The Latin America allergen free food market is set to grow from an estimated USD 3,954.3 million in 2025 to USD 8,648.3 million by 2035, with a compound annual growth rate (CAGR) of 8.1% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 3,954.3 Million |

| Projected Latin America Value (2035F) | USD 8,648.3 Million |

| Value-based CAGR (2025 to 2035) | 8.1% |

The growing consumer knowledge about the allergies and the intolerances of the foods is a crucial factor in the increasing demand of the consumers for the allergen-free products. This high-grade educational stage is a direct result of the better scientific knowledge and information diffusion through channels such as newspapers, radio, television, health care providers, etc.

Besides, people became aware that there are potential health risks resulting from the consumption of certain foods that contain allergens in them. Thus, as they learn more about these possible health issues, they tend to be more careful and ask for the allergens' free alternatives.

This new pattern in the customers due to the manufacturers' introduction, both, of production and marketing of the new products that fulfill their needs is caused an expansion of the allergen-free food market. The increase of food allergies in Latin America is the reason for the need of allergen-free food.

Research indicates that there are more and more people who, both kids and adults, are diagnosed with food allergies which is the main cause of the increased worries in the families as well as communities. Thus, individual patients affected seek for alternative food sources that instead of causing the mucosal proximal small bowel symptoms one might suffer from allergic reactions should be misfed to the patient.

This new surge not only increases the disfavorable honest man balance but also, in turn, the bacterium is driven to make more microbes. The problem of allergy is not only consuming more food with the particular allergens in them but also it is making food manufacturers innovate and present new foods to challenge themselves to these demands.

Explore FMI!

Book a free demo

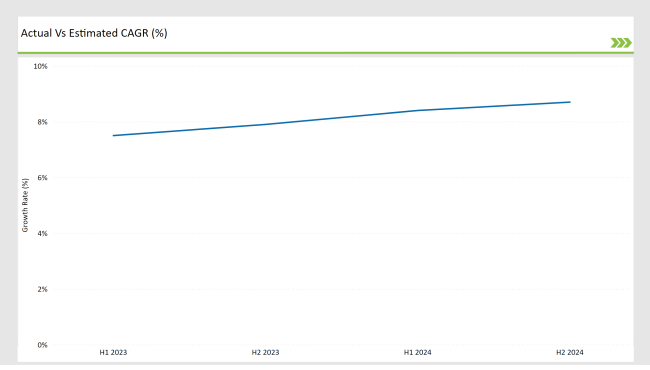

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Latin America allergen free food market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin America allergen free food market, the is predicted to grow at a CAGR of 7.5% during the first half of 2024, with an increase to 7.9% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 8.4% in H1 and is expected to rise to 8.7% in H2. This pattern reveals a decrease of 18 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

Redefining Nutrition: The Impact of Plant-Based Diets on Allergen-Free Markets

In Latin America, the incorporation of plant-based diets is positively affecting the allergen-free food market. A healthy lifestyle and environmental consciousness being on top of the list are the two most important reasons for people to change animal for plant products.

The pressure of ethical concerns about animals, the health benefits related to meat production, and the environmental consequences of meat manufacturing were the main motives for this movement. As a result, ecosystem-friendly options, like tofu, tempeh, and plant-based dairy products are booming with popularity as they are not only for vegans but they also benefit the larger part of the population that is looking for ways to cut back on their meat consumption.

The development of innovative products, for example, made plant-based foods more accessible and appealing, therefore it also drove sales in the allergy-free segment.- Notions of progress in the food sector were not restricted to that occurring in the plant-based proteins market but also in various other spheres.

E-Commerce and Allergen-Free Foods: A New Era of Accessibility

The significant growth in the number of allergen-free goods that are found in different retail stores is the main reason why people are buying these products easily in Latin America. Retailers, such as supermarkets, specialty stores, and online platforms, are reacting to the increased demand for allergen-free products by augmenting their product lines.

