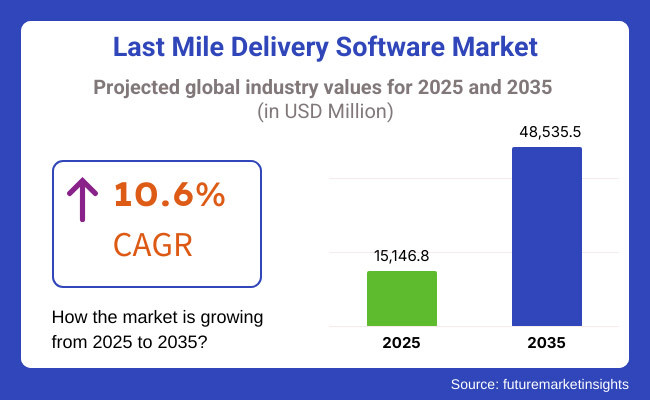

The global Last Mile Delivery Software market is projected to grow significantly, from USD 15,146.8 Million in 2025 to USD 48,535.5 Million by 2035 an it is reflecting a strong CAGR of 10.6%.

Last-mile delivery software is an advanced tech that enables goods or packages to timely and easily reach their final destination from a distribution hub. Last-mile logistics involves complex procedures, such as route optimization, real-time tracking, and resource allocation. Advanced algorithms and data analytics present in last mile delivery software aid in minimizing operational costs, improving delivery times, and enhancing customer satisfaction.

Optimizing routes is the most major advantage of last mile delivery software. Old practices meant longer delivery times and subsequently higher fuel consumption. To this end, the software analyzes data such as traffic patterns, precise delivery windows, and vehicle capacities to develop the most efficient routes possible to save time while reducing carbon footprints towards sustainability.

The software helps in organizing and allocating resources to tasks, ensuring that they are used effectively. The company can monitor the performance of the drivers, keep an eye on the maintenance of the vehicle, and analyze the delivery metrics so that they can take better decisions. Therefore, in that manner, last-mile delivery software denies error from human hands as they deliver with full- fledged efficiency.

Moreover, the blend of AI, machine learning, and big data analytics in last-mile delivery software further increases their functionality and efficiency. Investment and partnerships are attracted in the sector through startups and existing companies employing such technologies The funds and partnerships facilitate businesses to adopt modern solutions which help them to get real-time tracking, predictive analytics, and auto route planning.

Furthermore, growing urbanization and changing customer demand are propelling the growth of the industry. Investments in last-mile delivery software are important to overcome the challenges of dense urban environments, such as traffic congestion and parking constraints. So, advanced delivery solutions and services help businesses overcome these challenges in terms of reduced delivery time and higher Operational efficiency more conveniently.

Explore FMI!

Book a free demo

| Company | Bringg |

|---|---|

| Contract/Development Details | Collaborated with a leading retail chain to implement a last mile delivery platform, aiming to optimize delivery routes, enhance customer experience, and reduce operational costs through real-time tracking and analytics. |

| Date | April 2024 |

| Contract Value (USD Million) | Approximately USD 20 |

| Renewal Period | 5 years |

| Company | Onfleet |

|---|---|

| Contract/Development Details | Partnered with a food delivery service to provide advanced last mile delivery software, focusing on improving delivery efficiency, driver performance monitoring, and customer satisfaction through intuitive interfaces and seamless integrations. |

| Date | October 2024 |

| Contract Value (USD Million) | Approximately USD 18 |

| Renewal Period | 3 years |

Integration of AI & Machine Learning and other Automation Tools is an Emerging Trend in Last-Mile Delivery Software Market

AI and machine learning in the last-mile delivery software change the nature of delivery of logistics companies. Such technologies optimize routes based on large amounts of data, including traffic patterns and weather conditions, synchronized with delivery schedules. Companies can also apply predictive analytics to detect fluctuations in demands, hence providing a better basis for resource allocation.

For example, considering the statistics that orders are provided with a surge over a time frame, organizations may modify their delivery fleet for proper delivery in that time window. Moreover, AI algorithms can learn progressively through previous deliveries; hence, it fine-tunes routing choices and enhances delivery time. This dynamic ability also helps minimize fuel and labor cost related to such deliveries.

The challenges of time and cost efficiencies in last-mile logistics are best addressed through automation technologies, such as drones and autonomous vehicles. Drones can immediately be flown into cities and over congested roads, saving time in delivery and forgoing congested traffic.

Autonomous vehicles maximize routes and travel on predetermined schedules, making them more reliable and efficient. The trend thus makes possible quick delivery and minimizes cost for human labor, hence easier for companies to manage fluctuating delivery demands.

