The Latin America Mezcal Market is projected to be valued at USD 42.1 million in 2025 and is expected to reach USD 95.3 million by 2035, expanding at a CAGR of 8.5% over the forecast period.

In Latin America, the Mezcal market is currently on the rise, with the phenomenon of market concentration being particularly noticeable as manufacturers take recourse to strategic measures to amplify their market share.

The manufacturers want to cope with the increasing domestic and international demand for spirits, and thus, some of the plants are augmenting their production capacities, mostly in Mexico, and both traditional and artisanal distilleries are intensifying their output.

The increased variety of premium and craft spirits consumption witnessed is the main factor driving the manufacturers to introduce a wider range of different product lines, for example, adding and smoking Mezcal experiments to entice more people.

The clear tendency of consumers to prefer all-natural and organic ingredients has crucially affected the market, thereby making producers focus on sustainability and additive-free Mezcal. Thus it comes as no surprise that brands are now competing with their claims of using nothing other than 100% agave and traditional techniques for distillation of their products.

Furthermore, companies are utilizing digital marketing and experiences, like distillery tours and Mezcal-tasting events, to further strengthen consumer engagement and brand loyalty.

| Attributes | Description |

|---|---|

| Estimated Latin America Mezcal Market Size (2025E) | USD 42.1 million |

| Projected Latin America Mezcal Market Value (2035F) | USD 95.3 million |

| Value-based CAGR (2025 to 2035) | 8.5% |

The increasing premiumization aspect, together with growing export figures, is pushing the manufacturers to work on branding and packaging refinement, thereby lending to the lifestyle feeling for the customer of Mezcal instead of just being a regular drink.

Amid the growing competition, businesses are also investigating new pathways of distribution, including direct-to-consumer sales and alliances with upscale retailers, to consolidate their position in the market.

Explore FMI!

Book a free demo

The table below is a detailed comparative overview of the six-month changes in the compound annual growth rate (CAGR) for the base year (2024) and the current year (2025) solely for the Latin America Mezcal market.

This semester report defines the key shifts in market trends and illustrates revenue receiving patterns, thus enabling stakeholders to obtain more exact interpretative reports about the year's growth. H1, the first half of the year, is superior covering the period from January to June and H2, the second half, is far better covering the period from July to December and thus guarantees more returns.

H1 signifies period from January to June, H2 Signifies period from July to December

In the Latin America Mezcal market, the sector was experiencing a growth rate of 8.1% in H1 2024 and 8.5% in H2 2024 to 2034, reflecting the increasing interest of consumers in premium and artisanal spirits.

This trend continued into 2025, where the sector achieved a CAGR of 8.2% in H1 thanks to the improved production capacity and consumer demand. But in H2 2025 to 2035, growth dropped slightly to 8.7% with the brand's competition increasing and market saturation in certain areas starting to occur.

Prospectively, the Latin America Mezcal market is predicted to keep rising with an expected CAGR of 8.5% from 2025 to 2035. Expansion is foreseen to be driven by greater exports, changes in the consumer preferences toward natural ingredients, and the launching of innovative products aimed at various demographics.

Latin America’s Mezcal Market Adapts Pricing Strategies to Balance Affordability and Quality Amid Rising Demand

The Latin America Mezcal market is undergoing a transition in its pricing strategy as manufacturers focus on achieving the best affordability alongside quality. Even though the round Mezcal is still basically priced close to the competition to achieve easier accessibility for locals, the premium and artisanal distillates are currently very expensive due to higher product manufacturing costs and an explosion in demand for handcrafted beverages.

The organized sector is in the process of utilizing the aspects of scale to remain competitive on pricing, while the smaller labels are, on the contrary, using storybranding to support their higher premium price strategy. The rise of direct-to-consumer sales and e-commerce has also started to allow brands to adjust prices in real-time in line with the demand.

What is more, the option of a smaller format bottle along with the launch of a premium Mezcal of a smaller size is also being promoted, as it would be unfeasible for the consumers to make a full course commitment just to know.

Younger Generations Drive Innovation in Chile’s Mezcal Market with New Flavors and Engaging Marketing Strategies

Chile is notable for the fact that Younger generations are the driving force in the market's quest for innovation, and consequently, brands have commenced to try out new flavors, packing forms, and marketing strategies. Primarily Millennials and Gen Z, are rather fond of the craft spirits that stand out as authentic, eco-friendly, and are the key to view of unique experiences.

Flavoring these variations of Mezcal, such as the IPC ones and including its fruit and barrel-aged, the introducing of flavored Mezcal's by the brands addressing contemporary tastecut preferences is a masterpiece. Furthermore, the companies try to engage tech-savvy consumers by using social media campaigns and influencers that fit their high-tech approach.

Mezcal-based ready-to-drink (RTD) cocktails are also on the market as a trend concerning the convenience-dependent habits of younger consumers. In addition, the companies introduce engaging experiences, such as virtual tastings, and use social media for storytelling to enhance brand loyalty and consumer engagement.

Sustainability Becomes a Priority in Latin America’s Mezcal Industry, Focusing on Eco-Friendly Production Practices

Sustaining a viable environment has emerged as the top priority in the Mezcal business of Latin America, with the consumers and authorities putting stress on ecological production. The trend in agave growing is to move towards the use of sustainable farming methods, which guarantees the protection and health of the environment and the prevention of dangers to the forest in the long term.

Many of the makers undergo trade certifications that give proof of their allegiance to fair labor issues, aside from using the age-old methods of making agave spirit. Also, packaging with fewer environmental hip problems is now being used in terms of biodegradable bottles, the use of recycled glass, and minimalist labeling targets that, according to the industry’s carbon footprint.

Given the fact that they are gaining the inclination of the buyer with the information, the brands are giving the opposite of who gets the money into looking at their eco-sourcing and production initiatives. The fair-trade element is involving the pricing as well, with the product of splendid quality that is “green” at the same time, thus making it pivotal for the business to flourish

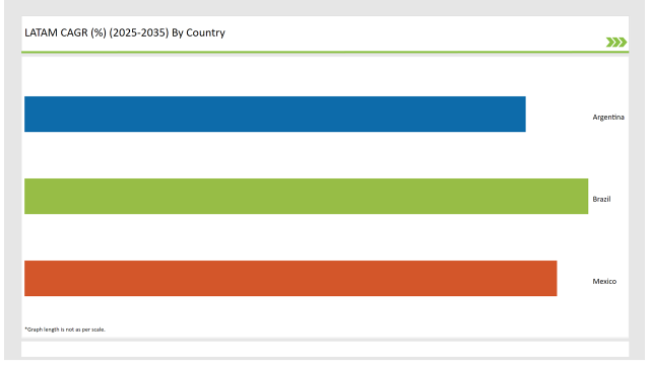

Mezcal is the native drink of Mexico, and it is also the reason Mexico leads in the Latin American market for Mezcal, which is projected to have a growth rate of 7.0% from 2025 to 2035. This advancement is attributed to the increased domestic use and the surging external market for genuine Mexican alcoholic drinks.

Producers in Mexico are making necessary changes, such as expanding facilities and implementing ecological techniques of farming agave to keep pace with this demand. Mezcal promotion, such as advertising it as a cultural heritage product, also helps with its global recognition. On top of that, the increasing interest in Mezcal among tourists who visit distilleries to learn about traditional production processes is one of the considerable factors for market expansion.

Peru is the emerging force in the Latin American Mezcal market, predicted to grow at a CAGR of 6.5% in the next ten years. The increase in the Mezcal market of Peru can be attributed to the people wanting to buy artisanal and premium drinks.

Artisanal producers from Peru are uniquely positioning their products, emphasizing indigenous agave species and traditional distillation techniques. Agreements with off-shore companies have led to an expansion in the Peruvian Mezcal export business, increasing its mark in global markets. Adding to that, Mezcal's integration into the country's culinary culture has popularized it with both local customers and foreign tourists.

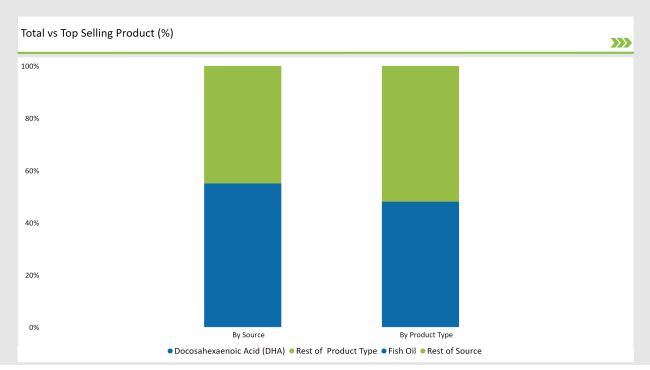

In 2025, Mezcal Joven remains the most significant product category, commanding 48.5% of the market. It is a traditional unaged Mezcal, and consumers and mixologists love it because of its pure agave flavor and the ability to make drinks with it more easily.

