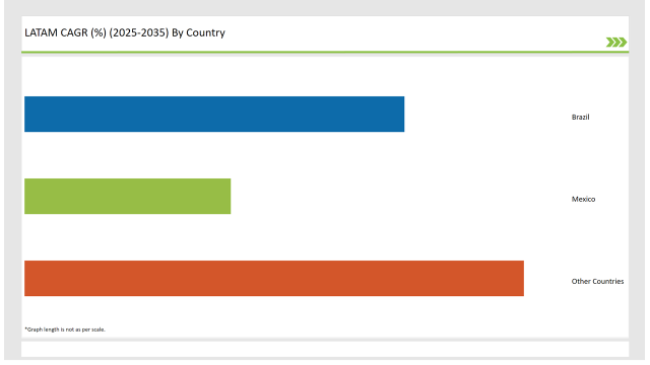

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Brazil | 35% |

| Mexico | 19% |

| Other Countries | 46% |

In Brazil, the demand for diverse and convenient oral nutritional supplement (ONS) formats is on the rise. Consumer preferences indicate that 61% of ONS users prefer ready-to-drink formats, such as milkshakes and juice-type supplements, due to their ease of consumption and portability.

Meanwhile, 43% of caregivers recommend high-energy powders or soup-like supplements for patients requiring customized energy intake. Additionally, thickened liquids for dysphagia, protein-enriched jellies, and low-volume, high-concentration shots are increasingly being adopted to meet diverse patient needs.

Flavor and taste variety play a crucial role in consumer choice, with 62% of customers stating that taste is a major deciding factor when selecting an ONS product. Moreover, as nutritional care at home becomes more prevalent, there has been a 76% increase in demand for high-protein supplementation among individuals engaged in sports or post-recovery nutrition

In Mexico, the market is expanding rapidly due to increasing awareness about clinical nutrition's role in managing chronic diseases, such as diabetes, cardiovascular conditions, and cancer. Given Mexico’s high diabetic population, targeted nutritional products such as Glucerna® are in high demand for blood sugar management. Additionally, the prevalence of malnutrition among cancer patients has fueled interest in oncology-focused nutritional supplements.

Healthcare professionals are increasingly recommending oral nutritional supplements to bridge dietary gaps, particularly among elderly patients and individuals recovering from illnesses. The growing availability of these products in pharmacies, hospitals, and online platforms, coupled with competitive pricing tailored to local markets, is further driving adoption.

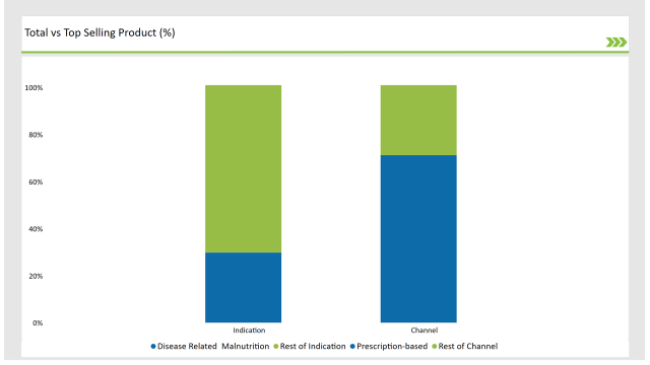

| Segment | Value Share (2025) |

|---|---|

| Indication - Disease Related Malnutrition | 29.8% |

The disease-related malnutrition (DRM) segment is projected to hold a significant 32.6% market share in 2025, underscoring the critical role of ONS in addressing nutritional deficiencies among patients with chronic illnesses, post-surgical recovery needs, and age-related conditions. Healthcare professionals are increasingly prioritizing tailored nutritional support to enhance recovery and improve quality of life.

Key products in this segment include Fortimel Advanced by Nutricia, which combines high-protein content with specialized nutrients like ActiSyn™ to combat muscle loss. With the growing elderly population and increasing prevalence of chronic diseases, the demand for advanced nutritional solutions in the DRM segment is set to expand

| Segment | Value Share (2025) |

|---|---|

| Channel - Prescription-based | 71.2% |

The prescription-based sales channel is expected to dominate the Latin American ONS market, accounting for a 69.5% value share by 2025. This dominance is driven by the increasing role of healthcare professionals in recommending specialized ONS products for patients with conditions like malnutrition, diabetes, dysphagia, and oncology-related nutritional needs.

