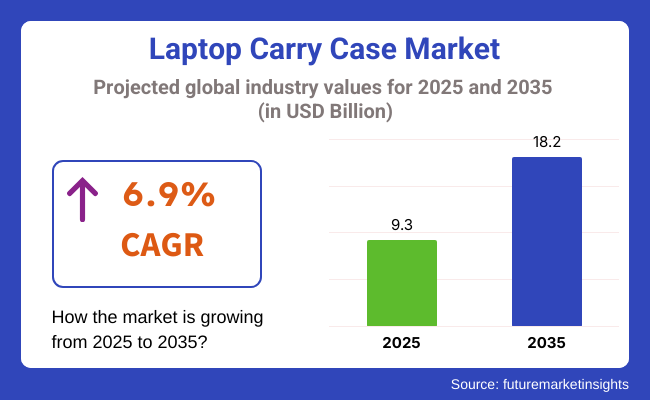

The global laptop carry case market was valued at USD 9.3 billion in 2025 and is expected to grow at a 6.9% CAGR from 2025 to 2035. The industry is anticipated to expand to USD 18.2 billion in 2035. A dominant driver fueling the market towards this trend of growth is the steady expansion of hybrid work models and increased professional mobility, fueling demand for versatile, safe, and stylish carry solutions among different populations.

Students and professionals have overwhelmingly embraced mobile computing. City shoppers and remote employees increasingly spend more on cases providing better ergonomics, organizational features, and materials suitable for high-frequency travel and varied environmental exposures. Product segmentation grows more advanced, with examples ranging from minimalist sleeves and backpacks to anti-theft and RFID-guarded ones.

Buyers are demanding lightweight, resilient, and weather-resistant materials along with device-specific compatibility. Features like built-in chargers, location tracking, and USB pass-through ports are transforming the product category from minimal protection to smart accessories.

The growth of D2C and e-commerce channels is facilitating easier expansion for wider reach and differentiation by brands. Branding, customization, and personalization opportunities are making inroads, particularly in corporate and academic settings where institutional distribution on a bulk basis is common. The manufacturers are responding with green lines, recycled polyester use, vegan leather use, and biodegradable packaging to appeal to sustainability-conscious customers.

The industry is growing steadily in mature economies and emerging economies alike, where the increasing availability of laptops through education and work-from-home is creating new avenues. With customers continuing to seek portability without sacrificing protection or looks, this industry will continue to be strong and innovation-driven over the next decade.

Explore FMI!

Book a free demo

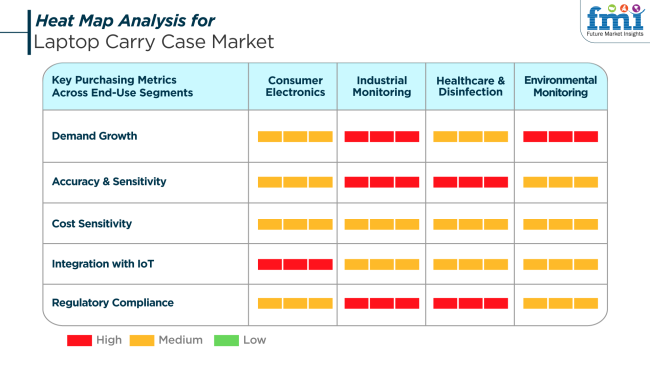

Lifestyle factors, functional expectations, and design appeal heavily influence purchasing behaviors. For consumer electronics users, high demand is driven by the need for compact, smartly designed cases that complement portable tech ecosystems. Integration with IoT and smart storage for peripherals are emerging as major purchasing incentives, especially in younger demographics.

For industrial and technical users, very high demand growth correlates with ruggedized cases offering high durability and environmental resistance. These cases must often comply with strict safety standards and accommodate additional equipment, making regulatory compliance and structural integrity top concerns.

In healthcare and disinfection-related environments, demand is driven by secure, sanitized transport of laptops across clinical settings. Here, antimicrobial coatings and easily cleanable surfaces are valued. Environmental monitoring use cases similarly demand robust, weather-resistant cases for field use. Across all segments, cost sensitivity varies, but value-added features such as modular compartments, sustainability, and ergonomic comfort significantly influence buying decisions.

