The Latin America Lactase market is projected to be valued at USD 211.7 million in 2025 and is expected to reach USD 363.9 million by 2035, expanding at a CAGR of 5.6% over the forecast period.

| Attributes | Description |

|---|---|

| Estimated Latin America Lactase Business Size (2025E) | USD 211.7 million |

| Projected Latin America Lactase Business Value (2035F) | USD 363.9 million |

| Value-based CAGR (2025 to 2035) | 5.6% |

The lactase market is characterized by moderate concentration with some of the primary producers majorly focusing on market share increases through the built-in production capacities as well as through the technological development in lactase enzyme formulations.

A number of the manufacturers are pushing forward the investment in building new plants and organizing production lines to satisfy the increasing sales lactase-based dairy alternatives. The expansion not only helps secure the supply chain but also allows better product availability in Latin American markets.

A consumer's mood change toward lactose-free and digestive health products is the source of innovation, and high-purity, efficient lactase formulations that meet the needs of clean-label and vegan products are the result of the manufacturers.

The growing interest in naturally sourced ingredients affects the sector too, compelling firms to use enzymes from sustainable and non-GMO fermentation processes. Moreover, product integration in lactose-free dairy segments is built up by the signing of agreements with dairy producers and food processors.

Market participants are also strengthening their sales networks and are launching product variations to match local eating habits in the regions. Regulatory approvals that promote enzyme applications in functional foods will add more opportunities for growth in the lactase market in Latin America.

Explore FMI!

Book a free demo

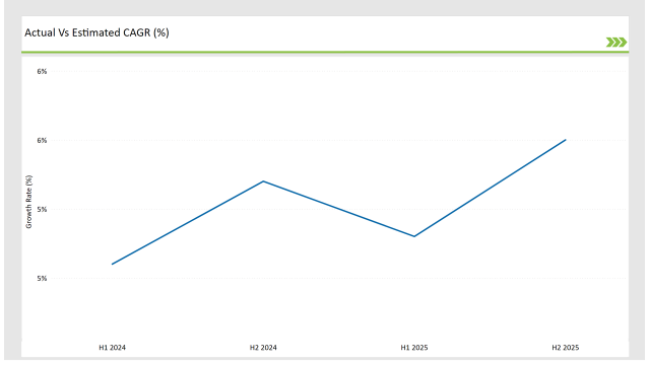

The table below provides a comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) in the Latin America Lactase Market.

This semi-annual analysis highlights key market shifts, revenue realization patterns, and growth trends, offering stakeholders a clearer understanding of the market's trajectory. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

The Latin America Plant-Based Pet Food Market has experienced steady growth, driven by increasing consumer preference for sustainable and natural pet nutrition. In H1 2024 to 2034, the market grew at a 4.9% CAGR, accelerating to 5.5% in H2 2024 to 2034. This upward trend continued in H1 2025 to 2035, reaching 5.1%, fueled by rising investments in production capacity and product innovation.

By H2 2025 to 2035, the market is expected to expand at 5.6% CAGR as manufacturers introduce new formulations incorporating functional ingredients. The shift toward plant-based pet diets, coupled with increasing retail and e-commerce penetration, is set to maintain the industry’s strong growth trajectory in Latin America.

Lactase Production Capacities Are Expanded to Meet the Growing Demand

The Latin America Lactase Market is currently in the phase of production capacity expansion as a result of the manufacturers' efforts to meet the continual rise in demand for lactose-free dairy products. Due to the higher percentage of people suffering from lactose intolerance, dairy manufacturers are increasing their investments in cutting-edge facilities dealing with lactase enzymes.

Emphasis is being put on fermentation-based lactase production, which will lead to improved enzyme purity and production efficiency with reduced costs. The launch of local production facilities will also help to minimize the dependence on imports and stabilize the supply chain. It is significant since the demand for lactose-free milk, cheese, and yogurt is penetrating the market, especially in Brazil, Mexico, and Argentina.

Manufacturers are not only reinforcing regional production but are also paving the way for export involving the growing health-conscious consumer base in the whole of Latin America.

Transition in the Direction of Clean-Label and Plant-Based Lactase Solutions

The main trend in the Latin America Lactase Market is that consumers are increasingly turning to clean-label and plant-based lactase enzymes. With the increasing number of consumers that want transparency at food ingredient levels, companies are coming up with lactase enzymes that are non-GMO, organic certified, and free from artificial additives.

