The lamella clarifier market in the world is predicted to witness a decent growth from 2025 to 2035, owing to the augmented need for water and wastewater treatment solutions in diverse industries. Due to their compact structure and high separation efficiency, lamella clarifiers are utilized more & more at municipal and industrial water treatment plants.

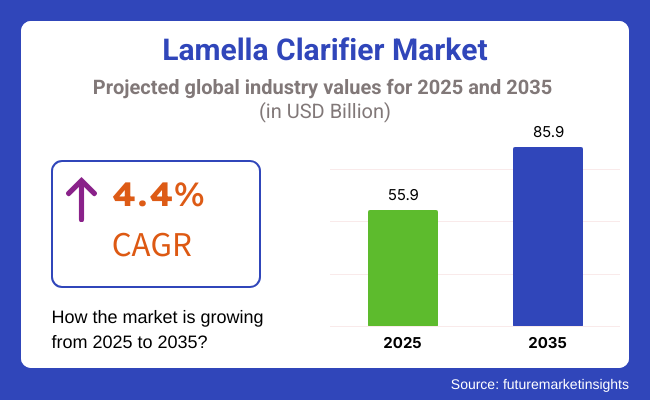

However, as environmental regulations continue to tighten, industries are increasingly relying on lamella clarifiers to not only meet regulatory standards but also save on operational expenses. The lamella clarifier market was valued around USD 55.9 Billion in 2025 and is projected to reach USD 85.9 Billion by 2035. This increase represents a CAGR of 4.4% during the forecast period.

The growing adoption of these clarifiers is driven by their major role in removing suspended solids, minimizing the use of chemicals, and aesthetic space requirement, thus saving space, compared to conventional clarifiers. Key equities producing lamella, or certain lamella, because the design is prefilling, so the demand also varies, but key industries are commonly mining, pulp and paper, food and beverage and also chemical processing.

A wide range of innovative technologies such as automations and real-time monitoring systems are being integrated into lamella clarifiers Technologies to further optimize their performance and efficiency.

With an increasing emphasis on environmentally friendly water management practices across various sectors, lamella clarifiers are anticipated to be vital in assisting organizations in meeting sustainability targets while ensuring compliance with regulations.

The 4.4% CAGR reflects the growing importance of efficient water treatment solutions across multiple industries and the increasing preference for compact, cost-effective clarifiers that deliver reliable performance.

Explore FMI!

Book a free demo

USA, Canada and Mexico in North America also account up a prominent market for lamella clarifiers due to the sustainable water treatments focus and tightening environmental standards in the region. The United States and Canada possess a strong industrial base and increasing demand for advanced water treatment technologies.

In particular sectors including food and beverage processing, pulp and paper, and chemical manufacturing, lamella clarifiers are used to accomplish a consistent water quality, and to enable compliance with discharge standards. Infrastructure upgrades and water conservation initiatives, in addition, will further augment market growth.

The global lamella clarifier market is also driven by the region of Europe being a large revenue share for the global market due to strong environmental policies and river resource management and associated regulations.

There are standards for water treatment set by countries such as Germany, the UK and France, which promote the use of advanced clarifiers. Industrial sectors in the region, including pharmaceuticals, dairy processing and mining, are investing in efficient water-treatment systems to meet compliance and cut costs. Moreover, initiatives undertaken by the European Union to promote circular water use and reduce the environmental impact contribute to the growing demand for lamella

Asia-Pacific lamella clarifier market is expected to witness the highest growth during the forecast period owing to rapid industrialization, growing population, and increasing water stress in the region. Members of this group such as China, India, and Southeast Asian countries are investing in water treatment infrastructure due to increasing demand and pollution challenges.

KMT Technology Lamella clarifiers are used in a growing number of verticals such as textiles, electronics, and petrochemicals where effective water treatment is vital. The market is expanding due to the region's focus on increasing wastewater recycling and the government's efforts to promote sustainable water management practices.

Challenge

High Maintenance Costs and Operational Limitations

High Demand for Skilled Personnel to Manage System Efficiency Lamella clarifiers are common components in wastewater treatment plants, industrial effluent treatment, and municipal water treatment plants however these systems must be periodically cleaned and sludge removed otherwise blockages will occur limiting what they were designed to do.

