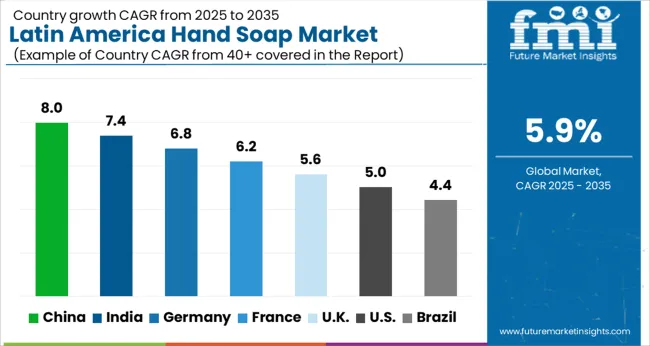

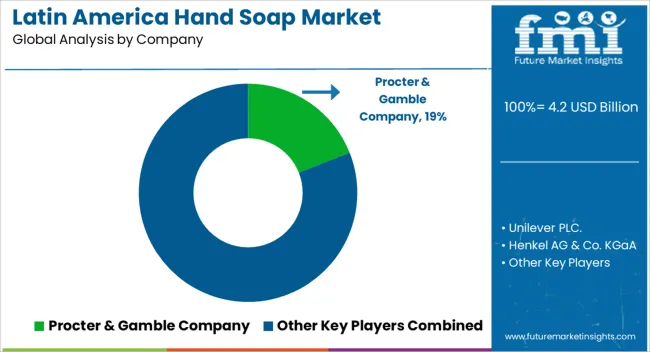

The Latin America Hand Soap Market is estimated to be valued at USD 4.2 billion in 2025 and is projected to reach USD 7.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

| Metric | Value |

|---|---|

| Latin America Hand Soap Market Estimated Value in (2025 E) | USD 4.2 billion |

| Latin America Hand Soap Market Forecast Value in (2035 F) | USD 7.4 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The Latin America hand soap market is experiencing steady expansion, supported by heightened hygiene awareness, expanding middle-class demographics, and strong penetration of personal care products across urban and semi-urban zones. Shifts in consumer habits post-health crises have reinforced routine handwashing behavior, elevating daily-use product demand.

Regional manufacturing capabilities are strengthening through foreign investment and automation, enabling scalable production and improved distribution across domestic and export markets. Retail modernization, coupled with omnichannel strategies adopted by major brands, is increasing accessibility and affordability.

Sustainability concerns and demand for dermatologically tested products are shaping formulation trends, while fragrance innovation and packaging aesthetics are emerging as key differentiators. The future outlook is expected to remain positive, driven by rising household consumption, premium product positioning, and continuous innovation in formulation, scent, and packaging.