The signs of this trend are all around as more and more shelves are given to the allergen-free products, thus, shoppers can easily locate them and buy them. E-commerce is the latest invention which, besides the advantage of the absence of the pressure from the salespeople, allows you to buy the goods whenever you want, thus, it is making it easier for the consumers to buy allergen-free products.

Furthermore, the retailers are giving the item, for example, the detailed data on allergenic ingredients that support informed purchasing by the buyers. The added accessibility to the diet products that people with certain food allergies eat is helping not only these sections of the population but is also taking off food allergy-free shopping beyond this.

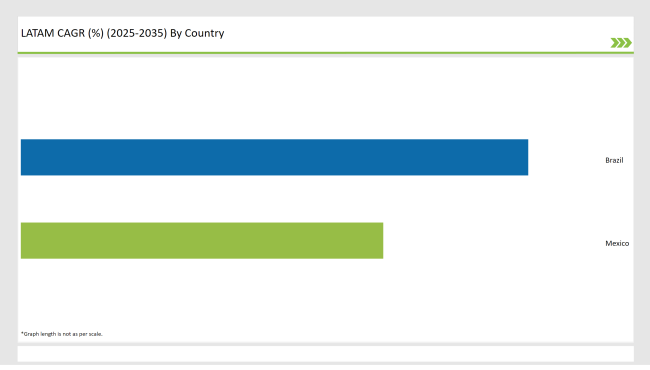

The following table shows the estimated growth rates of the top two markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

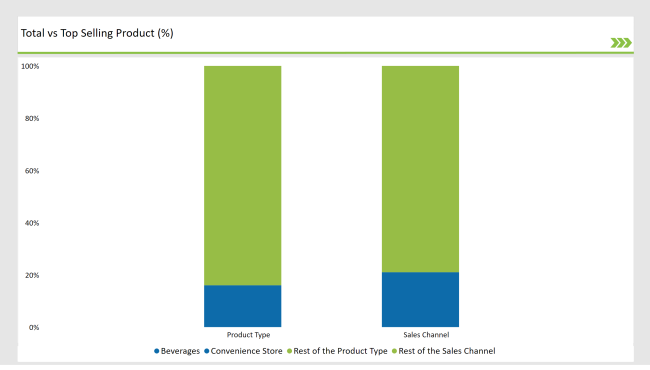

The cultural acceptance of beverage alternatives in Latin America marks a significant shift in consumer preferences for allergen-free products. Prevalent drinks such as horchata and mate are famous health drinks that have currently been shifted into allergen-free products, and thus they appeal to holistic primary drinkers and individuals with dietary restrictions. Such a change represents not only a continuity of cultural tradition but also reflects the fact that today's diets emphasize more on plant-based and gluten-free options.

The increasing number of consumers who prefer drinks that are beneficial to their health is the main reason for the adaptation of traditional drinks into the allergen-free available choices, which brings people diversity and unity in the cultural vision. As a result of this trade-off, replacements will be considered, and manufacturers will be prompted to try out novel recipes that mix indigenous tastes with their own.

The shift of convenience stores in Latin America to carrying a broad selection of allergen-free items, including gluten-free snacks, dairy alternatives, and plant-based beverages is becoming noticeable. This range of products is the result of customer demand for good-quality food that is much healthier.

Therefore, people who are worried about allergens can easily find good products. Moreover, many of these convenience stores are making strategic moves in the direction of working with brands specializing in allergen-free products. The promotional aspect is about the stores having access to exclusive products and special offers that are enticing to health-focused consumers.

Essentially by promoting notable allergen-free foods, the stores are looking to elevate their competitive positions in environmental health, use promotional campaigns on board exclusive brand partnerships, and fulfill the emerging tastes of the new shopper.

% share of Individual categories by Product Type and Sales Channel in 2025

Cultural acceptance of alternative beverages in Latin America is significantly influencing the demand for allergen-free options. Traditional drinks, such as horchata and mate, are being reimagined in allergen-free formats, appealing to health-conscious consumers and those with dietary restrictions.

This adaptation not only preserves cultural heritage but also aligns with modern dietary preferences, such as plant-based and gluten-free diets. As consumers increasingly seek beverages that cater to their health needs, the innovation of classic drinks into allergen-free versions fosters a sense of inclusivity and variety. This trend is driving demand and encouraging manufacturers to explore new formulations that resonate with local tastes.

Convenience stores in Latin America are increasingly expanding their product ranges to include a diverse array of allergen-free options, such as gluten-free snacks, dairy alternatives, and plant-based beverages. This diversification is a direct response to the growing consumer demand for healthier food choices, making it easier for shoppers to find safe and convenient options.

Additionally, many convenience stores are forming strategic partnerships with brands that specialize in allergen-free products. These collaborations enable stores to offer exclusive items and promotions, enhancing their appeal to health-conscious consumers.

By combining a wider selection of allergen-free foods with exclusive brand partnerships, convenience stores are positioning themselves as key players in the allergen-free market, catering to the evolving preferences of modern shoppers.

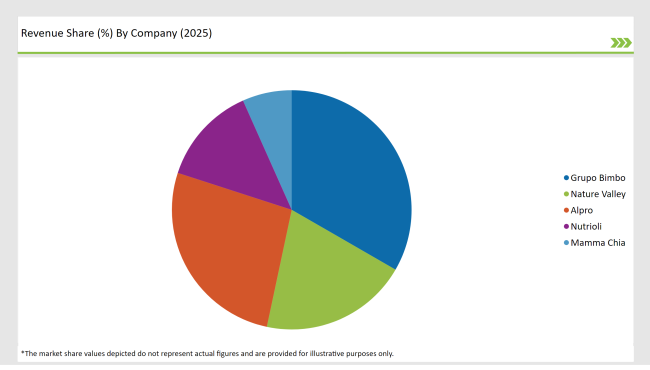

2025 Market share of Latin America Allergen Free Food Manufacturers

Note: above chart is indicative in nature

The Latin America allergy-free food market shows a fair amount of consolidation as Grupo Bimbo, Alpro, and Schar dominate the market with their broad product ranges alongside solid distribution networks. Those firms employ their vigour through the process of innovation and gain new products and secure food options for consumers by research and development.

In addition, local companies like Mamma Chia and Nutrioli have their own strategies, concentrating on specific niches, and providing the local community with tailor-fitted products. The result of this type of market is that there is persistent competition, while at the same time, it is a vehicle for the proliferation of allergy-free foods in the region.

The Latin America allergen free food market is projected to grow at a CAGR of 8.1% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 8,648.3 million.

The increased availability of allergen-free products across diverse retail channels is significantly enhancing consumer accessibility in Latin America.

Mexico and Brazil are key regions with high consumption rates in the Latin Americaallergen free food market.

Leading manufacturers include Grupo Bimbo, Nature Valley, Alpro, Nutrioli, and Mamma Chia.

As per Product Type, the industry has been categorized into Beverages, Chocolate, Processed Meat & Poultry, Others, Edible Oil, Frozen Meals, Tofu & Seitan, Tempeh, Processed Milk Products, Mayonnaise, Tortilla, Natto, Snacks, Pasta, Infant Formula, Bakery Products, Cereals & Grains, Flour Mixes, and Dairy and Dairy Products

As per Form, the industry has been categorized into Modern Trade, Specialty Stores, Convenience Store, Direct-to-Customer Channels, Online Retailers, and Other Sales Channel.

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

Feed Attractants Market Analysis by Composition, Functionality, Livestock, Packaging Type and Sales Channel Through 2035

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Bouillon Cube Market Analysis by Type and Distribution Channel Through 2035

Food Fortification Market Analysis by Type, Process and Application Through 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Bone and Joint Health Supplement Market Analysis by Product Type, Form and Sale Channels Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.