The Latin America dehydrated onions market is set to grow from an estimated USD 158.3 million in 2025 to USD 264.2 million by 2035, with a compound annual growth rate (CAGR) of 5.8% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 158.3 million |

| Projected Latin America Value (2035F) | USD 264.2 million |

| Value-based CAGR (2025 to 2035) | 5.8% |

Onions that are dehydrated have an absolute edge over their fresh counterparts, in that they have much longer usability when stored properly. Depending on the conditions and the technique used for their removal of water, these vegetables can become an ideal choice for both households and food manufacturers alike, especially in the regions where refrigeration is a constraint.

The long-lasting feature of dehydrated onions as an ingredient reduces the food waste and the latter part of this statement alone is, they use easy storage to facilitate households and businesses to have a standard supply of onions without spoilage.

Dehydrated onions are also a highly versatile product with application in many different dishes across the world. They can be made soft by adding water to the soup, or the starch in the sauce can thicken; otherwise, they are the second chief component in the dry mix, snack, and marinade.

Their strong taste is a shortcut to upgrading the menu without needing complicated preparation. Such flexibility is the reason why people usually have dehydrated onions in their homes or in the kitchens of world-famous chefs who are looking for comfort, and great flavor.

Explore FMI!

Book a free demo

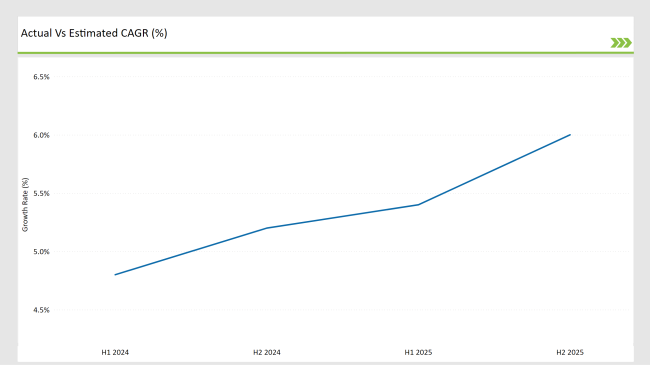

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Latin America dehydrated onions market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin America dehydrated onions market, the is predicted to grow at a CAGR of 4.8% during the first half of 2024, with an increase to 5.2% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 5.4% in H1 and is expected to rise to 6.0% in H2.

This pattern reveals a decrease of 12 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

Enhancing Culinary Experiences: The Rise of Flavored Dehydrated Onions

Innovation in product offerings is a major factor in the Latin America dehydrated onions market, as companies respond to changing consumer preferences such as the demand for various and unique flavors. Producers are developing flavored dehydrated onion products, like garlic-infused or herb-seasoned types, both of which will enrich meals and have a special appeal to curious diners.

In addition, products that mix dehydrated onion with vegetables, such as bell peppers or garlic, are being used more and more, as a result of being practical and adding nutritional benefits. The trend of organic product lines has reached a considerable level, the product oriented audiences are looking for natural and minimally processed ingredients.

These innovations not only expand the client portfolio but also foster net-buyers, leading to profit increases and customer loyalty in a market with stringent rivalry.

Ready-to-Eat Revolution: Dehydrated Onions in Meal Solutions

The dehydration of onions as a segment of convenience food is vastly influencing the organic sector, owing to the pressure exerted by the fast lifestyles prevalent in modern society. People are consistently hunting for quick solutions to their meals, hence, dehydrated onions have become a sought-after figure among these kinds of elements due to their simplicity of use and long life with regard on the shelf.

They add to the ease of the preparation which is possible through the introduction of dehydrated onions in different meals without the chopping or been involved in other extensive cooking. This phenomenon can be seen in the ready-made meals and snacks categories, where dehydrated onions deliver the deepness of taste and texture in foods like instant soups, sauces, or snacks that are salty and rich in flavor.

Through dehydration of onions, the producers improve the most consumed meal by providing a solution to the time-tested problem of stress and preoccupation, which eventually leads to the rise of the market.

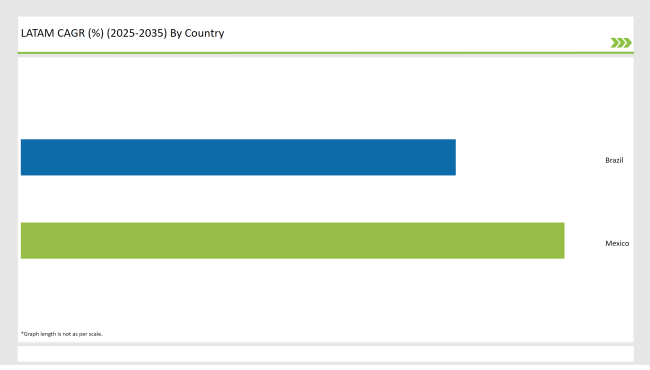

The following table shows the estimated growth rates of the top two markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The severe food processing sector in Brazil is the leading cause of the increased demand for dehydrated onions. Dehydrated onion serves as a key ingredient, offering the delicious and simple solution. In addition, this is particularly seen in the urban municipalities where the chapter asks for the introduction of new, rich, and easy-to-make food products, further securing the place of dehydrated onions in the market.

The Mexican dehydrated onion products exporting capacity to the United States just pumps up the demand. As the Mexican producers take advantage of this opportunity, they are moving. This quality standpoint is not only a vehicle to promote Mexican dehydrated onions abroad but also entails local repercussions as local producers want to stay in the game and thus, upgrade their offerings.

The expanding export market is the backbone of technological development and the main reason why Mexico remains a leader in the dehydrated onion industry throughout the world.

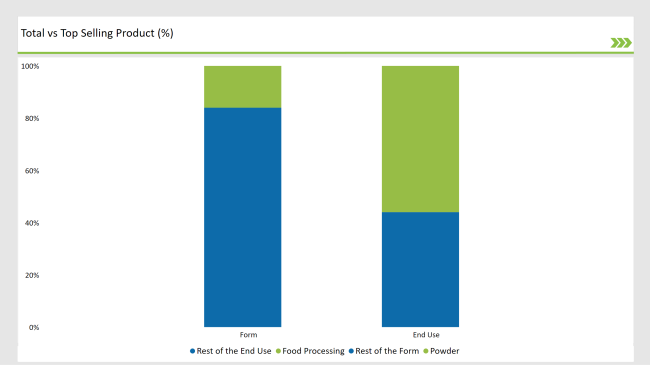

% share of Individual categories by Form and End Use in 2025

Powdered dehydrated onions are increasingly used and thus, embraced for their versatility in formulations and ease of use during food preparations. They mix easily with meals and do not require cutting or rehydration, making them perfect for busy home cooks and food manufacturers.

The ease of use applies to varied products, such as seasoning blends, sauces, and marinades, thus giving enhanced flavors a pass with minimum effort. In addition, the concentrated flavor of powdered onions allows for a robust onion taste using smaller quantities, which is particularly appealing in the food processing sector.

Here, flavor intensity is crucial for product development, which gives manufacturers the other way to feature modern, original, and bold in-demand tastes in meals.

The broad food processing industry in Latin America is for the most part here again with a significant demand boost for dehydrated onions. Urbanization is a driving force as people are looking for more "low-maintainance" food types such as sauces, snacks, and the ever-popular instant food, in the making of which dehydrated onion holds a vital spot.

Very often they have no need for refrigiration and have a long shelf-life, thus being the manufacturer's choice. So, food manufacturers value the advantages of dehydrated onions, which not just assist in the simplification of the work process but also address the sector's focus on being productive and financially prudent.

Therefore, the use of dehydrated onions has become so popular that manufacturers are growing their businesses in the dehydrated onion food segment while being in line with the needs of modern consumers for rich and practical meal choices.

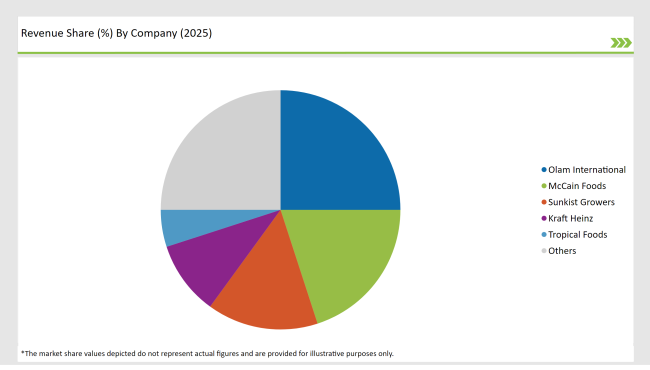

2025 Market share of Latin America Dehydrated Onions Manufacturers

Note: above chart is indicative in nature

The dehydrated onion sector in Latin America, however, is slightly fragmented as major actors like Olam International, McCain Foods, and Himalaya Food International drive the segment using their strengths in production and trade.

These firms take advantage of their frontend investment in R&D to innovate and broaden their product portfolio in response to the higher convenience, and taste demand of clients on processed foods. At the same time, local players such as Agro Products and Sierra Valley concentrate on the regional market needs via their particular products and brands that finally foster the dehydrated onions market.

The Latin America dehydrated onions market is projected to grow at a CAGR of 5.8% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 264.2 million.

Mexico and Brazil are key regions with high consumption rates in the Latin America dehydrated onions market.

Leading manufacturers include Olam International, McCain Foods, Sunkist Growers, Kraft Heinz, and Tropical Foods.

As per Variety, the industry has been categorized into White Onion, Red Onion, Pink Onion, and Hybrid.

As per Form, the industry has been categorized into Chopped, Minced, Granules, Powder, Flakes, Kibbled, and Sliced.

As per End Use, the industry has been categorized into Food Processing (Dressing & Sauces, Ready Meals, Snacks & Savory, Infant Food, Soups, Others), Food Service Providers and Retail/Household

As per Distribution Channel, the industry has been categorized into B2B, B2C (Hyper/Super Markets, Convenience Stores, Specialty Stores, Traditional Grocery Retailers, Online Retailers).

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

Sports Nutrition Market Share Analysis – Trends, Growth & Forecast 2025-2035

UK Sports Nutrition Market Report – Growth, Demand & Innovations 2025-2035

USA Sports Nutrition Market Trends – Demand, Size & Forecast 2025-2035

Australia Sports Nutrition Market Outlook – Trends, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.