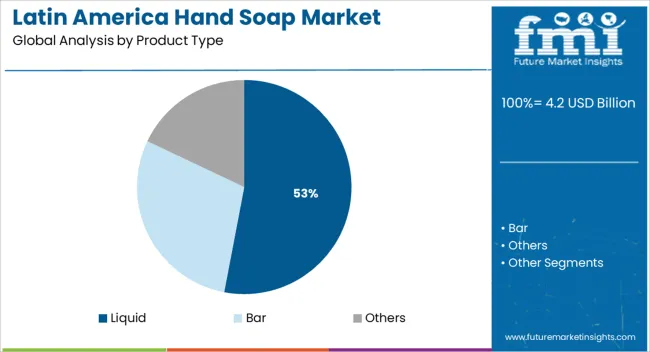

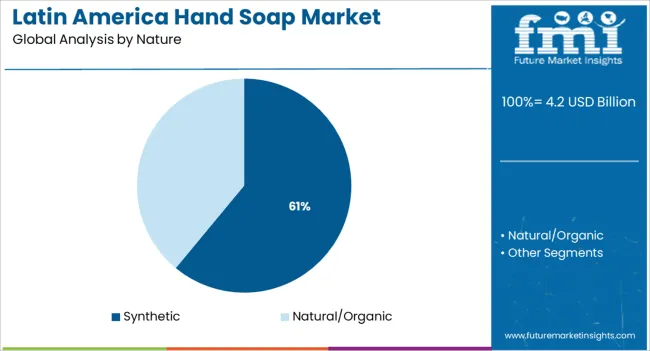

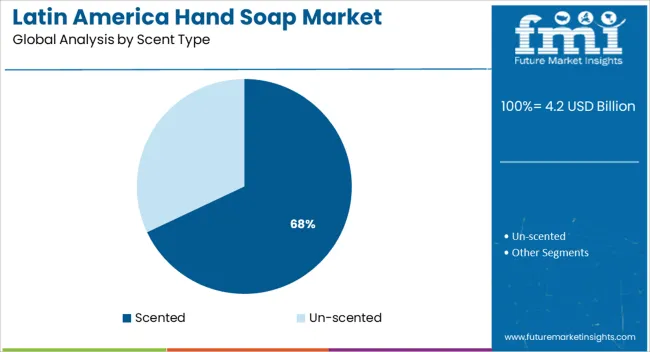

The market is segmented by Product Type, Nature, Scent Type, and Application and region. By Product Type, the market is divided into Liquid, Bar, and Others. In terms of Nature, the market is classified into Synthetic and Natural/Organic. Based on Scent Type, the market is segmented into Scented and Un-scented. By Application, the market is divided into B2C and B2B. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Liquid hand soap is projected to hold 53.0% of total market revenue in 2025, making it the dominant product type. This segment's leadership is being attributed to consumer preference for convenience, superior lathering, and ease of dispensing.

Enhanced shelf presence through attractive packaging and pump formats has strengthened liquid soap’s retail appeal, particularly in modern trade outlets and e-commerce platforms. Liquid formats are perceived as more hygienic due to minimal direct contact, and their compatibility with refill packaging has also contributed to rising adoption.

Manufacturers are investing in skin-safe, moisturizing variants to address regional concerns around hard water and frequent usage, which is further reinforcing the segment's appeal across income brackets.

Synthetic formulations are expected to account for 61.0% of the market share in 2025, establishing themselves as the leading nature category in hand soap. This position is driven by formulation stability, lower production costs, and broader compatibility with antimicrobial additives and fragrance systems.

Synthetic soaps offer longer shelf life and consistent performance under varying climatic conditions—critical for Latin American markets with diverse humidity and temperature ranges. The ability to produce high foam content and integrate vibrant colors and scents has made synthetics preferred by both consumers and manufacturers.

Additionally, synthetic formulations facilitate mass production and standardization, aligning with regulatory compliance and cost-efficiency goals.

Scented hand soap is projected to lead with 68.0% of revenue share in 2025, dominating the scent type category. The segment’s strength is underpinned by consumer emphasis on sensory experience and product indulgence, especially in personal and home care routines.

Fragrance variety—ranging from floral and fruity to herbal and therapeutic—is enhancing repeat purchases and brand loyalty. Scented options are perceived as offering premium quality, and they often align with lifestyle branding strategies adopted by leading companies.

The growing popularity of mood-enhancing and seasonal scents is also contributing to diversification within the segment. In-store sampling, influencer campaigns, and targeted promotions around wellness and self-care are accelerating the adoption of scented variants in both mass and premium price bands.

As per newly released data by Future Market Insights (FMI), there has been an increase in urbanization rates, including in developing countries of Latin America, with a large share of the population moving from rural to urban areas. This has led to a rise in income, improved standard of living, and the adoption of hygiene products such as soaps in daily life.

There has also been a significant rise in the case of infections and skin diseases. Therefore, anti-fungal or medicare soaps are highly adaptable among individuals across Latin America.

Lastly, product innovation and trends play a vital role in resulting in the boost of the market. Market leaders are focusing on developing eco-friendly products and emphasizing sustainable packing, green marketing, and a green supply chain to attract a huge audience with the help of an environment-friendly strategy.

Expansion of Hotel and Restaurants to Boost the Sales of Hand Soaps in Latin America

Hotels and restaurants are a highly profitable and lucrative business vertical. However, in post covid situations, the hotel & hospitality industry is set to serve its customers with increased hygiene standards. Hotel chains are extensively focusing on preventive measures and following the hygiene protocols abided by the government.

Furthermore, large chain hotels frequently provide hand soaps to clients to advertise their brands. Private-label hand soap manufacturers form partnerships with hotel chains to provide hotel-branded amenities.