Probably, one of the benefits of automated systems is that they allow one to track deliveries in real time. This means that consumers get clearer insight into their orders. Scalability of these automated solutions makes it possible for businesses to scale up their operations without corresponding increases in overhead costs.

This will make last-mile delivery operations increasingly involve automation in the delivery process with technological advancement combined with the prospect of heightened service quality, reduced environmental impact, and higher demands placed on faster delivery options.

Rising Consumer Expectations and E-commerce Growth is fueling the Last-Mile Delivery Software Market Growth

Retail is witnessing high demand for effective last-mile delivery solutions owing to the revolutionary growth of e-commerce. With the growing online shopping, business enterprises have to maintain their pace with consumer demands as more and more customers want their orders delivered promptly and reliably.

This growing demand for fast deliveries has led companies to invest in advanced last-mile delivery software that optimizes routes, manages delivery resources, and improves tracking capabilities. Real-time updates with automated notifications enhance transparency for businesses and help build trust for their customers. Integration of e-commerce platforms into last-mile delivery solutions is important to smooth out the order fulfillment process.

Therefore, companies that offer innovative delivery software can eventually use their position more effectively than others by providing better service levels that could lead to higher customer satisfaction and loyalty.

Moreover, consumer expectations have completely changed, especially in terms of delivery time and quality of service. The current demand is to have purchases delivered very quickly and as fast as possible-many even wanting same-day and next-day services that force companies to refine their last mile services. This trend is very pronounced in the e-commerce world, which has orientated customers to expect things immediately.

Growing Focus on Customization & Personalization and Integration with Other Supply Chain Solutions Creates Opportunities for Last-Mile Delivery Software Market

Logistics organizations can increase overall efficiency and improve operations by integrating last-mile delivery software with larger supply chain management systems. It creates a unified framework connecting diverse elements of a supply chain such as inventory management, warehouse operations, & transportation, and gives real-time visibility throughout the whole supply chain. This holistic view allows for better coordination and decisions yielding improved responsiveness to customer demands.

Several companies are launching a completely integrated logistics platform that encompasses all the solutions a customer would need to help them develop lower costs and maximize their market revenue. For instance, in September of 2024, Uber Freight, a provider of transportation & logistics solutions launched their end-to-end enterprise logistics platform to meet the evolving & complex needs in industry. It features advanced insights, flexible procurement software, and modular TMS functionality.

The opportunity for customization and personalization in last-mile delivery software is becoming increasingly critical as businesses strive to meet diverse customer needs. Today, customers expect a customized delivery experience according to specific requirements. That can range from preferred times to methods & even other services like package assembly and returns handling.

Technologies that will provide delivery software with customized solutions will enhance customer experience and allow companies to build loyalty to their brand. By allowing customers to make choices concerning their lifestyle such as same-day delivery at scheduled time slots or alternative locations of delivery, a company can differentiate itself in an increasingly very competitive marketplace.

Infrastructure Limitations and Dependence on Third-Party Logistics Providers (3PL) may affect Last-Mile Delivery Software Market Growth in the Projected Timeframe

Infrastructure constraints is expected to impact the effectiveness of last-mile delivery solutions across cities and rural areas with lesser-developed transport networks. The lack of transport networks and adequate signages hinders logistics providers from performing timely deliveries.

For instance, narrow streets, heavy traffic congestion in densely populated urban environments, causation of delays, connectivity is limited and avenues for delivery are fewer in rural areas. All these require advanced routing and scheduling algorithms, thus increasing complexity and operational costs for logistics companies.

Further, another barriers to the market for last-mile delivery software is the reliance on 3PLs. A weak point in the supply chain can be found in the final leg of delivery, which is handled by 3PLs in the case of many software solutions in this market. The total client experience can be directly impacted by the dependability and performance of 3PLs, and delivery problems can reflect adversely on the business employing the software.

since of this reliance on outside parties, businesses may be reluctant to use last-mile delivery software since they don't want to take a chance on damaging their reputation as a brand. The risks may also be increased by 3PLs' own operating difficulties, which could include shortages of drivers, capacity issues, or technological issues.

