The Latin America fermented ingredients market is set to grow from an estimated USD 4,482.8 million in 2025 to USD 9,222.1 million by 2035, with a compound annual growth rate (CAGR) of 7.5% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 4,482.8 million |

| Projected Latin America Value (2035F) | USD 9,222.1 million |

| Value-based CAGR (2025 to 2035) | 7.5% |

Based on the latest market analysis, the Latin America fermented ingredients market is foreseen to witness explosive growth during the period of 2025 to 2035. The advancement of food technology has served as the catalyst in the development of novel emulsifiers with better functionalities, which in turn, helps in the stability of the product, moisture retention, and fat content.

By the year 2025, the market for fermented ingredients is projected to reach USD 4,482.8 million in value, whereas the next 10 years are estimated to be the period of annual growth at 7.5%. The health benefits of fermented foods are most identified with the intake of several digestive enzymes in the gut tract, the growth of good gut bacteria, and the rise of nutrient absorption.

There is a noticeable increase in demand for probiotic-rich fermented products on the part of consumers who are increasingly leaning toward health.

Dishes enriched with fermented ingredients not only become distinctive in flavor but also appeal to both chefs and home cooks alike. Their talent in reshaping conventional recipes and sparking new culinary ideas has raised the bar for their employment.

Fermented ingredients, be it veranda sauces or rich, umami-packed components are not only the means of adding unique taste to dishes but also of promoting culinary experimentation and innovation in various cuisines.

Explore FMI!

Book a free demo

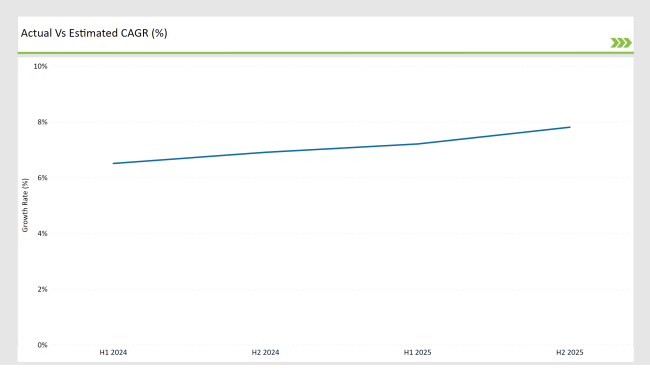

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Latin America fermented ingredients market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin America fermented ingredients market, the sector is predicted to grow at a CAGR of 6.5% during the first half of 2024, with an increase to 6.9% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 7.2% in H1 and is expected to rise to 7.8% in H2.

This pattern reveals a decrease of 12 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

Surging Demand for Fermented Vitamins and Antibiotics in Latin America

The Latin American pharmaceuticals' sector is not far behind as there has been a huge upsurge in the antibiotics and organic acid market coming from fermentation processing which is due to their natural source, high bioavailability, and eco-friendliness.

The use of these ingredients is a prerequisite in the formulation of drugs especially antibiotics since their production through fermentation guarantees a certain level of purity and potency. As the government remains more consistent with the rules that support the use of naturally sourced raw ingredients, the companies are shifting towards fermentation-based remedies.

In personal care, manufacturers are using fermented vitamins (like Vitamin C and B complexes) and industrial enzymes in skincare and haircare formulations. The addition of these fermented ingredients leads to increased absorption, stability, and better skin compatibility; therefore, they have become the most wanted components in anti-aging creams, serums, and shampoos.

With the consumers putting a premium on natural, chemical-free products, the trend is shifting towards the use of fermentation in manufacturing personal care products in a broad spectrum of countries in Latin America.

Innovative Fermentation Methods Reshaping Ingredient Production in Latin America

The Latin American fermented ingredients market is being facilitated by the rapid pace of technological development in areas like continuous fermentation, and aerobic fermentation. Thanks to these techniques, manufacturers have become more efficient, scalable, and cost-effective, consequently being able to produce high-quality fermented ingredients at a lower price.

Continuous fermentation improves the production process through the consistent state of microbial activity, which reduces downtimes and improves yield consistency. Aerobic fermentation is used to produce organic acids, enzymes, and probiotics, and this mode provides more oxygen, hence leading to a higher yield.

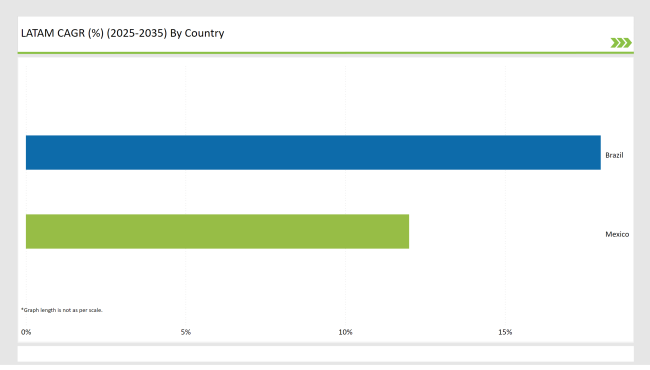

The following table shows the estimated growth rates of the top two markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The quest for specific yeast strains and enzymes has risen as the Brazilian craft beer revolution takes the stage, the independent brewers shift toward the artisanal - fermented beer varieties. As more and more microbreweries surface, the need for quality fermentation-distributed raw materials has practically shifted to a new comparative dimension.

However, traditional Brazilian fermented foods like vinaigrette (fermented vegetable relish) and doce de leite (fermented sweetened milk) continue to form a strong basis in the local food culture.