For instance, in 2020, Delta Hotels (Marriott) partnered with Soapbox to obtain a supply of premium hand wash products. Following the epidemic, increased attention to sanitation might emerge as a significant USP for hotel chains, making this factor essential for the growth of the hand soap industry.

Government Attempts Towards Creating Hygiene Awareness are Anticipated to Boost the Sales in the Country

Brazil is one of the fast-growing markets for the hand soap market and holds a share of 32.0% of the entire Latin America hand soap market. The hand soap market in Brazil is anticipated to rise at a CAGR of 3.9% during the estimated tenure.

The prevalence of infectious diseases like diarrhea, pneumonia, and other diseases can be reduced or minimized by maintaining proper hand hygiene. As per the WHO report, most children get sick owing to a lack of proper hand hygiene. Thus, government organizations are taking initiatives to promote soaps and make people aware of the importance of washing hands to prevent infections and diseases, driving the demand for hand soap products.

Company Focus on CSR Activities to Aid the Growth of the Hand Soap Market in Mexico.

Mexico is one of the lucrative markets for the hand soap market and holds a share of 19.1% of the Latin America hand soap market. The hand soap market is anticipated to rise at a CAGR of 4.8% during the estimated tenure.

With the growing adoption of hand soap among the masses, manufacturers are now focused on engaging in CSR activities to create awareness of their products. CSR activities are the best marketing medium resulting in the tremendous sales of hand soaps in the Mexico market. Meanwhile, CSR activities also help enhance the product market while considering the customers' needs.

Rising Standard of Living and Disposable Income is Anticipated to Drive the Hand Soap Market in Chile

Chile is one of the emerging markets in the Latin America hand soap market and holds a share of 12.3% of the entire Latin America hand soap market. The hand soap market in Chile is anticipated to rise at a CAGR of 6.5% during the estimated tenure.

With increased disposable income in Chile, there has been a significant increase in the usage of personal hygiene products. The quality of life, disposable income, urbanization, and economic importance of the personal care industry have all altered dramatically in communities. Consumption of hygiene goods in the country has increased considerably in recent years, and this trend is expected to continue in the coming years.

Liquid Soap is Anticipated to Generate High Demand in Hand Soap Market

Based on the product type, liquid hand soap holds a share of 35.5% of the overall sales of the hand soap market. The sales of bar hand soaps are anticipated to grow rapidly at a CAGR of 7.1% during the estimated tenure.

Due to a wide variety in flavor, the market for liquid soaps is growing significantly compared to soap bars and other soaps. Lavender-flavored products outsell counterparts such as rose, lemon, and other varieties of liquid hand wash. Companies are introducing additional features to cater to consumers' diverse interests and preferences. Certain flavors, notably botanical or natural tastes, are more popular than conventional flavors soaps.

The Natural/Organic Soap to Hold a Lion’s Share in the Hand Soap Market

In terms of nature, natural/organic soaps hold a significant share in the market of 52.0% of the total hand soap market share in Latin America. The natural/organic soap growth is anticipated to grow at a CAGR of 6.6% during the forecast period.

Due to increasing consciousness about the harmful effects of certain compounds found in conventional hand washes, such as parabens, silicone, sulfates, artificial dyes, and colorants, the Latin America market for organic hand soap has witnessed an increase in demand for natural and clean-label liquid soap products.

Over the last several years, there has been a surge in demand for safe, natural, organic, and cruelty-free bath products.

B2C Are Anticipated to Drive the Sales in Market

In terms of application, B2C holds the major share in the hand soap market at around 56.0% of the total market share. The B2C segment is anticipated to grow steadily at a CAGR of 4.8%.

Demand from B2C has witnessed significant growth due to customers' large availability of retail choices. Moreover, the wide availability of products at multiple locations results in better accessibility of products to the customers.

Due to the wide availability of sales channels, the manufacturers can cater to many customers. Hence, key manufacturers in the hand soap industry are strategizing their sales strategies with the help of an Omni channel medium.

Leading companies are focusing on product launches and mergers & acquisitions to increase their global presence and generate high revenue. To cater to the increasing demand for hand soap worldwide, manufacturers are focusing on the objective to expand product lines or to include newer products in their respective offerings.