Prescription-based supplements provide a more targeted and customized approach, ensuring that patients receive appropriate nutrition in the correct dosage. Leading brands have established strong partnerships with hospitals, clinics, and dietitians, reinforcing their position in this segment

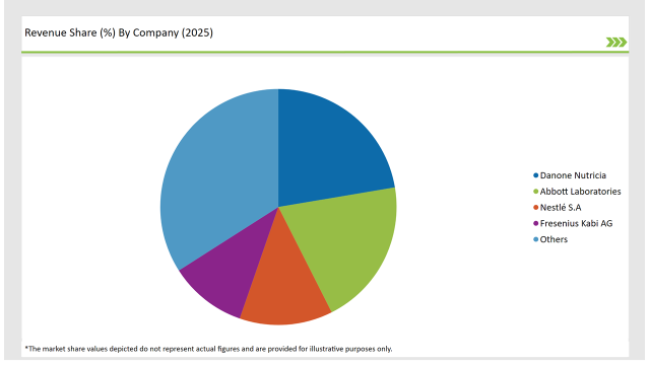

2025 Market share of Latin America Oral Clinical Nutrition Supplement manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Danone Nutricia | 21% |

| Abbott Laboratories | 19% |

| Nestlé S.A | 12% |

| Fresenius Kabi AG | 10% |

| Others | 32% |

Note: The above chart is indicative in nature

The Latin American oral clinical nutrition supplement market is characterized by strong competition among multinational corporations and regional players.

Danone Nutricia, Abbott Laboratories, Nestlé S.A., and Fresenius Kabi AG collectively hold a significant share, with Danone Nutricia leading, followed by Abbott Laboratories , Nestlé, and Fresenius Kabi . These companies have substantial financial capabilities, extensive product portfolios, and well-established distribution networks, giving them a competitive edge.

Danone Nutricia has made a significant impact through its specialized medical nutrition products, particularly in disease-related malnutrition and pediatric care.

The company has heavily invested in innovation and sustainability, promoting plant-based formulas and organic ingredients to align with growing consumer awareness of health and environmental concerns. While multinational giants dominate the sector, regional players also hold niche positions by offering cost-effective and locally adapted products tailored to specific dietary preferences and health conditions.

Overall, the Latin America oral clinical nutrition supplement market is poised for significant growth, driven by innovation, increased disease awareness, and expanding distribution channels. The industry's focus on customized nutrition solutions for diverse health conditions ensures sustained market expansion and new opportunities for players across the clinical nutrition landscape.

The Latin America industry is estimated at a value of USD 1,212.4 million in 2025.

The industry is projected to grow at a forecast CAGR 7.0% from 2025 to 2035.

Prominent players in the landscape include NUTRICIÓN MÉDICA SL.; Medtrition Inc.; Baxter International Inc.; B. Braun Melsungen AG.; Fresenius Kabi AG; Mead Johnson & Company, LLC; Abbott Laboratories; Danone Nutricia;.; Cambrooke Therapeutics, Inc.; GlaxoSmithKline plc; Nestlé S.A.; Kate Farms, Inc.; Perrigo Company plc; Sichuan Kelun Pharmaceutical Co., Ltd.; AYMES International Ltd.; Pfizer Inc.; Medifood GmbH. Otsuka Holdings Co., Ltd.;

As per form, the industry has been categorized Standard Formula, Specialized Formula

This segment is further categorized into Disease-Related Malnutrition (DRM), Renal Disorders, Hepatic Disorders, Oncology Nutrition, Diabetes, Dysphagia, IBD & GI Tract Disorders, Neurological Disorders, Respiratory Orders, Others

As per form, the industry has been categorized into Liquid, Semi-solid, and Powder

Prescription-based, Over-the-Counter are two Sales channel covered in scope.

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America

Curcumin Market Insights - Health Benefits & Industry Expansion 2025 to 2035

Microalgae in Fertilizers Market - Growth & Sustainability Trends 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dinner Ready-to-Eat (RTE) Food Market - Trends & Consumer Insights 2025 to 2035

Potato Flakes Market Analysis Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, Others End Use Application Through 2035

A detailed analysis of the Australian Vitamin Premix industry and growth outlook covering vitamin type, form, and end user segment

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.