The Latin America HMO market is set to grow from an estimated USD 8.4 million in 2025 to USD 17.0 million by 2035, with a compound annual growth rate (CAGR) of 7.3% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 8.4 million |

| Projected Latin America Value (2035F) | USD 17.0 million |

| Value-based CAGR (2025 to 2035) | 7.3% |

A surge in the number of healthcare professionals and parents becoming aware of the significant impact nutrition has on the growth and development of infants is being observed. Educational campaigns along with researches showcasing the advantages of correctly feeding infants, are the main reasons for this awareness.

The importance of Human Milk Oligosaccharides (HMOs) is being realized more and more as people find out that they have a positive effect on factors such as gut health, immune functions, and the overall well-being of infants. Thus, parents are mostly seeking HMO-containing products in order to assist their children towards a good life.

Birth rates in some areas of Latin America are either remaining at the same level or increasing. This directly affects the amount of infant nutrition products in the market. With the arrival of new family members, the demand for quality infant formula and other products increases in a corresponding way. The mapping of this trend is strongest in urban places, where busy mothers choose to use formulas.

The sum of this is that the increasing number of infants leads to the growth of the market for products that are fortified with Human Milk Oligosaccharides (HMOs) which mirror a turn in the direction of better nutritional practices.

Explore FMI!

Book a free demo

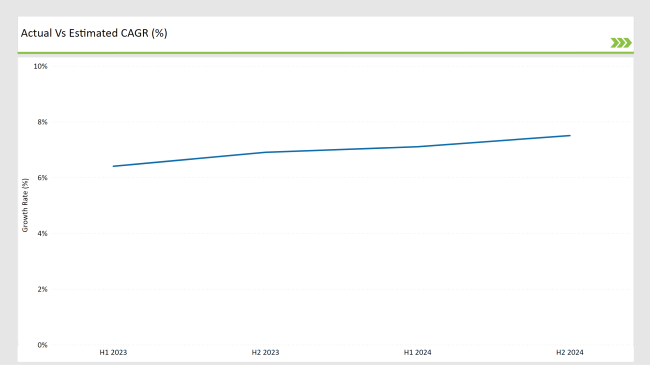

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Latin America HMO market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin America HMO market, the is predicted to grow at a CAGR of 6.4% during the first half of 2024, with an increase to 6.9% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 7.1% in H1 and is expected to rise to 7.5% in H2.

This pattern reveals a decrease of 14 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 18 basis points in the second half of 2025 compared to the second half of 2024.

The Gut Health Revolution: Understanding Its Impact on Well-Being

The increasing realization that your gut health is the most important factor in your health is reshaping the consumer behavior in Latin America. Human Milk Oligosaccharides (HMOs) are gaining more and more recognition for being the prebiotic ingredients that facilitate the colonization of the gut bacteria that improve digestion. This trend refers not only to the nutrition of babies but to other age-suitable additions as well, which helps to reflect a comprehensive plan for health.

As customers learn more about the gut-brain connection and how it can affect immunity, mood, and metabolic health, the growth of demand for HMO-enriched products is on the rise. Companies are answering the call and produce different products using formulations with HMOs which are sold to health-conscious consumers who strive after improved health and a better quality of life.

Fucosylated HMOs: A Game Changer in Infant Formula

The trend of parents increasingly being selective when it comes to choosing products for their babies is observed, hence, the demand for premium quality infant nutrition products skyrocket. Parents are given the chance to look for infant formulas that are a close match to human breast milk, which is popular for its unique and health-promoting factors in infants.

Human Milk Oligosaccharides (HMOs) that are types of fucosylated, like 2FL and 3FL, are featured more in premium formulas as the most important components. The components are related to the gut's health condition and the body's auto immune factors which is why they are featured as a product of choice for parents who are health-conscious.

Manufacturers are now becoming involved with the development of both the artery and the infant formula industry by creating formulas that contain such ingredients thus ensuring themselves the place in the market of the new generation families who are looking for the best for their infants.

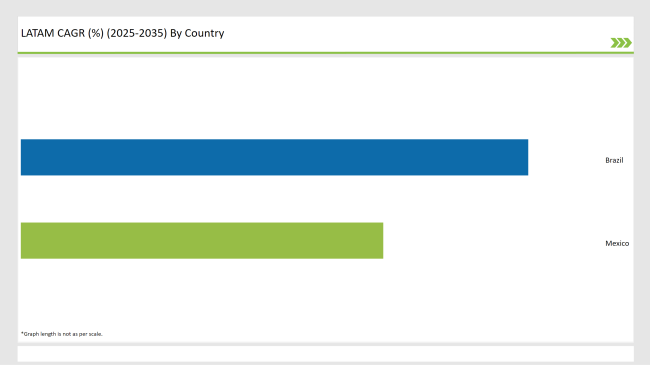

The following table shows the estimated growth rates of the top two markets. These countries are set

Pediatricians in Brazil act as major actors in influencing the decision of parents on what to feed infants. Due to their being more aware of the benefits of Human Milk Oligosaccharides (HMOs) for immune support and gut health, many pediatricians are now recommending HMO-enriched formulas to parents more often. This endorsement of a professional is particularly important among families who are health-conscious and are looking for the best nutritional solutions for their infants.

Pediatricians stress the importance of the allocation of HMOs to the effects of mimicking breast milk, thus reassuring the parents about the quality and the efficacy of these products. Advancing the demand for HMO-enriched infant formulas in the market is the consequence of this particular guidance.

The demand for Human Milk Oligosaccharides (HMOs) is heavily affected by the entrance of big global infant formula brands into the market in Mexico, which is a big factor driving this trend.

These companies are putting HMO-enriched products that are particularly made according to local preferences into the market, which makes them more appealing to health-conscious parents. Along with this market expansion, there is a cultural change towards premium and organic products that trend with Mexican consumers.

Parents are showing more interest in purchasing high-quality infant nutrition that is supplemented with various health benefits and notably gut health and immune support. The readiness to choose premium alternatives is the key factor driving consumer interest in HMO-enriched formulas, which are regarded as the best substitutes for breast milk with similar nutritional content and lastly boost sales in the infant nutrition market.

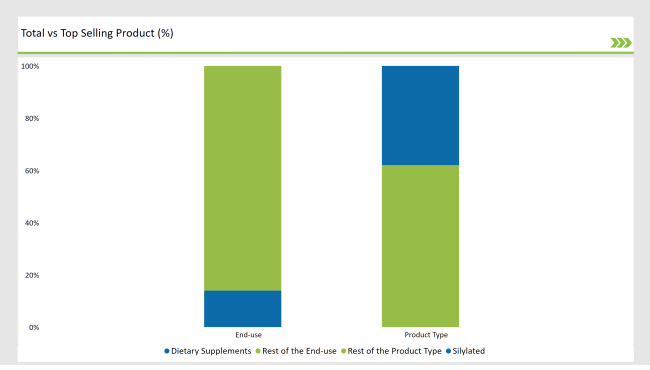

% share of Individual categories by Product Type and End-use in 2025

Enhancing Infant Nutrition: The Impact of Sialylated HMOs and Regulatory Frameworks

Sialylated Human Milk Oligosaccharides (HMOs), 3SL and 6SL for instance, are now viewed as enormousenhancing potential of cognitive development and brain health in infants. As the focus on early brain development rises among parents, there is a parallel increase in demand for infant formulas which come with these positively oligosaccharides.

On the other hand, governmental and regional health organizations provide the right backing by offering support for the sialylated HMOs inclusion in infant nutrition products.

Thanks to this supporting regulatory framework, the manufacturers are adequately encouraged to come up with new HMO-enriched formulas while at the same time it gives the parents a feeling of being on the safe side due to the product being proven effective and safe. The sialylated HMOs market is being pushed forward by these factors since they meet the consumers' requirements as well as the regulations.

Empowering Health: The Role of HMOs in Targeted Dietary Solutions

The need for Human Milk Oligosaccharides (HMOs) in dietary supplements is reliant on the targeting of specific demographics, including children, pregnant women, and the elderly to a large extent.

All of these groups are particular regarding their nutritional needs and HMOs are known for their benefits, e.g. the support for gut and immune health, making them so appealing to customers who care a lot about their health. Moreover, manufacturers came up with this problem by creating many diverse products which include HMOs in several different formats, like powders, capsules, and functional foods.

This assortment of HMO-enriched goods makes it easier for the consumers to include the supplements in their everyday routines, which in turn caters to different preferences and lifestyles. These tactics work together to increase the availability of HMO products, in turn they are with much higher popularity in the dietary supplements market.

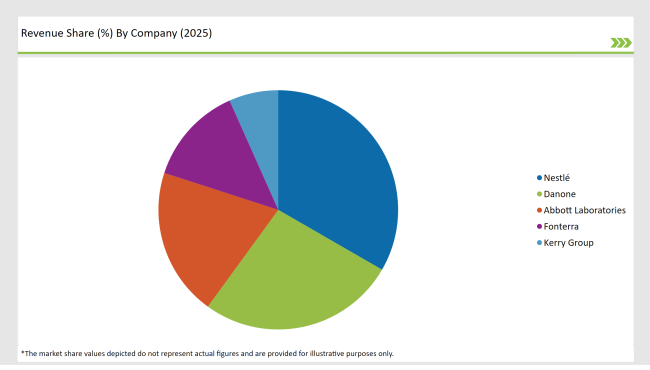

Note: above chart is indicative in nature

Human Milk Oligosaccharides (HMO) market in Latin America is observed to have a moderate level consolidation with players like Nestlé, Danone, and Abbott Laboratories maintaining the industry leadership with their extensive portfolio of products and robust distribution networks. These companies use their significant resources in research and development to bring about innovations to the HMO formulations, thus they remain competitive in the premium infant nutrition market.

Alongside, local players such as Bifidobacterium and HMO Bio concentrate on niche sectors by creating custom-made products to meet regional consumer demands. The fast-paced environment is a breeding ground for competition and drives innovation in HMO products and technology throughout the region.

The Latin America HMO market is projected to grow at a CAGR of 7.3% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 17.0 million.

The expansion of major global infant formula brands is significantly influencing the demand for Human Milk Oligosaccharides (HMOs). These brands are introducing HMO-enriched products specifically tailored to local preferences, enhancing their appeal to health-conscious parents.

Mexico and Brazil are key regions with high consumption rates in the Latin America HMO Market.

Leading manufacturers include Nestlé, Danone, Abbott Laboratories, Fonterra, and Kerry Group.

As per Type, the industry has been categorized into Fucosylated (2FL, 2FL DFL, 3FL), Silylated (3SL, 6SL) and Non-fucosylated Neutral (LNT, LNnT, LNFP)

As per End-use, the industry has been categorized into Infant Formula and Dietary Supplements.

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

A detailed analysis of the Australia Licorice Root industry and growth outlook covering form, and application segment

UK Licorice Root Industry Analysis from 2025 to 2035

USA Licorice Root Industry Analysis from 2025 to 2035

A detailed analysis of the Australia Mezcal industry and growth outlook covering product, source, concentration, and distribution channel segment

Comprehensive Analysis of Europe Mezcal Market by Product, Source, Concentration, Distribution Channel and Country through 2035

Comprehensive Analysis of ASEAN Mezcal Market by Product, By Source, By concentration, By sales Channel and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.