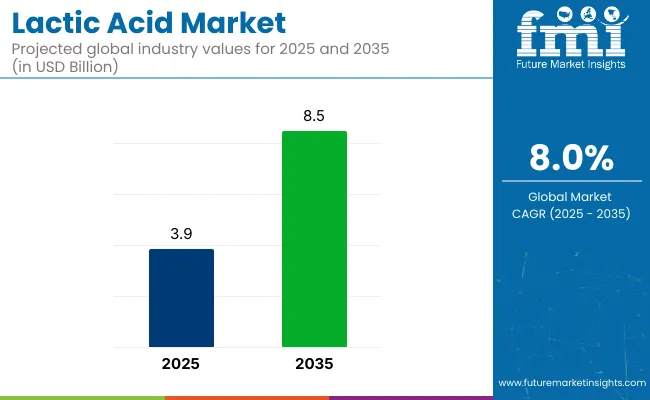

The global lactic acid market is projected to grow from USD 3.9 billion in 2025 to USD 8.5 billion by 2035, registering a CAGR of 8.0%. The market expansion is being driven by rising demand for biodegradable plastics, natural preservatives, and personal care ingredients.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.9 billion |

| Industry Value (2035F) | USD 8.5 billion |

| CAGR (2025 to 2035) | 8.0% |

Consumers shift towards eco-friendly, plant-derived, and health-focused products is accelerating lactic acid applications in bioplastics, food & beverages, pharmaceuticals, and cosmetics. This aligns with sustainability trends and regulatory drives towards green chemistry and natural formulations.

The market holds approximately 18% share in the global bioplastics market due to its major role in PLA production. In the food additives market, it contributes nearly 5% as a preservative and acidulant. Within the personal care ingredients market, its share is around 2%, driven by AHA-based skincare formulations.

In the pharmaceutical ingredients market, it holds less than 1%, mainly used in drug delivery systems and topical formulations. Overall, in the industrial chemicals market, its share remains below 0.1%, as it is a specialised organic acid within a broad category of industrial chemical applications.

Government regulations impacting the market focus on food safety, biodegradable packaging standards, and green chemistry mandates. The Food Safety and Standards Authority of India (FSSAI) sets norms for food additives, including lactic acid usage levels in processed foods.

The USA FDA and European Food Safety Authority (EFSA) regulate its use as a preservative and pH regulator in food and beverages. Additionally, ASTM International standards (D6400, D6866) guide bioplastic applications such as PLA production, while REACH regulations ensure safety in cosmetic and personal care formulations. These standards drive the adoption of high-purity, compliant lactic acid across multiple sectors globally.