The trend towards homemade and small-batch fermented foods has emphasized the necessity for fermented cultures, probiotics, and organic acids, which in turn, have pointed out a larger consumer move toward health-conscious, natural, and quality fermented products in Brazil's food and beverage sector.

The focus on gut health in Mexico propels the need for fermented ingredients to the forefront. People now more than ever regard probiotic substances having a direct impact on the health of digestive systems, and they are starting to relate it to other benefits like strengthening the immune system and enhancing overall well-being.

Therefore, functional foods and drinks like yogurt, kombucha, and plant-based fermented dairy alternatives are popular. These products are in harmony with the persistent health movement, thus attracting a broadening part of health-conscious buyers.

Also, campaigns that concern Mexico's government in the fight against obesity and diabetes have inversely caused the introduction of alternatives that are healthier.

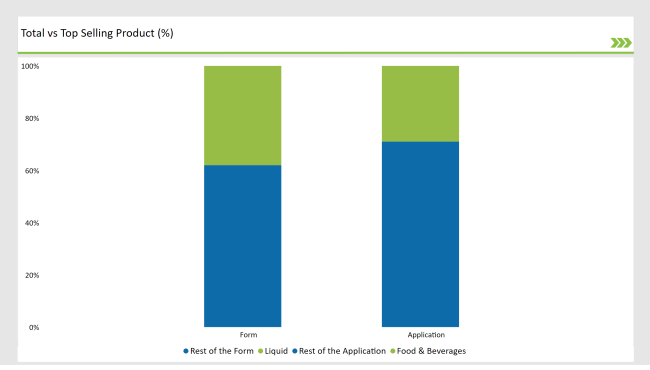

% share of Individual categories by Form and Application in 2025

The excellent solubility and dispersion of liquid fermented ingredients make them very popular in food and drink applications. Liquid forms, such as solutions, suspensions, and emulsions, make it easy for the integration of different products without extra processing. This aspect is the most important for the uniform thickness, quality, and better taste that should be in attractive products like yogurt, sauces, and functional drinks.

Also, the surge in the popularity of fermented drinks in the Latin American market is a driving force behind the increase in the use of liquid fermented ingredients. These additives play an important role in the enhancing taste, giving probiotic properties, and extending the shelf life of these products. The interest of healthy consumers in natural and gut-friendly beverages drives the demand for liquid fermented ingredients by a great deal.

The return of the traditional fermented drinks has been a game-changer to some extent, since they are leading to the demand for the same fermented ingredients. Beverages like Tepache, making with fermented pineapple, and Pulque, an indigenous Mexican drink from agave sap, have started to get more attention from consumers because of their traditional value and also because of the probiotics they provide.

This has led to the commercial production rise and the artisanal revival, which in turn has increased the need for fermentation cultures, yeast strains, and organic acids. As consumers in Latin America go for the combination of tradition and innovation in their diet, fermentation stays essential in the food revolution.

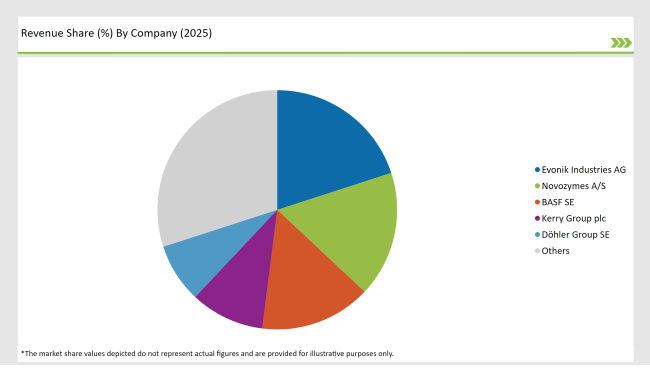

2025 Market share of Latin America Fermented Ingredients Manufacturers

Note: above chart is indicative in nature

The Latin America fermented ingredients market has a moderate level of consolidation with key players such as Evonik Industries, BASF, and Novozymes dominating the market because of their highly advanced production and wide distribution.

These companies are capitalizing on the power that comes through their R&D proficiency, and the reputation, which is already well established among the customers, to hold and make improvements in their positions. They are fully committed to developing sustainable fermentation technologies in order to meet the burgeoning consumer demand for eco-friendly ingredients.

Regional participants, like Manuchar Brazil and Angel Yeast, are also creating their identity by positioning themselves in the local markets and providing the right products. This very interaction of mammoth corporations that are on one hand and regional boutique companies that are more specialized on the other leads further in competitive and product innovation aiming towards customers in Latin America.

The Latin America fermented ingredients market is projected to grow at a CAGR of 7.5% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 9,222.1 million.

The resurgence of traditional fermented beverages in Latin America is significantly influencing the demand for fermented ingredients.

Leading manufacturers include Evonik Industries AG, Novozymes A/S, BASF SE, Kerry Group plc, and Döhler Group SE.

As per Form, the industry has been categorized into Liquid and Dry.

As per Product Type, the industry has been categorized into Amino Acids, Organic Acids, Biogas, Polymer, Vitamins, Antibiotics, and Industrial Enzymes.

As per Application, the industry has been categorized into Food & Beverages, Pharmaceuticals, Paper, Feed, Personal Care, Biofuel, and Others.

As per Process, the industry has been categorized into Batch Fermentation, Continuous Fermentation, Aerobic Fermentation, and Anaerobic Fermentation.

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

A Detailed Analysis of Brand Share Analysis for Herbs and Spices Industry

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

USA Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

UK Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Herbs and Spices Market by Product Type, Form, End Use, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.