But solids accumulation and constant monitoring increase operational costs. Moreover, lamella clarifiers may start underperforming depending on influent characteristics changes which need constant adjustments.

To overcome these issues, manufacturers will need to employ self-cleaning technology, real-time monitoring, and automated sludge management to improve efficiency and minimize maintenance expenses. Companies that can design compact, modular pieces with minimal maintenance requirements will have a competitive edge in an increasingly sustainability-focused market.

Opportunity

Rising Demand for Efficient Water Treatment and Compact Clarification Solutions

The growing global emphasis on water conservation, strict regulations concerning the treatment of wastewater, and expansion of various industries are the major factors driving the growth of the Lamella Clarifier Market. With expanding urbanization and industrialization, industries are implementing modern water treatment technologies to meet regulatory needs and environmental sustainability.

Hitherto, lamella clarifiers have grown to become more than popular in municipal water treatment plants, water reduction plants in power generation stations and minerals and metal extraction operations.

IoT-based monitoring, automated backwash cycles and AI-driven performance optimization are among the features of smart water treatment systems that are transforming the industry as well. Investing in advancing digital integration as well as energy-efficient clarification processes along with adherence to sustainable materials used for lamella plates will drive future market growth

The lamella clarifier market grew substantially from 2020 to 2024, driven by the improving demand for water treatment in municipal and industrial applications. Also, with stricter environmental regulations in place, industries had to modernize their water clarification facility, which led to a rapid adoption.

However, factors like fluctuating prices of raw materials, maintenance-intensive designs of products, and limited awareness about smart grid technologies in developing regions impacted market growth. For long-term performance and compliance with wastewater treatment standards, design structures are optimized and corrosion-resistant materials utilized, along with enhanced automation in clarifier operations.

With a long-term forecast for 2025 to 2035, the market anticipates revolutionary innovations such as efficient smart treatment of water, automatic processes, and sustainable clarification capabilities. AI in water analysis, self-regulating clarification systems, and modular clarifiers provide adjustable flow capacity for operation adaptability and efficiency.

Moreover, the trend towards Zero-liquid discharge (ZLD) and reuse of water projects will augment the demand for highly efficient lamella clarifiers in industrial applications. The next wave of growth in the Lamella Clarifier Market will be driven by companies that accept the sustainable innovations as a marketplace norm, improve endeavours towards sludge dewatering, and grow in emerging economies

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Strict waste water treatment regulations. |

| Technological Advancements | Adoption of corrosion-resistant materials and improved sludge removal |

| Industry Adoption | Increased use in municipal and industrial wastewater treatment |

| Supply Chain and Sourcing | Dependence on steel and polymer-based clarifier materials |

| Market Competition | Dominance of large-scale water treatment equipment manufacturers |

| Market Growth Drivers | Rising demand for efficient water clarification and industrial compliance |

| Sustainability and Energy Efficiency | Initial efforts to improve operational efficiency in clarifier systems |

| Integration of Smart Monitoring | Limited digital adoption in clarifier operations |

| Advancements in Compact and Modular Designs | Use of traditional large-scale clarifiers |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of ZLD policies, and stricter effluent discharge limits. |

| Technological Advancements | AI-driven monitoring, self-cleaning clarifiers, and automated performance optimization. |

| Industry Adoption | Expansion into desalination plants, power generation, and sustainable agriculture applications. |

| Supply Chain and Sourcing | Transition to eco-friendly, recyclable materials for enhanced sustainability. |

| Market Competition | Growth of startups offering digital water management and compact, high-efficiency clarifiers. |

| Market Growth Drivers | Increased investment in decentralized water treatment, smart monitoring, and energy-efficient clarifiers. |

| Sustainability and Energy Efficiency | Full-scale integration of low-energy operation, renewable-powered clarifiers, and advanced sludge management. |

| Integration of Smart Monitoring | AI-powered predictive maintenance, cloud-based performance tracking, and real-time water quality analytics. |

| Advancements in Compact and Modular Designs | Development of space-saving, modular, and mobile clarifiers tailored for varied industrial needs. |

The United States lamella clarifier marketplace has expanded gradually owing to strict water contamination rules, increasing call for municipal water remedy, and emerging adoption in industrial wastewater management. The setting protection company (EPA) enforces thoroughly clean water act (CWA) laws, urging industries to embrace excessive-efficiency water remedy structures. These structures help remove suspended solids and organic particles from wastewater through chemical, physical, and biological processes before environmental discharge.

The oil and gas, meals processing, and chemical industries are major customers of lamella clarifiers for wastewater remedy and sludge removal. Moreover, rising investments in clever water infrastructure consisting of monitoring systems and internet of items (IoT)-enabled remedy plants which can be remotely monitored and controlled are riding marketplace growth. Completely different industries use customized designed clarifiers made of plastic, metal, or FRP subject material relying on wastewater traits and volume for higher energy potency.

With robust regulatory enhance and rising adoption of modern, computerized water remedy answers with remote tracking potential, the USA lamella clarifier marketplace is anticipated to develop steadily over the following decade because the nation makes investments in inexperienced applied sciences and clean water availability.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.7% |

The United Kingdom lamella clarifier industry has expanded significantly due to increasing government focus on proper wastewater management, growing industrial applications that produce vast amounts of wastewater daily, and strict compliance with regulations controlling water discharge contents. The Environment Agency mandates high wastewater processing efficiency from all industries and municipalities, pushing facilities to invest in innovative lamella clarifiers to meet treatment standards.

Key customers for lamella settlers include water utilities and various manufacturing sectors, utilizing the equipment for a variety of purposes from sediment separation to sludge densification. In addition, the nation's commitment to sustainability and transforming waste into resources is propelling demand for high-performance yet compact clarifier designs.

With rising investments into water recycling schemes and intensifying emphasis on environmental protection practices, analysts expect the UK lamella clarifier market to experience steady growth in the coming years as organizations procure advanced treatment technology to handle waste streams compliantly.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.2% |

The European Union lamella clarifier marketplace has viewed powerful increase, pushed through stringent water first-rate standards, increasingly more wide adoption throughout distinct commercial sectors, and developing investments updating municipal wastewater remedy amenities.

Major customers of lamella clarifiers in electricity vegetation, unique factories, and advanced city sewage remedy stations are countries consisting of energetic Germany, cultured France, spirited Italy, and passionate Spain.

Regulations like the EU's Water Framework Directive and Industrial Emissions Directive require effective processing of industrial and municipal wastewater, amplifying call for for compact but roomy clarifiers. In addition, heightened center of attention on water conservation and industrial water reuse is propelling marketplace increase.

Consultants predict the EU lamella clarifier marketplace will expand steadily with ongoing investment in sustainable water remedy answers and sensible water structures as clarifiers help accomplish massive environmental and financial dreams throughout numerous industries.

across sectors, the drive for innovative, modern approaches to deal with and reuse water signals continual growth for producers as clarifiers aid in attaining vital ecological and monetary goals across a selection of industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.5% |

The Japanese lamella clarifier market has flourished considerably owing to escalating needs for cutting-edge water treatment infrastructures, stringent regulatory standards, and the necessity for industrial water reuse. Japan's Water Contamination Control Act compels exacting wastewater emission benchmarks, motivating industries to invest in highly-proficient lamella clarifiers.

The microchip, electronics, and fabrication industries extensively rely on such clarifiers, requiring pristine water and proficient wastewater administration solutions.

Moreover, Japan's dedication to sustainable urban water administration is driving the adoption of compact yet sophisticated clarifier systems. With rising capital expenditure in clever water treatment technologies and expanding industrial applications, analysts anticipate that the Japanese lamella clarifier market will maintain stable development going forward.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.3% |

The South Korean lamella clarifier market has steadily expanded, fueled by the increasing number of urban wastewater handling projects, rising needs in industrial uses, and powerful national initiatives in clean water administration.

The Ministry of Environment of South Korea actively advocates for water recycling and industrial wastewater treatment, pushing adoption of lamella clarifiers. Larger wastewater treatment sites in major cities have substantially increased investments in modern lamella clarifier systems to handle growing volumes and strengthen effluent standards.

The petrochemical, electronics, and food processing sectors are key customers of highly-effective clarifiers for sludge removal and water purification. At the same time, the development of advanced urban facilities and water infrastructure modernization is driving demand for automated and Internet of Things integrated water treatment solutions. As South Korean cities and industries continue expanding, the requirements for proficient removal of contaminants is heightening.