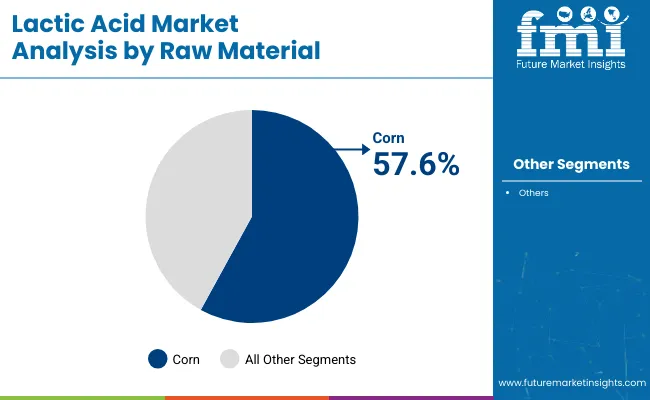

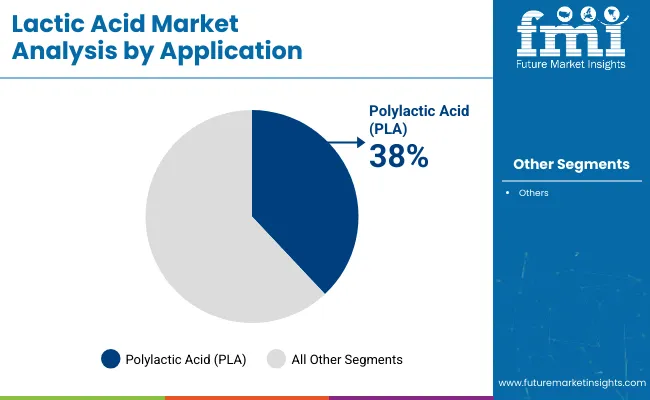

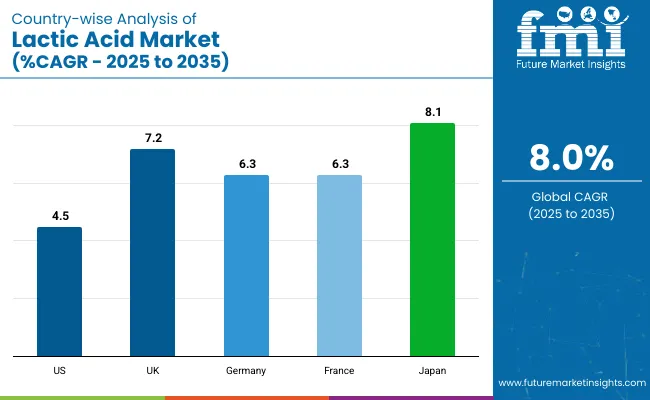

Japan is projected to be the fastest-growing market, expanding at a CAGR of 8.1% from 2025 to 2035. Polylactic Acid (PLA) will lead the application segment with a 38% share, while corn will dominate the raw material segment with a 57.6% share. The USA and Germany markets are also expected to grow steadily at CAGRs of 4.5% and 6.3%, respectively. The UK will grow at 7.2% CAGR, and France at 6.3% CAGR over the forecast period.

The lactic acid market is segmented by raw material, application, form, and region. By raw material, it includes corn, sugarcane, cassava, and other crops (rice, potato, wheat and barley).

Under application, the market covers Polylactic Acid (PLA) (biodegradable polymers, medical devices), food & beverages (meat, poultry, and fish, beverages, confectionery and bakery, fruits and vegetables, dairy), pharmaceuticals (drug formulations, topical applications), cosmetics & personal care, and other applications (animal feed additives, chemical intermediates, textile processing, leather tanning).

By form, it is classified into dry and liquid. Regionally, it spans North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Corn will lead the raw material segment with a 57.6% market share in 2025, driven by its renewable nature, cost-effectiveness, and suitability for PLA and food-grade lactic acid production.

PLA will capture 38% of the application segment in 2025 as demand rises for biodegradable plastics in packaging and safe medical device applications globally.

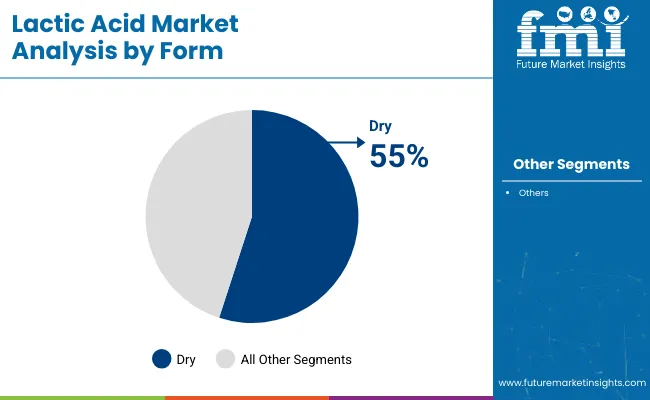

Dry form will lead with a 55% market share in 2025 due to stability, ease of storage, and wide use in food, cosmetics, and pharmaceuticals.

The global lactic acid market is experiencing steady growth, driven by increasing demand for biodegradable plastics, natural food preservatives, and personal care ingredients. Lactic acid plays a crucial role as a sustainable raw material in various industries, supporting eco-friendly and health-focused product development.

Recent Trends in the Lactic Acid Market

Challenges in the Lactic Acid Market

Japan shows the fastest growth in lactic acid market at 8.1% CAGR, driven by strong bioplastics and food-grade demand. The UK follows with 7.2% CAGR, supported by clean-label food and cosmetic applications. Germany and France each grow at 6.3% CAGR, led by EU sustainability and natural ingredient regulations.

The USA records the slowest growth at 4.5% CAGR, focusing on pharmaceuticals, food preservation, and premium bioplastics. Overall, Japan’s market expands near the global average (8%), while Germany, France, UK, and USA grow moderately, reflecting varied priorities across food safety, bioplastics, and personal care segments.

Japan leads in high-purity lactic acid production used in bioplastics, food preservation, and personal care. Germany and France leverage their strong food processing and cosmetic industries, with EU directives accelerating natural preservative and bioplastic adoption.

The USA market emphasizes pharmaceutical and food-grade applications, while the UK focuses on natural food preservatives and cosmetic formulations. As the market adds over USD 4.6 billion globally by 2035, both sustainability-led and food safety-driven regions will shape long-term demand.

The report covers in-depth analysis of 40+ countries, five top-performing OECD countries are highlighted below.

The Japan lactic acid revenue is poised to grow at a CAGR of 8.1% from 2025 to 2035. Growth is driven by strong demand in food and beverage, bioplastics, and personal care segments. As a technology-driven OECD economy, Japan prioritizes high-purity, food-grade, and biodegradable lactic acid for food safety and sustainability.

The demand for lactic acid in Germany is slated to grow at 6.3% CAGR during the forecast period, slightly below the global average but strongly regulation led. EU sustainability goals, clean-label trends, and food safety standards are pushing adoption of lactic acid in food, cosmetics, and bioplastics.