The laptop carry case market is exposed to several strategic and operational risks, particularly in relation to consumer preferences, raw material fluctuations, and competitive oversaturation. As fashion and technology evolve rapidly, consumer expectations for aesthetic design and multifunctionality are increasing. Brands that fail to innovate or adapt to emerging lifestyle trends risk losing relevance in a highly style-conscious market.

Raw material volatility presents another key concern. Supply chain interruptions or price increases in synthetic fabrics, zippers, and foams can affect cost structures, especially for manufacturers targeting mid-range or value segments. Reliance on imported components may create vulnerabilities tied to trade disruptions or currency fluctuations.

Additionally, the low barrier to entry in the carry case market has led to intense competition and price undercutting, especially via online marketplaces. This can erode margins and reduce brand loyalty unless companies establish clear differentiation through quality, innovation, or sustainability. To mitigate these risks, firms must focus on continuous product development, adaptive sourcing strategies, and strong customer experience across both digital and physical retail channels.

From 2020 to 2024, the industry grew exponentially, driven by the widespread use of remote work, e-learning, and digitalization. As individuals across the world started working and studying from home during the pandemic, the need for functional, fashionable, and protective carry cases increased exponentially.

The consumer market changed its preference to multi-purpose cases that would hold not only laptops but other accessories such as chargers, tablets, and pens. These items, such as water-repellent clothing, eco-leather, and recycled polyester, became more popular because customers were becoming more environmentally conscious.

In the coming years, through 2025 to 2035, the industry is anticipated to change with innovation in smart accessories, such as laptop bags featuring USB charging, RFID-blocking pockets, and solar charging. Product development will be fueled by sustainability, focusing on biodegradable materials, circular product design, and eco-friendly manufacturing processes.

Since the demand for remote work and hybrid office setups continues, laptop cases will become increasingly personalized, with ergonomic features, intelligent storage solutions, and modular designs. The impact of AI and IoT is likely to introduce features like self-locking cases and fingerprint access for greater security.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Remote work, e-learning, personalization trends, and e-commerce growth. | Smart, technology-integrated accessories, sustainability, and hybrid work environments. |

| Remote workers, students, technology experts, and general consumers. | Technology-smart customers, green-conscious people, and hybrid employees seeking creative, multi-functional designs. |

| Multi-functional materials, green materials, shock-absorbing linings, and waterproofing materials. | Intelligent storage features, charging integration capabilities, RFID-blocking panels, and modular structures. |

| Expansion of e-commerce, customized offerings, and web-based customization features. | IoT-enabled smart cases, biometric protection, and solar-powered solutions. |

| Use of sustainable leather, recycled polyester, and eco-friendly manufacturing practices. | Circular economy business models, biodegradable materials, and sustainably sourced textiles. |

| Direct-to-consumer brands, e-commerce sites, and brick-and-mortar stores. | Omni-channel retailing, smart product customization platforms, and eco-friendly consumer marketplaces. |

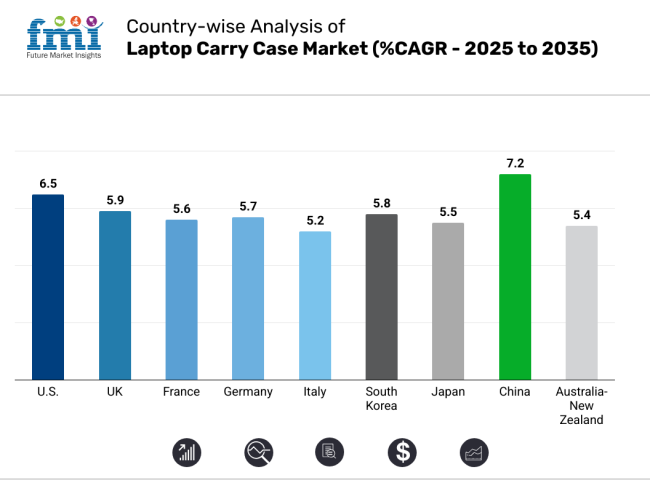

The USA will grow at 6.5% CAGR throughout the study. High demand from technology-proficient professionals, students, and business professionals is driving steady growth. With remote and hybrid work models continuing in leading sectors, people are increasingly investing in durable and ergonomically shaped laptop carry cases for mobility and safety.

