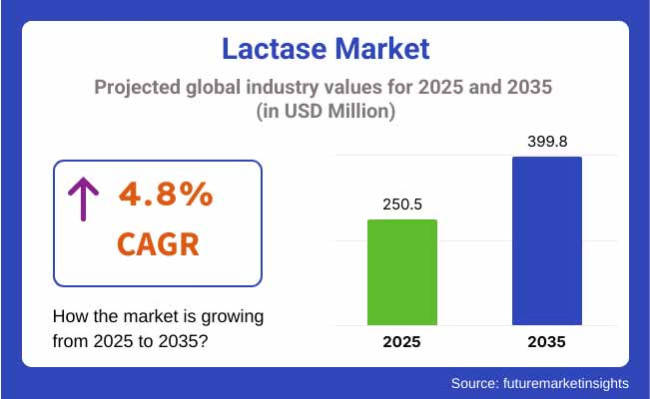

Lactase market volume was USD 219.9 million in 2022 and is going to be USD 250.5 million in 2025. The market will increase at a CAGR rate of 4.8% in the year 2025 to 2035, and the aggregate value will be USD 399.8 million. The demand for lactase has been increasing year after year with the support of increasing awareness regarding lactose intolerance, increase in consumers' demand for milk which is lactose-free, and improvement in enzyme technology.

Lactase is a necessary lactose, milk and milk product contained sugar, body digestion enzyme. The enzyme would be widely used in food and beverage, nutraceutical food supplement, and lactose-free vegetable and medicine in diet of lactose intolerant patient.

Growing rate of gastrointestinal disease and growing demand of plant and lactose-free would stimulate the market. Lactose intolerance is an overseas disease commanding a gigantic majority of human population. Over 65% of the global population have been described as lactose malabsorbed and consist mostly of Asians, Africans, and South Americans. This has therefore generated market demand for milk products that are lactose-free and lactose hydrolyse through the use of lactase enzymes.

The dairy industry reacts to market demand by producing lactose-free milk, cheese, yogurt, and ice cream. They are all made by lactase enzyme processing that removes lactose without affecting nutrition or flavor. Lactaid, Arla Foods, and Danone are spending huge capital promoting their huge volumes of lactose-free product because demand is increasing.

Technical advances in enzymes have brought such technology onto the market that manufacturers can now make more thermostable and active lactase enzymes to provide better quality product and production capability.

Biotech product systems are being used more extensively in the marketplace of enzyme activity stimulation at lesser cost. Supplements of lactase are increasingly used by lactose intolerance patients to be easily absorbed. Usage of lactose health supplements has also been instrumental in the evolution of adaptation of pharma and the nutraceutical industry towards lactase-strengthened foods.

Increased attention towards gut care and probiotic further boosted business. Further patenting, further lactase enzyme innovation is being utilized for production. This puts the latter in front of the traditional dairy foods and can be a price-sensitive portal market barrier.

Growing demand for substitute milk crops (i.e., almond, soy, oat, coconut milk) represents a business competitiveness risk to the lactase market. Furthermore, consumers buy dairy-free, rather than lactose-free, dairy, and that is something which impacts demand for lactase.

This is a basis point change (BPS) within the lactase market representing short-term and long-term change of performance within the market.

| Period | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.5% |

| H2 (2024 to 2034) | 4.6% |

| H1 (2025 to 2035) | 4.7% |

| H2 (2025 to 2035) | 4.8% |

Lactase market rose by 10 BPS between H2 and H1 of 2024 to 2034 due to ongoing consumer demand for lactose-free and gut food. The trend will continue with the trend of incremental BPS growth for the period 2025 to 2035 since the long-term position of the market.

The worldwide lactase market will experience shift with increasing cases of lactose intolerance, use of milk constituents in lactose-free food products, and customer awareness for clean-label food and good food nutrition. Gastrointestinal health trend and clean-label foods trend will put pressure to drive demand further.

All such investment on the part of all participants in enzyme capability, next-generation new-format, and value positioning on the part of all players will be done by emerging consumers as revenues skyrocket exponentially long-term to 2035.

Revenues, leadership, and adequate market coverage are all the priorities of Tier 1 majors. They are all Tier players with high advertisement spending and product R&D spending. Chr. Hansen Holding A/S (Denmark) has monopoly position with lactase in lactase enzyme solutions to supply dairy segment of broad-based for lactose-free product ranges.

Koninklijke DSM N.V. (Netherlands) has with diversified nutrition and enzyme portfolios like lactase to supply in other geographies with solution-based innovation. Industry players associate market leadership with titanic size of production quantity, co-operative relationship, and rare innovation to offer convenience of adapted consumer need.

Tier 2 players are below Tier 1 revenues but also with sufficient market share. Among the companies included are such as Novozymes A/S (Denmark), a business company that engages in biotics solutions via lactase enzyme use to be used on different segments in foods and beverages.

Kerry Inc. (Ireland), a business company, is an enzyme technology taste and nutrition solution provider of such as lactase to help in product formulation development. The companies compete on niching, premium, and difference fronts to offer specialty foods with distinctive diet and wellness needs. Their local intensity and density enable them to create a strong grip on the market.

The new entrants and the small players are clustered in Tier 3, the new arrival of lactase space. They are underpenetrated but create new store formats and new business models, offline or online, to stay in the mix. Advanced Enzyme Technologies (India) is another company that has developed expertise in R&D of market enzymes like lactase.

Enmex (Mexico) is another company that exports enzymes like lactase to be utilized locally in the food-processing industry. They will be in a position to create brands from word-of-mouth and social networking and battle multinationals. Their emphasis on the natural source, greenness, and creative application of the product will be most likely to attract consumers looking for new and green products.

Increased Demand for Lactose-Free Milk and Lactose-Free

Shift: People need to consume lactose-free milk in higher quantities due to increasing cases of lactose intolerance, gastrointestinal illness, and food trend towards dairy alternatives. People from North America, Europe, and the Asia-Pacific region are seeking gut-friendly, easily digestible milk and creating demand for lactase enzymes to consume milk.

Strategic Response: Chr. Hansen of Denmark responded with the introduction of next-generation lactase enzymes optimizing milk and yogurt lactose hydrolysis for greater digestibility and taste. DSM of the Netherlands extended Maxilact line of enzymes to leading European and American dairy food producers. Novozymes of Denmark partnered Asian dairy producers in the development of lactose-free dairy beverages for China's and India's expanding health-conscious consumer market.

Emphasis towards Functional and Nutritive Milk Products

Shift: There is a shift towards functional and nutritional milk food with the trend for increased probiotic, protein, and gut-happiness content in milk food. For more digestible and nutritious milk production, there is a steep rise in consumption of lactase in infant food material, sport nutrition, and geriatric-care food.

Strategic Response: To reverse this trend, Switzerland's Nestlé launched lactose-free baby foods and protein drinks for sportmen for the lactose intolerant. France's Danone launched its Actimel and Alpro brand of lactose-free yogurt due to the health benefit to the digestive system. Denmark's Arla Foods launched a series of lactose-free milk with protein value for the health-conscious sportspersons of Europe and America.

Launch of Plant-Based Dairy and Lactase-Enriched Food

Shift: Plant milk is a global expanding market and lactase enzymes are increasingly utilized to break through dairy blends and blended lactose-free foodstuffs. They are driving nutritional parity among dairy food products and dairy-free replacements.

Strategic Response: To follow such a boom, Ben & Jerry's Unilever introduced lactase-treated crossover ice creams consisting of vegetable food and milk. Sweden's Oatly introduced lactase-treated oat-milk branded waiting for Canadian upscale consumers to consume and relish dairy-like. Lactase-treated plant yogurts introduced by General Mills, USA, achieved 12% retail sales in North America.

Retail and E-Commerce Redistribution Transformation Introduction

Shift: Drops of lactase and lactose-free foods are more and more being placed on the market to the consumer via the supermarket, health foods, and World Wide Web. Direct selling and subscription increasingly fill their niche, especially in the USA, UK, and Germany.

Strategic Response: To fuel convenience, Walmart and Amazon imposed e-tail penetration of lactase supplements 19%. Whole Foods Market (USA) led lactose-free dairy placements, impacting shopper spending on special dairy 15%. Alibaba's Tmall (China) registered 27% import value growth of lactase-based products with growth in Asia-Pacific economies.

Paradigm Shift in Dairy Processing by Sustainability and Clean-Label Trends

Shift: Amongst one of the greatest challenges of the era being sustainability, there are cleaner-label, non-GMO lactase enzymes from a nature-based fermentation platform that are required every day more than ever before. Consumers more and more within Europe and North America's markets are requiring more and more responsibly sourced and traceable enzyme solutions.

Strategic Response: These launches, DuPont (USA) launched bio-based lactase enzyme solution, and it bestowed upon it its clean-label advantage. Kerry Group (Ireland) launched sustainably sourced lactase, and 17% growth was witnessed in its B2B foundation of customers. Lactalis (France) launched organic lactose-free milk in value premium segment of Western Europe.

Competitive Pricing and Market Accessibility Strategies

Shift: Whereas today there is the more expensive lactase-fortified type, today its value brands and store brands appearing on shelves as a transition toward greater use by the firms. Third-world countries like Brazil, India, and South Africa are being compelled to provide an inexpensive market for dairy foods that are lactose-free.

Strategic Response: To target price-conscious consumers, Lactaid (USA) introduced economy-priced lactose-free ice cream and milk, and market share was 22% among middle-income consumers. Nestlé Brazil introduced economy-priced lactose-free dairy, and market share was 9%. Economy-priced lactase supplements were introduced by China's Mengniu Dairy in the emerging Asian markets.

E-Commerce and Subscription Model Leveraging

Shift: Direct-to-consumer retail food purchases, as well as sales of retail and subscription food and lactase products, are increasing as people buy more auto-renewable dairy specialty food and food supplements online.

Strategic Response: In an effort to combat the trend, Lactaid (USA) launched a monthly subscription box and 25% incremental direct sales afterwards. Swanson Health (US) launched lactase supplements in Amazon and experienced a 30% DTC order increase. HealthKart (India) launched lactase enzyme packs out of compulsion and for urban wellness-pursuing consumers.

Regional Adaptation Strategies

Shift: Geographically, consumption of lactase and lactose-free milk is also extremely diverse across consumers. Digestive health is high in North America and Europe but once more reaches its peak in the Asia-Pacific market with consumption of dairy products and rising lactose intolerance.

Strategic Response: To fulfill domestic market needs, Japan's Meiji Dairy placed lactase-fortified yogurt in stomach-sensitive consumers' hands. Argentina's Mastellone Hermanos introduced Latin America's dairy industry to domestic production of lactose-free milk. Germany's Müller placed high-quality lactose-free milk in the commanding place among European stomach-sensitive consumers.

Demand for lactose-free dairy products increased strongly, particularly in high-lactose nations. Improvements in microencapsulation technology and enzyme production have also introduced a higher-performance lactase enzyme that is ideally suited for broader application across product types. Estimated CAGR (2025 to 2035) in key markets is as follows:

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

| Germany | 4.8% |

| China | 6.1% |

| Japan | 4.5% |

| India | 6.7% |

The USA lactase market is also developing very fast with rising demand from health-oriented consumers for dairy lactose-free. More and more Americans are diagnosing themselves as lactose intolerant and turning to alternative dairy products, and this is fueling the demand for lactase enzymes in milk, yogurt, cheese, and ice cream. USA functional food is one of the most potent market drivers, fueled by very high consumer demand for digestive health.

Major dairy food companies are investing in lactose-free R&D and providing more lines of product to address expanding customer bases. There is also the presence of well-established USA providers of enzymes. Extremely high-level biotechnology within the country has also enabled it to attain high availability as well as high lactase enzyme efficiency.

Also, the FDA regulation and approval of lactase enzyme uses are also one of the most important reasons for the increase in the market. The easily accessible supplement of lactase consumption in infant food is also a driving force in the market growth where parents target infants who are lactose intolerant to be easily digestible.

Germany's lactase market is growing as a result of the stringent food safety laws and the rising demand for premium quality dairy alternatives. The European Union's emphasis on food labeling and lactose-free food certification has prompted the use of lactase during processing by dairy firms to appeal to lactose-intolerant customers.

The expansion of flexitarian and vegan consumer segments in Germany also spurred the demand for lactose-free and plant-based milk alternatives, once again stimulating innovation in the application of enzymes in non-dairy foods. German consumers are also very health-conscious and go the extra mile to purchase gut-friendly and digestive health foods, which spurred a very sudden rise in demand for lactase supplements and milk fortification.

The German pharmaceutical sector is also launching digestive enzymes with lactase content to offer the solution for mild and moderate lactose intolerance patients. Having strong biotech and enzyme firms in the nation has encouraged market growth with continuous R&D enhancing the stability and functionality of lactase enzymes used in food systems.

China is among the most rapidly growing lactase markets because lactose intolerance is widespread in more than 90% of the adult population. This therefore represents a colossal change towards milk products that are lactose-free with enormous scope for the use of lactase enzyme in milk, yogurt, infant nutrition, and functional drinks.

The Chinese milk market grew at a frenzied pace in which government regulation to enhance the quality of milk and consumption saw local firms loading lactase on production lines. Lactose enzymatic elimination technology is being funded by leaders in the dairy industry due to rising demands for stomach-friendly milk.

Particularly, Chinese online shopping imported lactase supplement and lactose-free food products and made them incredibly accessible in quantities as well as consumer-friendly. Pharma segment also experiences rising utilization of lactase in formulations of digestive enzymes to protect intestinal well-being along with elimination of lactose intake-borne digestive disorders.

| Segment | Value Share (2025) |

|---|---|

| Microbial (By Source) | 68.7% |

Microbial lactase boasts the largest market share since it is cost-effective, resistant to temperature changes, and used pervasively by the drug market and the milk industry. Considering that milked intolerance is common to the majority of humans in the world, food processors currently incorporate microbial lactase during processing to create lactose-free foods like milk, cheese, yogurt, and ice cream.

This field has been very much sought after, particularly as it works absolutely flawless across broad pH ranges and temperatures and hence it is optimum commercially. Large food businesses are employing fermentation-borne microbial lactase in an attempt to deliver maximum enzyme yield and highest possible productivity efficiency.

Plant-based and clean-label lactase is also making headway, as the consumer is more and more looking for natural enzyme solutions. Moreover, microbial lactase formulations as dairy enzymes for lactose-intolerant consumers have expanded the market of this segment. Since the food sector is shifting towards scalable and sustainable solutions, microbial lactase will remain steadfast on the strength of developments in enzyme technology and growing adoption in the dairy industry.

| Segment | Value Share (2025) |

|---|---|

| Liquid (By Form) | 61.2% |

Liquid lactase has been shown to be the best market product utilized by large-scale commercial milk production. Liquid lactase was found to be appropriate for large-scale dairy businesses because it is capable of hydrolysing lactose in milk, yogurt, and cheese making. It enables the manufacturers to create lactose-free milk products with shorter processing time, but with optimum efficiency and quality.

Increasing demand for lactose-free dairy products, especially in Europe and North America, is promoting demand for liquid lactase. Milk and milk drinks are being consumed in increasing volumes with customers requiring easier-to-digest dairy. Manufacturers are launching lactose-free product lines and thus promoting demand for liquid lactase enzymes.

Apart from this, liquid lactase is superior to powder lactase used in production because it can be easily mixed with other products and has good solubility. The capacity of evenly distributing enzymes in the event of dairy production makes liquid lactase superior to powder lactase. With the fact in mind that the lactose-free market continues to grow, liquid lactase will be operational with technological developments in enzyme preparation and increased levels of healthy consumers.

The giants of the Lactase Market are Koninklijke DSM N.V., Kerry, Novoenzymes, IFF, Nature Bioscience, Armora Pharma, Merck KGaA (Sigma-Aldrich), Rajvi Enterprise, Antozyme Biotech Pvt Ltd, and Infinita Biotech. They keep the market in balance with biotechnology innovation, enzyme engineering, and long supply chains to provide diversified applications like dairy processing, pharmaceuticals, and nutraceuticals.

Growing demand for lactose-free milk products owing to rising incidence of lactose intolerance and digestive health requirements are fueling the market growth. Companies are looking to develop high-purity lactase enzymes, novel enzyme stabilization technologies, and non-GMO variants in an attempt to meet regulation requirements and consumer demands.

Market leaders are adopting the following strategies

For instance

As per source, the industry has been categorized into Animal, Microbial, Plants

This segment is further categorized into Liquid and dry.

This segment is further categorized into Food and Beverages and healthcare.

The market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic countries, Russia and Belarus, and the Middle East & Africa.

The global industry is estimated at a value of USD 250.5 million in 2025.

The market is projected to grow at a compound annual growth rate (CAGR) of 4.8% during this period.

Some of the leaders in this industry include Koninklijke DSM N.V., Kerry, Novoenzymes, IFF, Nature Bioscience, Armora Pharma, Merck KGaA (Sigma-Aldrich), Rajvi Enterprise, Antozyme Biotech Pvt Ltd, Infinita Biotech, and Others.

The Asia-Pacific region is anticipated to maintain a significant market share, driven by the rising incidence of lactose intolerance and increasing demand for lactose-free dairy products.

The market's growth is primarily driven by the increasing prevalence of lactose intolerance globally, leading to a higher demand for lactose-free dairy products and lactase supplements.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Lactase Providers

UK Lactase Market Growth – Innovations, Trends & Forecast 2025-2035

USA Lactase Market Trends – Growth, Demand & Analysis 2025-2035

ASEAN Lactase Market Report - Size, Demand & Industry Trends 2025-2035

Europe Lactase Market Report – Trends, Demand & Industry Forecast 2025-2035

Australia Lactase Market Growth – Trends, Demand & Forecast 2025-2035

Latin America Lactase Market Insights – Growth, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA