The Latin America Herbs and Spices sales is set to grow from an estimated USD 11,239.4 million in 2025 to USD 17,123.3 million by 2035, with a compound annual growth rate (CAGR) of 4.0% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Latin America Industry Size (2025) | USD 11,239.4 million |

| Projected Latin America Industry Value (2035) | USD 17,123.3 million |

| Value-based CAGR (2025 to 2035) | 4.0% |

The herbs and spices market in Latin America is projected to see new innovations, shaping it into major fuelling the flash over the next years with some innovative factors such new consumer preferences, health, turmeric, ginger, garlic, and cinnamon.

Furthermore, pushing the manufacturers to similar clean source products to go organic is the trend in urban areas where consumers increasingly prefer organic and sustainably sourced herbs and spices. The changing demands of urban consumers prioritize the organic and environmentally responsible products which are affecting the whole region purchasing behaviour.

Food diversity is also a crucial factor as Latin American consumers have become bolder in trying international dishes: from Middle Eastern to Asian food. This trend, in turn, is stimulating the demand for spices such as cumin, cardamom, and chili peppers in home cooking and foodservice.

What is more, product development is taking off the ground widely, which is done through the brands assigning spice blends, ready-to-use seasonings, and creative designs to satisfy the busy and healthy consumers. Last but not least, the herbs and spices of Latin America exporting, as it the region is a supplier on the global market, it expands the Chilean and Peruvian trade. Back to normal, this report showcases the herbs and spices market in Latin America with the following highlights and key aspects of it.

Explore FMI!

Book a free demo

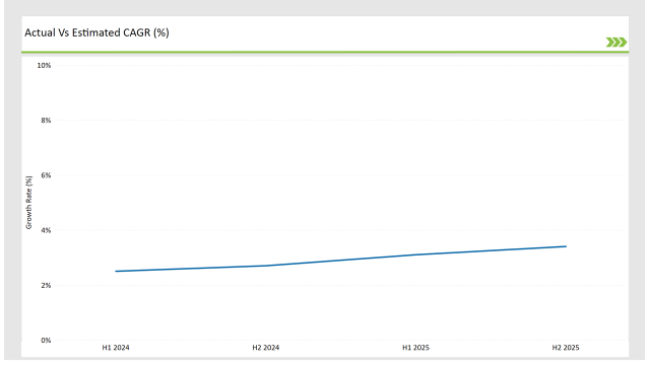

The table below provides a comparative assessment of the changes in compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Latin American Herbs and Spices market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 2.5% |

| H2 (2024 to 2034) | 2.7% |

| H1 (2025 to 2035) | 3.1% |

| H2 (2025 to 2035) | 3.4% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin American Herbs and Spices Industry, the sector is estimated to grow at a CAGR of 2.5% during the first half of 2024, with an increase to 2.7% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 3.1% in H1 but is expected to rise to 3.4% in H2.

| Date | Development/M&A Activity & Details |

|---|---|

| 24- Oct | In October 2024, Badia Spices, a family-owned Hispanic food company, agreed to sell a majority stake to a group of investors, including Grupo Mariposa's investment arm, Bia Foods, and BDT & MSD Partners. |

Consumer Preference of Organic and Clean-Label Products

The increasing consumer preference for organic and sustainably sourced herbs and spices is a major growth driver in the Latin American market. Health-conscious consumers are prioritizing transparency in food sourcing, driving demand for organic certifications and clean-label products, which relates to the global tendency towards the healthier and environmentally responsible consumption, thyme, and other herbs that have long time been used for health applications.

Increased Culinary Diversification and Global Flavor Trends

The Latin American population has embraced exploring new cooking traditions inspired by world gastronomy and cultural spices. Assimilation of international recipes peppering existing food culture increases the necessity for herbs and spices, like cumin, cardamom, and saffron. The herb and spice market, having a broad impact on home cooking, is also spurring innovation in the food service, packaged foods, where ethnic-flavor innovations are gaining traction.