The France lactic acid market is projected to grow at a 6.3% CAGR during the forecast period. Demand is driven by clean-label food initiatives, sustainable packaging, and natural cosmetics regulations.

The USA lactic acid market is projected to grow at 4.5% CAGR from 2025 to 2035, translating to 0.56x the global rate. Unlike emerging markets focused on new manufacturing, USA demand is heavily tied to pharmaceuticals, food preservation, and bioplastics.

The UK lactic acid revenue is projected to grow at a CAGR of 7.2% from 2025 to 2035, representing slightly below the global pace at 0.90 times. Growth is supported by natural food preservative use and rising demand for AHAs in cosmetics.

The market is moderately consolidated, with leading players like Corbion, Galactic, JIAAN BIOTECH, Food chem International Corporation, and Cargill, Incorporated dominating the industry. These companies provide high-purity, food-grade, pharmaceutical, and bioplastic-grade lactic acid catering to industries such as food and beverages, personal care, pharmaceuticals, and packaging.

Corbion focuses on bioplastics and medical-grade lactic acid, while Galactic specializes in food preservation and personal care formulations.

Cargill, Incorporated delivers large-scale fermentation-based lactic acid for bioplastics and food applications. Foodchem International Corporation offers a broad portfolio of food-grade acids, and JIAAN BIOTECH is known for its biotechnology-driven production.

Other key players like Ennore india Chemical, Haihang Industry, Anmol Chemicals, SimSon Pharma Limited, Henan Jindan Technology Co. Ltd., and Unitika contribute by providing specialized lactic acid and derivatives for diverse industrial and consumer applications.

Recent Lactic Acid Industry News

In September 2024, Cargill unveiled the acquisition of two USA feed mills to bolster its production capabilities.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 3.9 billion |

| Projected Market Size (2035) | USD 8.5 billion |

| CAGR (2025 to 2035) | 8.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/Kilotons |

| Raw Materials Analyzed | Corn, sugarcane, cassava, and other crops (rice, potato, wheat and barley) |

| Applications Analyzed | Polylactic Acid (PLA) (biodegradable polymers, medical devices), food & beverages (meat, poultry, and fish, beverages, confectionery and bakery, fruits and vegetables, dairy), pharmaceuticals (drug formulations, topical applications), cosmetics & personal care, and other applications (animal feed additives, chemical intermediates, textile processing, leather tanning). |

| Forms Analyzed | Dry, Liquid |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | Corbion, Galactic, JIAAN BIOTECH, Food chem International Corporation, Ennore india Chemical, Haihang Industry, Anmol Chemicals, SimSon Pharma Limited, Cargill Incorporated, Henan Jindan Technology Co. Ltd., Unitika |

| Additional Attributes | Dollar sales by application and form, share by raw material, regional demand growth, sustainability and regulatory influence, bioplastics adoption trends, competitive benchmarking |

As per raw material, the industry has been categorized into Corn, Sugarcane, Cassava, and other crops.

This segment is further categorized into Polylactic Acid (PLA) (Biodegradable Polymers, and Medical Devices), Food & Beverages (Meat, Poultry, and Fish, Beverages, Confectionery and Bakery, Fruits and Vegetables, and Dairy), Pharmaceuticals (Drug Formulations, and Topical Applications), Cosmetics & Personal Care, and Other Applications.

As per form, the industry has been categorized into Dry and Liquid.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

The market is valued at USD 3.9 billion in 2025.

The market is forecasted to reach USD 8.5 billion by 2035, reflecting a CAGR of 8.0%.

Corn will lead the raw material segment, accounting for 57.6% of the global market share in 2025.

Polylactic Acid (PLA) will dominate the application segment with a 38% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 8.1% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lactic Acid Cosmic Blends Market Size and Share Forecast Outlook 2025 to 2035

Lactic Acid Bacteria Market Analysis by End-use Application, Functionality and Other Strains Type Through 2035

Lactic Acid Blends Market

Lactic Acid Esters Of Mono And Diglycerides Of Fatty Acids Market

Lactic Acid Esters Market Trends & Demand 2022 to 2032

UK Lactic Acid Market Outlook – Size, Share & Forecast 2025-2035

USA Lactic Acid Market Analysis – Trends, Growth & Industry Insights 2025-2035

Polylactic Acid Market Expansion - Biodegradable Materials & Industry Trends 2024 to 2034

Europe Lactic Acid Market Trends – Demand, Growth & Forecast 2025-2035

Natural L-Lactic Acid Market

Gypsum-Free Lactic Acid Market Growth – Trends & Forecast 2022-2032

Encapsulated Lactic Acid Market Analysis by Application, Nature, Form, and Region from 2025 to 2035

Lactic Butter Market Analysis - Size, Share & Forecast 2025 to 2035

Prophylactic HIV Drugs Market Growth - Industry Trends & Forecast 2025 to 2035

Thromboprophylactic Drugs Market Insights – Trends, Demand & Growth 2025-2035

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA