The Latin America Lactose market is projected to be valued at USD 218.2 million in 2025 and is expected to reach USD 413.4 million by 2035, expanding at a CAGR of 6.6% over the forecast period.

The market is following the trend of concentration mainly due to key manufacturers being the ones who are directly involved in expanding their production capacities as well as the optimization of supply chains to consolidate their market power.

Optimization of supply chains, along with production efficiency enhancement through the adoption of new technology and strategic partnerships, are the main focuses of manufacturers. Some companies have increased their lactose production in different locations in Latin America, thus ensuring a stable supply to the chocolate, pharmaceutical, and infant nutrition sectors.

Besides, these companies are benefiting from the diversification of their products and, in this case, are offering tailored lactose grades to different application needs, which, in turn, helps them to boost their market share.

The manufacturers' receptiveness of unprocessed and clean-label ingredients is a plus point for the area. Alongside the increase of health-conscious individuals, the consumption of lactose as a natural sweetener and functional ingredient in food and pharmaceutical products is also rising. This change leads dairy sector players to market lactose as an ingredient that is sustainable, non-GMO, and minimally processed, which is in line with consumer trends.

| Attributes | Description |

|---|---|

| Estimated Latin America Lactose Market Size (2025E) | USD 218.2 million |

| Projected Latin America Lactose Market Value (2035F) | USD 413.4 million |

| Value-based CAGR (2025 to 2035) | 6.6% |

Also, aggressive marketing strategies, alliances with dairy producers, and the expansion of distribution channels are together paving the way for the companies to get a larger market share. This aggressive competitive atmosphere is predicted to steady even more due to the rise in demand over the region of Latin America.

Explore FMI!

Book a free demo

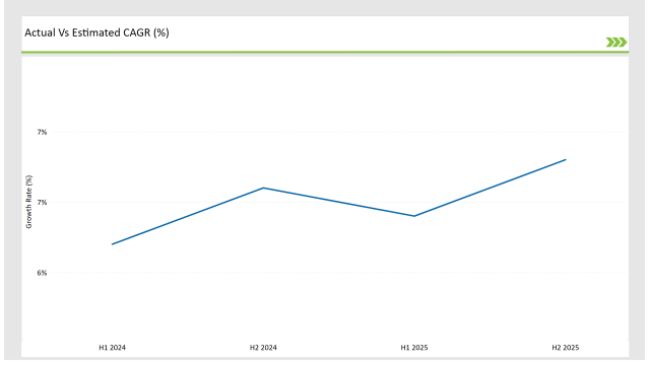

The table below decks out the relative changes in the compound annual growth rate (CAGRE) over six months with the base year (2024) and the present year (2025) in the Latin America Lactose Market.

This semi-annual analysis represents the key shifts in market dynamics and revenue realization patterns which will help stakeholders to understand the year trend better. The first halves (H1) incorporate the period between January and June, while the second halves (H2) consist of July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

During H1 2024 to 2034, the Latin America Lactose Market managed to achieve a growth rate of 6.2%, which reflected the steady demand from the dairy and pharmaceutical industries. This increased to 6.6% in H2 2024 to 2034 as the customers' wish for natural and clean-label products increased in turn driving the market expansion.

In 2025 to 2035, the journey of growth continues, the average rate calculated will be 6.4% in the first half of the year, which is mainly driven by production capacity expansion and the implementation of innovation captures in lactose applications. However, in H2 2025 to 2035, the growth rate will merely have a marginal fluctuation to sit at 6.8%, as the market will transform according to the new regulations and supply chain optimization processes.

Area of Lactose Production Facilities in Latin America

Latin America's lactose market is experiencing a fast process of facility setup as manufacturers aim to catch up with regional and international demand. The dairy-rich nation is helping to build stronger local supply chains and reduce imported goods through increased funds to processing plants.

In addition, the companies are implementing the most up-to-date filtration and purification technologies to not only increase the amount of lactose but also promote the quality. This facility boost is being accomplished through government support by promoting the dairy sector with growth and export opportunities.

In addition, local producers are creating alliances with international companies in the dairy sector to improve their production and competitiveness. These actions are likely to bolster market stability and propel Latin America into the ranks of the world's most trusted suppliers of high-quality lactose for the food, pharmaceutical, and infant nutrition industries.

Surging Lactose Demand for Infant Nutrition and Pharmaceuticals

The rising trend of consumer preference for infant nutrition products that do not involve chemical additives can urge lactose demand in Latin America. Lactose, which is the main carbohydrate of breast milk, is often used in infant formula production, thus encouraging the development of lactose and specialized lactose grades.

Alongside that, the pharmaceutical area is turning its back on lactose, which is now used more alongside quality excipients in drug formulations, which are becoming more and more stable and compatible with active ingredients. As healthcare awareness grows and the availability of nutritional supplements increases, the market is further supported.

The manufacturers are concentrating on the purification of lactose, which is an essential requirement to comply with strict quality control in these applications. As the infant nutrition and pharmaceutical industries will breed, Latin America's lactose market will take up a long-running ticket to thrive with active companies targeting the high-value sectors the most thus getting a competitive advantage.

Clean-Label and Natural Ingredient Trends Boosting Market Growth

The trend for clean-label and natural products has led people in Latin America to ask for lactose as a minimally processed and sustainable ingredient, thus creating a demand for the latter. This change is driving the lactose industry's tendency to stress transparency in the entire supply chain from sourcing to production, ensuring that the lactose is both non-GMO and allergen-free.

Moreover, companies in the food and beverage sector are also utilizing lactose in the formulations to be naturally sweetened which is our region's focus on health-conscious consumption.

The regulatory support for the clean-label products and the sustainable dairy sourcing, which, in turn, helped the product come into the market, was further added by the appeal of lactose. As consumer literacy rises, manufacturers are seizing the initiative to flaunt the multi-faceted role that lactose can play in food formulation, health foods, and nutraceuticals beyond traditional dairy products.

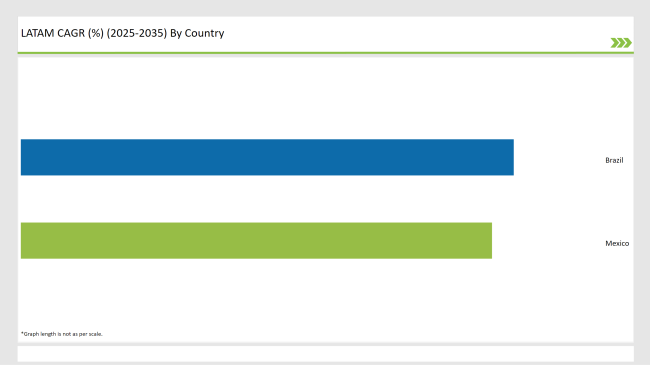

Brazil is the main lactose market in Latin America and has a CAGR of 6.8%. This increase is powered by the strong dairy sector in the country and the ever-growing need of people for different dairy products. The schemes of the Brazilian government to rehabilitate dairy farming and processing plants have resulted in higher milk production efficiency and more lactose on the market.

In addition, the health conscience among the Brazilian audiences has had a direct impact on the consumption of lactose included products such as yogurt and infant formula. Moreover, as the pharmaceutical sector is also growing, the demand for lactose has risen since it is used as an excipient in drug formulations.

What is more, the strategy to welcome Brazil as a prominent dairy products exporter in the region is a clear signal of the country's important role in the Latin American lactose market.

Mexico has the potential to reach a lactose market volume with a CAGR of 6.5%. The rise in dairy product consumption has been significantly influenced by the country's growing urban population which in turn is forcing the lactose demand up.

The government, by laying down policies comforting the dairy sector and the entrepreneurs who have invested in advanced processing technologies, has collectively pulled lactose production to a better state. The trend of Mexican consumers toward shopping for natural and functional foods has brought about an even greater use of lactose in such products.

The pharmaceutical industry has been expanding, and the addition of lactose as a crucial excipient is a significant factor in the growth of the market. Mexico´s free trade agreements with other countries, mainly the United States, alongside the transportation infrastructure, make the export of lactose easier and strengthen its regional position in Latin America.

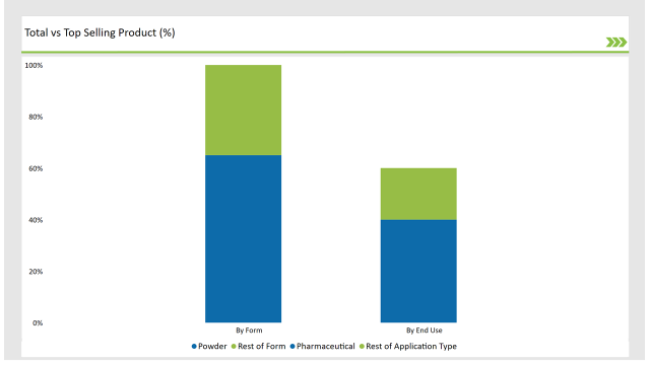

Powdered lactose sits at the top of the Latin American market, with 65% of the market share in 2025. The reason is quite simple: its solubility is high, it is easy to carry, and it is utilized by many sectors, such as food, pharmaceuticals, and animal feed. The increasing demand for lactose in infant nutrition and dairy products has propelled the powdered segment’s growth.