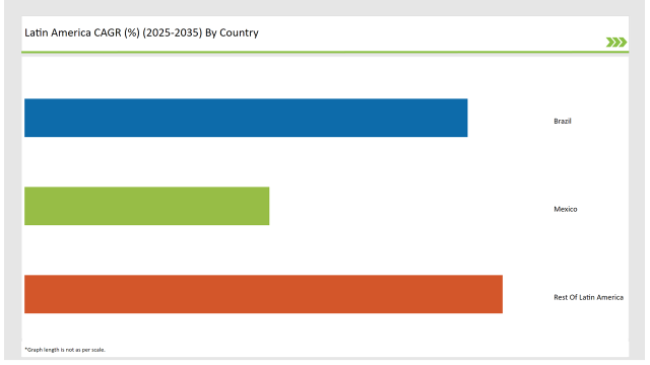

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Brazil | 38% |

| Mexico | 21% |

| Rest Of Latin America | 41% |

The most substantial part of the herbs and spices market in Latin America is occupied by Brazil, which has a share of 38%, thanks to the country's diverse agricultural lands that allow it to be one of the main cultivators of several vegetables including oregano, garlic, and chili peppers. The diversity of the Brazilian culinary culture is characterized by the use of different spices in regional dishes.

Moreover, the upward trend of healthy eating brings about a higher demand for spices that carry a health message (e.g. turmeric and ginger) which are natural and functional. With the increase in the cultivation of organic farms, Brazil has a wider selection of organic herbs and spices which is positive for local and global market actors.

Mexico captures 21% of the region's market with the largest area spices in the plants market driven by the authentic traditional culture where different spices like cumin, chili, oregano fill the posters in the home kitchens.

At the same time, opening more restaurants and increased demand thus, healthcare has come with spices for all the various regions of Mexico through a portuestable. Furthermore, the overall amusement of the consumption of product mixtures, where customers see spices like cinnamon and cloves used for their antioxidant benefits is acquiring prevalence.

The country besides watching growth in the organic and clean-label segment so much that both domestically and internationally, people, and customers seek more transparent and more sustainable products.

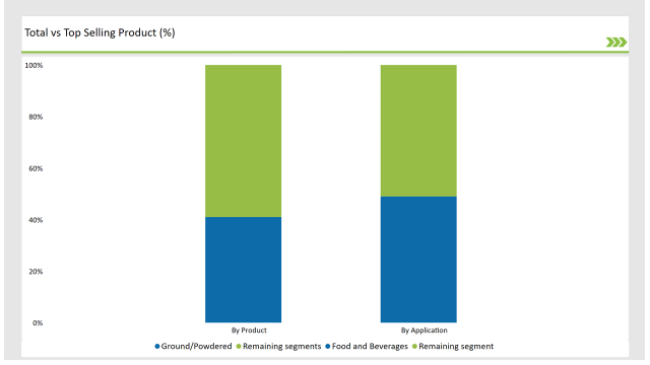

% share of Individual categories by Product Type and Applications in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Ground/Powdered) | 41% |

| Remaining segments | 59% |

The Ground/Powdered herbs and spices segment holds a significant 41% market share in the Latin American region. This product type is particularly popular due to its convenience and versatility in cooking, allowing consumers and food manufacturers to easily incorporate them into a variety of dishes. Ground or powdered forms of herbs and spices like chili powder, cumin, oregano, and turmeric are commonly used in both home kitchens and the foodservice industry for flavor enhancement and food preservation.

This assertion of the preference for powdered option herbs and spices is supported by the fact that they have a longer shelf life and that they are staples in many households in the subregion. Moreover, the growing demand for convenience's genetic materials and sustainability in every aspect drives the ground/powdered form to be a go-to for busy consumers who want something quick and tasty.

The trend of health continues to dominate the powdered version of spices, too, so that we see just a few of these are left, such as functional turmeric, ginger, and garlic powder which are popular among everyone for their health propertiesThe popularity of packaged spices and spice blends is also on the rise, and the expected growth of the powdered form sector in the forthcoming years will very likely be supported by this

| Main Segment | Market Share (%) |

|---|---|

| Application (Food and Beverages) | 49% |

| Remaining segments | 51% |

The Food and Beverages application segment dominates the herbs and spices market in Latin America, accounting for 49% of the market share. This significant portion is driven by the widespread use of herbs and spices in both home cooking and the foodservice industry.