Due to this, businesses may opt to employ internal logistics systems or different delivery techniques, which would restrict the market's ability to expand for last-mile delivery software. Software suppliers may need to invest in their own logistical skills, forge stronger alliances with 3PLs, or provide more dependable and flexible delivery choices in order to lessen the constraints imposed by their reliance on 3PLs.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Increased regulations on delivery tracking and carbon emissions control. |

| AI & Predictive Analytics | AI-powered route optimization enhanced delivery efficiency. |

| Automation & Robotics | Drone and autonomous vehicle testing gained traction. |

| Customer Experience & Transparency | Real-time tracking and ETA predictions improved customer satisfaction. |

| Market Growth Drivers | E-commerce expansion and rapid urbanization fueled demand for last-mile solutions. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven compliance tracking automates adherence to sustainability regulations. |

| AI & Predictive Analytics | Fully autonomous last-mile delivery solutions integrate with real-time demand forecasting. |

| Automation & Robotics | Large-scale deployment of AI-driven robotic couriers and drone deliveries. |

| Customer Experience & Transparency | AI-driven sentiment analysis customizes delivery experiences based on consumer preferences. |

| Market Growth Drivers | AI-optimized hyperlocal delivery models and predictive inventory management accelerate growth. |

Tier 1 companies have significant capabilities, strong technologies, and a large customer base. This kind of company usually provides integrated solutions, including routes and real-time tracking along with analytics, under the purview of last-mile delivery. They established themselves as trusted partners for giant-sized enterprises as well as e-commerce companies.

The important players of tier 1 are Oracle Corporation, Amazon.com, Inc., Google LLC, Microsoft Corporation, and SAP SE. Tier 2 companies are mid-sized with a good market presence but not at par in scale or resource pool depth with Tier 1 businesses.

Tier 2 firms are mid-sized companies specialize in niche within the last-mile delivery space and are known to focus on regional solutions for last-mile deliveries or specialized services for specific industry verticals.

Tier 2 players are agile and allow for fast innovation with responsiveness to shifting market trends. Notable firms in tier 2 include last-mile API GmbH, Onfleet Inc, Gloat, Locus Robotics Corp Source, and Descartes Systems Group Inc.

Tier 3 companies are actually a small emerging companies or startups coming into the last-mile delivery software market. They mostly bring new solutions or unique features suitable for specific needs of a particular customer, such as same-day delivery or green logistics. While they may not have the same market influence or financial resources as of Tier 1 and Tier 2 players; however, they also majorly drive innovation and competition within this sector.

The section highlights the CAGRs of countries experiencing growth in the Last Mile Delivery Software market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 13.9% |

| China | 12.9% |

| Germany | 8.3% |

| Japan | 11.0% |

| United States | 9.6% |

China's e-commerce industry has expanded quickly, making it the world’s biggest online marketplace. This boom is driven by expanding internet access, a burgeoning middle class, and increasing consumer appetite for e-commerce. The logistics industry is straining to deliver goods quickly, given growing expectations, particularly in densely populated city centers where traffic jams and lack of access pose obstacles.

To overcome these challenges, companies are relying on AI-based last-mile delivery software to maximize routing efficiency, manage fleets, and improve real-time tracking. The Chinese government is also advocating for technology through AI integration into logistics and manufacturing.

Most drone deliveries are getting more commonplace, with some converse even high-traffic tourist areas and urban places. Graduate and Post Graduate programs for educational scheming Citilution Fundamental research for future cities and many more.

Increasing investment in AI-driven last-mile delivery solutions underlines the significance of technology in maintaining China’s e-commerce boom. China is anticipated to see substantial growth at a CAGR 12.9% from 2025 to 2035 in the Last Mile Delivery Software market.

The digital commerce market in India is growing fast due to rising smartphone penetration, low-cost internet access adopted by consumers who prefer convenience. Next story: The growing hyperlocal deliveries are transforming logistics as consumers are demanding groceries, food and everyday items within minutes.

The companies are turning to last-mile delivery software that provides better fleet coordination, real-time tracking and route optimization as a solution. Now: Quick commerce services are spreading across country especially in the Tier-2 and Tier-3 areas creating a whole new demand.

They have introduced policies to ensure fair competition (for example, the new e-commerce rules) and protect consumer interests. Both AI-driven logistics and electric vehicle adoption are gaining footing in such a context to meet shared sustainability goals.

These developments are driving the need for advanced last mile delivery solutions to cater to India’s burgeoning hyperlocal logistics demands. India's Last Mile Delivery Software market is growing at a CAGR of 13.9% during the forecast period.

The last-mile delivery market in the USA is changing, with the growth of micro-fulfillment centers and autonomous delivery technologies. Micro-fulfillment centers that are located in urban areas enable retailers to store goods closer to consumers to lower delivery times and operational costs. This shift is because of the increasing demand for same-day and next-day deliveries.

The same applies to the adoption of drones and self-driving robots for autonomous delivery, a trend that is propelling logistics into a new era. Firms are plowing money into AI-powered systems to work faster, delete staffing costs, and decrease mistakes. And the USA government is encouraging this creativity by designing regulatory environments to allow autonomous vehicles in urban logistics.

Retail giants and logistics companies are also increasing investment in automation, looking for faster delivery with a smaller carbon footprint. The future of the last mile will be faster and more efficient, with the micro-fulfillment and automation trends shaping the USA market.USA is anticipated to see substantial growth in the Last Mile Delivery Software market significantly holds dominant share of 79.3% in 2025.

The section contains information about the leading segments in the industry. By Product, the KVM High Performance Switch segment is estimated to grow quickly from the period 2025 to 2035. Additionally, by Industry, IT & telecom segment holds dominant share in 2025.

| Deployment | CAGR (2025 to 2035) |

|---|---|

| Cloud-Based | 12.4% |

Cloud Based segment is expected to grow at a CAGR of 12.4% from the period 2025 to 2035. The demand for cloud-based last-mile delivery solutions is on the rise, due to the scalability and efficiency, they provide to businesses. Owing to real-time tracking, route optimization, and smooth integration with various supply chain management tools, these platforms have become a necessity for modern-day delivery operations.

Cloud-based solutions allow businesses to scale according to on-demand delivery and growth, especially around peak e-commerce periods, so businesses can save and operate efficiently. Governments around the world are exerting additional pressure to transform the logistics industry by promoting the use of AI in enhancing supply chain transparency/efficiency via cloud adoption.

Many of the national postal services and logistics providers have already migrated to cloud-based systems to enable faster delivery and more accuracy in tracking. Often times and recently, governments in nations have simultaneously engaged in a massive push to enhance last-mile logistics capability as they pour millions of dollars into AI and cloud-based solutions.

Optimizing delivery routes and minimizing empty miles through the adoption of cloud platforms also enables sustainability efforts by reducing fuel consumption. Here, businesses strive for highly efficient operations in the cloud with the emergence of same-day and instant deliveries. This dynamic change towards the cloud-Solution's will reshape the last-mile logistics in that will continue to maintain and deliver better services to their consumers at lower-valued expenses.

| Industry | Value Share (2025) |

|---|---|

| E-Commerce | 26.3% |

The E-Commerce industry is poised to capture share 26.3% in 2025. The last-mile delivery software market value share is held by e-commerce, the most valuable last-mile delivery software sector. With the boom of online shopping, it was already evoking utilitarian anxiety for consumers who wanted their products delivered faster than they could move.

Retailers are spending big in logistics infrastructure, using AI-enabled software to make order fulfillment and delivery quicker. Governments too are waking up to how vital e-commerce logistics is to our economies, enacting policies to ensure last-mile efficiency and reduce delivery bottlenecks.

We are now able to reduce the expenses that come with delivering the goods you order and carry out the significant facility investments in smart logistics hubs that will strengthen e-commerce supply chains," it said in a recent announcement. Same-day deliveries and hyperlocal drivers are increasing the demand for efficient last-mile solutions, motivating e-commerce leaders to explore automated sorting centers and robotic warehouses.

Moreover, governments are rolling out regulations on last mile solutions and incentives for electric delivery vehicles and sustainable logistics practices. As consumer demand for a seamless shopping experience grows, e-commerce companies are focusing on optimizing their last-mile delivery processes for faster order processing and improved tracking. This continued growth confirms e-commerce as number one contributor to the last-mile delivery software, shaping the future of logistics technology.

It is a highly competitive market for last-mile delivery software, driven by growing demand for e-commerce deliveries and increasing expectations for rapid service. Fleets are looking to boost efficiency and cut expense through AI-powered route optimization, real-time tracking and automation.

The constant push with these new technologies is what sets these platforms apart in the fast-evolving landscape of cloud-based solutions and integration with autonomous vehicles and drones. Companies are ramping up efforts in sustainability, electric vehicle adoption and data-driven logistics optimization to gain a competitive edge.

Recent Industry Developments in Last Mile Delivery Software Market

The Global Last Mile Delivery Software industry is projected to witness CAGR of 10.6% between 2025 and 2035.

The Global Last Mile Delivery Software industry stood at USD 15,146.8 million in 2025.

The Global Last Mile Delivery Software industry is anticipated to reach USD 48,535.5 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 12.5% in the assessment period.

The key players operating in the Global Last Mile Delivery Software Industry Onfleet, FarEye, DispatchTrack, Route4Me, OneRail, Urbantz, project44, Zeo Route Planner, Routific, Dispatch Science.

In terms of deployment, the industry is divided into cloud-based and on-premises.

In terms of enterprise size, the industry is divided into small & medium enterprises and large enterprises.

The industry is classified by industry as courier express & parcel, retail & FMCG, transportation, e-commerce, manufacturing, pharmaceutical, and others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.