The Latin America hypodermic syringes market is valued at USD 228.07 million in 2025. As per FMI's analysis, the market will grow at a CAGR of 5.9% and reach USD 404.6 million by 2035.

The Latin American hypodermic syringes and needles industry experienced consistent growth during 2024, stimulated by higher vaccinations, increased chronic diseases, and the development of healthcare infrastructure. Greater insulin applications resulting from diabetes and increased bronchodilator injection demand spurred the consumption of syringes.

Mass vaccination drives, particularly in Brazil and Mexico, further boosted growth. Moreover, the growing use of self-administered drugs and the resurgence of elective procedures supported the sales of syringes.

The industry is expected to reach USD 228.07 million by 2025, fueled by an aging population and rising adoption of disposable plastic syringes. Vaccinations at the point of care outside of hospitals, like in pharmacies and community centers, will grow. Government-led immunization programs will strengthen syringe distribution channels in both urban and rural areas.

The industry is anticipated to expand still further by 2035, driven by technological advancements in safety syringes and the enforcement of more stringent single-use regulations. Domestic manufacturing investment will increase supply chain robustness as well as cost-effectiveness. Although needle-free drug delivery systems will gain popularity, hypodermic syringes will continue to be crucial for medical use, allowing long-term growth in the industry.

Key Metrics

| Metric | Value |

|---|---|

| Estimated Global Size in 2025 | USD 228.07 Million |

| Projected Global Size in 2035 | USD 404.6 Million |

| CAGR (2025 to 2035) | 5.9% |

Explore FMI!

Book a free demo

(Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across manufacturers, healthcare providers, policymakers, and distributors in Brazil, Mexico, Argentina, Chile, and Colombia)

Regulatory Compliance and Safety

Regional Variance:

High Variance in Supply Chain Stability

Localization vs. Imports:

Diverging Opinions on Adoption

Cost vs. Adoption Rates:

Alignment on Safety and Innovation

81% of global manufacturers plan to invest in R&D for enhanced safety syringes, particularly focusing on retractable and auto-disable designs.

Divergence in Focus Areas:

Stronger Government Intervention in Procurement

Leverage these insights to stay ahead in the evolving Latin American syringe industry. Contact FMI for strategic guidance on regulatory adaptation, supply chain optimization, and investment opportunities.

The Latin American hypodermic syringes and needles industry is poised for consistent growth with the increasing cases of chronic diseases, growing vaccination drives, and rising elderly population.

The production of disposable and safe syringes will benefit as regulatory agencies drive them towards single-use compliance, while the production of traditional glass syringes can lose demand. Increased healthcare accessibility and local production investments will further influence the competitive environment, which will continue to grow in the region.

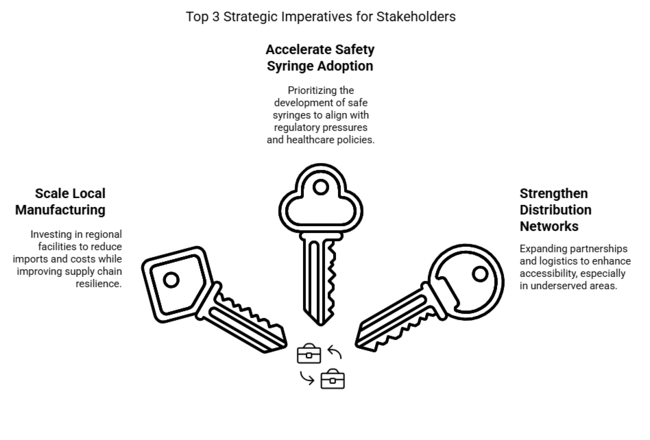

Scale Local Manufacturing

Executives should invest in regional production facilities to reduce reliance on imports, lower costs, and improve supply chain resilience. Expanding local manufacturing will enable faster distribution, ensuring syringes remain accessible amid growing healthcare demand.

Accelerate Safety Syringe Adoption

With increasing regulatory pressure on single-use compliance, companies must prioritize the development and commercialization of safe syringes. Aligning product portfolios with evolving healthcare policies and provider preferences will drive long-term industry positioning.

Strengthen Distribution Networks

Expanding partnerships with pharmacies, hospitals, and vaccination centers will enhance industry reach and accessibility. Investing in last-mile logistics and digital tracking systems will ensure seamless delivery, particularly in underserved rural areas.

| Risk | Probability & Impact |

|---|---|

| Regulatory Shifts on Single-Use Syringes - Stricter regulations on reusable and non-compliant syringes may disrupt existing product lines and force manufacturers to invest in safety syringe innovations. Companies must stay ahead of evolving policies to ensure compliance and maintain industry access. | High Probability, Severe Impact |

| Supply Chain Disruptions & Raw Material Shortages - Dependence on plastic resins, stainless steel, and rubber components makes the industry vulnerable to material shortages, price volatility, and global trade restrictions. Diversifying suppliers and investing in localized production will be key to mitigating these risks. | Medium Probability, Significant Impact |

| Rising Competition from Needle-Free Drug Delivery - Innovations in needle-free injection systems may reduce demand for traditional hypodermic syringes, particularly in chronic disease management. Companies must focus on cost-effective manufacturing and product differentiation to sustain industry relevance. | Low Probability, High Impact |

| Priority | Immediate Action |

|---|---|

| Regulatory Compliance Readiness | Conduct feasibility studies on adapting product lines to meet evolving single-use syringe regulations. Perform regulatory impact assessments, accelerate safety syringe development, and engage with policymakers to ensure compliance and industry readiness. |

| Supply Chain Resilience | Secure alternative suppliers for key raw materials like plastic resins and stainless steel to reduce dependency on volatile global supply chains. Negotiate long-term contracts, explore localized manufacturing, and assess material substitution options to mitigate cost fluctuations. |

| Needle-Free Technology Assessment | Conduct R&D assessments on needle-free injection systems to evaluate their impact on hypodermic syringe demand. Establish strategic partnerships with biotech firms, track adoption trends, and explore hybrid solutions to maintain industry relevance. |

To stay ahead, companies must immediately align syringe production with evolving single-use regulations, invest in supply chain diversification to mitigate material shortages and assess the competitive threat of needle-free technology.

Prioritizing safety syringe innovation, securing regional manufacturing partnerships, and expanding last-mile distribution will be critical to sustaining industry leadership. This intelligence underscores the urgency of proactive regulatory adaptation, cost-efficient sourcing, and forward-thinking R&D investments, ensuring long-term growth while navigating shifting healthcare dynamics in Latin America.

| Countries | Regulatory Impact & Mandatory Certifications |

|---|---|

| Brazil | The National Health Surveillance Agency (ANVISA) mandates that all syringes meet RDC 12/2012 standards, ensuring compliance with sterility, biocompatibility, and disposal regulations. The government heavily regulates syringe procurement for public immunization programs, requiring manufacturers to obtain ANVISA certification before supplying to hospitals and vaccination centers. Recent policies are pushing for auto-disable syringes in national vaccination programs to prevent reuse. |

| Mexico | The Federal Commission for the Protection against Sanitary Risks (COFEPRIS) requires manufacturers to comply with NOM-249-SSA1-2010, ensuring syringes meet sterility and performance criteria. Public tenders for syringe procurement favor cost-effective suppliers, making price a key determinant for industry entry. Recent policy discussions focus on enforcing safe disposal and recycling guidelines, which could increase compliance costs. |

| Argentina | The National Administration of Drugs, Food, and Medical Technology (ANMAT) enforces GMP (Good Manufacturing Practices) for medical devices, including hypodermic syringes. To reduce import dependency, the government is considering stricter import regulations and incentivizing local production. Proposed policies on eco-friendly syringe disposal could impact hospital procurement strategies, requiring healthcare facilities to adopt sustainable practices. |

| Chile | The Institute of Public Health (ISP Chile) oversees medical device approvals, requiring adherence to Decree No. 825 on Medical Devices. The government is tightening regulations on syringe importers, favoring pre-certified international suppliers with compliance with ISO 13485 standards. Public hospitals are now required to procure single-use syringes exclusively, increasing demand for certified disposable products. |

| Colombia | The National Institute for Food and Drug Surveillance (INVIMA) regulates syringe quality under Decree 4725 of 2005, aligning with international safety and sterility standards. Recent government programs are subsidizing syringe production for rural healthcare access, leading to increased local manufacturing. Stronger waste disposal policies are being introduced, requiring hospitals and clinics to implement structured disposal programs for used syringes. |

