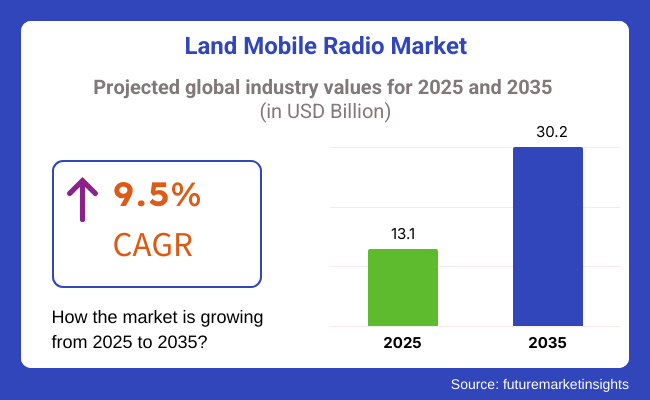

The Land Mobile Radio (LMR) market is projected to reach USD 13.1 billion in 2025. It is expected to expand to USD 30.2 billion by 2035, registering a compound annual growth rate (CAGR) of 9.5% over the forecast period. This growth is fueled by the increasing adoption of advanced digital LMR systems such as Project 25 (P25), Digital Mobile Radio (DMR), and Terrestrial Trunked Radio (TETRA), which are revolutionizing communication networks for public safety, defense, transportation, utilities, and industrial sectors. As organizations seek reliable, real-time, and secure communication solutions, investments in LMR infrastructure continue to accelerate, particularly in mission-critical environments where network reliability is non-negotiable.

Key market drivers include the transition from analog to digital LMR systems, which provide superior audio clarity, enhanced coverage, better spectrum efficiency, and advanced encryption for secure communication. Moreover, the growing demand for interoperable communication systems that allow seamless coordination among multiple agencies and jurisdictions is a pivotal factor boosting market expansion. Integration with broadband technologies, including LTE and emerging 5G networks, is enabling hybrid communication systems that combine the strengths of LMR with the data capabilities of modern cellular networks.

However, the market faces challenges such as high initial investment costs, spectrum availability constraints, and the complexity of integrating legacy systems with modern digital platforms. Additionally, spectrum reallocation for commercial use in certain regions can create hurdles for public safety and critical infrastructure communication providers.

Opportunities are emerging with the development of software-defined radios (SDRs), which offer flexibility and scalability, as well as with the rise of push-to-talk (PTT) over cellular (PoC) and LTE-LMR interoperability, enabling seamless voice communication across platforms. The adoption of cloud-based LMR management solutions, AI-powered analytics for communication optimization, and satellite-based LMR systems in remote areas are further enhancing market potential.

Key trends include the growing convergence of LMR with broadband technologies, the deployment of private LTE networks for critical communication, and advancements in rugged, wearable LMR devices. As governments and enterprises prioritize resilient and secure communication networks, particularly for disaster response, border security, and industrial operations, the industry is poised for sustained global expansion through 2035.

Explore FMI!

Book a free demo

Between 2020 and 2024, the industry grew gradually owing to the growth of mission-critical communication and digital radio technology. The migration from analog to digital systems such as P25, DMR, and TETRA enhanced spectrum efficiency, encryption, and interoperability.5G-enabled LMR deployment and broadband-integrated equipment improved coordination between public safety and industrial operations.FCC and ITU regulatory support made it easier to speed up modernization, but high costs and interoperability challenges remained.

From 2025 to 2035, communication will be revolutionized by AI-based network analytics, 5G-based LMR, and cloud platforms. AI-based dynamic spectrum allocation and blockchain-protected encryption will provide greater security and efficiency. LMR infrastructure, IoT integration, and green solutions such as solar-powered base stations and biodegradable components will propel future growth.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments encouraged digital transition policy, spectrum assignment, and public safety network financing. | AI-driven spectrum management, blockchain-secured communication compliance, and next-gen LMR cybersecurity mandates will define regulatory frameworks. |

| Migration from analog to digital LMR, P25, and TETRA adoption, and broadband-LMR hybrid solutions. | AI-driven spectrum optimization, 5G-LMR integration, and blockchain-secured encrypted communication networks will transform mission-critical connectivity. |

| LMR was extensively employed in public safety, defense, transportation, and industrial communication. | AI-based emergency response, IoT-based LMR networks, and predictive maintenance-based industrial communication will increase LMR applications. |

| Organizations adopted broadband-enabled push-to-talk, digital radios, and interoperable communication platforms. | Next-gen mission-critical networks will be shaped by drone-augmented LMR systems, artificial intelligence-driven dispatch analytics, and radio signal processing adaptable in real-time. |

| LRM adoption was influenced due to costly infrastructure, constricted spectrum availability, and difficulty transitioning to an analog-to-digital paradigm. | Artificial intelligence networks will propel sustainable mission-critical communication. |

| AI-aided monitoring of the network, real-time radio diagnostic capabilities, and predictive maintenance enhanced efficiency. | AI-guided self-reconfiguring autonomous LMR networks, real-time emergency analysis, and quantum-proof encryption will increase reliability and security. |

| Supply chain interruption, excessive cost risks in radio manufacturing, and availability risks due to component shortages affected availability. | Decentralized local manufacturing of LMR, supply chain logistics optimized by AI, and blockchain-based radio component traceability will enhance worldwide accessibility. |

| The expansion was propelled by public safety requirements, modernization of defense communications, and broadband-LMR hybrid systems. | Mission-critical networking driven by AI, LMR integrated with IoT for smart industries, and next-generation secure communication solutions will propel future growth. |

The land mobile radio (LMR) market is expanding with increasing demand for secure and dependable communication systems from different industries. Public safety organizations (police, fire, EMS) require reliability, extended-area coverage, and encryption to offer continuous communication in case of emergencies.

The defense and military sectors are interested in highly secure, rugged, and mission-critical communication solutions with advanced encryption. Transportation and logistics firms require affordable LMR systems with decent coverage for fleet management and operations.

Utilities like energy and water management need LMR systems with robust reliability and coverage, especially in remote locations. The commercial and industrial sector, including manufacturing and construction, needs cost-effective and effective communication devices for workplace coordination and safety.

As the market matures, hybrid LMR-LTE solutions, network optimization through artificial intelligence, and robust encryption are dominant trends that will influence future adoption.

Contract and Deals Analysis

| Company | Contract Value (USD Million) |

|---|---|

| Motorola Solutions and Defense Information Systems Agency (DISA) | Up to USD 191 |

| AEG Group Inc. and USA Navy | Approximately USD 49.7 |

In 2024 and early 2025, the Land Mobile Radio (LMR) market experienced significant activity, marked by substantial contracts aimed at enhancing communication infrastructure for defense and public safety. Motorola Solutions' contract with the Defense Information Systems Agency (DISA), valued at up to USD 191 million, focuses on sustaining enterprise land mobile radio systems for the Navy Installations Command, with potential services extending through 2029. Similarly, AEG Group Inc.'s approximately USD 49.7 million contract with the USA Navy involves the procurement of advanced radio equipment to upgrade first responder communication capabilities, with completion expected by February 2030. These developments underscore a broader trend of investing in advanced LMR technologies to ensure robust and reliable communication channels for critical operations.

The land mobile radio (LMR) segment is the heart of telecommunication, with its applications in public safety, defense, and commercial areas. Nevertheless, massive infrastructure costs and maintenance charges have become a major concern for its adoption.

Organizations should have to reserve ample budgets for networking, updating, and long-term sustainability of the system to achieve the desired reliability in the communication systems.

The rise in broadband and cellular networks is a threat to traditional LMR systems. The conversion to LTE and 5G-based communication systems is a factor that pushes away market development. In order for local mobile radio (LMR) manufacturers to be competitive, they have to pay attention to interworking with new networks and hybrid communication deals that involve broadband and common radio technologies.

Spectrum availability is still the main challenge as the governing bodies are reallocating the frequencies for new technologies. The restricted bandwidth range can indirectly lead to the small size of LMR networks in addition to the negative side of efficiency in operational performance.

In this regard, the companies are to join forces with the policymakers for them to get the set frequency bands exclusively for their operations and also chest spectrum-sharing approaches as a potential solution to the problem of interference.

As digital LMR systems attach more and more interconnected sources, the threats to cyber security are a rising concern. Some of the issues that the devices carry include unauthorized access, signal jamming, and data breaches that could potentially harm critical communications. It is definitely the musts like the end-to-end encryption, the resilient authentication methods, and the actual security oversight that will defend the LMR networks against cyber menaces and with malicious intents.

| Segment | Value Share (2025) |

|---|---|

| Hand Portable Land Mobile Radios (LMRs) | 58% |

The Hand Portable Land Mobile Radios (LMRs) segment is predicted to command an estimated 58% share in 2025, as its portability, ease of use, and critical role only further the development of these devices for the few networked applications. These devices are widely used in the public safety, defense, and commercial sectors.

Hand-portable LMRs are essential for real-time coordination in emergencies and are often used by law enforcement agencies and first responders. The adoption of GPS tracking, encryption, and the interoperability of communication networks have greatly increased their prevalence. Motorola Solutions, Harris Corporation, and Kenwood are among existing companies that innovate more feature-intensive digital radios that meet high security and operational demands.

In-vehicle LMRs are expected to account for 42% of the market in 2025, primarily within transportation, logistics, and emergency response services. These systems enable long-range communications over vast distances with greater coverage. Public transit authorities and trucking fleets use mobile LMRs to improve fleet management, route schedules, and emergency response.

The growing adoption of digital trunked radio systems and the advent of AI-driven dispatch solutions are creating new applications for these systems. An increasingly essential initiative is the integration of LTE networks and push-to-talk (PTT) over cellular solutions. Organizations such as Sepura, Tait Communications, and Hytera Communications have led the way by innovating hybrid digital-analog LMRs to satisfy shifting industry demands.

| Segment | Value Share (2025) |

|---|---|

| Analog LMRs | 35% |

Analog LMRs moderately dominated the market at about 35%, and they are used by end users who often value simplicity and low-budget communications (Market Share in 2025). Industries like construction, transportation, and municipal agencies still rely on analog LMRs as they are simple to deploy, easy to maintain, and less expensive in terms of infrastructure. However, with better voice quality, encryption, and spectrum efficiency, the market is moving towards the digital alternative. Regulatory mandates and the need for interoperability in critical communications further hasten the shift away from aging analog systems.

Digital LMR (Projected at a 65% Market Share by 2025) As the industry standard, digital LMRs offer greater security, scalability, and versatility through both voice and data transmission. AUTOCOMM can combine different equipment from various manufacturers, thanks to leading technologies like Project 25 (P25), Digital Mobile Radio (DMR), and Terrestrial Trunked Radio (TETRA), which have been widely adopted by law enforcement, emergency responders, defense, and large enterprises demanding mission-critical communications. The digital LMRs provide end-to-end encryption, GPS tracking, and full integration to AI-driven analytics to enhance operational efficiency and situational awareness.

Companies, including Motorola Solutions, Hytera, and L3Harris Technologies, are also expanding portfolios in other technologies, such as software and software apps, by forming partnerships and joint ventures. For instance, the smartphones used in LTE enjoy features like internet access and safer communication that include push-to-talk and fast call setup, among many others.

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 6.5% |

| The UK | 6.1% |

| France | 6.0% |

| Germany | 6.3% |

| Italy | 6.2% |

| South Korea | 6.7% |

| Japan | 6.4% |

| China | 6.8% |

| Australia | 6.0% |

| New Zealand | 5.9% |

The industry is growing with increasing demand for secure and dependable communication systems. Government programs have resulted in the adoption of law enforcement, fire departments, and emergency medical services. Analog-to-digital migrations of LMR systems and increasing interoperability requirements drive the growth. Leaders like Motorola Solutions, Harris Corporation, and JVCKENWOOD prioritize technologies, including AI-based dispatch, integration with broadband, and greater spectrum efficiency.

The move to Push-to-Talk over Cellular (PoC) and LTE-based LMR solutions drives communication at speeds in utilities, transportation, and manufacturing. Hybrid solutions led by private enterprises and public safety institutions provide watertight connectivity. Innovation in encryption and network security further underscores support for the adoption of LMR, which makes the USA lead innovative communication solutions.

Growth in the UK comes as emergency services and government agencies migrate to next-generation digital communication networks. The Home Office's Emergency Services Network (ESN) initiative, which is replacing the old Airwave network, is accelerating the move. Growing mission-critical communications reliability issues drive investment in digital LMR systems for real-time information sharing and enhancement of interoperability.

The transport and utility sectors are revising their communication frameworks to provide operational efficiency and security. Companies such as Sepura, Motorola Solutions, and Simoco Wireless Solutions are highlighting hybrid LMR-LTE technology to provide an extension of coverage, especially to remote and rural locations. With industries demanding radio systems with high performance and artificial intelligence-based analytics, the UK industry will also expand at a steady rate in the utilization of LMR.

France is supported by government spending on public safety, defense, and industrial communications. Increased operational efficiency allows the nation to modernize its TETRA and Digital Mobile Radio (DMR) systems to enhance emergency services. The implementation of emergency services such as the Réseau Radio du Futur (RRF) is also propelling the use of next-generation LMR technology.

French companies like Thales and Airbus are pioneering the development of LMR solutions with state-of-the-art encryption, AI-driven optimization, and broadband. Increasing mission-critical communication demands in rail transport networks, defense, and urban security add further to the expansion. With continued digitalization, hybrid LMR-LTE solution adoption will grow in terms of size, further establishing the industry in France.

Germany, being a leader in the deployment of LMR, spends huge sums on defense, public safety, and transport communication networks. The government subsidizes emergency response backup capacity programs using improved TETRA and DMR systems. The interoperability programs between agencies ensure that the streams of communications are seamless, especially between law enforcement and emergency services.

German players such as Rohde & Schwarz and Hytera Mobilfunk are spearheading the development of LMR technology with a focus on AI-based network operation, spectrum efficiency, and cloud dispatching platforms. Automation of industrial processes and smart city initiatives drive expansion, as firms need secure and scalable communication.

Italy is growing due to heightened security threats, government spending on digital communication, and increased reliance on mission-critical radio networks. Analog-to-digital migration of LMR systems ensures higher interoperability and data-sharing capability for public safety agencies and emergency responders.

Industry giants such as Leonardo and Selex ES spearhead innovation through AI analysis embedded in LMR systems and broadband networks. Logistics, transportation, and utilities employ digital radio solutions, fueling growth. As industrial connectivity and Italy develops its emergency response infrastructure, demand for next-generation LMR systems continues to rise.

South Korea has developed substantially with strong government investment in comms networks of military standards, smart cities, and public safety. An investment of USD 2.5 billion ensures the rollout of digital LMR solutions among security officials and emergency responders.

Industry players such as KT, SK Telecom, and LG Uplus integrate LTE and 5G with LMR technology for improved communication. Cloud-based LMR and AI-based dispatching solutions are used increasingly in transport and logistics industries. IoT-friendly LMR system developments in South Korea drive the industry forward.

Security, smart city projects, and public safety spending are in favor of Japan's LMR industry. The Ministry of Internal Affairs and Communications actively promotes the utilization of digital LMR networks in favor of improving emergency response capabilities.

Key leaders include Icom, Kenwood, and Hitachi, which are the leading providers of sophisticated encryption, AI-based analytics, and satellite-enabled LMR solutions. Applications of digital radio technology in defense, transport, and commercial sectors drive the industry forward. With an increased focus on 5G-integrated communication, Japan continues to advance LMR infrastructure.

China is growing with government support in strategic public safety, industrial automation, and smart city applications. Digital radio infrastructure investment supports seamless communication between emergency responders, transportation networks, and enterprise applications.

Key leaders Huawei and Hytera are leading the way in these innovations with AI-based products, hybrid broadband-LMR technology, and advanced encryption. 5G-enabled LMR network expansions are continually enhancing connectivity, placing China at the forefront.

LMR sales in Australia are driven by investment in defense communications, emergency response networks, and infrastructure developments. Transitioning to digital solutions allows for enhanced reliability and security of public safety bodies.

Leading suppliers such as Codan and Barrett Communications are spearheading the charge with high-frequency radio solutions and hybrid LMR-LTE technology. Increasing adoption in mining, logistics, and remote-area communications remains a main growth driver.