In Latin America, spices like chili, cumin, oregano, and garlic are essential in the preparation of regional dishes, giving the food a unique and vibrant flavor profile. The growing popularity of ethnic cuisines, particularly Mexican, Brazilian, and South American flavors, has fueled this demand, as consumers seek to recreate traditional and international dishes.

The rise in convenience meals, packaged foods, and beverages are other reasons for this segment's growth. Manufacturers are introducing more herbs and spices into functional beverages, including smoothies, detox drinks, and wellness products, to resonate with health-conscious consumers.

The increased knowledge of the health benefits of herbs and spices-such as their antioxidant, anti-inflammatory, and digestive properties-has also led to the use of spices in functional foods and beverages. As consumer preferences shift towards healthier, more flavorful, and more convenient options, the food and beverages sector will continue to be a crucial driver of growth in the herbs and spices market in Latin America.

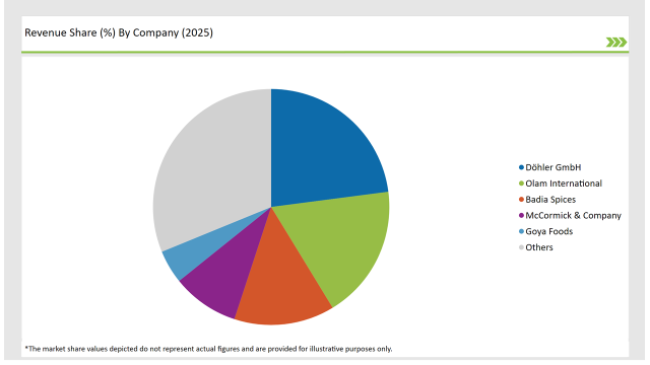

2025 Market share of Latin America Herbs and Spices manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Döhler GmbH | 25% |

| Olam International | 20% |

| Badia Spices | 15% |

| McCormick & Company | 10% |

| Goya Foods | 5% |

| Others | 34% |

Note: The above chart is indicative in nature

The herbs and spices market в Latin America is сoncentrated moderately and high, few global and regional players dominate the market. The leading companies here, like McCormick & Company, Badia Spices, and Goya Foods, are the ones with considerable market shares due to their widespread distribution networks and brand equity that has been established in the entire region. They make use of superior supply chain capabilities, broad product offerings, and economies of scale, as leverage, to retain their market standing in the retail and foodservice segments.

However, the market is also characterized by the growing presence of players from local companies like La Fama, Herdez, and Empresas Polar who are tailored to specific regional preferences and tastes, particularly in Mexico, Brazil, and Venezuela. These companies are commonly more effective because of their local knowledge, brand loyalty, and access to native herbs and spices that are critical to Latin American food.

Despite high players with this strong practical influence, the remaining market space is occupied by smaller upfront with respect to many SME players reLf.int.

Moreover, the space is particularly noticeable in the organic and the functional herbs and spices segments, where local producers are winning ground due to the increasing consumer demand for clean-label and sustainable options.

The Latin America Herbs and Spices market is projected to grow at a CAGR of 4.0% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 17,123.3 million.

The growth is primarily driven by the rising consumer demand for organic, clean-label products, the increasing popularity of ethnic cuisines, and the growing awareness of the health benefits of herbs and spices. Additionally, innovations in spice blends and functional ingredients are attracting health-conscious consumers.

As per Product Type, the industry has been categorized into Herbs, Spices, Paprika (Hot Pepper), and Cumin.

As per Form, the industry has been categorized into Powder & Granules, Flakes, Paste, Whole or Fresh

As per End Use, the industry has been categorized into Food and Beverages, Food Service, and Retail Sales.

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest Of Latin America

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

USA Aqua Feed Additives Market Analysis from 2025 to 2035

Comprehensive Analysis of Europe Fish Meal Market by Product Type, Application, Source, and Country through 2035

Comprehensive Analysis of ASEAN Fish Meals Market by Product Type, by Application, Source, and Region through 2035

A Detailed Analysis of Brand Share Analysis for Fungal Protein Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.