By product type, it is anticipated that the needles segment will witness a high growth rate with a CAGR of 6.3% during 2025 to 2035, compared to the overall industry CAGR of 5.9%, due to increasing demand for vaccinations as well as injectable therapies.

However, overall CAGR is still at 5.9% as the syringes segment is expected to grow at slower rates, also because of competition from prefilled syringes and needle-free alternatives. Demand is being driven by the increasing implementation of vaccination programs, blood collection procedures, and drug administration through injectable therapies.

Moreover, technological advancements including ultra-thin, pain-free needles and needle-free injectors are being adopted, fueling the growth further. One of the significant drivers of growth is the growth rates of production as well as utilization of hypodermic needles to outpatient settings such as pharmacies as well as home healthcare.

After-market, retractable and auto-disable needles are being used by manufacturers to improve needle safety which is expected to further spur adoption among end users. In addition, as support to the segment's healthy growth is the surge of point-of-care testing and personalized medicine.

Across end users, hospitals will keep a strong hold on the market, expanding at a CAGR of 5.8% during the forecast period, fuelled by surgical treatments, inpatient care, and government immunization initiatives.

Hypodermic syringes and needles are predominantly consumed by hospitals as they are widely used in surgeries, emergency departments, ICUs, and vaccination programs. Increased cases of chronic diseases that followed by a rising volume of inpatient admissions and surgeries are anticipated to a support demand.

Moreover, government-led vaccination initiatives and infection control measures, which mandate such use, are also pushing the adoption of disposable and safe syringes in the hospital settings. Hospital procurement volumes are poised to grow further with expanding healthcare infrastructure across emerging economies, thus bolstering segment growth.

In 2025, Becton Dickinson (BD) should continue to dominate Latin America with a 30-35% share in 2025, due to robust local manufacturing in Brazil and collaboration with public health programs. With a clear focus on safety-engineered syringes and supply chain resilience, it has been widely adopted across hospitals and clinics.

Terumo is projected to hold a 20 to 25% share, driven by demand for safety syringes in Mexico and Colombia. Regulatory support for needlestick prevention boosts its growth while expanding partnerships with healthcare providers enhances regional penetration. Nipro Corporation is expected to hold 12-15%, benefiting from its cost-competitive syringes and strong distribution networks in Brazil and Mexico.

Hindustan Syringes & Medical Devices (HMD) is expected to capture 8-12%, benefiting from cost-effective auto-disable syringes used in large-scale vaccination drives. Gerresheimer AG (7-10%) and Cardinal Health (5-8%) grow through prefilled syringes and hospital supply chains, addressing chronic disease management needs.

B. Braun (5-7%) and regional manufacturers collectively hold 10-15%, competing with cost-efficient and sustainable syringe solutions. Local firms gain traction in government procurement programs while increasing demand for eco-friendly medical devices, which creates growth opportunities in the region.

Rising chronic diseases, expanding vaccination programs, and advancements in medical technology are boosting demand.

Strict safety standards, sterilization protocols, and waste disposal laws are shaping manufacturing and distribution.

Hospitals, diabetic patients, and family practitioners drive demand, with hospitals leading due to high surgical volumes.

Retractable needles, smart syringes, and eco-friendly materials are enhancing safety, efficiency, and user convenience.

Growing home-based treatments for diabetes and hormone therapy are increasing demand for prefilled and auto-disable syringes.

By type, the industry is segmented into needles, syringes, and combinations.

In terms of end users, the industry is segmented into hospital, diabetic patients, family practitioners, psychiatry, and others.

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.