Moreover, high-end product segments, such as smart and anti-theft cases, are seeing higher adoption because of rising consumer inclination toward security-focused designs. The availability of well-known consumer electronics brands and online shopping platforms has also enhanced product availability and brand recognition to become more prevalent throughout the region.

The American consumer is more interested in style, functionality, and sustainability, which has driven manufacturers to innovate with green materials and multi-functional models. Distribution arrangements with retail chains and e-commerce sites complement sales penetration further.

Expanding corporate gifting behavior and customization services are also expected to offer incremental growth prospects over the forecast period. As urban mobility and digital lifestyles transform work and learning spaces, the demand for high-quality and resilient laptop-carry solutions is expected to continue strong.

The UK will register growth at 5.9% CAGR through the period covered by this study. Expanding urban workforces, a heavy focus on education, and rising laptop penetration are key drivers that are propelling growth. Educational institutions across the globe have embraced digital learning methodologies, making laptop carry cases more essential among students. Even businesses continue to provide employees with portable computing units, boosting corporate demand.

The consumer choice in the UK is oriented towards small, trendy, and versatile laptop covers. Product trends focused on minimalist design and sturdiness are catching on, especially among working professionals in financial, legal, and creative fields. Additionally, rising environmental concern has resulted in growing interest in environmentally friendly manufactured cases produced with recycled or biodegradable components.

The adoption of e-commerce within the region is also improving access to the industry, with options for customization and delivery drawing an increasingly larger number of customers. The use of home and foreign brands provides diversity in design and cost.

France is anticipated to expand at 5.6% CAGR throughout the study. The increasing base of mobile professionals, growing digital learning in schools, and increased lifestyle-oriented consumption behaviors are driving the consistent progress of the laptop carry case industry. In addition, increasing awareness of design innovation, wherein design and usability play an integral part in buying decisions.

France shows a strong inclination towards high-end and quality accessories, leading local and international brands to prioritize upscale product lines. In addition, there is a high interest in travel convenience features such as cushioned pockets, trolley sleeves, and water-resistant materials. Urban consumers often look for multifunction carry styles like convertible shoulder bags and backpacks, particularly for multiple uses.

Online shopping and specialty stores act as major channels, allowing for easy comparison and customization. Moreover, France's green policies are encouraging companies to use recyclable packaging and biodegradable materials in product offerings. The combination of functionality, eco-friendliness, and fashion sensibilities is creating a positive trend for the laptop carry case industry.

Germany will grow at 5.7% CAGR throughout the study. A technology-aware population and a high rate of adoption of intelligent workspaces are key demand drivers for laptop accessories, including carry cases. Enterprises continue to invest in mobile infrastructure, making professionals use laptops on the go, which creates the demand for safe and convenient carrying tools. Functionality and robustness continue to be key considerations in consumer choices, with a clear bias toward cases that incorporate security features and light materials.

German consumers welcome innovative designs with RFID protection, USB charging outlets, and storage expansion, leading to product differentiation. The focus of the manufacturing industry on precision engineering and quality also translates into consumer expectations, compelling brands to provide extremely dependable products. In addition, Germany's robust logistics and e-commerce infrastructure enables quick access to global and local brands.

The growing interest in sustainability is also driving innovations with recycled PET fabrics and vegan leather substitutes. These converging interests in functionality, sustainability, and digital mobility are building positive conditions for industry expansion.

Italy is projected to grow at 5.2% CAGR over the study period. A combination of aesthetic appeal and functional use characterizes consumer behavior in this industry. As more freelancers, creatives, and students use portable computing devices, there is an increasing focus on protective laptop cases that resonate with Italy's fashion-conscious approach.

The domestic market is experiencing a gradual transition from utilitarian cases to designer-styled and multi-functional products that address both business and lifestyle requirements. Materials like vegan leather, canvas, and top-grade synthetics are being utilized more and more to marry aesthetics with durability.

In addition, the tourism and hospitality industry's convergence with remote work trends is driving demand for travel-compatible cases. Online shopping channels are improving consumer participation through curated collections and virtual try-on features, enabling users to see functionality and style.

Further, government initiatives towards digitalization in schools are also positively impacting student-focused product segments. As Italian consumers believe strongly in craftsmanship and design, the industry tends to gravitate towards premium and locally sourced laptop carry case products during the forecast period.

South Korea will grow at 5.8% CAGR throughout the study period. South Korea is a robust and developing region for laptop carry cases. A connected population, high penetration of devices, and greater student and employee mobility are key drivers of growth. There is strong consumer demand for smart, light, and slim designs that are suited to fast-paced urban living.

With an intensely competitive electronics industry, product bundling and brand loyalty are driving demand for complementary accessories such as laptop cases. Youth culture and K-fashion trends are also impacting design trends, demanding bold, colorful, and functionally diverse cases.

Sustainability is also becoming an important consideration, with environmentally aware consumers demanding recyclable and low-impact products. Furthermore, the home shopping base provides a backing for consumer-direct sales and rapid product delivery. As increasingly digital lives become more integrated into daily existence, South Korea is likely to be positively impacted by utility and trend-driven consumer behavior.

Japan is anticipated to register a growth of 5.5% CAGR over the study period. With a well-established technology infrastructure and a high focus on professional productivity, Japan continues to experience a steady demand for laptop-related accessories. Demand for structured, lightweight, and secure carry cases is evident in business and academic applications. Consumer preference for minimalist and high-quality designs is driving product innovation, with companies emphasizing craftsmanship, long-lasting stitching, and understated design.

Japan's aging but active workforce also drives demand for ergonomically designed products with easy-to-use compartments and light construction. Urban high-density environments also require compact but resilient designs that integrate easily into dense commutes.

Partnerships with online retail and convenience stores guarantee extensive availability, and rising sustainability standards are encouraging domestic brands to incorporate recyclable elements and biodegradable materials. Japan's laptop carry case industry is being defined by a design-sensitive culture and a focus on efficiency, underpinning moderate but consistent growth across the forecast period.

China is anticipated to witness 7.2% CAGR growth between the study periods. Being among the most dynamic consumer electronics industries in the world, China has enormous potential for the adoption of laptop carry cases. A vibrant middle class, growing digital labor force, and rising student body are driving immense demand for style and protection-oriented laptop storage products.

High domestic capacity for production supports diversified products in different price segments, from low-end to high-end. Domestic design innovation in terms of materials and functionality is encouraging the adoption of waterproof, anti-theft, and multi-layered storage functionality.

Urbanization in China and the acceleration of online shopping platforms also fuel demand. Social commerce and influencer marketing contribute disproportionately to purchase decisions, especially among Gen Z and millennial buyers. In addition, state-supported digital learning programs support further sales growth.

The Australia-New Zealand region will grow at 5.4% CAGR throughout the study. Increased adoption of remote work, higher education enrollment growth, and changing lifestyle requirements are fueling demand for functional and fashionable laptop carry cases. The trend of outdoor and hybrid work cultures also fuels demand for rugged, water-resistant, and travel-focused carry solutions. Australian and New Zealand consumers prioritize both durability and design, with many demanding lightweight cases with additional protection features.

There is growing demand for sustainable and ethically sourced products, prompting brands to focus on organic fabrics and green materials. E-commerce is a key sales channel underpinned by well-developed logistics networks that enable rapid delivery even to remote areas. Further, consumers who are aware of brand identity increasingly opt for well-known worldwide and reputable regional brands that provide warranty-covered, value-packed products. With the ongoing development of work and learning trends, the industry is projected to develop at a stable pace with a mounting electronic dependence.

By product, backpacks will capture the largest revenue share for laptop carry cases, with 63.8%, and messenger bags will hold 12% of the industry.

Backpacks have several designs that are practical and ergonomic and can carry not just the laptop but also other accessories like chargers, notebooks, and personal items. The current fashion trend is toward remote working, online homeschooling, and being a digital nomad, and these features have, therefore, encouraged the demand for all-purpose, heavy-duty backpacks. Leading brands in the segment, Targus, Samsonite, and Swiss Gear, provide ergonomic features like padded straps, back support, and multiple compartments for organization.

Additionally, it is easier to carry with weight distribution, thus conserving strain on the shoulders and back from around-the-back packs that laptop users perceive on a daily commuting basis or travel. Additionally, because these bags also provide in-demand features that include protection from water, anti-theft designs, and RFID-blocking pockets, they are appealing bags to the tech-savvy consumer.

With a comparatively smaller projected market share of 12.5%, messenger bags appeal to consumers looking for an elegant, sophisticated alternative to a backpack. Great for the business professional, urban commuter, or school-goer with a taste for sleek compactness, brands such as Timbuk2, Fossil, and Bellroy have jumped into this space, offering messenger bags where high-end materials perfectly meet stylish good looks and decent padding to protect laptops. Yet, the limited carrying capacity and poor weight distribution for daily laptop commuting limit their appeal.

In 2025, the Laptop Carry Case industry will be dominated by offline retail channels with a revenue share of 60.05%, while the online retail segment will hold 39.50%.

Offline retail continues to dominate, owing to the experiential nature of shopping, where the consumers can inspect and sample laptop carry cases before making a purchase. This is very critical for customers who want to evaluate the material quality, durability, and comfort of the case. Big-box physical stores like Best Buy and Target and department stores are other big players in this space.

In addition, the in-store experience gives instant purchase ability and instant gratification because the customer can take the product home immediately. In regions where the adoption of e-commerce is sluggish or for consumers who are more comfortable discussing opinions with sales assistants about the personalization of products, offline retail becomes very important.

Conversely, online retail has witnessed tremendous growth in the last few years thanks to convenience, multiple options, and competitive pricing. Online platforms like Amazon, eBay, and the direct brand websites of Targus or Samsonite offer clients the privilege of purchasing from home while comparing different products easily. Advancements have also aided the growth of e-commerce in digital payments and delivery logistics.

In addition, customer reviews and ratings have significantly benefited consumers by steering their purchasing decisions. With the gradual increase in online shopping, it is also anticipated to rise in share further as younger tech-savvy individuals adopt e-commerce innovations in preference to other traditional shopping means.

Samsonite International S.A. and Targus control the industry with laptop bags and sleeves. These companies maintain their turf in the sector due to the consolidated brand strength, extensive distribution channels, and innovative designs. Samsonite, being one of the premium luggage brands, has made forays into the laptop carry-case segment with worthwhile products of quality, durability, and style.

Targus has further established a reputation for manufacturing dependable, feature-rich cases accommodating a multitude of laptops and tech equipment. With protection and organization as prime themes, Targus has emerged as the first preference for consumers. Other players continuing to lure the niche that craves high quality at a fair price include SWISSGEAR, with their ergonomic and durable designs, whereas ACCO Brands, home to several brands from Kensington, alike.

Tech firms such as ASUSTeK, Lenovo, and Belkin also have a reasonable presence in the industry, with laptop cases branded to accent their range of devices. These brands have always focused on ensuring that their laptop carry cases provide maximum protection and functionality through features such as custom compartments and smart designs appealing to business professionals and tech enthusiasts alike.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Samsonite International S.A. | 18-20% |

| Targus | 15-17% |

| ACCO Brands | 8-10% |

| SWISSGEAR | 10-12% |

| ASUSTeK Computer Inc. | 6-8% |

| Other Players | 35-40% |

Key Company Insights

The company was established as Samsonite International S.A. and is now one of the most dominantly operating contenders in the entire market by converting its brand equity with regard to legacy baggage (luggage) manufacturing into a laptop carry case portfolio underlining its products from the premium cases to the more business-oriented professionals looking for both durability and style aspects that accompany their hardware. Being able to beef up this portfolio with its known distribution network and global reach further cements its position as a market leader.

Targus manufactures high-quality and durable cases that cover laptop sizes from big to small. The brand speaks efficiency through its features, which are organized compartments for gadgets and documents, making it appealing to professionals and students alike. It is also a pioneer when it comes to innovation, and its materials and designs enable it to generate demand in the business segment.

The laptop carry case industry is expected to reach USD 9.3 billion in 2025.

The industry is projected to grow to USD 18.2 billion by 2035.

The industry is expected to grow at a CAGR of approximately 6.9% during the forecast period.

Backpacks are a key segment in the laptop carry case market.

Key players include Samsonite International S.A., Targus, ACCO Brands, SWISSGEAR, ASUSTeK Computer Inc., Fabrique LTD., Thule Group, Sanwa Supply Inc., Lenovo, and Belkin International, Inc.

The segmentation is into Backpack, Messenger Bags, Sleeves, Briefcase, and Rollers.

The segmentation is into Online and Offline.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.