The global lactase market is a moderate monopoly with most of the global share taken by a handful of dominant multinationals. The top five players, Novozymes, DuPont/IFF, DSM-Firmenich, Chr. Hansen, and Advanced Enzymes, combined, hold 91% of the total market share.

These companies focus on the production of highly efficient lactase enzymes through proprietary fermentation technologies, research and development investments, and well-developed supply chain networks. Novozymes controls the largest market share, 26.8%, which is driven mainly by technological advancement in enzyme optimization and collaborative partnerships with several of the leading manufacturers of dairy products.

The following is DuPont/IFF at 24.2% owing to its diversified enzyme portfolio and customer base in dairy and plant-based beverage sectors. DSM-Firmenich owns 18.5% and mainly supplies high-performance lactase for infant formula and specialized nutrition products. The remaining 9% of the players have diverse regional or niche manufactures.

Explore FMI!

Book a free demo

| Market Structure | Top 5 Players |

|---|---|

| Industry Share (%) | 91% |

| Key Companies | Novozymes, DuPont/IFF, DSM-Firmenich, Chr. Hansen, Advanced Enzymes |

| Market Structure | Smaller Regional Players |

|---|---|

| Industry Share (%) | 6% |

| Key Companies | Amano Enzyme, Enzyme Development Corporation |

| Market Structure | Small-Scale Players |

|---|---|

| Industry Share (%) | 3% |

| Key Companies | Antozyme Biotech, Creative Enzymes, Aumgene Biosciences |

The market is moderately fragmented, as both the global and regional players have considerably contributed to the overall dynamics of the market.

Fungi-derived lactase leads with 52% market share because it holds high stability under varying pH levels and temperature changes. These contribute to its commercial value; both DSM-Firmenich and Chr. Hansen use fungus strains in their offerings of lactase to the customers in the dairies and in the nutraceutical industries. Yeast-derived lactase (35%) exists in strong competition since it efficiently degrades the lactose under acid conditions, making it favorable for beverages that are fermented dairy and plant. Danone, a leading dairy company, prefers using yeast-based lactase for the lactose-free yogurt products. Bacterial lactase (13%) is a growing niche market whose application remains limited in specialized pharmaceutical as well as probiotic uses. Companies such as DuPont/IFF offer bacterial strains to their customers for the development of functional food formulation.

Dairy manufacturing products account for 68% of the market since lactase enzymes can be used in lactose-free milk, cheese, and yogurt. The brands Lactaid, Arla, and Fairlife are reliant on solutions provided by Novozymes and DSM-Firmenich on lactase. The production of infant formula accounts for 17% due to increased demand on the part of consumers for lactose-free as well as hypoallergenic formulas. Nestlé (using Gerber Good Start), Abbott (Similac), and Mead Johnson (Enfamil) have lactases that have been specially designed to generate infant-friendly products. According to 15%, beverage processing includes composing lactose-free sports drinks, protein shakes, or milks with alternative sources, such as plants. Some examples are Silk (Danone), Alpro (Danone), and Ripple Foods that use lactase's addition to improve their products in terms of digestibility.

The Global Lactase Market witnessed developments aplenty in 2024-from new product launches to strategic acquisitions to technological innovations.

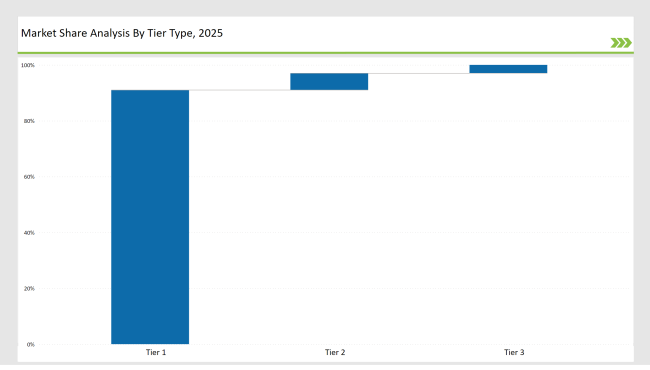

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 91% |

| Example of Key Players | Novozymes, DuPont/IFF, DSM-Firmenich, Chr. Hansen, Advanced Enzymes |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 6% |

| Example of Key Players | Amano Enzyme, Enzyme Development Corporation |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 3% |

| Example of Key Players | Antozyme Biotech, Creative Enzymes, Aumgene Biosciences |

| Brand | Key Focus |

|---|---|

| Novozymes | Developed high-speed lactase enzyme to reduce dairy processing time by 20%. |

| DuPont/IFF | Introduced acid-stable lactase for fermented dairy and functional beverages. |

| DSM-Firmenich | Strengthened enzyme production for lactose-free infant formula applications. |

| Chr. Hansen | Acquired a probiotic enzyme company to expand in gut health and dairy formulations. |

| Advanced Enzymes | Expanded partnerships with Amul and Yili Group for cost-effective lactase supply. |

| Amano Enzyme | Launched lactase for lactose-free frozen desserts, enhancing texture and sweetness. |

| Enzyme Development Corporation | Increased production capacity by 20% to meet rising demand. |

| Antozyme Biotech | Introduced non-GMO lactase enzymes, targeting clean-label brands. |

| Creative Enzymes | Developed customized lactase solutions for small dairy manufacturers. |

| Aumgene Biosciences | Expanded into Western Europe, securing new supply agreements with mid-sized dairy firms. |

The sports and performance nutrition area are seeing a rush in lactose-free protein drinks. Players invested in high-digestibility lactase enzymes will be in good stead, with growing milkshakes free from lactose being introduced by registered brands such as Silk and Arla. The expanding nature of lactose-free dairy in China, India, and Brazil poses prospects for lactase enzyme manufacturers who will partner with local dairy companies to benefit from this high-growth trend, just as did Advanced Enzymes in Asia.

The demand for low-lactose yogurt, probiotic drinks, and fortified dairy is increasing. Companies that develop tailored lactase enzyme solutions for specific pH conditions and dairy formulations will lead to functional dairy innovation. Large-scale dairy manufacturers are looking for cost-effective and high-efficiency lactase solutions. Enzyme companies that guarantee bulk enzyme supply contracts to dairy processors like Danone and Nestlé will be fostering long-term strategic ties.

The eco-conscious aspect will determine the future of the lactase market in respect to green enzymes manufacturing and carbon neutrality. The brands that will invest in biodegradable packaging to launch these enzymes and develop renewable fermentation processes will be securing their leadership in the markets concerned with sustainability.

The global lactase market is moderately consolidated, with the top five players controlling 91% of the industry. Smaller regional and niche players make up the remaining 9%, serving specialized applications.

The powdered lactase segment holds the largest share at 75%, mainly due to its higher enzyme stability, ease of storage, and suitability for commercial dairy processing.

Lactase enzymes are increasingly used in plant-based dairy beverages, particularly in oats, almonds, and pea-based formulations, to improve sweetness and digestibility.

The top five companies—Novozymes, DuPont/IFF, DSM-Firmenich, Chr. Hansen, and Advanced Enzymes—control most of the market due to their technological advancements and strong supply chains.

Lactase is used in hypoallergenic and lactose-free infant formulas, allowing major brands like Nestlé (Gerber), Abbott (Similac), and Mead Johnson (Enfamil) to produce digestible milk-based formulas.

Acid-stable lactase enzymes are essential for fermented dairy and fruit-based protein drinks, where standard lactase enzymes break down inefficiently in low-pH environments.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.