For instance:

Colgate-Palmolive Company, Procter & Gamble, and Henkel AG & Co- Providing the Cleanest Hands in Latin America with Best Hand Soap!

Colgate-Palmolive Company is a global consumer goods corporation located on Park Avenue in Midtown Manhattan, New York City. It is a manufacturer, distributor, and provider of home, health care, personal care, and veterinary products.

Colgate-Palmolive used a patent approach to protect the liquid soap bottle's dispensing pump. Without access to the pump, other rivals could not debut their goods for two years, giving Colgate-Palmolive (Softsoap brand) a distinct advantage in the market area.

Due to growing awareness of the negative effects of certain chemicals, such as paraben, silicone, sulphate, artificial dyes, and colorants contained in hand washes and shower gels, the demand for natural and clean-label liquid soap products has increased across Latin America.

In July 2024, Colgate Palmolive introduced Softsoap foamy hand wash tablets and a refillable, recyclable aluminum container. A typical foaming plastic soap container includes 71% more plastic than the Softsoap foaming tablet starter set. The strategic project intended to eliminate plastic waste from the packaging of liquid hand soap.

The Procter & Gamble Company (P&G) is an American global consumer products conglomerate headquartered in Cincinnati, Ohio. William Procter and James Gamble formed the company in 1837. It specializes in a wide range of personal health/consumer health, personal care, and hygiene goods, divided into numerous categories such as beauty, grooming, health care, fabric & home care, and infant, feminine, and family care.

Furthermore, customers are gradually shifting toward refill pouch solutions since they are less expensive than plastic bottles and can be readily discarded. Likewise, increased investments in marketing and branding operations are projected to boost demand for hand soap in Latin America.

In April 2024, Procter & Gamble introduced water-free swatches of soaps and detergents, which foam when water is added and are projected to drastically cut water consumption throughout the manufacturing process.

Henkel AG & Co., or Henkel, is a German multinational chemical and consumer products corporation headquartered in Düsseldorf, Germany. It operates in both the consumer and industrial markets.

The DAX firm, founded in 1876, is structured into three worldwide functioning business areas (Laundry & Home Care, Beauty Care, and Adhesive Technologies) and is recognized for brands like Loctite, Persil, Fa, Pritt, Dial, and Purex, among others.

In August 2025, Dial, a Henkel brand, is demonstrating its commitment to sustainability with the debut of its new invention, Concentrated Refills, and relationships with sustainability pioneers like the Plastic Bank Recycling Corporation, TerraCycle, Inc., and Solidaridad.

When mixed with water, each Dial Concentrated Refill package produces a full-size bottle of Dial Foaming Hand Wash while using 95% less plastic. The containers are also constructed entirely of paper-based cardboard, and the packets are recyclable thanks to Dial's collaboration with TerraCycle.

Similarly, in September 2024, Henkel AG & Co. KAaA, a Germany-based consumer goods major, invested USD 23 million to expand the production capacity of its Dial brands' liquid hand soap and sanitizer at the New York and Pennsylvania, USA locations.

| Attributes | Details |

|---|---|

| Estimated Market Size 2025 | USD 4.2 billion |

| Projected Market Size (2035) | USD 7.4 billion |

| Value CAGR (2025 to 2035) | 5.9% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | Latin America |

| Key Countries Covered | Brazil, Mexico, Costa Rica, Chile, Colombia, Guatemala, Panama, Peru, and the Rest of Latin America |

| Key Segments Covered | Product Type, Nature, Scent Type, Application, and Country. |

| Key Companies Profiled | Procter & Gamble Company; Unilever PLC.; Henkel AG & Co. KGaA; Reckitt Benckiser Group PLC; Gojo Industry Inc.; Vi-Jon Laboratories, Inc.; S. C. Johnson & Son, Inc.; The Clorox Company; Colgate-Palmolive Company; Daryza S.A.C. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global latin america hand soap market is estimated to be valued at USD 4.2 billion in 2025.

The market size for the latin america hand soap market is projected to reach USD 7.4 billion by 2035.

The latin america hand soap market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in latin america hand soap market are liquid, bar and others.

In terms of nature, synthetic segment to command 61.0% share in the latin america hand soap market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Fungal Protein Market Outlook – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA