Demand is increasing for sturdy, high-quality laminated products in the lamination machines industry, driven across printing, packaging, education, and commercial industries. Companies will focus on the automation of eco-friendly laminating solutions and other high-speed processing technologies to achieve the needs and demands of ever-changing consumers and industries.

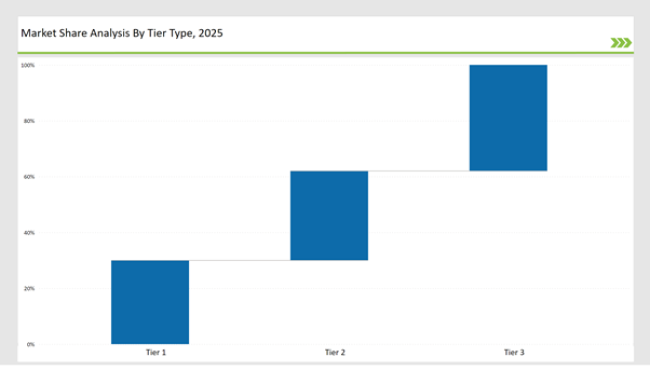

Tier 1 market leaders are GBC (General Binding Corporation), Fellowes, and Royal Sovereign, which account for 30% of the market share through their use of state-of-the-art laminating technologies, vast global networks, and continued R&D investments.

Tier 2 includes companies like Akiles, USI, and Vivid Laminating Technologies, which control 32% of the market. These firms cater to mid-sized consumers with customized and cost-effective laminating solutions, benefiting from strong supply chain efficiencies and compliance with environmental regulations.

Tier 3 players, including regional and niche manufacturers specializing in industrial laminating, specialty films, and automated solutions, constitute the remaining 38% of the market. These companies focus on tailored designs, localized production, and flexible manufacturing processes to meet diverse consumer demands.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (GBC, Fellowes, Royal Sovereign) | 13% |

| Rest of Top 5 (Akiles, USI) | 10% |

| Next 5 of Top 10 (Vivid Laminating, Drytac, GMP, D&K Group, Tamerica) | 7% |

It is a market of laminating machines for industries seeking high-quality, durable, and efficient laminating solutions. Trends are more or less on automation, energy efficiency, and the use of environmentally friendly laminating materials.

Companies innovate with demands from different industries, both in speed, automation, and sustainability factors; investments in AI-driven technology optimize production efficiency while beneficial laminating materials increase popularity.

There has been innovation because of the growth in automated laminating technology, sustainability, and AI-driven quality control. Investment in R&D is being used to improve efficiency in lamination, reduce energy consumption, and integrate smart features. New types of eco-friendly laminating films and biodegradable adhesives are in demand.

Year-on-Year Leaders

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

Technology suppliers should prioritize eco-friendly laminating materials, automation, and enhanced durability to align with evolving industry demands.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | GBC, Fellowes, Royal Sovereign |

| Tier 2 | Akiles, USI, Vivid Laminating Technologies |

| Tier 3 | Drytac, GMP, D&K Group, Tamerica |

The laminating machines market is evolving with new sustainability initiatives and automation advancements.

| Manufacturer | Latest Developments |

|---|---|

| GBC | Launched an AI-enabled high-speed laminating system in March 2024. |

| Fellowes | Introduced an energy-efficient laminating machine in August 2023. |

| Royal Sovereign | Developed compact, high-performance laminating solutions in May 2024. |

| Akiles | Expanded global distribution and introduced IoT-enabled systems in Nov 2023. |

| USI | Launched a low-energy, sustainable laminating solution in Feb 2024. |

| Drytac | Developed advanced adhesive laminating films for specialized applications in April 2024. |

| GMP | Introduced high-speed thermal laminators with eco-friendly film options in June 2024. |

| D&K Group | Expanded its product line with heavy-duty industrial laminators in July 2024. |

The laminating machines market is highly competitive, with key players focusing on automation, sustainability, and efficiency.

Market growth will be driven by automation, sustainable material innovations, and smart laminating systems. Companies will integrate AI-driven monitoring, develop energy-efficient laminators, and enhance recyclability. Demand for high-speed and portable laminators is expected to rise, further expanding market opportunities globally.

Leading players include GBC, Fellowes, Royal Sovereign, Akiles, and USI.

The top 3 players collectively control 13% of the global market.

The market shows medium concentration, with top players holding 30%.

Key drivers include automation, sustainability, material innovation, and regulatory compliance.

Explore Function-driven Packaging Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.