Government spending on disaster management and emergency response drives the growth in New Zealand. Digital LMR technology offers extended coverage and interoperability for public safety and industrial agency applications.

Local players such as Tait Communications are at the forefront of the innovation tide with cloud-based LMR solutions and AI-driven analytics. Strong demand from defense, utility, and transport industries for secure and reliable communication is driving growth with incremental next-generation LMR solution adoption.

The industry is growing, especially because demand increases for mission-critical communication across public safety, defense, transportation, utility, and industrial needs. As governments and enterprises demand secure, real-time voice and data transmission, the LMR solution continues to evolve through digital enhancements, encryption, and broadband integration.

Key leaders such as Motorola Solutions, L3Harris Technologies, JVCKENWOOD, and Hytera Communications maintain their dominance in professional LMR systems by providing advanced digital LMR systems, interoperability solutions, and encrypted communication networks. Centrally, emerging players and niche providers are committed to providing cost-effective and software-defined LMR solutions, including hybrid broadband-LMR integration for industry diversification.

Advancements in technology are contesting the development of the P25, TETRA, and DMR systems of the respective organizations regarding network resilience, efficiency, and interoperability between different agencies. The expansion of LMR capabilities beyond radio networks can be realized through the in-house development of broadband push-to-talk (PTT) and AI-enhanced voice processing with LTE/5G-enabled hybrid solutions.

Competitors are also motivated by factors such as government contracts that help in gaining access to funds, regulatory compliance, and seamless integration with evolving broadband and satellite networks. As larger public safety entities and enterprises search for next-generation solutions to communications, top players are speeding up research and development, acquisitions, and service volume expansion for better LMR performance and coverage concerning critical operations.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Motorola Solutions, Inc. | 35-40% |

| L3Harris Technologies, Inc. | 15-20% |

| Hytera Communications Corp. | 10-15% |

| JVCKENWOOD Corporation | 5-10% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Motorola Solutions, Inc. | Develops P25 and DMR digital radio systems, secure communications, and broadband-integrated solutions. |

| L3Harris Technologies, Inc. | Specializes in tactical and encrypted communication systems for defense and public safety. |

| Hytera Communications Corp. | Offers cost-effective DMR and TETRA radio systems for commercial and government sectors. |

| JVCKENWOOD Corporation | Provides analog and digital radio solutions with a focus on interoperability and rugged design. |

Key Company Insights

Motorola Solutions, Inc. (35-40%)

Motorola Solutions is the leading company for its P25 and DMR radio systems, which will cater to public safety agencies, enterprises, or government line organizations. The company also incorporates intelligence through analytics and cloud push-to-talk solutions for enhanced situational awareness.

L3Harris Technologies, Inc. (15-20%)

L3Harris engages in mission-critical communication solutions and specifies these services. This involves encryption, tactical networks, and radio systems that are software-defined for defense and first responders.

Hytera Communications Corp. (10-15%)

Hytera sells DMR and TETRA digital LMRs and offers services that provide more solutions to cost-sensitive markets while establishing a broader scope in both emergency and commercial sectors of the globe.

JVCKENWOOD Corporation (5-10%)

The company creates both analog and digital radio systems with a major focus on interoperability and ease of use in industrial and public safety sectors.

Other Key Players (20-30% Combined)

The Global LMR industry is projected to witness a CAGR of 9.5% between 2025 and 2035.

The Global LMR industry stood at USD 13.1 billion in 2025.

The Global LMR industry is anticipated to reach USD 30.2 billion by 2035 end.

North America is expected to record the highest CAGR, driven by increased demand for secure communication in public safety and defense.

The key players operating in the Global LMR industry include Harris Corporation, Motorola Solutions, Simoco, Raytheon Company, Thales SA, Hytera Communication Corporation Limited, Tait Communications, Sepura Plc, and others.

The segmentation includes hand-portable and in-vehicle (mobile).

The segmentation covers Analog and Digital.

The segmentation covers 25 to 174 MHz (VHF), 200 to 512 MHz (UHF), and 700 MHz & Above.

The segmentation includes Public Safety and Commercial.

The segmentation covers North America, Latin America, Europe, Asia Pacific, and Middle East & Africa (MEA).

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.