With continuing investment in wastewater treatment amenities and increasing commercial needs, the South Korean lamella clarifier market is expected to steadily develop. The administration has established performance-based standards for water reclamation and reuse from industrial plants, motivating further optimization of clarification facilities.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

Industrial and municipal application segments are significantly contributing to the lamella clarifier market. Industries and municipalities are increasingly employing advanced technology for wastewater management to improve sedimentation and to lower suspended solids.

The high-performance inclined plate settlers engineered and developed by us for clarifying cleaner water assist in faster sedimentation, optimized sludge thickening and less footprint, therefore becoming an integral component of the industrial wastewater treatment plants, power generation facilities, chemical processing units and municipal water treatment systems.

Industrial Applications are among the largest consumers of lamella clarifier owing to their functionalities such as improved solid-liquid separation, increased settling capacity, and better reduction in chemical usage in manufacturing processes.

Unlike conventional sedimentation tanks, lamella clarifiers operate on inclined plate technology which gives them superior separation efficiency and a much smaller footprint and hence they are highly suitable for space constrained industrial setups.

Paper and pulp industry will hold significant growth opportunities for lamella clarifiers, due to rising demand for high-volume effluent treatment and fiber recovery, driven by increased focus in paper mills toward resource optimization and regulatory compliance. According to studies, lamella clarifiers increase sedimentation rates by more than 50%, making wastewater treatment in paper processing plants more efficient.

The increased use of lamella clarifier across food and beverage operations, which include application-specific design configurations to separate high-fat, grease, and organic loads, has considerably stimulated market growth, resulting in their growing acceptance in dairy sector, beverage production and meat processing industry.

This: The rising usage of AI-powered lamella clarifier monitoring with real-time sludge level detection and automated flow rate adjustments has ramped up adoption even further, offering superior operational efficiency and reduced maintenance costs in industrial applications.

High such systems have been introduced known as modular lamella clarifier systems which are stackable in design, offering scalability of wastewater treatment capacity which has further increased the growth of the market and higher adaptability to various other industrial water treatment applications.

Lifesaving superior abuse resistant material use, high duty quality stainless steel with strong polymer enamel coat for an extended part life is strengthening market growth by offering superior performance in extremely alkaline or corrosive industrial wastewater type environments.

Industrial lamella clarifiers offer several benefits including space-saving design, high sedimentation efficiency, potential for lower sludge handling costs, but they also have limitations such as higher initial installation costs, maintenance is required in regular intervals, and not feasible for very high sludge loads. Nonetheless, new innovations like self-cleaning clarifier designs, AI-driven sediment monitoring, and hybrid multi-stage clarification systems are enhancing efficiency, adaptability, and cost-effectiveness, indicating sustained market growth for the industrial lamella clarifier market.

Strong market adoption for municipal applications is strongly observed in urban wastewater treatment, drinking water purification, and decentralized sewage treatment plants, as governments and local authorities invest in sustainable and space-efficient water treatment solutions. It explains how, compared to typical sedimentation basins, lamella clarifiers offer increased performance, decreased operational costs, and enhanced sludge concentration, which aid municipal applications.

As water utilities increasingly prioritize water quality and public health, the increasing trend of lamella clarifiers in municipal drinking water treatment for the utilization of inclined plate settlers for improved turbidity removal and coagulation efficiency has enhanced the growth of improving the demand for high-performance clarifiers. Studies show that lamella clarifier technology is able to remove up to 90% suspended solids in drinking water treatment which helps to meet stringent global quality standards.

The increasing penetration of lamella clarifiers in municipal wastewater treatment plants with customizable configurations for differing sludge load capacities has further bolstered the market demand for lamella clarifiers to achieve higher adoption in expanding urban areas and smart city solutions.

The increased adoption of automated sludge discharge control, which distributes real-time sludge density automatically, has further improved efficiency and reduced manual intervention in relation to municipal wastewater treatment plants.

Meanwhile, the growth of the market has been optimized owing to the development of prefabricated lamella clarifier units equipped with plug-and-play designs enabling rapid deployment in decentralized municipal sewage treatment systems ensuring enhanced flexibility for evolving urban wastewater management requirements.

Municipal water treatment operators rely on particular technology and process solutions to meet their residential water needs, so the new designs of energy-efficient lamella clarifiers, which use low-power consumption, gravity-based sedimentation systems, have further strengthened the market and ensured that municipal water treatment operations are more sustainable.