It has a lower price in comparison to aged variants of Reposado and Añejo Mezcal, so it is more available for the customers, mainly in the on-trade channel sector. The present times' trade in craft cocktails establishes Joven Mezcal as a central ingredient, where it is used as a base in creative drinks.

A multitude of labels are taking part in this by offering artisanal small-batch Mezcal Joven, which is made with environmentally friendly and organic methods. The category is also getting help from the strong export market, where international consumers look for traditional, original Mezcal tastes.

For now, Espadín is the most common single agave type in Latin America, with a market share of 65.2% in 2025. This fast-growing plant is practically a weed compared to Tobala or Tepeztate, plus the quantity it delivers is twice as much, which is the reason it is the main agent of Mezcal on the market. Because it is so easy to find, Espadín-based Mezcal is usually the most economical and the most common product available, which leads to a considerable market share.

Favored by producer companies for being so adaptable, it can be used in both types of Mezcal: the entry-level ones, as well as ideally the high-end products. Besides, many companies have been trying out the production of different formulations, such as smoked and barrel-aged Espadín Mezcal, to meet the dynamic consumer appetites.

The growing international image of Espadín Mezcal as an outstanding spirit is also the reason for its increasing demand abroad, thus going along with its overall success in the industry.

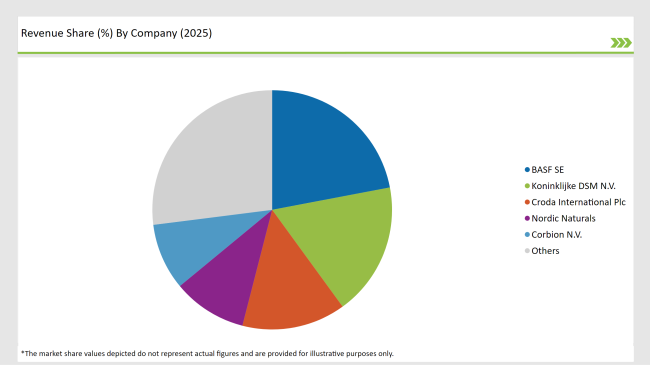

2025 Market share of Latin America Mezcal manufacturers

Note: The above chart is indicative in nature

The Latin American Mezcal market has fierce competition, which comes from the global brands and the regional ones. José Cuervo, Lobos 1707, Mezcal Amarás, and Los Danzantes are the dominant traders in the market together and this group is headed by José Cuervo, thanks to its vast sales network and the notoriety of the brand.

The two, Lobos 1707 and Mezcal Amarás, which are reaching out to cutting-edge and environmentally-inclined production methods, still need to stand on their premium product lines. Those firms had access to the funding resources that no other company had at their disposal, therefore, they expanded their production while keeping high standards in their products.

At the same time, artisanal makers like Real Minero and Mezcaloteca, despite being small, do carry a lot of influence through their advocacy of traditional distillation and handcrafting exclusivity. Premium organic and sustainably sourced spirits have gained favor with consumers, leading to a rise in demand for handcrafted Mezcal.

The competition is heightened by the introduction of direct-to-consumer sales, e-commerce, and export expansion. The Latin American Mezcal sector shall continue experiencing growth, solely brought by different scopes of innovation, transforming customers' ambitions, and investment boost in manufacturing, thus speaking of the Latin American industry as a whole.

The market is projected to grow at a CAGR of 8.5% from 2025 to 2035.

The market is expected to reach approximately USD 95.3 million by 2035.

The market is likely to be valued at USD 42.1 million in 2025.

Mexico is likely to remain a leading market.

Peru is the fastest-growing market.

Market segmented into Joven, Reposado, Añejo, and Others (such as Extra Añejo and flavored variants).

Market segmented based on agave species into Espadín, Tobalá, Arroqueño, and Others (including Tepeztate, Cuishe, etc.).

Market segmented into 100% Agave and Mezcal Mixto.

Market segmented into Supermarkets/Hypermarkets, Liquor Stores, Online Retail, and HoReCa (Hotels, Restaurants, and Cafés).

An Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Vegan DHA Market Outlook - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.