The market also observes the birth of plant-based lactase formulations that utilize microbial fermentation, hence catering to the plant-eating and flexitarian consumer group. The dairy companies are incorporating these enzyme-friendly products into nutritional beverages, plant-based dairy, and functional foods.

This development is particularly efficient in urban cities such as São Paulo, Buenos Aires, and Mexico City, where health-centric consumers are searching for sustainable and digestible-friendly products. The fraction of the market that is eco-friendly and enzyme-free encapsulates the extraction processes, thereby enhancing the market's conformance with the sustainability movement.

Strategic Partnerships Between Dairy Producers and Enzyme Suppliers

In the Latin America Lactase Market, we have been witnessing a series of strategic partnerships being formed between dairy manufacturers and enzyme producers to enhance the functional effect of lactase in dairy and non-dairy applications.

Companies are collaborating in the co-development of customized lactase formulations, which will improve the properties of the final products such as flavor, texture, and nutrition in the lactose-free products. Besides, these partnerships are also targeted at the streamlining of the process of applying the enzymes, which will lead to the reduction of the production time and the enhancement of the efficiency.

Furthermore, the dairy brands are associating with the enzyme suppliers firmly to educate the consumers about the advantages of lactase-enriched dairy, thereby boosting the market entry.

Some partnerships focus on research and development programs especially on the formulation of low-sugar and high-protein lactose-free dairy products, thus catering to the growth in sports nutrition and health-conscious customers. This collaborative methodology is the essence of speeding up innovation and making quality lactose-free dairy available to the market.

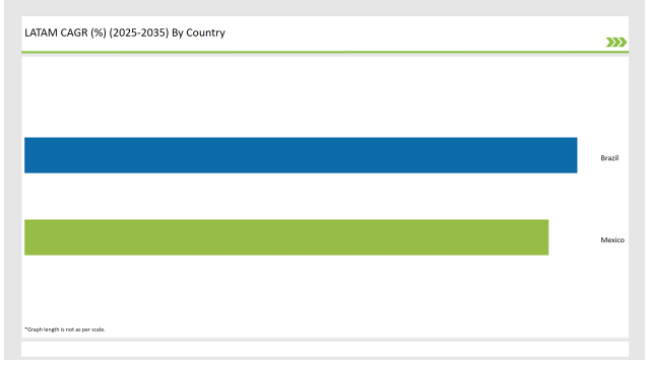

The Brazilian lactase market is expected to grow at a CAGR of 5.8% from 2025 to 2035. The major reason for this rise is the increase in the number of people in Brazil who are lactose intolerant, requiring more and more products that are free from lactose.

The strong dairy sector in the country is adapting by adding lactase enzymes to the production processes so that it can keep pace with the new customer base. Another reason is that Brazilian citizens are becoming more aware of their health and starting to seek products that support digestive wellness, which is driving the market further.

The rise of new retail channels, such as supermarkets and online platforms, has made lactose-free products more available to consumers, thus leading to market growth. Government policies that favor the dairy sector and the investment in food technology are also factors that are crucial in the expansion of the market.

Mexico's lactase market is projected to grow significantly, with an anticipated CAGR of 5.5% from 2025 to 2035. The recent rise of lactose intolerance cases in Mexico has resulted in the high demand for lactose-free dairy products. The increased utilization of lactase enzymes has benefited Mexican dairy factories as they started to offer a variety of lactose-free products like milk, cheese, and yogurt.

Urbanization and dietary changes have promoted the awareness of digestive health issues, and more people have started to seek foods that are free of lactose. The presence of multinational dairy companies that invest in the Mexican market has introduced advanced lactase technologies, which is the main reason for an increase in the quality and variety of products.

Apart from that, the partnerships established between local dairy farmers and the enzyme providers are fortifying the supply chain and consequently ensuring the wide availability of lactose-free products throughout the country.

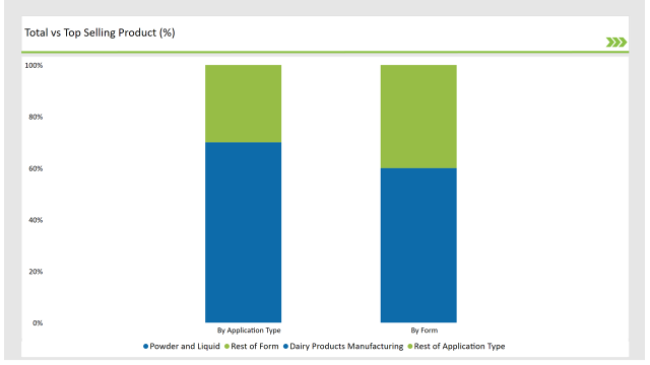

The powder form takes the lead with around 60% of the value share in the market. This is because it has a longer period of storage, is easy to transport, and is suitable for a wide range of applications. The powdered form of lactase is a great choice for dietary supplements and dry food mixes because it is stable and has a longer shelf life.

Also, its convenience of handling and precise dosing is the main reason that it is preferred by manufacturers who want consistent formulations. Likewise, liquid lactase is used in processes where immediate enzyme activity is needed, especially in dairy processing, however, the powder form's flexibility and ease of operation keep it firmly on top.

In terms of applications, dairy product manufacturing leads with 70% of the entire market's value share. This is a direct result of customers' growing demand for lactose-free products such as milk, cheese, yogurt, and ice cream. The manufacturers have been utilizing lactase enzymes to break down lactose, thus making the products suitable for lactose-intolerant people.

The incremental awareness concerning lactose intolerance and the positive health effects related to lactose-free products have triggered this development. The advancement in enzyme technology is also relevant as it makes it easier to break down sugars without changing the taste or the texture that the products had previously. This has led to an additional promotion of the uptake of lactase in the fabricating works of the dairy manufacturers.

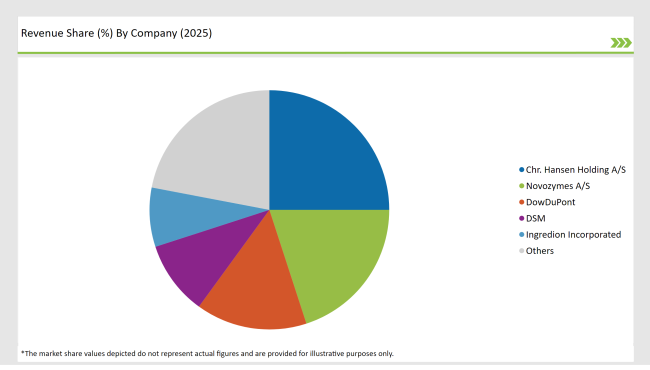

2025 Market share of Latin America Lactase manufacturers

Note: The above chart is indicative in nature

The Latin America lactase market is a fierce battleground where global enzyme and local companies face off. The dominant multi-national corporations control a good amount of the market, utilizing state-of-the-art enzyme technology, ample financial benefits, and a wide-reaching distribution network. The premier firms are occupied with R&D investments, collaborations with dairy farmers, and the introduction of new products to hold onto a strong market position.

Market front-runners are emphasizing enzyme efficiency, clean-label formulations, and sustainability, as these reflect the widespread demand among the consumers for natural, lactose-free dairy products. The technological breakthroughs in the area of high-purity lactase and the stabilization of the enzymes are the major factors for the distinction.

Even though the global players are predominantly present in the market, regional manufacturers still make their impression by providing cost-efficient and culturally tailored solutions that meet the dietary requirements of the Latin American population. These companies are directing their efforts at organic, non-GMO, and plant-based lactase formulations to attract the attention of health-conscious consumers.

The market is projected to grow at a CAGR of 5.5% during the forecast period.

The market is expected to reach approximately USD 363.9 million by 2035.

The dairy products manufacturing segment is anticipated to experience the highest growth due to rising demand for lactose-free dairy alternatives.

Increasing lactose intolerance awareness, expanding dairy industry, demand for lactose-free products, and advancements in enzyme technology are key growth drivers.

The market is led by Chr. Hansen Holding A/S, Novozymes A/S, DowDuPont, DSM, Ingredion Incorporated.

The Latin America Lactase Market is segmented into powder and liquid forms, with varying applications in dairy processing, beverages, and nutritional formulations.

The market is categorized by source into fungi, yeast, and bacteria, each offering distinct enzymatic properties for lactose hydrolysis in different food and beverage applications.

The lactase market is divided intodairy products manufacturing, infant formula production, and beverage processing, driven by increasing demand for lactose-free food and drinks.

Based on grade, the market is segmented into food-grade and feed-grade lactase, catering to human consumption in dairy products and animal feed formulations.

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Comprehensive Analysis of Pet Dietary Supplement Market by Pet Type, by Product Type, By Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.