Even with their spatial, sedimentation rates, and water quality benefits compared to municipal clarifiers, lamella clarifiers in municipal service also have their difficulties, such as sludge dewatering expense, sensitivity to hydraulic shock loading, and forced routine cleaning of the plates.

Whereas historical considerations have exhibited limitations within lamella clarifiers for municipal wastewater treatment, new advancements in the form of AI fuelled water treatment optimization, self-regulating clarifier flow control and hybrid clotting-lamella clarifier are expanding efficiency, scalability and prolonged operational cost-effectiveness for city lamella clarifiers of the future.

The lamella clarifier market is witnessing growth, which is a result of rising demand for solid-liquid separation process across various sectors such as wastewater treatment, industrial effluent treatment, as well as municipal water treatment applications. Some companies are developing compact and high-throughput clarifier designs, AI-powered monitoring systems, and energy-saving sludge removal technologies in order to improve clarification efficiency, operational sustainability, and compliance.

Covering global water treatment equipment manufacturers as well as the specialized clarifier solution providers, the market fosters a collaborative exchange of technological innovations involving inclined plate clarifiers, modular designs, and automated sludge management systems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Veolia Water Technologies | 15-20% |

| SUEZ Water Technologies & Solutions | 12-16% |

| Evoqua Water Technologies LLC | 10-14% |

| WesTech Engineering, Inc. | 8-12% |

| Hydro International | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Veolia Water Technologies | Develops compact, high-efficiency lamella clarifiers with AI-based water quality monitoring for industrial and municipal applications. |

| SUEZ Water Technologies & Solutions | Specializes in modular lamella clarifiers with automated sludge removal and low-energy operation. |

| Evoqua Water Technologies LLC | Manufactures high-capacity inclined plate settlers for wastewater treatment and industrial process water clarification. |

| WesTech Engineering, Inc. | Provides custom-designed lamella clarifiers for sediment removal in chemical processing, mining, and water treatment facilities. |

| Hydro International | Offers pre-engineered, space-saving lamella clarifier systems for storm water and industrial effluent treatment. |

Key Company Insights

Veolia Water Technologies (15-20%)

Lamella clarifiers are an energy-efficient and space-saving solution in many environments, especially when monitored with AI, such as in applications for sustainable water treatment, where Veolia dominates the market.

SUEZ Water Technologies & Solutions (12-16%)

SUEZ provides high performance automated sludge management solutions for low maintenance high efficiency water clarification.

Evoqua Water Technologies LLC (10-14%)

Evoqua is a supplier of high-performance lamella clarifier systems for effective solid-liquid separation in industrial and wastewater applications.

WesTech Engineering, Inc. (8-12%)

WesTech designs tailor-made clarifier solutions based on heavy-duty applications and automated sludge removal technologies.

Hydro International (5-9%)

Hydro International make small footprint, efficient clarifiers for very economical sediment removal, for municipal and industrial wastewater.

Other Key Players (40-50% Combined)

Next-next-generation lamella clarifiers, AI-driven sedimentation monitoring, energy-efficient sludge handling solutions - all of these innovations are the result of support from several generations of water treatment and environmental engineering firms. These include:

The overall market size for Lamella Clarifier Market was USD 55.9 Billion in 2025.

The Lamella Clarifier Market expected to reach USD 85.9 Billion in 2035.

The demand for lamella clarifiers will be driven by factors such as increasing water treatment needs, urbanization, and industrial wastewater management. Additionally, the growing focus on efficient and sustainable water treatment processes, coupled with rising environmental regulations, will further boost the market for lamella clarifiers.

The top 5 countries which drives the development of Lamella Clarifier Market are USA, UK, Europe Union, Japan and South Korea.

Industrial and Municipal Applications Drive Market Growth to command significant share over the assessment period.

Domestic Booster Pumps Market Growth - Trends, Demand & Innovations 2025 to 2035

Condition Monitoring Service Market Growth - Trends, Demand & Innovations 2025 to 2035

Industrial Robotic Motors Market Analysis - Size & Industry Trends 2025 to 2035

Ice Cream Processing Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Large Synchronous Motor Market Analysis - Size & Industry Trends 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.