The labeling machines sector is progressing swiftly as business houses call for automation, accuracy, and eco-friendliness in packaging operations. With businesses like food & beverages, pharma, and personal care seeking high-speed and efficient labeling solutions, manufacturers are innovating using AI-based automation, green adhesives, and smart tracking technologies.

Manufacturers are investing in digital labeling machines, modular label applicator solutions, and high-speed printers to improve productivity and compliance. The market is moving towards compact, high-performance machines with support for digital connectivity, smart label integration, and green materials.

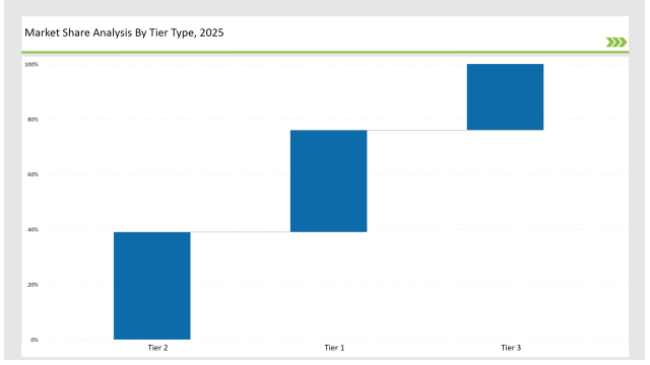

Tier 1 companies such as Krones AG, Herma, and Markem-Imaje have 37% market share with their prowess in precision labeling, automation technologies, and robust global distribution networks.

Tier 2 players like SATO Holdings, Avery Dennison, and Weber Packaging Solutions hold 39% market share by providing affordable, high-speed, and customizable labeling systems to other industries.

Tier 3 consists of regional and niche players specializing in RFID labeling, digital printing, and compact labeling solutions, holding 24% of the market. These companies focus on localized production, customized designs, and eco-friendly solutions.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Krones AG, Herma, Markem-Imaje) | 19% |

| Rest of Top 5 (SATO Holdings, Avery Dennison) | 10% |

| Next 5 of Top 10 (Weber Packaging Solutions, Domino Printing, Videojet, Accraply, Quadrel Labeling) | 8% |

The labeling equipment industry serves multiple sectors where precision, speed, and compliance are essential. Companies are developing advanced labeling solutions to enhance product identification, traceability, and branding.

Manufacturers are optimizing labeling equipment with automation, sustainability, and intelligent tracking systems.

Automation and sustainability are transforming the labeling equipment industry. Companies are adopting AI-based label inspection, energy-efficient printing systems, and high-speed digital labeling to meet evolving regulatory and branding requirements. Businesses are developing recyclable label adhesives to replace solvent-based alternatives. Manufacturers are integrating predictive maintenance systems to reduce downtime and improve efficiency. Additionally, firms are enhancing cloud-based labeling solutions to streamline multi-location packaging operations.

Technology suppliers should focus on automation, smart tracking, and sustainability-driven innovations to support the evolving labeling equipment market. Partnering with FMCG and pharmaceutical brands will drive adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Krones AG, Herma, Markem-Imaje |

| Tier 2 | SATO Holdings, Avery Dennison, Weber Packaging Solutions |

| Tier 3 | Domino Printing, Videojet, Accraply, Quadrel Labeling |

Leading manufacturers are advancing labeling equipment technology with AI-powered automation, sustainability-focused materials, and precision-engineered applicators.

| Manufacturer | Latest Developments |

|---|---|

| Krones AG | Launched AI-driven high-speed labeling systems in February 2024. |

| Herma | Introduced energy-efficient modular label applicators in April 2024. |

| Markem-Imaje | Expanded RFID-enabled label printing solutions in May 2024. |

| SATO Holdings | Released eco-friendly label adhesives for recyclability in June 2024. |

| Avery Dennison | Strengthened digital label customization with NFC and QR codes in january2024. |

| Weber Packaging | Developed scratch-resistant, high-resolution labels in March 2024. |

| Domino Printing | Innovated cloud-based label tracking systems in September 2024. |

The labeling equipment market is evolving as companies focus on automation, sustainability, and high-speed digital labeling solutions.

The industry will continue integrating AI-driven labeling, cloud-based automation, and sustainable materials. Manufacturers will refine high-speed labeling techniques to increase accuracy and reduce waste. Businesses will adopt bio-based label adhesives to minimize environmental impact. Companies will develop fully recyclable label materials to support circular economy goals. Smart labels with real-time tracking will enhance supply chain visibility. Additionally, firms will optimize label printing systems to reduce downtime and improve overall equipment efficiency.

Leading players include Krones AG, Herma, Markem-Imaje, SATO Holdings, Avery Dennison, Weber Packaging Solutions, and Domino Printing.

The top 3 players collectively control 19% of the global market.

The market shows medium concentration, with top players holding 37%.

Key drivers include automation, sustainability, digital labeling, and smart tracking solutions.

Korea Industrial Electronics Packaging Market Analysis by Material Type, Product Type, Packaging Type, and Province through 2035

Japan Industrial Electronics Packaging Market Analysis by Material Type, Packaging Type, Product Type, and City through 2035

Blister Card Market Analysis by Product Type, Technology Type, Material Type, End-use Industry, and Region Forecast Through 2035

Vietnam Plastic Bottle Market Analysis by Capacity, Material, End-use, and Region Forecast Through 2035

Green Packaging Film Market by Product Type, End Use, Material, and Region 2025 to 2035

Market Share Breakdown of Protective Packaging Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.