Therefore, the manufacturers in the pharmaceutical industry have gone for powdered lactose as an excipient due to its properties of comfortable flow and good compressibility in the tablets. The rise of the powdered lactose market is steadily being backed up with the expansion of the lactose production facilities and the advancements in the drying technologies in the Latin America region.

The pharmaceutical sector has a 40% market share in the lactose market in Latin America. This progress is being fueled by the growing rates of lactose in drug additives, especially in solid oral dosage forms such as tablets and capsules. Lactose works as a binder and filler in the medications, thus ensuring a steady drug delivery.

The augmented investments in health care, alongside the increase of consumers aged over 65 who need pharmacological treatments, have been the main forces that have pushed up lactose consumption. The approvals and regulations that are relevant for the pharmaceutical-grade lactose have not been overlooked in this picture, aka, the main drivers to the market development.

Additionally, global pharmaceutical companies are putting more money in the production facilities across Latin America to fortify the sector that is the greatest lactose consumer.

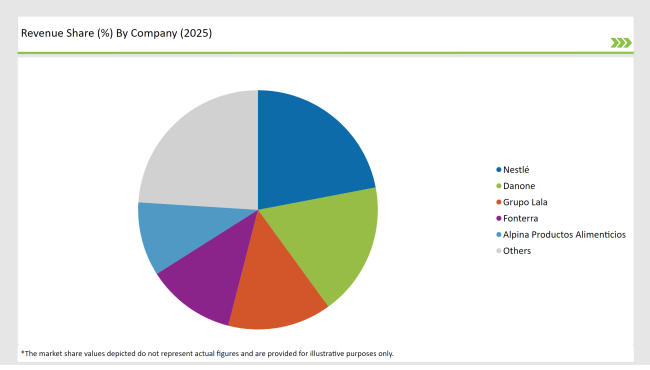

2025 Market share of Latin Lactose Mate manufacturers

Note: The above chart is indicative in nature

The Latin America Lactose Market is very competitive, shaped by a mix of multinational corporations and local dairy manufacturers pushing the market target. Nestlé, Danone, Grupo Lala, and Fonterra play the central leadership role in the sector through their wide distribution network, and the modern dairy processing hewing.

Nestlé, with its strong foothold in infant nutrition and pharmaceutical-grade lactose, is the market leader. The second position is on Danone, which has added more dairy-based products to its catalogue to satisfy what the market is looking for.

Grupo Lala and Alpina Productos Alimenticios have personalized their offerings in a way that they support the lactose diet of the locals, and therefore, they play a strong regional game. As for Fonterra and Parmalat, their advanced dairy technologies are being linked with their supply chains to deal with the surging demand for quality lactose.

Regional markets are unproblematic with giants covering their included spaces, but that does not mean the small regional players do not have a say as well; they are also finding niche sectors and innovating their products. The lactose market is going up with the demand for the compound in the pharmaceutical sector, functional foods, and the growth in the lactose industry, which has positively influenced this matter.

The market is projected to grow at a CAGR of 6.6% during the forecast period (2025 to 2035).

The market is expected to reach approximately USD 413.4 million by 2035.

The pharmaceutical segment is expected to witness the highest growth due to increasing lactose use in drug formulations and excipients.

Growth is driven by increasing demand for lactose in infant nutrition, pharmaceuticals, and functional foods, along with expanding dairy production capabilities.

Major players include Nestlé, Danone, Grupo Lala, Fonterra, and Alpina Productos Alimenticios, with strong market positions in dairy-based lactose production.

The Latin America lactose market is segmented into powder and granule, with powder being widely used in food, pharmaceuticals, and infant nutrition applications.

The market is categorized into food and beverage, pharmaceuticals, animal feed, and others, with pharmaceuticals emerging as a key sector driving lactose demand.

The market is divided into lactose monohydrate, galactose, lactulose, tagatose, and others, with lactose monohydrate dominating due to its extensive use in pharmaceutical formulations.

An Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Comprehensive Analysis of Pet Dietary Supplement Market by Pet Type, by Product Type, By Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.